RIIO-2 appeals—CMA provisional findings

The Competition and Markets Authority (CMA) has published a summary of its Provisional Determination of the appeals in respect of Ofgem’s RIIO-GD2 and RIIO-T2 price control review. Out of 12 grounds of appeal, it provisionally upheld, partially or fully, five. In many instances, the CMA did not find Ofgem’s decisions wrong even if Ofgem’s approaches were different from those that the CMA followed in PR19. This may reflect the differences in the legal frameworks between water and energy.

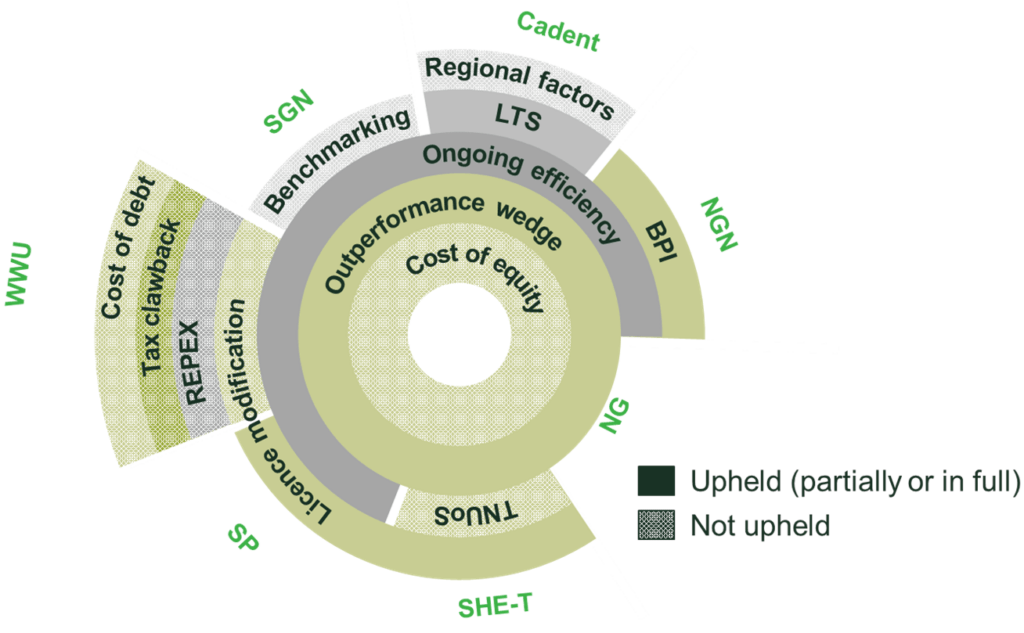

On 11 August 2021, the Competition and Markets Authority (CMA) published a summary of its Provisional Determination of the appeals in respect of Ofgem’s RIIO-2 price control review for transmission and gas distribution networks, as well as for the Electricity System Operator (ESO).1 (A summary of Ofgem’s Final Determinations (FDs) is available on our website.) All nine networks that are subject to Ofgem’s price control appealed to the CMA,2 and out of four joined grounds and eight individual grounds of appeal, the CMA provisionally upheld, fully or partially, five. Figure 1 and Table 1 outline the grounds of appeal and the CMA’s provisional decision for each of them.

Figure 1 Networks’ grounds of appeal and the CMA’s provisional decisions

Source: Oxera, based on CMA (2021), ‘RIIO-2 Energy Licence Modification Appeals. Summary of provisional determination’, 11 August.

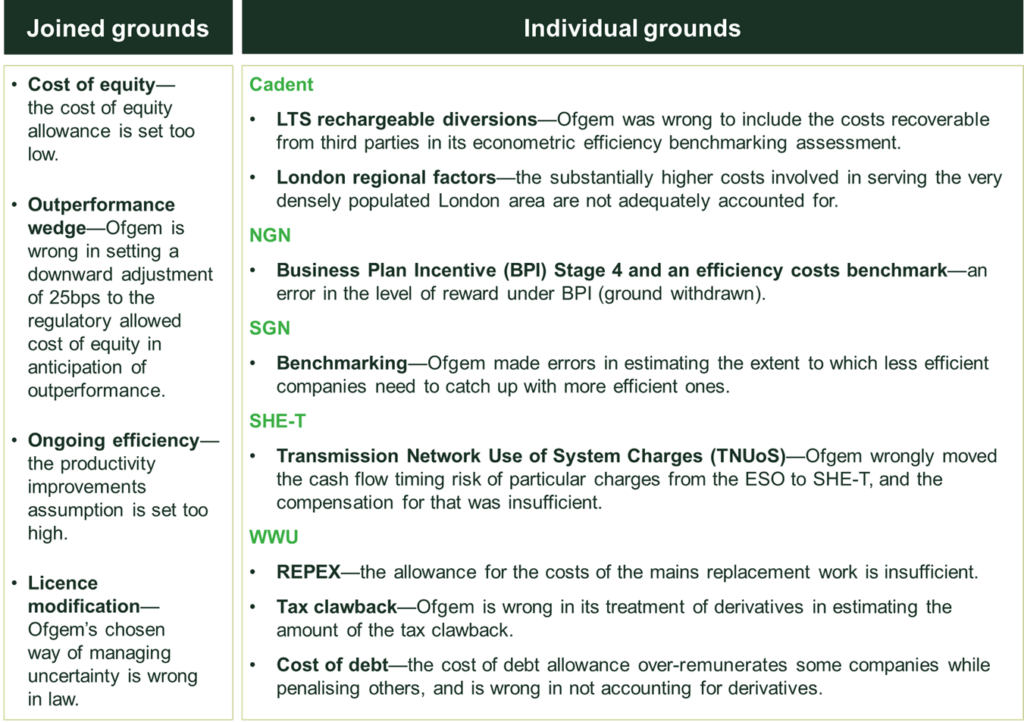

Table 1 Networks’ grounds of appeal

This number of appellants is unusually high for UK utility regulation. These appeals follow another unprecedented process, the CMA’s redetermination of Ofwat’s PR19 determination, at the request of four water networks, which was finalised in March 2021. (A summary of the CMA’s PR19 FDs is available on our website.) Although there is an overlap in the issues discussed in water and energy appeals, the legal frameworks differ substantially.

- In the PR19 water appeals, the CMA was required to conduct a redetermination of the price controls.

- In the RIIO-2 energy appeals, the CMA’s role is limited to determining whether Ofgem was wrong on any of the specific grounds. Based on this, the CMA considers whether there is a ‘margin of appreciation’ on some grounds where the regulator has had to exercise its judgement—i.e. there could be cases where the CMA would do things differently from Ofgem, but nonetheless does not consider Ofgem’s decision wrong.

In other words, in RIIO-2 appeals, the burden of proof lies with the appellants to demonstrate that Ofgem has erred in its decision, and the bar for evidence is high.

As a result, the CMA can decide against Ofwat and in favour of Ofgem even if the two regulators followed the same approach. Similarly, it can decide in favour of both regulators even if their approaches are different. It would then be up to the networks and regulators to consider which of the CMA’s precedents is applicable to their circumstances.

In the rest of this article, we delineate the three joined grounds appealed by the majority of the networks: cost of equity (not upheld), outperformance wedge (upheld), and ongoing efficiency (partially upheld).

Cost of equity

All appellants submitted that Ofgem has set the cost of equity too low. The appellants argue that Ofgem has erred in its decisions on setting the risk-free rate (RfR), the total market return (TMR), the beta, and the point estimate. Specifically, the appellants argued the following.3

- UK gilts cannot be used as the sole benchmark to estimate the RfR. The use of UK gilts violates the capital asset pricing model (CAPM) theory, which states that all agents must be able to borrow and lend at the market RfR, while in reality even the highest-rated market participants can borrow only at rates above UK gilt yields. Hence, an appropriate RfR for the CAPM should be adjusted upwards.4

- The TMR should be estimated with reference to the arithmetic average of returns and/or well-established estimators such Blume/JKL and Cooper. The appellants argue that Ofgem’s estimation based on the geometric average is downward biased and that the uplift applied is not sufficient to offset this bias. Furthermore, the appellants argue that some weight should be placed on the CED/RPI inflation series to deflate historic total returns.

- Ofgem’s sample of comparators to estimate the asset beta does not reflect the systematic risk of UK energy networks. Specifically, the appellants argue that too much weight was placed on water betas, bringing the overall estimate down.

- In selecting a point estimate, the regulator should aim up to mitigate the risks associated with parameter estimation errors and uncertainty.

The CMA has provisionally concluded that the evidence provided by the appellants is not sufficient to demonstrate that Ofgem has erred in its decision even though Ofgem’s methodology was different from the CMA’s PR19 FDs. In reaching its preliminary decision, the CMA states the following.

- Ofgem’s approach to estimate the RfR with reference to UK gilts only is not wrong. This is methodologically different from the CMA’s PR19 FDs, where the CMA calculated the RfR with reference to UK gilts and AAA-rated corporate bonds.

- Ofgem’s point estimate and range of TMR are not wrong. Ofgem estimates the TMR with reference to the geometric average of total market returns uplifted to account for the bias in geometric estimates. In the PR19 decision, the CMA estimated the TMR with reference to the arithmetic average of returns and other estimators such as Blume and JKM. Furthermore, Ofgem uses the CPI backcast series to deflate historical returns, whereas the CMA used both the CPI and RPI in PR19.

- Ofgem’s approach to estimate the beta is within Ofgem’s regulatory margin of appreciation. The methodology adopted by Ofgem is broadly similar to the CMA’s PR19 decision in terms of the estimation window and frequency of the data in use (a broad range of estimates is used to draw a conclusion). We note, however, that in the PR19 decision, the CMA placed weight only on companies operating in the sector of interest (i.e. water), while Ofgem uses a sample of comparators that includes companies from different sectors (i.e. energy and water companies).

- The decision to aim up (or not) in the point estimate is at Ofgem’s regulatory discretion. In contrast, in PR19, the CMA has explicitly aimed up by 25bps above the mid-point of the estimated cost of equity range.

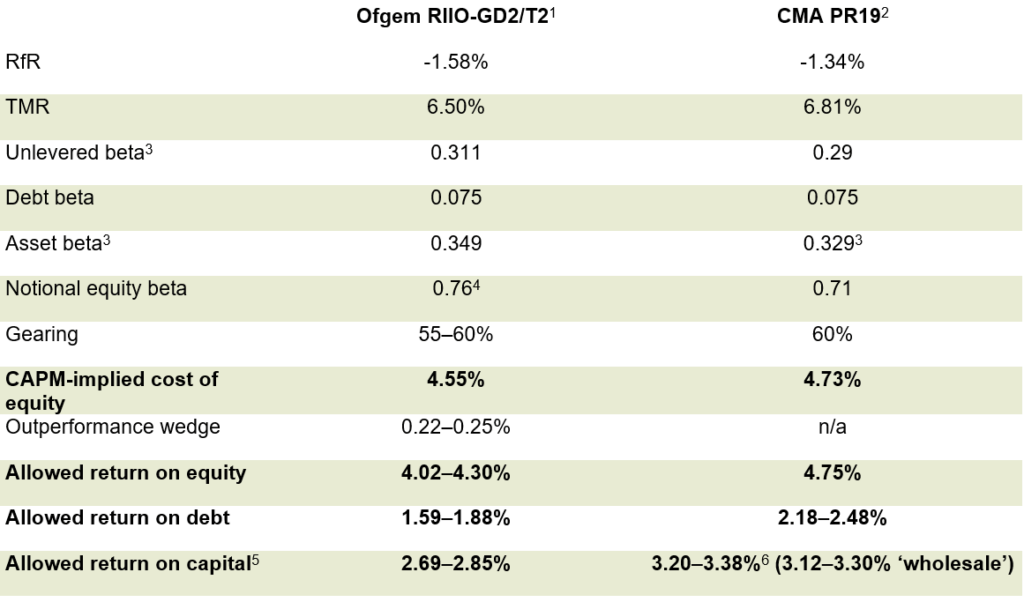

Table 2 compares Ofgem’s RIIO-GD2/T2 and CMA’s PR19 allowed returns on capital.

Table 2 Allowed return on capital in Ofgem’s RIIO-GD2/T2 and CMA’s PR19 FDs

Source: Ofgem (2020), ‘RIIO-2 final determinations – Finance Annex’, 8 December, p. 71. CMA (2021), ‘Anglian Water Services Limited, Bristol Water plc, Northumbrian Water Limited and Yorkshire Water Services Limited Price Determinations – Summary of Final Determinations’, 17 March, p. 27.

Outperformance wedge

In its FDs, Ofgem considered that there is an expectation of outperformance in RIIO-2 and therefore proposed a 25bp downward adjustment to the CAPM-based cost of equity. This adjustment is referred to as an ‘outperformance wedge’. If a network does not outperform, it recovers the outperformance wedge after the price control.

The appellants noted that the adjustment would undermine investors’ confidence, bias investor decisions towards lower-risk projects, and negatively impact outperformance incentives. Furthermore, the appellants argued that such an adjustment to the cost of equity is ill suited in the context of RIIO-2 since the package already foresees cost reduction incentives and challenging targets.

The CMA has provisionally upheld the appeal concluding that Ofgem was wrong in introducing the outperformance wedge. In deriving its conclusion, the CMA has found that:5

- there were a number of errors in Ofgem’s analysis of the expected operational outperformance;

- the outperformance wedge would be a poorly targeted way of addressing Ofgem’s concerns;

- there was a realistic possibility that the outperformance wedge, if introduced, might also undermine broader regulatory certainty, which could result in increased costs to consumers over time.

Ongoing efficiency

Ongoing efficiency (OE) relates to the ability of the most efficient firms in an industry to improve productivity—for example, through technological progress. These productivity improvements advance the current frontier of best practice for the industry, and are additional to any catch-up efficiency (i.e. the reduction of divergence from current best practice).

At the FDs, Ofgem set an OE challenge of 1.15% p.a. for CAPEX and REPEX, and an OE challenge of 1.25% p.a. for OPEX, based on:

- Growth Accounting (GA) analysis, where productivity growth is calculated in competitive sectors of the UK economy. Ofgem concluded that such evidence leads to a ‘core’ OE target of 0.95% p.a. for CAPEX and REPEX, and 1.05% p.a. for OPEX;

- uplift for innovation funding, where Ofgem assumes that companies can achieve greater productivity improvements than the wider economy due to past innovation stimulus to the networks. This led to an uplift of 0.2% p.a. for all three expenditure categories.

Five network companies appealed elements of the OE challenge. On the GA analysis, some companies argued that Ofgem had made several methodological errors resulting in an overestimation of the core OE target. Regarding the uplift for innovation funding, companies argued that Ofgem failed to consider embedded innovation savings baked into the business plans.6

The CMA has provisionally concluded that while it did find some errors in Ofgem’s evidence, it considers that the majority of its data sources were consistent with Ofgem’s core OE assumption. The CMA has, therefore, retained the core OE targets of 0.95% and 1.05% p.a. While the details of this assessment are not publicly available yet, there are methodological differences between Ofgem’s approach to setting the core OE target (that the CMA has provisionally upheld) and Ofwat’s approach to setting the OE challenge (that the CMA also largely upheld in the PR19 inquiry). Therefore, there could be methodological differences between the CMA’s approach between the two inquiries. The CMA’s analysis and reasoning will need to be carefully scrutinised to establish implications for future price reviews.

In its Provisional Determination, the CMA has concluded that Ofgem’s uplift for innovation funding was materially overestimated. In making the decision, the CMA has noted that while it recognises that benefits from past innovation funding are likely to be above zero, it found errors relating to important aspects of Ofgem’s evidence base, such that the evidence does not support the 0.2% uplift. While the exact errors have not been specified in the summary decision, the CMA’s conclusion will likely have knock-on implications for OE analysis in future price control reviews, across the sectors. This could include RIIO-ED2 and PR24, where companies currently have an innovation funding allowance and regulators are considering accounting for this in the cost assessment framework.

Next steps

While the Provisional Determination represents the CMA’s current view on the various topics, we note that the CMA can be (and has been in the previous appeal processes) persuaded to alter its view in the light of new evidence. For example, there were several changes between the CMA’s Provisional Findings and its Final Decision in the PR19 appeals that had a material impact on the appellants’ outcomes. Two examples are provided below.

- TOTEX assessment. In PR19,the CMA provisionally determined that it was inappropriate to include the latest year of cost and output data in the cost modelling due to a hypothesised risk that it would overestimate the efficient level of expenditure. Subsequent to submissions from the main parties, the CMA final decision was that the most recent data should be included in the analysis, leading to an increase in cost allowances of £129m for the appellants, as quantified by the CMA.7

- Cost of equity. The CMA provisionally determined that TMR should have been estimated with reference to the geometric average of returns and estimators such as JKM and Blume. In its FDs, the CMA changed the methodology based on the arguments presented by the appellants and third parties, and used the arithmetic average of returns alongside estimators such as JKM and Blume.

The CMA expects responses to its Provisional Determination within the next three weeks. It is likely that the main parties will submit additional evidence where the CMA has found the current evidence base lacking. The CMA’s Final Determination is then expected to be published by the end of October 2021.

1 CMA (2021), ‘RIIO-2 Energy Licence Modification Appeals. Summary of provisional determination’, 11 August, accessed on 11 August 2021 at: https://assets.publishing.service.gov.uk/media/61136944d3bf7f04482f89ab/Summary_energy_Aug.pdf.

2 On 3 March 2021, Cadent Gas, National Grid Electricity Transmission, National Grid Gas, Northern Gas Networks, Southern Gas Networks, Scotland Gas Networks, Scottish Hydro Electric Transmission, SP Transmission, and Wales & West Utilities appealed on various grounds. National Grid Electricity Transmission and National Grid Gas, as well as Southern Gas Networks and Scotland Gas Networks, had joint appeals as National Grid and SGN.

3 The following outlines a general position of the majority of the appellants—however, it may not reflect the arguments of each individual appellant in detail.

4 The upward adjustment accounts for the convenience premium: approximately 50–100bps.

5 CMA (2021), ‘RIIO-2 Energy License Modification Appeals, Summary of provisional determination’, 11 August, para. 25.

6 Note that one appellant also argued that Ofgem had miscalculated the rate of OE ‘embedded’ in its business plan.

7 The CMA estimated the impact of including the latest data in isolation, without considering the impact that the data has on other aspects of the cost assessment (e.g. the impact on the estimated upper-quartile benchmark). When these other aspects are accounted for, the impact of incorporating the latest data in the cost assessment models could be materially larger.

Download

Contact

Dr Luis Correia da Silva

Chair and PartnerContributors

Related

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More