Meaningful purpose in business

What is the purpose of a business? Recent years have seen growing social, political and market pressures on business leaders worldwide to go beyond simply creating short-term value for shareholders. Utilitalia—the federation of Italian water, energy, and municipal waste companies—asked Oxera to explore how a wider purpose can be embedded within an organisation, and how performance could be monitored.

Increasingly, the notion that businesses exist primarily for their shareholders (‘shareholder primacy’) has been openly challenged, while concepts such as ‘responsible capitalism’, ‘stakeholderism’ and ‘sustainable business models’ have become prevalent. The drivers of this change in mindset are diverse—from a recognition of the need to protect the environment, mistrust in big corporations following the financial crisis, concerns around equality and the fair treatment of consumers and workers, and changing attitudes to work. International commitments to address the climate crisis have focused minds—such as the 2015 Paris Agreement, the United Nations Sustainable Development Goals (SDGs) and the European Green Deal. The COVID-19 pandemic has also led firms, investors and the general public to question what a greener, fairer and more sustainable recovery would look like.

Changing investor expectations, new corporate code requirements, and the evolution of reporting approaches—in particular, environmental, social, and governance (ESG) reporting and integrated reporting (IR)—have pushed companies to consider their underlying purpose and wider impacts.1 Against this backdrop, Utilitalia asked Oxera to explore how a wider purpose can be embedded within an organisation, and how performance could be monitored.2

Embedding a purpose

The benefits of a purposeful business model

As we discuss in our report, there is increasing recognition that, to be profitable in the longer term, a firm must maintain and enhance its different sources of capital. Put another way, effective management of a company’s various capitals can result in:

- increased value creation;

- improved risk management;

- improved decision-making;

- engaged stakeholders;

- more effective communication.

Consumers are increasingly switching away from brands associated with firms that have a poor environmental record.3 Studies show that companies employing a more diverse workforce enhance their human capital and make higher profits,4 and that employees want to work for and stay with firms with a good social and environmental record.5 There is also evidence that firms that have adopted ESG or IR reporting make higher returns (although there are critiques of these analyses).6 Investors are acutely aware of these trends.

However, for a company to realise these kinds of benefit, it must act in a way that is genuine and credible—as opposed to ‘greenwashing’.7 Investors and consumers should not be misled. It is important that any such strategy is implemented for meaningful reasons rather than in a cosmetic way that purely ‘ticks the boxes’. Purpose is also about how a firm makes its moneyand whether this has societal value, as opposed to how it chooses to spend its money—this goes beyond ‘philanthropy’.

In our report, we explore a variety of examples internationally where companies have adopted a purpose. In Italy, the ‘Benefit Corporation’ (Società Benefit) model has been adopted by a number of companies since 2016 as a means of embedding a broader purpose in the business. Companies can adopt the model as a step towards attaining B Corp certification (and vice versa). B Corp is an international certification process, undertaken by the non-profit entity B Lab since 2008. In contrast, a Benefit Corporation is a legal structure, which legally empowers a for-profit business to pursue positive wider impacts beyond profit. Nonetheless, the Benefit Corporation model in Italy is still in its infancy, and there is considerable variation in implementing the model and in the quality of reporting (although reporting quality is higher for larger companies).8

The role of reporting

What approaches might a company adopt to measure and monitor its progress in delivering its purpose? The critical challenge is understanding the impact that the company is having on the world at large, rather than just on shareholder value. In addition to governance arrangements, reporting is a key tool for holding management to account for delivery. Three types of annual reporting activity are:

- financial reporting;

- sustainability (ESG) reporting;

- integrated reporting (IR).

While reporting annual accounts is a legal requirement, for many sectors and companies ESG reporting and IR are voluntary initiatives. However, the adoption by some companies of ESR and IR has placed pressure on others to follow. In addition, at the EU level non-financial reporting is mandatory for certain companies. Figure 1 below compares the three approaches.

Figure 1 Alternative reporting models

As shown on the left-hand side of Figure 1, traditionally firms have reported their financial situation and investments in their annual accounts. These are prepared on behalf of shareholders and other investors.

As shown on the right-hand side of the figure, in recent years some firms have incorporated annual sustainability reporting within (or alongside) their accounts, using the ESG model. This sets out metrics on issues such as how companies have an impact on the environment, mitigate climate change, invest in their skills base, increase diversity and inclusion, and build links with the communities within which they operate.

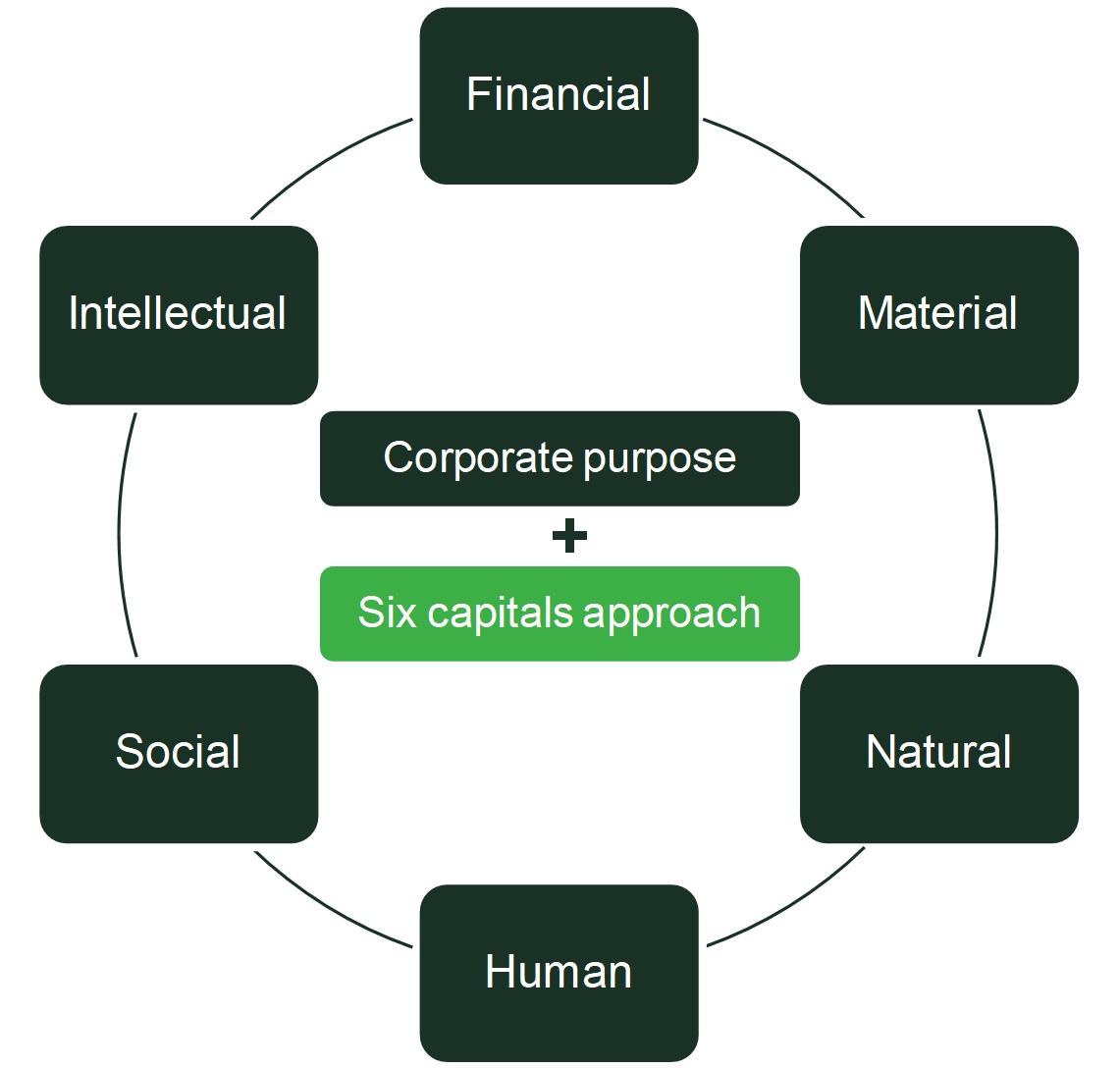

However, the six capitals model seeks to integrate the five capitals captured within the traditional and ESG frameworks, while adding intellectual capital. A number of companies now report their annual performance against the six capitals using an IR framework.

The 2015 United Nations SDGs framework provided an impetus for large companies to report on their wider impacts, and a number of firms adopted ESG reporting. At the EU level, through the 2014 Non-Financial Reporting Directive (NFRD), certain large ‘public-interest entities’ (including listed companies, banks and insurers) are required to disclose information on environmental, social and diversity matters.9

In April 2021 the European Commission set out, among other sustainability measures, plans to revise and strengthen the NFRD. The proposed Corporate Sustainability Reporting Directive (CSRD) aims to make sustainability reporting by companies more consistent, so that firms, investors and the public can access comparable and reliable sustainability information.10 This means that nearly 50,000 companies in the EU (including listed SMEs) will need to follow detailed EU sustainability reporting standards, an increase from the 11,000 companies that are currently subject to the NFRD.11 To help ensure that reported information is reliable, the proposed CSRD would also introduce a general EU-wide audit (‘assurance’) requirement for reported sustainability information—starting with a ‘limited’ assurance requirement.12

It is likely that, in the future, audit firms will increasingly scrutinise companies’ ESG performance as well as their financial accounts.13

The six capitals model

While ESG is one framework for addressing this challenge, another, more recent, initiative is for companies to state a purpose and measure delivery against it using the six capitals framework. In this vein, to survive in the long run, firms must maintain not only their physical and financial capital, but also their natural, human, social, material and intellectual capital. This model can help to frame how companies make decisions, measure performance and assess their impact on society. The framework is illustrated in Figure 2 below.

Figure 2 The six capitals approach

In our report we explore examples from around the world in which companies have stated a purpose. ESG reporting is commonplace, while companies that have adopted the six capitals framework increasingly use IR. There is also a push from some in academia for large listed companies to go further than ESG or IR, and to publish impact-weighted accounts, with adjusted-EBITDA figures in the company’s bottom line.14

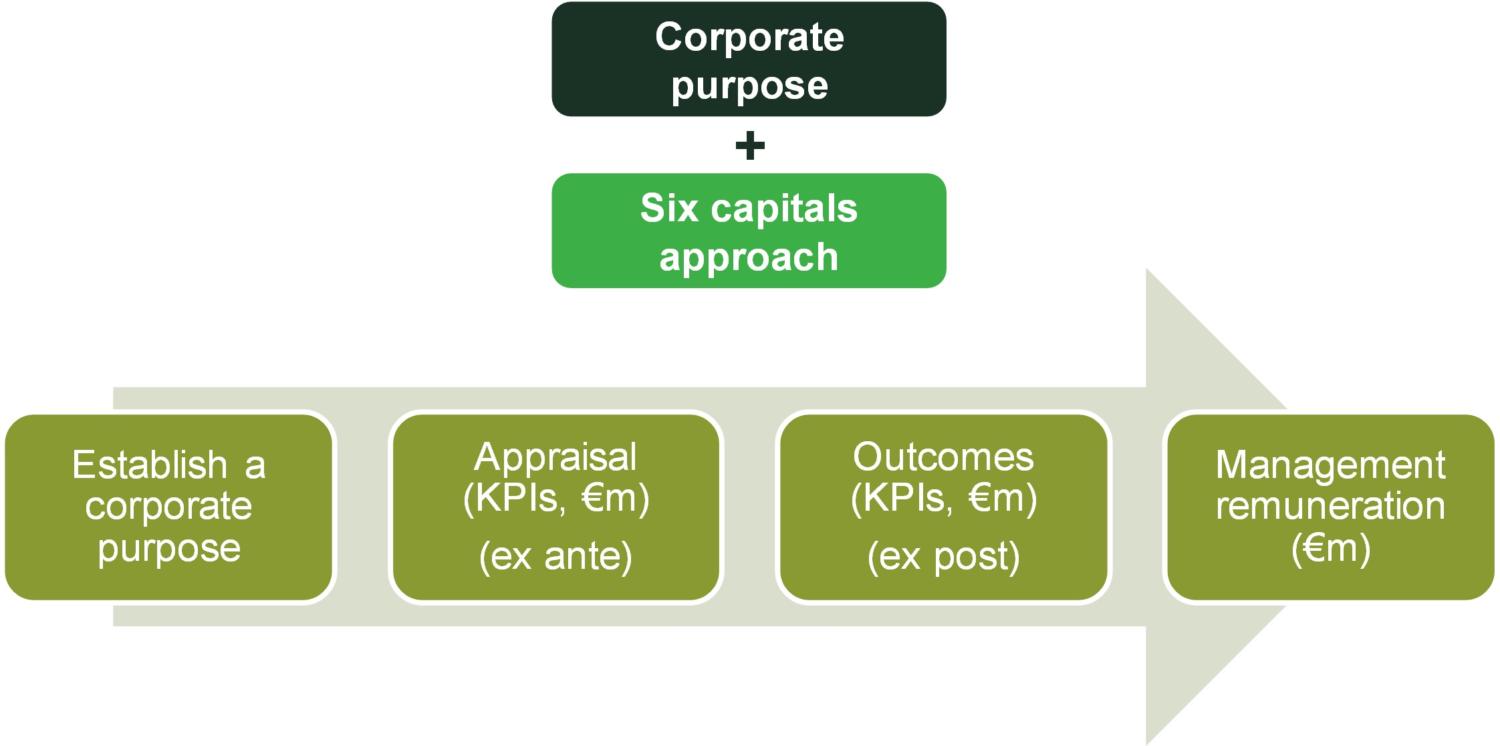

Arguably, the ‘gold standard’ would involve:

- stating clearly the corporate purpose and establishing the six capitals framework;

- establishing monetisation of impacts in an ex ante appraisal framework;

- measuring ex post impacts in a monetised (and non-monetised) form;

- linking ex post performance to management remuneration.

This is illustrated in Figure 3 below. Our research has not identified an example that meets all of these conditions, particularly in relation to comprehensive ex ante and ex post monetisation of wider impacts.

Figure 3 An ideal-world six capitals approach?

Implications for utilities

The special case of utilities

Utilities are a special case: they provide an essential service and contain a naturally monopolistic element, and there is a problem of information asymmetry that necessitates economic regulation.

Therefore, while providing a continuous service to society while minimising adverse environmental impacts is in the DNA of water, energy and municipal waste companies, market failures may arise as consumers cannot monitor firm behaviour perfectly and (in the case of the network component of the value chain) cannot switch. In turn, the firms’ interests may not be completely aligned with those of wider society or the environment.

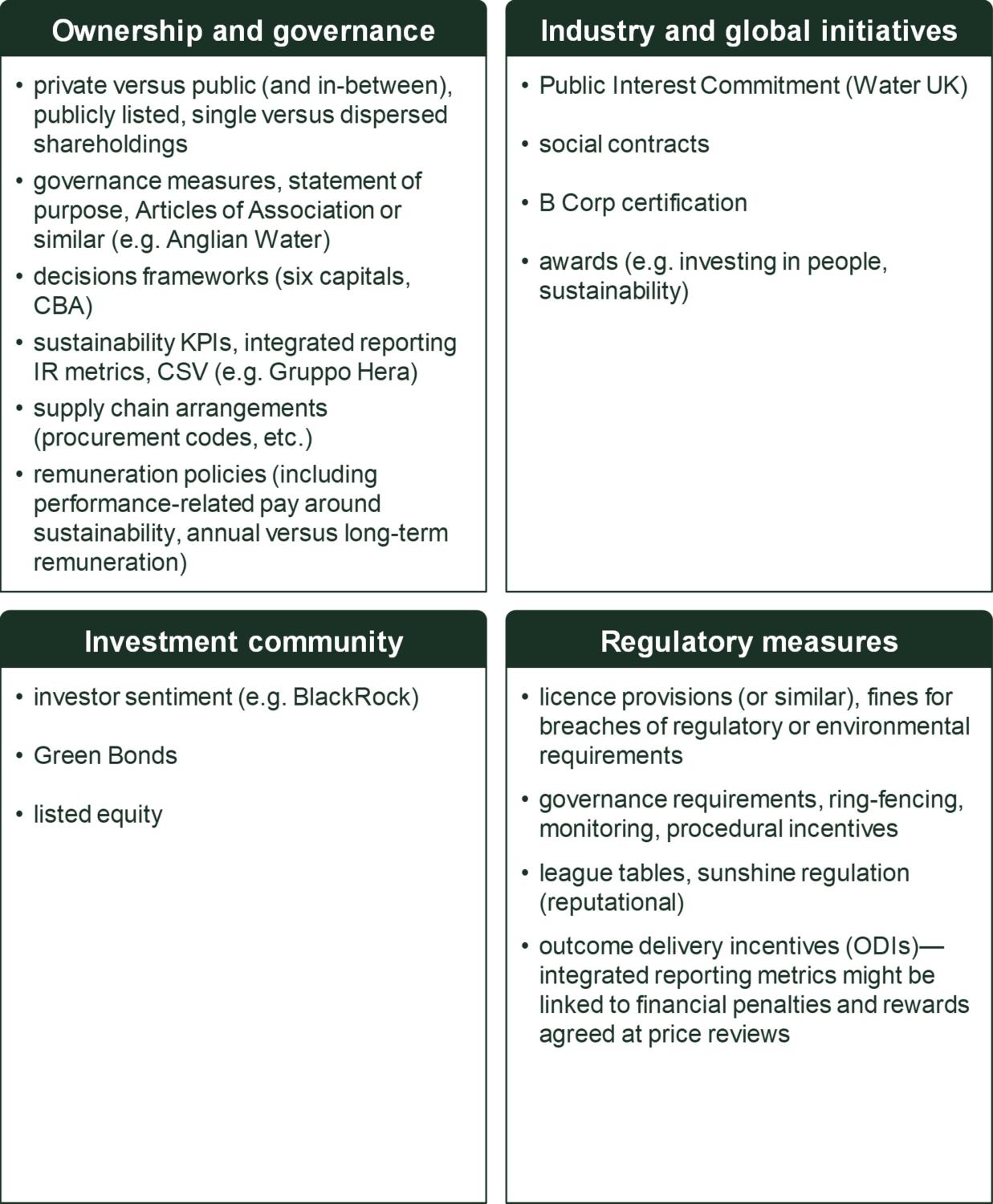

However, a variety of correction mechanisms could be employed, including ownership and governance changes, industry and global initiatives, investment community pressure, and regulatory measures. These differ in the degree to which they are adopted by firms or are imposed on them. They also differ in terms of their severity. Figure 4 provides some examples. One option (among many) is to enshrine the corporate purpose within the company’s articles of association.

Figure 4 Alternatives to align utility companies with public value

Current practice in Italian utilities

We explored with Utilitalia members how they approach sustainability and the kinds of issues discussed above. We spoke with a variety of companies involved in water supply, wastewater treatment, energy, and municipal waste. These companies varied with respect to:

- whether they were publicly owned (by municipalities), privately owned, or a mixture of the two;

- whether they were large-scale multi-utilities or smaller scale with a single focus;

- their evolution along the path of ESG and other initiatives.

One strong message that came from these discussions was that the very nature of the activities that they undertake—that of providing essential services crucial to the wellbeing of society and the environment—means that purposefulness is in many ways embedded in their ways of working.

The model of ownership was also cited as making a difference, but no one model dominated in delivering outcomes. Municipalities are public-sector bodies and, as shareholders, want a good service for their citizens, employment and training opportunities, and stewardship of the environment. Publicly listed companies said that equity investors were increasingly looking for companies that could demonstrate their sustainability and diversity credentials, as were the debt (bond) markets. Some companies had a mixture of public-sector and private-sector (publicly listed) ownership—and thus a mixture of these motivations.

Depending on the company, changing the articles of association or equivalent could be difficult due to legal constraints, although we did speak with one company that had done this. Nonetheless, in practice, companies undertook other initiatives within their company structure, corporate governance, codes, initiatives and reporting. Larger listed companies are required to disclose information on environmental, social and diversity matters under the EU NFRD and under Italian law.

Companies have sustainability plans of various forms (in addition to business plans or strategic plans), in which the concept of the circular economy is emphasised. Many now publish annual Sustainability Reports (reporting against SDG/ESG KPIs). Various companies have initiatives that are aimed at improving gender diversity in science. And many have procurement policies in place under which only sustainable and accredited suppliers are invited to tender.

Most companies targeted KPIs linked to ESG goals in some form, although some were at an early stage in this process while others had fully embedded ESG. One company that we spoke to had embodied the ‘creating shared value’ (CSV) concept within its operations, whereby a number of sustainability KPIs are reported on wider value created each year, including reporting of sustainability-adjusted profits. Most companies linked management remuneration to these KPIs.

Barriers to change and moving forward

There were, however, barriers to improving societal outcomes in Italian utilities. Culture could be difficult to change overnight, and communication within an organisation was often an enabler of change. Regulation did not always remunerate additional activities, such as the additional costs of waste collection that companies have incurred during the COVID-19 pandemic. Downstream supply chain issues were also beyond the control of some companies. While some assets are not, and cannot be, totally decarbonised at present, future technologies may enable this.

All of these issues highlight how alignment is important for achieving corporate purpose.

Much progress has been made in Italian utilities, in particular in relation to the SDGs and ESG. Our research found (and bearing in mind the ‘gold standard’ discussed above) that there is further opportunity for Italian utilities to focus on their public purpose.

- At present, companies tend to operate within an ESG framework, as opposed to the more recent six capitals framework.

- In addition, most companies adopt KPIs around sustainability, but these are not (with some exceptions) monetised in terms of public value.

- Monetisation of public value impacts has not yet been incorporated into the ex ante investment decision frameworks of companies. Rather, impacts are taken into account ex post through the KPI framework.

Such initiatives will have practical implications, but are nonetheless worth considering.

Some reflections

While the very nature of the activities that utility companies undertake means that purposefulness is embedded in their approach, various measures can be adopted to align this purpose with society. In many ways, in any jurisdiction, the ball is within companies’ court to devise and implement innovative changes to their governance, reporting and remuneration practices.

However, at the system level, other aspects also need to be in alignment with this. In any country, there need to be robust reporting standards, meaningful ESG investment funding criteria, and a system of economic regulation that assists in the achievement of a wider purpose.

In a similar vein, at the recent COP26 UN climate change conference it was recognised that, to tackle the climate crisis, there is a need for collaboration between governments, businesses and civil society. The need for alignment is a common theme as efforts are made to solve society’s problems.

1 For a discussion of ESG investment and ways of staving off greenwashing, see Oxera (2022), ‘Washing out greenwashing: regulation and investment for a net zero future’, Agenda, February.

2 Oxera (2021), ‘Corporate purpose: implications for Italian utilities’, report prepared for Utilitalia, 7 December.

3 For example, see Wells, L. (2019), ‘Consumers boycotting brand over environmental policies, Kantar reveals’, Talking Retail, December. Also see Pollet, M. (2021), ‘Two-thirds of French sports fans ready to boycott non-eco-friendly events’, Euractiv, translated by D. Eck, 24 February.

4 For discussion, see McKinsey & Company (2020), ‘Diversity wins: How inclusion matters’, report, May; Deloitte (2017), ‘Diversity and inclusion: The reality gap: 2017 Global Human Capital Trends’, February; and Myers, J. (2020), ‘Opinion: The numbers don’t lie: Diverse workforces make businesses more money’, MarketWatch, 1 August.

5 For example, see Cone Communications (2016), ‘2016 Millennial Employee Engagement Study’, November.

6 See section 3.6 of our report for further discussion.

7 For example, if a company claims to be reducing its carbon emissions by examining selective measures when in fact its emissions are increasing, consumers may be misled. Milder forms of greenwashing may be inadvertent rather than deliberate. For a discussion of greenwashing, see Oxera (2022), ‘Washing out greenwashing: regulation and investment for a net zero future’, Agenda, February.

8 See, for example, Mion, G. and Adaui, C. (2020), ‘Understanding the purpose of benefit corporations: an empirical study on the Italian case’, International Journal of Corporate Social Responsibility, 5:1, December, pp. 1‒15; Mion, G. (2020), ‘Organizations with impact? A study on Italian Benefit Corporations reporting practices and reporting quality’, Sustainability, 12:21, October, pp. 1‒21.

9 European Commission (2014), ‘DIRECTIVE 2014/95/EU OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 22 October 2014 amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups’, 22 October.

10 European Commission (2021), ‘COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS, EU Taxonomy, Corporate Sustainability Reporting, Sustainability Preferences and Fiduciary Duties: Directing finance towards the European Green Deal’, COM(2021) 188 final, 21 April.

11 European Commission (2021), ‘Sustainable Finance and EU Taxonomy: Commission takes further steps to channel money towards sustainable activities’, press release, 21 April.

12 European Commission (2021), ‘Questions and Answers: Corporate Sustainability Reporting Directive proposal’, 21 April.

13 For more on the regulation and auditing of ESG reporting, see Oxera (2022), ‘Washing out greenwashing: regulation and investment for a net zero future’, Agenda, February.

14 See Serafeim, G., Zochowski, T.R. and Downing, J. (2019), ‘Impact-Weighted Financial Accounts: The Missing Piece for an Impact Economy’, Harvard Business School. Also see Cohen, R. and Serafeim, G. (2020), ‘How to measure a company’s real impact’, Harvard Business Review, 3 September.

Contact

Leon Fields

Senior ConsultantContributors

Related

Related

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More