Vertical contracts and their effects on the passing-on of overcharges

According to EU Directive 2014/104 on competition law damages actions, after an infringement of competition law, any party suffering damages can claim full compensation. This involves not only direct purchasers of the infringer but also indirect ones. To quantify the damage incurred by direct and indirect purchasers, a central question is how much of the actual overcharge is passed on by direct purchasers. As the extent of this passing-on depends on a range of factors, such as the industry structure, the competitive environment in the market of the direct purchaser, buyer power, and so on, it is usually difficult to quantity. The European Commission, in collaboration with RBB Economics and Cuatrecasas, has issued a report on the passing-on of overcharges.1

Economics gives assistance by providing tools to determine how the extent of the overcharge depends on the market environment. This article explores the aspect of vertical contracts, and vertical restraints in general, between the direct and the indirect purchaser, and their impact on the passing-on of overcharges. In the RBB/Cuatrecasas study prepared for the Commission, these contracts were considered only in conjunction with buyer power. However, even without buyer power, different contracts have important effects on the extent of overcharges. They should therefore be taken into account in a quantification of the overcharge.

General considerations on pass-on

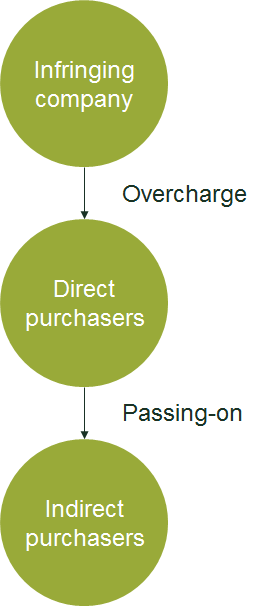

If an infringing company overcharges its customers, this leads to an increase in the cost to the direct purchasers. In turn, it will trigger a change in the prices charged by these direct purchasers to their customers—i.e. the passing-on. This is illustrated in Figure 1.

Figure 1 The passing-on of overcharges

When deciding how much of the overcharge to pass on, a direct purchaser faces a standard trade-off: a larger pass-on will lead to a fall in demand, but the margin will shrink by less than would be the case when keeping the price constant. If the direct purchaser’s demand is, for example, very responsive to price, the optimal pass-on should therefore only be small.

In addition, the competitive environment in the market is an important driver of the passing-on. If the direct purchaser is operating in a highly competitive market, in which prices are close to marginal cost, the company does not have much choice but to increase its price by around the same size as the overcharge. This is different if the firm has market power. It can then balance off the pros and cons from a price increase, which may lead to a pass-on of more or less than 100%. For example, in a simple scenario with linear demand and constant marginal costs, economic theory predicts an overcharge of 50%, provided that indirect purchasers do not pass on the overcharge themselves. However, due to factors not related to market power, such as economies of scale or a constant percentage mark-up, the pass-on can be more than 100%. Also, the shape of the demand function is a crucial driver of the pass-on rate. For example, if demand is convex, pass-on is predicted to be more than 100% because a cost increase drives the optimal price to a less elastic part of the demand. In fact, several studies in various industries document overcharges of more than 100%.2

Moreover, the extent to which competitors are affected by the overcharge also determines the scope to pass on the cost increase. This leads to the distinction between a firm-specific and an industry-wide overcharge. If only one company is subject to the overcharge, it is constrained in its ability to pass on the cost increase—especially if competition is strong. As the company can pass on only a small amount of the overcharge, this could, in the extreme, render its business unprofitable, leading to exit from the market in the medium run. Instead, if the overcharge is industry-wide, no direct purchaser is at a competitive disadvantage, which implies that pass-on is likely to be higher. Again, this effect is pronounced if competition is strong. If, instead, the company has considerable market power, the difference between firm-specific and industry-wide overcharge becomes less pronounced—and the two cases converge if the company is acting as a monopolist.

Underlying these considerations is the presumption that direct purchasers charge a price per unit or a royalty, and are not merged with indirect purchasers. However, in most industries non-linear contracts are the rule, and firms are often vertically integrated.

Two-part tariffs

Many contracts in business-to-business relationships involve some fixed payment component in addition to a unit price or royalty. The simplest form is a two-part tariff contract, which consists of a fixed payment in addition to the unit price. Even these simple contracts have important implications for the pass-on of overcharges compared with simple linear contracts. As also noted in the RBB/Cuatrecasas study for the Commission, the most efficient way to structure a two-part tariff contract is to set a per-unit price close to marginal cost, to avoid inefficiencies between the contracting parties and share the profit via the fixed fee.

With a two-part tariff contract, the implications for the overcharge and the pass-on are markedly different from the case of a linear contract. First, a two-part tariff between the direct and the indirect purchaser leads to a particularly high pass-on in the per-unit price (theoretically 100%), as the linear component is optimally set close to marginal cost. The profit from the relationship of the direct and indirect purchasers will then be lower, as volume falls due to the increase in the final price and the lower margin of the indirect purchaser (assuming that its pass-on is less than 100%). Both parties are harmed, as the direct purchaser loses on volume and the indirect purchaser loses both on volume and on margin. The firms will probably also renegotiate the fixed fee. The firm with more bargaining power is then harmed more as it continues to obtain a bigger share of the pie, but the pie becomes smaller as a result of the cost increase.

By contrast, if a two-part tariff is signed between the infringer and the direct purchaser, the optimal overcharge will be in the fixed fee and not in the per-unit charge, to preserve efficiency. The problem for the direct purchaser is then that this increase in the fixed fee is less likely to be passed on via higher per-unit prices, as the costs per unit are unchanged. This therefore implies that the lion’s share of the damage will be incurred by the direct purchaser.

As the discussion in the previous paragraph suggests, the use of two-part tariffs poses a problem for the analysis of the pass-on rate in general. If the overcharge is partly or mostly on the fixed fee, this makes it difficult to evaluate what percentage of the overcharge has been passed on to indirect purchasers in terms of higher per-unit prices. It can then be tricky to quantify the damage claims. Several cartel cases nevertheless suggest that overcharges are often in the per-unit prices. For example, this was found to be the case in the electrical component market in TenneT vs Alstom,3 and in the sugar market in Nestlé and ors vs Ebro Puleva.4 One reason might be that per-unit prices are easier to cartelise, as they are normally observable and are fairly similar across firms. In a bilateral relationship, however, a fixed payment is usually negotiated, which is more difficult to observe. Deviation from collusive agreements cannot then be easily detected or punished. As a consequence, to determine the damages, it is important to find out whether fixed payments were ignored because they were not affected by the overcharge, or whether an overcharge in the fixed fee occurred but was left out because it is very difficult to prove.

A similar problem occurs with cost-plus contracts between direct purchasers and indirect purchasers. At first glance, this looks like a clear case of an overcharge being passed on 100% or more to the indirect purchaser. (For example, if the contract specifies cost plus €x, the overcharge is 100%, whereas if it is cost plus x%, the overcharge is more than 100%.) But if the overcharge occurs primarily in the fixed fee, this is no longer true.

Exclusivity agreements

Two-part tariff contracts are usually coupled with other clauses that make the general considerations obsolete or only of second order. Consider first an exclusive contracting agreement between a direct and an indirect purchaser, which is in place when the overcharge happens. This agreement prevents the indirect purchaser from buying substitute products in the upstream market. In this case, the competitive conditions in the market of direct purchasers are not relevant for the pass-on set in the relationship with the exclusive-dealing agreement. The direct purchaser will then act as a monopolist when deciding about its passing-on. Suppose the monopoly pass-on is less than 100% (as is the case with linear demand and constant marginal costs, where it is 50%). If other direct purchasers are not affected by the overcharge because it was firm-specific, the pass-on rate absent the exclusivity contract will be close to 0. Then, the damage for the indirect purchaser is higher with the exclusivity contract in place than without it. By contrast, if the overcharge is an industry-wide one and competition in the direct purchaser market is strong, pass-on will be close to 100%. Then, the indirect purchaser incurs less damage with the exclusivity contract—i.e. there would be the opposite result to a firm-specific overcharge.

These considerations exemplify the subtle effects of vertical contracts on the passing-on. Usually, a firm-specific overcharge is less problematic for an indirect purchaser, as it can switch to a company that is not affected by the overcharge and secure supplies at a lower price. An exclusive dealing contract changes this, as the indirect purchaser cannot revert to substitute firms, thereby affecting the damage claims of the direct and indirect purchaser.

A further damage can arise because the overcharge affects the profitability of the relationship between the direct and the indirect purchaser in additional ways than through higher input cost. The following discussion describes a channel for this effect.

A main reason why companies agree on an exclusivity arrangement is that it protects investments of the two parties. For example, in most franchising agreements in the hotel industry, franchisors include an exclusive-territory agreement, which implies that the franchisor will not open another hotel within a particular distance. This may limit competition and helps franchisees to benefit from their investment in the hotel brand.5 Similarly, suppliers of high-quality products often grant retailers exclusivity to ensure that they display the products in a particular way and expend effort in explaining their functioning to customers. Unrestricted competition may lead to free-riding problems and erode these incentives.

Consider now an overcharge on an important input for the franchisor or the supplier. First, this overcharge leads to lower profits in the relationship between the direct and indirect purchaser due to the standard increased cost effect. However, in addition to this effect, the incentive for the indirect purchaser to invest effort is also lower because of the reduced profit from the products of the direct purchaser. (For example, the indirect purchaser may reduce the window space devoted to these products or employ fewer people who can explain their functionality to customers.) This implies that there is an additional damage of the overcharge suffered by both the direct and indirect purchaser. This damage is particularly high if the pass-on is large, because it reduces the incentives of the indirect purchaser by a large amount. A general point here is that the effect of an overcharge need not be confined to the particular product but can also be substantial for complementary products, such as investment.6 Ignoring this effect can lead to an underestimation of the damage.

Slotting fees

Another prominent type of contract often imposed by big supermarket chains on suppliers of food products is a slotting fee.7 These fees are paid by the supplier to the retailer in exchange for shelf space.

For such a contract to be profitable for the supplier, a minimum amount of the quantity sold in the supermarket is necessary. The reason for this is that the slotting fee is a fixed payment, which implicitly leads to decreasing average costs for the supplier as output increases. If an infringer now puts an overcharge on an input used by the supplier, the supplier cannot reduce its quantity by a large amount, as this makes the selling of the product unprofitable. Therefore, the overcharge has almost no volume effect, and the only effect present will be the price increase. However, without a slotting fee, the direct purchaser would not be constrained in its response to the overcharge and would optimally adjust both its quantity and the price. As this is not possible, the damage is larger than it would be without any contractual restrictions.

Vertically merged firms

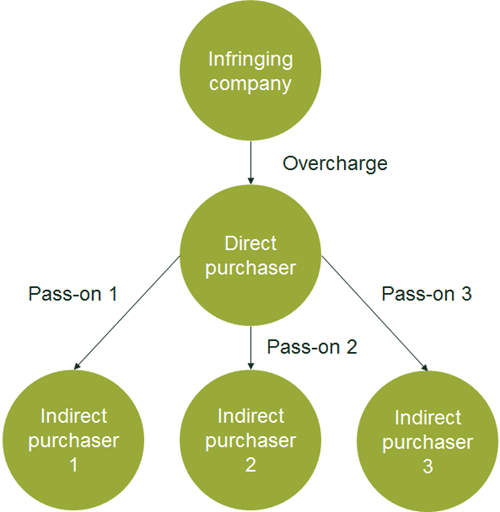

Another important problem for evaluating and quantifying the pass-on effects is that a direct purchaser may pass on the overcharge differently to different indirect purchasers. With contractual agreements, this may occur due to different efficiencies of indirect purchasers. However, if a direct purchaser is vertically merged with an indirect purchaser, such different passing-on can alter the competitive environment in the downstream market, which in turn affects the damage claims of different companies. For example, consider the situation in Figure 2.

Figure 2 Passing on the overcharge differently to different indirect purchasers

Because the direct purchaser and indirect purchaser 2 are one company, they trade products internally at the most economically efficient price. This price is usually equal to marginal cost. As a consequence, the internal economic pass-on will be close to 100%. By contrast, the pass-on to the other two indirect purchasers may be above or below 100%, depending on the general market conditions laid out above. Therefore, damage claims can be very different for the various firms.

An additional effect arises if the indirect purchasers are also competitors. This is usually the case if they are not final consumers. Then, foreclosure effects come into play.8 In particular, the direct purchaser provides preferential treatment to its affiliate to put it in a beneficial position in the downstream market. This implies that it sells its product to indirect purchasers 1 and 3 at a higher price than to indirect purchaser 2. A similar effect occurs for the overcharge. As the internal pass-on is close to 100%, the pass-on to indirect purchasers 1 and 3 will be above 100%. This is a specific instance of a firm-specific pass-on that is intentionally applied differently to different indirect purchasers. It must therefore be treated in a different way to an industry-wide pass-on and may give rise to higher damage claims because of foreclosure considerations.

The presence of a vertically integrated direct purchaser may also affect the pass-on rates of non-integrated direct purchasers. Suppose, for example, that in the framework of Figure 2, a second direct purchaser exists, which is also affected by the overcharge but is not vertically integrated with indirect purchasers. This second direct purchaser (‘direct purchaser 2’) sells a product that is differentiated from that of the vertically integrated direct purchaser to the three indirect purchasers. As indirect purchaser 2 is vertically integrated and will buy the main bulk of the products from its upstream affiliate, direct purchaser 2 gets a large share of its demand from indirect purchasers 1 and 3. The pass-on incentives of direct purchaser 2 are then different from those of the vertically integrated direct purchaser. In particular, it will pass on the overcharge mainly to the buyer from which it receives only a small demand, because the elasticity of this buyer is small and because direct purchaser 2 puts its main buyers in a favourable position downstream. In contrast to the integrated direct purchaser, direct purchaser 2 therefore passes on the overcharge to only a small extent to indirect purchasers 1 and 3. As a consequence, although the overcharge by the infringing company is an industry-wide one, it will be passed on to different extents by the direct purchasers, which makes damage claims difficult to determine.

Concluding remarks

In general, the contracts formed between infringer and direct purchaser, and the ones between direct and indirect purchasers, can be a crucial driver of the pass-on of overcharges. Where the parties at these stages in the supply chain are companies rather than final consumers, non-linear contracts are prevalent and range from simple two-part tariffs to sophisticated exclusive dealing or slotting-allowance contracts. This article has shown that an overcharge can have very different effects in contracts between the infringing company and the direct purchaser relative to contracts between direct and indirect purchasers. This occurs, for example, with two-part tariff contracts. As a general conclusion, in contracts between direct and indirect purchasers, there is likely to be an increase in the pass-on possibilities and the damage claims, as these contracts can prevent access to viable substitutes for indirect purchasers.

1 RBB and Cuatrecasas (2016), ‘Study on the Passing-on of Overcharges’, report for the European Commission, October. An earlier study that also provided guidance on pass-on is Oxera and a multi-jurisdictional team of lawyers led by Dr Assimakis Komninos (2009), ‘Quantifying antitrust damages: towards non-binding guidance for courts’, study prepared for the European Commission Directorate General for Competition, December.

2 For example, see Besley, T. and Rosen, H. (1999), ‘Sales Taxes and Prices: An Empirical Analysis’, National Tax Journal, 52, pp. 157–178; or Rojas, C. (2008), ‘Price Competition in U.S. Brewing’, Journal of Industrial Economics, 56, pp. 1–31.

3 District Court of Gelderland (2015), TenneT v. Alstom, judgment of 10 June 2015 (ECLI:NL:RBGEL:2015:3713).

4 Supreme Court of Spain (2013), Case No. 5819/2013, Nestlé and ors v. Ebro Puleva, judgment of 7 November 2013.

5 De Meza, D. and Selvaggi, M. (2007), ‘Exclusive Contracts Foster Relationship-Specific Investment’, RAND Journal of Economics, 38, pp. 85–97.

6 See Anderson, S. and Bedre-Defolie, Ö. (2017), ‘Optimal Variety and Pricing of a Trade Platform’, Working Paper.

7 See Marx, L. and Shaffer, G. (2007), ‘Upfront Payments and Exclusion in Downstream Markets’, RAND Journal of Economics, 38, pp. 823–843; and Rey, P. and Whinston, M. (2013), ‘Does Retailer Power Lead to Exclusion?’, RAND Journal of Economics, 44, pp. 75–81.

8 See Rey, P. and Tirole, J. (2007), ‘A Primer on Foreclosure’, in M. Armstrong and R.H. Porter (eds), Handbook of Industrial Organization III, North-Holland, Elsevier.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More