The ups and downs of vertical merger control: what’s the current state of play?

Recent years have seen renewed debate around vertical merger control. Authorities have been changing their guidance and competition headlines have been dominated by vertical mergers such as AT&T/Time Warner, Facebook/Giphy and Illumina/Grail. But exactly how has our collective economic understanding of vertical mergers evolved? And what role can economics play in competition policy practice? In May 2022, the Oxera Economics Council met to discuss these questions.

The Oxera Economics Council is a group of academic economists that comes to together twice a year to discuss a topic where economics might offer some important insight. We would like to thank the OEC Chair Sir John Vickers, all OEC members, and especially our invited guests Dr Hans Zenger (DG Competition), Dr Julie Bon (CMA), and Dr Etienne Chantrel (AdlC) for their insightful and engaging discussions. This article does not necessarily represent the position of the OEC members or its guests.

Recent years have seen renewed debate about the approach that competition authorities should take to vertical mergers.1 Unlike horizontal mergers, a vertical merger (i.e. between firms at different levels of the supply chain) does not involve the same elimination of direct competition—but does this mean that vertical mergers can be viewed much more favourably?

There appears to be a changing tone towards vertical mergers by some authorities. In the UK, the Competition and Markets Authority (CMA) last year issued updated guidelines in which it no longer described vertical mergers as ‘generally benign’.2 In the USA, the majority of the Commissioners at the Federal Trade Commission (FTC) even went so far as to revoke the 2020 vertical merger guidelines on the grounds that they included a ‘flawed discussion of the purported procompetitive benefits’.3 In the EU, in the meantime, the latest non-horizontal merger guidelines already date back to 2008. However, it is broadly recognised that case practice has evolved a lot from the more arithmetic approach described 15 years ago.4

In addition to changing competition guidance, several high-profile cases have made the issues surrounding non-horizontal mergers topical. In the USA, the AT&T/Time Warner has stirred up an intense debate on how to evaluate both the benefits and harms from vertical mergers—after the government conceded benefits from the ‘elimination of double-margins’ in the order of $350m without qualification.5 In the EU, the question around integrating the efficiencies resulting from internalising double-margins into analysis of the effects on competition have been raised in several cases.6

These developments raise two key questions.

- What is our current understanding of the benefits and harms of vertical mergers?

- What role can economics play in determining future policy and guidance on vertical mergers?

Revisiting the fundamentals

When two direct competitors merge, there is a risk that this eliminates a valuable competitive constraint from the market. However, there is a fundamental difference between such a horizontal merger and a vertical merger that involves parties at different levels of the supply chain. At its core, this difference comes down to a difference between a merger of substitute products and a merger of complementary products.

This in turn affects the theories of benefit and theories of harm that underlie any merger review.

Elimination of double-marginalisation

When firms selling two complementary products optimise their prices independently, they fail to take into account the pricing externality imposed on the other firm: by setting higher prices, they reduce demand, not just for their own products/services, but for those of the other firm as well. By vertically integrating, firms have the incentive to eliminate such double-marginalisation.7

This ‘elimination of double-marginalisation’ (EDM) is one of the most prominent efficiencies gains—as emphasised, for instance, by the European Commission in its 2008 Non-Horizontal Merger Guidelines:8

In vertical relationships for instance, as a result of the complementarity, a decrease in mark-ups downstream will lead to higher demand also upstream. A part of the benefit of this increase in demand will accrue to the upstream suppliers. An integrated firm will take this benefit into account. Vertical integration may thus provide an increased incentive to seek to decrease prices and increase output because the integrated firm can capture a larger fraction of the benefits. This is often referred to as the ‘internalisation of double mark-ups’.

EDM is an efficiency that originates purely from the internalisation of a pricing externality. This mechanism of taking into account the effect of your pricing decision on your merging partner is the exact same mechanism that in a horizontal merger leads to an upward pricing pressure. This raises the question of whether EDM should even be held to the same high standard as other efficiencies in merger assessments.9

Irrespective of the appropriate standard of proof, the economic theory of EDM in vertical mergers has been under increased scrutiny in recent years during the adoption and subsequent revocation of the US FTC’s vertical merger guidelines. In revoking the guidelines, the majority of Commissioners issued a statement that included the following:10

The VMGs’ reliance on EDM is theoretically and factually misplaced. It is theoretically flawed because the economic model predicting EDM is limited to very specific factual scenarios: mergers that involve one single-product monopoly buying another single-product monopoly in the same supply chain, where both charge monopoly prices pre-merger and the product from one firm is used as an input by the other in a fixed-proportion production process.

From an economic perspective, this statement is difficult to justify. The fundamental change resulting from a merger (whether vertical or not) is that firms take account of the pricing externality on the merging partner. Such a mechanism will hold in monopoly and non-monopoly settings—even when EDM may be more significant in the case of monopolies.

Double mark-ups can already arise with some market power upstream and downstream. However, there are situations where post-merger the elimination of double-margins does not occur or is clearly insufficient to offset potential harm.11

- No double-margins—EDM cannot occur if there are no double-margins to begin with—for example, when an upstream firm licenses its product to a downstream firm in exchange for a fixed fee, and the per-unit price is set at marginal cost (zero in this case).

- Diagonal merger—if the upstream merging party does not supply the downstream merging party (i.e. the merger is ‘diagonal’), there is no vertical pricing externality to begin with. This was the case, for example, in Deutsche Börse/LSEG.12

- Full market coverage—when the total market is unlikely to expand for the upstream firm, any increase in sales through the downstream merging firm will come at the expense of upstream sales to a downstream rival. Provided that upstream margins from supplying downstream rival(s) are not lower than the upstream margins from supplying the downstream merging party, there is no benefit to the merged entity in reducing downstream margins to increase sales. This was the case, for example, in Telia/Bonnier Broadcasting and later in LSEG/Refinitiv.13

- Strong horizontal overlap—some vertical mergers may involve a firm that is already, to a degree, vertically integrated. In such a case, horizontal upward pricing pressure may offset the vertical downward pricing pressure from EDM. This concern played a role in the recent Wieland/Aurubis EU merger prohibition.14

Moreover, there are situations in which the magnitude of EDM is reduced or even fully eliminated. For example, internal frictions may mean that the integrated firm fails to set optimal internal transfer prices between its upstream and downstream units, such that double-marginalisation remains post-merger.15

Other benefits from vertical mergers and the role of merger specificity

It is worth noting that—in addition to the pricing efficiency from EDM—vertical mergers can lead to other efficiencies that are potentially even more important. These include benefits from increased vertical control and security (e.g. reduced risk of ex post renegotiation of agreements and ‘hold-up’ problems), and effective vertical coordination. As already recognised by the European Commission:16

[…] [O]ther efforts to increase sales at one level (e.g. improve service or stepping up innovation) may provide a greater reward for an integrated firm that will take into account the benefits accruing at other levels.

In theory, any vertical efficiency—including EDM—could be achieved through optimal contracting between independent companies, rather than through a vertical merger. For example, the problem of double-margins disappears when the upstream firm prices a product at marginal cost while appropriating its share of the surplus with a fixed fee (i.e. non-linear contracting).

This raises questions regarding whether any purported efficiencies are really specific to the merger, or whether they would be achieved through other means if the merger did not go ahead.

The key point here, however, is that optimal contracting may not always be feasible. In particular, there may be relevant aspects of commercial relationships that are simply non-contractable—such as trust and reliability. Moreover, it is often observed in practice that firms selling complementary products have suboptimal contracting terms that do not eliminate inefficiencies in pricing or coordination. Firms may therefore resort to mergers instead.

Input and customer foreclosure

The benefits and pro-competitive rationales for vertical mergers notwithstanding, it is commonly recognised that vertical mergers are not without risks to competition. The theories of harm in vertical mergers focus primarily on practices that the merging parties could adopt post-merger to foreclose rivals at either level.

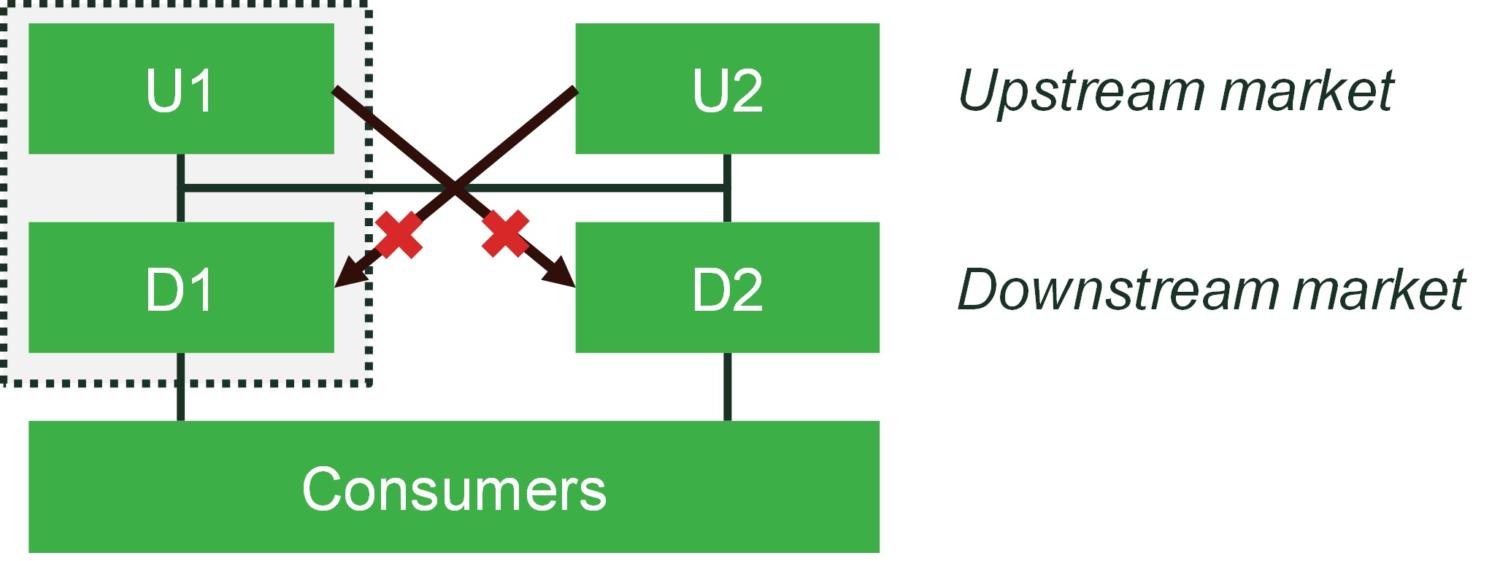

In particular, there are two main concerns: the merged entity may have the ability and incentive to engage in input foreclosure and/or customer foreclosure. Both these harms are illustrated in Figure 1.

- Input foreclosure, on the one hand, assumes that the merged company has market power in relation to an input that is important to downstream rivals. This theory of harm hypothesises that the merged entity would have the ability and incentive to foreclose downstream rivals. This can occur by raising the cost or reducing the quality of the input provided (partial input foreclosure) or by refusing to supply the input altogether (total input foreclosure). This would have the effect of raising downstream rivals’ costs (‘RRC’) by making it more expensive for them to access supplies of the input, thereby reducing downstream rivals’ ability and/or incentive to compete. And as result, prices charged to consumers may increase and/or quality may decrease.

- Customer foreclosure, on the other hand, might arise when a downstream firm is an important route to market for the upstream suppliers. This theory of harm hypothesises that the merged entity will have the ability and incentive to restrict access of competing upstream suppliers to reach downstream customers, to the benefit of the merged entity’s upstream arm. If upstream rivals’ access to downstream consumers is sufficiently reduced, this may hamper their ability and/or incentive to compete upstream. This, in turn, may lead to downstream rivals’ costs being raised, thereby reducing downstream rivals’ ability and/or incentive to compete. As a result, prices charged to consumers may increase.

Figure 1 Input and customer foreclosure

Source: Oxera.

The accepted framework for assessing whether there is such a risk of foreclosure looks at three elements:

- the ability of the merging parties to foreclose—i.e. whether they control a critical input or route-to-market;

- the incentives of the merging parties to foreclose—i.e. whether the benefits of rival foreclosure outweigh the loss in profits from not transacting with that rival (this is explained in more detail in the box below);

- the effect on competition from any foreclosure—i.e. whether the competitive process is adversely affected.

Where a negative effect on competition is established, the efficiency gains should be considered as a countervailing factor. While the burden of proof to demonstrate anti-competitive effects lies with the competition authority, the burden of proof to substantiate any countervailing efficiency typically lies with the merging parties. This is also the case for efficiencies resulting from EDM.

The question is whether different legal standards should be applied to RRC and EDM. As explained below, both RRC and EDM price effects originate from internalisation of a pricing externality between the merging parties. This issue was raised, for example, in LSEG/Refinitiv.

In practice, the Commission’s Non-Horizontal Merger Guidelines do not prevent the Commission and the Parties from assessing EDM and RRC together as the Guidelines make clear that ability, incentive and effects are closely intertwined and often examined in an integrated manner.

EDM and RRC: understanding the two price effects

As described above, the integrated firm may face incentives to raise its downstream rival’s input costs without fully foreclosing it. This raises an important question: exactly when is the upward pricing pressure from RRC smaller than the downward pricing pressure from EDM?

To answer this question, one may look at static price effects from RRC and EDM in isolation and then compare the two. This can be done by using a so-called vertical gross upward pricing pressure index—or ‘vGUPPI’. Similar to its established horizontal equivalent, vGUPPI aims to measure the degree to which a particular firm has an incentive to increase its prices because of the effect that this will have on its merging partner. This is done by expressing its sales in terms of ‘opportunity cost’—i.e. what other profit is forgone when making a sale.17

The exact arithmetic behind vGUPPI is discussed in more detail in the box below.

Vertical gross upward pricing pressure index (vGUPPI)

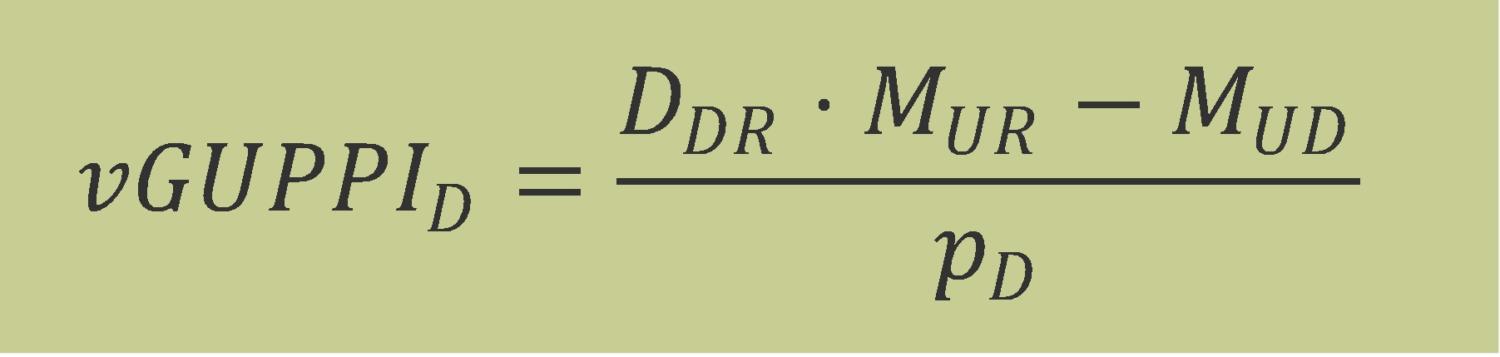

For the downstream merging party, vGUPPI is expressed as:

where DDR is the rate of diversion from the downstream merging firm to the downstream rival, MUR the margin of the upstream merging firm to the downstream rival, MUD the margin of the upstream merging firm to the downstream merging firm, and PD the price of the downstream merging firm.

Note that this opportunity cost is actually negative when the loss to the upstream merging party from sales to the downstream partner (MUD) is larger than its expected gain because of diversion to the rival (DDR . MUR). In that case, there is an incentive to decrease prices and sell more products downstream—which is what drives the EDM.

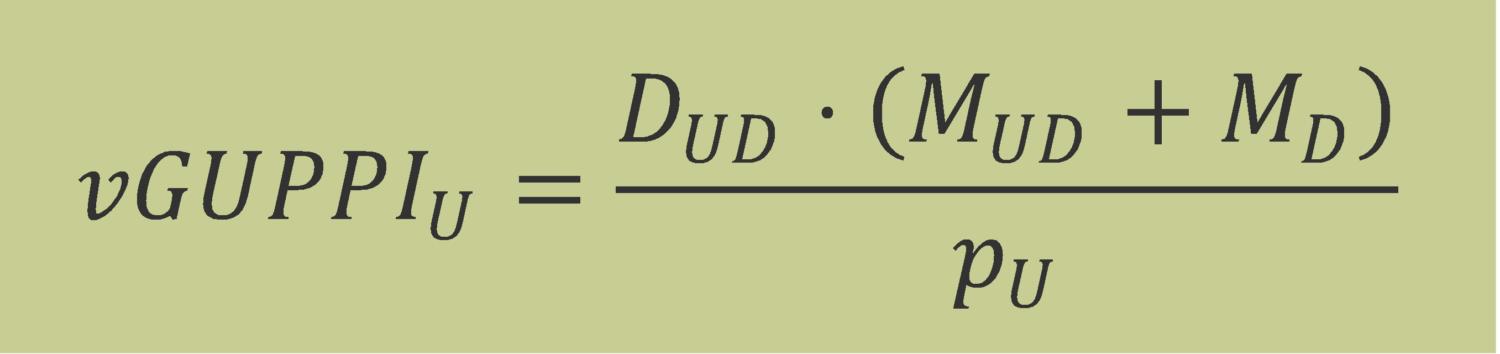

For the upstream merging party, vGUPPI is expressed as:

where DUD is the rate of diversion from sales going to the downstream rival to sales by the downstream merging firm, MUD and MD the margins of the upstream and downstream merging parties combined, and PU the price of the upstream firm. Given that this is always positive, there is an incentive post-merger to increase prices and reduce sales, as this involves a positive opportunity cost. This is what drives RRC.

However, the degree to which there is an increase in consumer prices downstream by the downstream rival depends on the degree of cost pass-through. This is reflected in the vGUPPI of the downstream rival, expressed as:

where vGUPPUU is as previously defined, CPT the percentage of cost pass-through, and PR the price of the downstream rival (usually assumed to be 50%).

Source: Moresi, S. and Salop, S.C. (2013), ‘vGUPPI: Scoring unilateral pricing incentives in vertical mergers’, Antitrust Law Journal, 79, p. 185; Zenger, H. (2020), ‘Analyzing Vertical Mergers’, CPI Antitrust Chronicle, October, pp. 1–8; Oxera (2018), ‘Mind the vGUPPI! A new approach to vertical mergers in local markets’, Agenda, 29 June.

Standard quantitative tools such as UPP and GUPPI can be an appealing way of considering price movements that result from the internalisation of pricing externalities in a merger, as they can be expressed in terms for which data is often available (margins and diversion ratios).

However, care needs to be taken. First, vGUPPI assumes that firms simply set prices so as to optimise their own profits—taking into account any best response by competitors. When prices are instead bargained (which they often are in a vertical context), a bargaining model may be more appropriate.

Moreover, in the case of vertical mergers, there may be considerable feedback between EDM and RRC effects that can lead vGUPPIs to be either over- or underestimated. This is discussed in more detail in the box below.18

Equilibrium feedback effect

EDM and RRC do not occur independently of each other. Instead, they are jointly determined and therefore should not be assessed in isolation. Estimating the net effect requires complex analysis.

To understand this joint determination intuitively, it is useful to describe how EDM may affect incentives to RRC. EDM decreases the downstream price of the merged entity. As a result, downstream rivals face a much more responsive consumer demand (in technical terms, its residual demand curve shifts inwards and its own-price elasticity increases). This means that the demand for the downstream rival decreases more in response to a price increase. As such, the upstream merging firm’s incentive to increase its input price to its downstream rival is lower. In fact, under certain conditions, the upstream merging party may actually have an incentive to lower its price to its downstream rivals rather than to raise them

However, there are other types of feedback effects that instead tend to increase RRC incentives and/or decrease EDM incentives. The net price effect will depend on the shape of the demand curve, but also on the degree of upstream bargaining power—both of which may be challenging to estimate in practice. As such, the standard quantitative tools may over- or underestimate the overall price effect of a vertical merger.

Source: Das Varma, G. and De Stefano, M. (2020), ‘Equilibrium analysis of vertical mergers’, The Antitrust Bulletin, 65:3, pp. 445–58.

The feedback effect between RRC and EDM can be estimated using more complex quantitative techniques, such as full merger simulation. Competition policy practitioners can be reluctant to use these techniques due to their complexity and vulnerability to seemingly innocuous assumptions (e.g. demand form, bargaining model used), and may therefore favour simpler static tools described above.

An important lesson for practitioners is therefore that any quantitative static analysis—however valuable—should not distract from the bigger picture that may involve considerations that are more difficult to measure.19 Even though the European authorities in practice do not impose an impossible standard of proof for the substantiation of EDM,20 no vertical mergers were cleared on the basis that EDM benefits outweighed RRC concerns.

Towards dynamic effects or away from standard techniques?

The focus on price effects in vertical mergers might distract from potentially more important dynamic effects. Competition authorities may also need to consider the reaction of existing rivals and/or potential entry, which increases uncertainty. In this respect, it will be interesting to see how the Commission concludes its investigation into Illumina/Grail.

In the UK, the Facebook/Giphy merger led to one of the first major big tech merger prohibitions—the decision is currently being appealed by Meta. The new CMA guidelines have recently been revised to reflect more flexible thinking about how foreclosure may arise. The reference to specific techniques in assessing the ability, incentive, and effects of foreclosure (e.g. vertical arithmetic or vGUPPI) were removed—recognising that their applicability can be strongly context-dependent.

The increased attention paid to dynamic harms and longer-term business strategies does not mean that quantitative tools such as vertical arithmetic or vGUPPI are no longer relevant. Authorities are keen to rely on internal documents, but for major merger cases there is bound to be internal data crunching to help inform the deliberations—even if they are not included in the final decision.

Importantly, economics also remains key in the conceptual thinking on possible and likely future developments in markets, in order to ensure that any qualitative analysis remains robust and is given appropriate weight alongside other evidence.

1 The issues discussed in this article are relevant to all mergers involving complementary products, which includes but is not limited to vertical mergers.

2 Competition and Markets Authority (2021), ‘Merger assessment guidelines’, CMA129, 18 March.

3 U.S. Department of Justice and Federal Trade Commission (2020), ‘Vertical merger guidelines’, 30 June; Federal Trade Commission (2021), ‘Federal Trade Commission withdraws vertical merger guidelines and commentary’, press release, 15 September. For a broader discussion on recent developments in the USA on (vertical) mergers and competition policy, see in particular Shapiro, C. (2021), ‘Antitrust: What went wrong and how to fix it’, Antitrust, 35:3, pp. 33–45, and Shapiro, C. (2021), ‘Vertical mergers and input foreclosure: Lessons from the AT&T/Time Warner case’, Review of Industrial Organization, 59:2, pp. 303–41.

4 European Commission, (2008), ‘Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings’, 2008/C 265/07; Karlinger, L., Magos, D., Régibeau, P. and Zenger, H. (2020), ‘Recent developments at DG Competition: 2019/2020’, Review of Industrial Organization, 57:4, pp. 783–814.

5 See, for instance, Kwoka, J. and Slade, M. (2020), ‘Second thoughts on double marginalisation’, Antitrust, 34:2, p. 51.

6 See, for example, Refinitiv/London Stock Exchange Group, Case M.9564, 26 February 2021.

7 Spengler, J.J. (1950), ‘Vertical integration and antitrust policy’, Journal of Political Economy, 58:4, pp. 347–52. Note that in the case of a horizontal merger, this pricing externality runs in the other direction. Higher prices increase demand for a rival and this pricing externality is internalised as a result of a merger, to the detriment of consumers.

8 European Commission (2008), ‘Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings’, 2008/C 265/07, para. 13.

9 For example, a related issue was raised in Refinitiv/London Stock Exchange Group, Case M.9564, 26 February 2021. In practice, it seems that the European Commission, for example, has in fact acknowledged EDM in a number of cases (even though this was not decisive for the case). See, for instance, M.4854 TomTom/Tele Atlas. Moreover, the Commission may in some cases be internalising the EDM effect by underplaying the extent of the potential effect on competition—for instance, in the recent M.9569 EssilorLuxottica/GrandVision merger (the decision has not yet been published).

10 See the Federal Trade Commission (2021), ‘Statement of Chair Lina M. Khan, Commissioner Rohit Chopra, and Commissioner Rebecca Kelly Slaughter on the Withdrawal of the Vertical Merger Guidelines’, Commission File No. P810034, 15 September, p. 4.

11 See also Kwoka, J. and Slade, M. (2020), ‘Second thoughts on double marginalisation’, Antitrust, 34:2, pp. 51–6, and Zenger, H. (2020), ‘Analyzing Vertical Mergers’, CPI Antitrust Chronicle, October, pp. 1–8.

12 European Commission, Deutsche Börse/London Stock Exchange, Case M.7995, 29 March 2017.

13 European Commission, Telia Company/Bonnier Broadcasting, Case M.9064, 24 April 2020 and Refinitiv/London Stock Exchange Group, Case M.9564, 26 February 2021. This argument on full market coverage does assume that upstream margins to the downstream partner are not higher than those to the downstream rival, and the upstream firm cannot increase its upstream prices until demand becomes elastic again.

14 European Commission, Wieland/Aurubis Rolled Products/Schwermetall, Case M.8900, 5 February 2019.

15 For empirical investigations into internal transfer pricing, see Crawford, G.S., Lee, R.S., Whinston, M.D. and Yurukoglu, A. (2018), ‘The welfare effects of vertical integration in multichannel television markets’, Econometrica, 86:3, pp. 891–954; Michel, C. and Weiergraeber, S. (2018), ‘Estimating industry conduct in differentiated products markets’, unpublished.

16 European Commission, (2008), ‘Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings’, 2008/C 265/07, para. 13.

17 Recent cases where vGUPPIs have been considered include EssilorLuxottica/GrandVision in the EU and Tesco/Booker and Co-op/Nisa in the UK.

18 Other recent papers that consider equilibrium price effects in vertical mergers include Choné, P., Linnemer, L., and Vergé, T. (2021), ‘On double marginalization and vertical integration’, CEPR Discussion Paper No. DP15849, and Akgün, U., Caffarra, C., Etro, F. and Stillman, R. (2020), ‘On the welfare impact of mergers of complements: Raising rivals’ costs versus elimination of double marginalization’, Economics Letters, 195, 109429.

19 The argument that focusing on static price effects in vertical mergers risks ‘muddying the water’ and distracting from other, more important considerations, is made for instance in Salinger, M.A. (2021), ‘The new vertical merger guidelines: Muddying the waters’, Review of Industrial Organization, 59:2, pp. 161–76.

20 See, for instance, M.4854 TomTom/Tele Atlas.

Contact

Stéphane Dewulf

PartnerContributors

Related

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More