Nuclear in the UK’s energy mix? The core question

Choosing the right energy mix is a hot topic for many countries around the world. In the UK, for example, the government appears committed to supporting new nuclear capacity; however, sceptics point to the declining cost of renewables as a reason why this commitment may be misplaced. What is the economic case for new nuclear capacity, given the objectives of security of supply, affordability, and decarbonisation?

Does new nuclear power have a place in the overall energy mix, in terms of energy security, affordability and decarbonisation? These are the three main objectives of energy policy defined by the UK Department for Business, Energy and Industrial Strategy (BEIS)—the ‘trilemma’ objectives.1 The question is therefore threefold: (i) does new nuclear make the electricity system more secure? (ii) does new nuclear help to keep electricity bills down? and (iii) what does new nuclear add to the decarbonisation programme? Based on research carried out on behalf of a client, we look at the role of nuclear in the UK’s future energy mix.

As described below, the UK electricity system has features that suggest that new nuclear build can play an important role in meeting these objectives, especially those relating to energy security and decarbonisation:

- increasing demand for electricity;

- retiring existing capacity;

- increasing reliance on intermittent (or ‘variable’) generation sources.

Electricity demand is expected to increase substantially

Electricity demand is expected to increase substantially over the coming decades. Recent projections indicate that, by 2035, demand for electricity in the UK is likely to increase by 20%.2

This forecast increase can, at least in part, be explained by the UK’s obligations to meet emissions targets. Under the Climate Change Act 2008, the UK is committed to reducing its greenhouse gas emissions by at least 80% by 2050 relative to 1990 levels.3 It is therefore necessary that the UK reduces its use of fossil fuels, particularly in the four sectors with the greatest emissions: transport, industry, heating for buildings, and electricity generation.4

So, how can this be done? Switching away from fossil fuels in these sectors is anticipated to be achieved partly through electrification, such as increased use of electric vehicles. However, to ensure that electrification does reduce overall emissions, the electricity will need to be generated from low-carbon sources.

This explains why the Department of Energy & Climate Change (now BEIS) considered an increase in the supply of low-carbon electricity to be an ‘essential prerequisite’ to meeting the UK’s emissions targets.5

Existing generating capacity will not last forever

A significant proportion of existing capacity from all sources is expected to retire in the medium term. Looking at the period 2016–35, the National Audit Office (NAO) estimates that c. 64GW is expected to be lost due to plant retirements by 2035.6 This represents more than a 60% decrease in generating capacity.

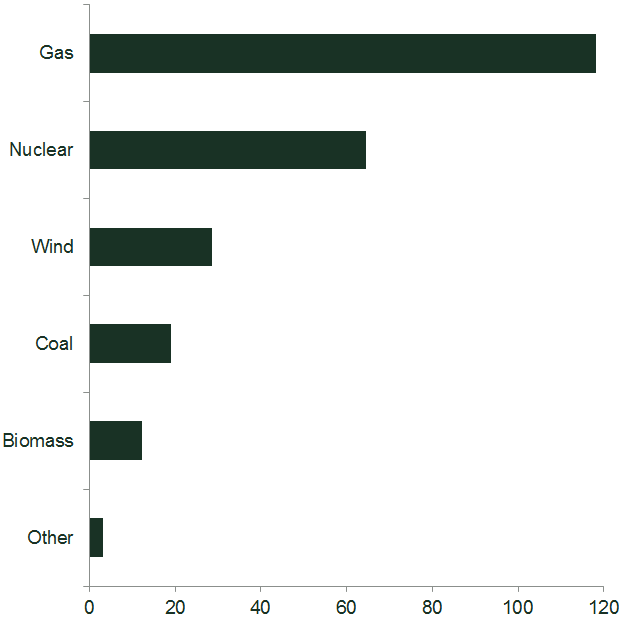

According to the latest figures from National Grid, the UK electricity system operator, nuclear is the second-largest source of generation that is connected to the transmission grid (‘centralised generation’)—see Figure 1.

Figure 1 Transmission-connected generation in the UK by technology over 2017 (TWh)

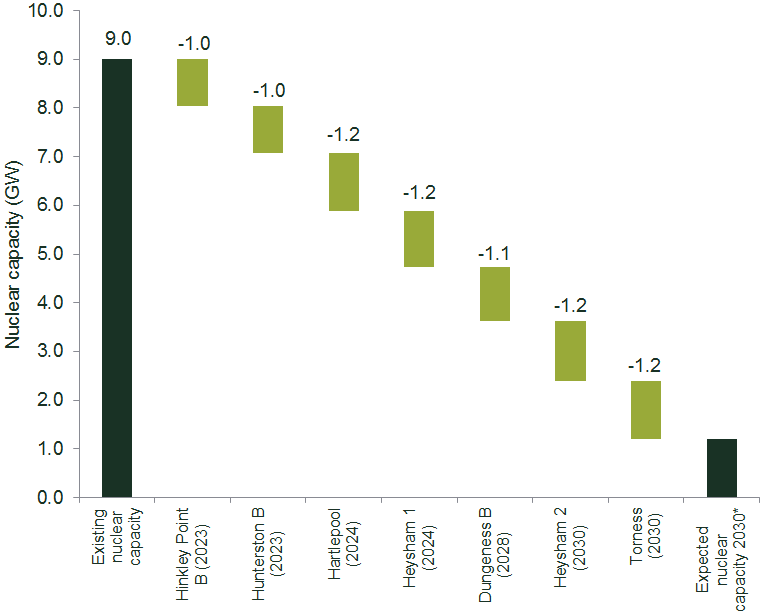

A large number of existing nuclear plants are planned to close by 2030. According to electricity supplier, EDF Energy, only 1.2GW of existing nuclear capacity in the UK will remain operational in 2030.7 This represents a decrease of more than 85% in existing nuclear capacity. Figure 2 illustrates the loss of existing nuclear generation capacity over time.

Figure 2 The loss of existing nuclear generation capacity in the UK

Source: Oxera analysis of EDF closure plans, accessed 29 August 2018.

Increasing demand + decreasing supply = generation shortfall?

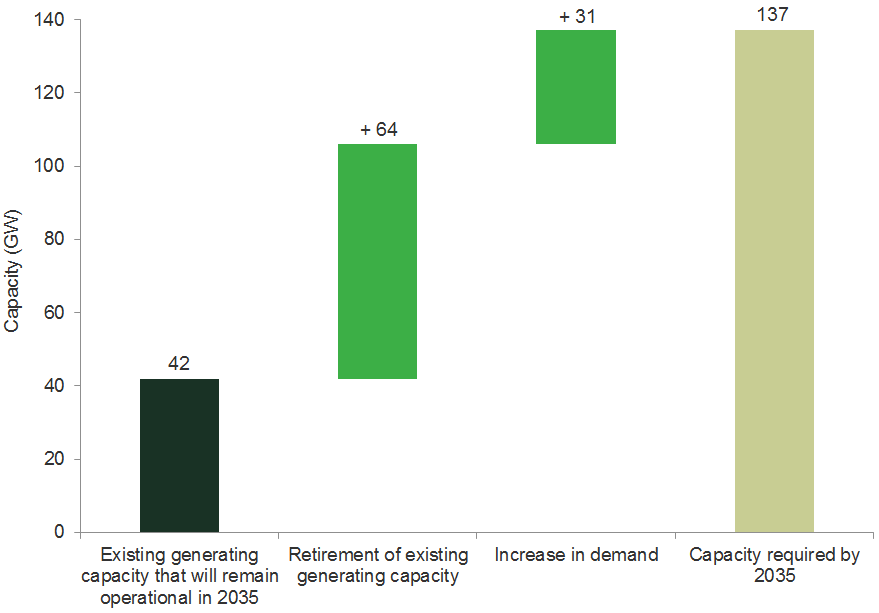

Given the rising demand and the retiring existing supply, a shortage of generation capacity is likely to materialise unless substantial new capacity is developed over the medium term. This is illustrated in Figure 3.

The NAO estimates that at least 31GW of capacity over and above the existing resources is needed to meet the minimum generating capacity required in 2035.8 Given that 64GW of existing capacity is expected to retire, this adds up to a capacity requirement of at least 95GW by 2035—a sizeable proportion of the total 137GW of minimum generating capacity required in 2035.

Figure 3 The UK’s energy challenge up to 2035

Is nuclear required to bridge the gap?

The combination of rising demand for electricity, retiring existing capacity and a requirement to meet emissions targets points to a significant need for new low-carbon electricity generation. Taking this as a starting point, the next question becomes: does nuclear have to be in the mix, or can the gap be bridged with renewables?

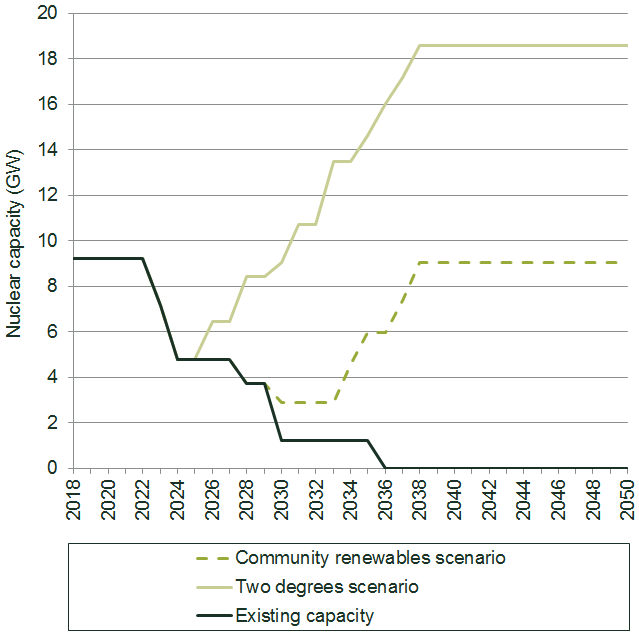

With its central role as system operator planning and operating the electricity system,9 National Grid can provide some insights. In its latest Future Energy Scenarios publication, National Grid defines two scenarios under which the UK would meet its 2050 emissions targets: (i) the two degrees scenario; and (ii) the community renewables scenario.10

The two degrees scenario takes its name from an objective of the United Nations Paris Agreement—to limit the increase in the global average temperature to well below 2°C above pre-industrial levels.11 Under this scenario, a relatively large proportion of generation is connected to the transmission (i.e. high-voltage) network, and a significant amount of new nuclear capacity is introduced.12

The community renewables scenario assumes that a significant proportion of generation becomes local (hence ‘community’). In this scenario, decentralised onshore wind and solar, co-located with storage, dominate the system.13

Both scenarios involve new nuclear capacity, as illustrated in Figure 4.

Figure 4 Nuclear capacity in the Future Energy Scenarios and under the assumption of no new nuclear being built

The reason for the large difference in nuclear capacity required between the two scenarios is the assumed level of new decentralised renewables. For wind alone, the community renewables scenario assumes an additional 17.6GW of capacity by 2050, over and above the two degrees scenario. To illustrate, this difference is equivalent to more than five power stations of a size similar to that of Hinkley Point C in the UK, which has a planned capacity of 3,200MW.14

The challenge with decentralised renewables is that they cannot always be relied upon to provide the necessary capacity.15 Under unfavourable weather conditions, this may lead to price spikes and, in extreme cases, blackouts. Mitigation of such risks will entail investment into additional capacity and additional network operation costs. According to research from Imperial College London, the UK’s Clean Growth Strategy will require capacity to exceed peak demand by more than 3 times, in contrast to 1.8 times today (given that today the proportion of variable generation in the energy mix is much lower than it would be under the Clean Growth Strategy).16 The same source also notes that some energy models do not adequately consider system operability requirements, which may lead them to underestimate the amount of ‘firm’ (i.e. reliable/fixed, rather than variable) generation capacity required. New nuclear generation can therefore potentially play an important role in maintaining system and price stability.

Using inputs from National Grid’s Future Energy Scenarios, Oxera has estimated that, by 2050, wholesale electricity prices could grow by 20–45% more if the planned new nuclear is not built. The lower wholesale prices arising with the new nuclear build would go some way to offsetting the costs of nuclear support measures.

Challenges with determining the future energy mix

Estimating the costs of alternative future energy scenarios, as with any forecasting exercise, is not without its challenges. Three factors are particularly important in analysing the costs and benefits of future fuel and energy mixes in an era of decarbonisation.

- Additional balancing and system services costs associated with a high share of renewable generation in the system—as discussed above, more intermittent energy generation would result in additional costs for the transmission system operator in order to balance the system. These additional costs would be passed on to consumers in the form of higher system operation and network charges.

- Plant investment decisions based on future electricity prices—there is an inherent circularity in estimating future electricity prices, because the future capacity that determines the prices depends on the expectation of the prices themselves. However, if a market is dominated by technologies with zero marginal costs (e.g. wind)17 then government policies and the design of subsidy schemes or other market arrangements, rather than market prices, will play a role in determining how much investment is made into which technologies, as well as where and when.

- Preserving wholesale market competition—all else being equal, high penetration of renewables could fundamentally change incentives for generation investment and market bidding behaviour. In a market that is expected to increasingly be dominated by technologies with zero marginal costs, existing unsupported baseload capacity may be retired and replaced with peaking plants. It would therefore be all the more important to ensure that the opportunities for market entry are not unduly limited and that policies designed to encourage greater demand-side flexibility are effective, otherwise the market prices could turn out to be both higher and more volatile than expected.

Conclusion: is new nuclear part of the solution?

Electricity demand is forecast to grow significantly over the coming decades. With a large proportion of existing capacity retiring in the medium term, new generation is required to avoid a capacity shortfall. Publications by National Grid show that new nuclear would be part of all scenarios where the 2050 emissions targets are met. Given the potential challenges that come with high reliance on intermittent generation, new nuclear energy could be well suited to complement intermittent generation by providing reliable low-carbon power and system stability.

1 National Audit Office (2017), ‘A short guide to the Department for Business, Energy & Industrial Strategy’, September, p. 26, accessed 4 September 2018.

2 Oxera analysis of Department for Business, Energy and Industrial Strategy (2018), ‘Updated energy and emissions projections 2017’, Annex F, accessed 30 August 2018. (This forecast is also reflected in Department for Business, Energy and Industrial Strategy (2017), ‘Statement on Energy Infrastructure’, accessed 30 August 2018.) Tab ‘Reference scenario’ in Annex F above shows that final consumption of electricity amounts to 26,370ktoe and 31,539ktoe in 2017 and 2035 respectively. The resulting increase therefore amounts to 20% (100∙(31,539/26,370) – 100).

3 Climate Change Act 2008, Chapter 27, Part 1, Section 1, para. 1.

4 Specifically, according to Ofgem, transport accounts for 26% of emissions, industry for 22%, heating for buildings for 19%, and electricity generation for 17%. See Ofgem (2017), ‘State of the energy market’, October, p. 80.

5 Department of Energy & Climate Change (2011), ‘Overarching National Policy Statement for Energy (EN-1)’, July, para. 3.3.13.

6 National Audit Office (2016), ‘Nuclear power in the UK’, p. 6.

7 Oxera analysis of EDF closure plans, accessed 29 August 2018.

8 National Audit Office (2016), ‘Nuclear power in the UK’, Figure 1.

9 See Ofgem (2017), ‘Ofgem confirms plans for greater separation of National Grid’s electricity system operator role’, press release, 3 August, accessed 3 September 2018. The system operation function of National Grid is being legally separated from the transmission owner function, within the National Grid Group.

10 National Grid (2018), ‘Future Energy Scenarios’, July, p. 14.

11 See National Grid (2017), ‘FES 2017: What’s changing?’, 21 April, accessed 12 September 2018.

12 National Grid (2018), ‘Future Energy Scenarios’, July, p. 18.

13 National Grid (2018), ‘Future Energy Scenarios’, July, p. 17.

14 See Department for Business, Energy and Industrial Strategy (2017), ‘Nuclear capacity in the UK’, accessed 29 August 2018.

15 For example, due to the dependence of wind and solar power on the weather, these forms of energy generation run the risk of failing to deliver a required amount of energy at a specified date in the future. Technologies such as coal, gas, nuclear, pumped storage and biomass have a much lower risk of falling short of the generation requirements. Given the emissions targets, this leaves nuclear, pumped storage and biomass as the main sources of firm low-carbon capacity.

16 Heuberger, C.F. and Mac Dowel, N. (2018), ‘Real-world challenges with a rapid transition to 100% renewable power systems’, Joule, 2:3, 21 March, pp. 367–70.

17 In this context, zero marginal cost refers to technologies that do not incur additional costs when increasing their output. For example, a wind farm can increase its output within the limits of its capacity without incurring any fuel costs. In contrast, a gas generator has to incur fuel costs for each additional 1MW produced.

Download

Contact

Jostein Kristensen

PartnerContributors

Related

Download

Related

Ofgem RIIO-3 Draft Determinations

On 1 July 2025, Ofgem published its Draft Determinations (DDs) for the RIIO-3 price control for the GB electricity transmission (ET), gas distribution (GD) and gas transmission (GT) sectors for the period 2026 to 2031.1 The DDs set out the envisaged regulatory framework, including the baseline cost allowances,… Read More

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More