Bad medicine? An effects-based approach to ‘pay-for-delay’ agreements

In July 2013, the European Commission, for the first time, fined pharmaceutical companies for settling a patent dispute via what it terms as ‘pay-for-delay’ agreements. Under these deals, generics producers agree to delay launching their (less-expensive) drug in exchange for a payment from the branded company. The Commission has treated the agreements as illegal per se—but do deals of this type necessarily harm consumers?

In the last five years, the pharmaceutical industry on both sides of the Atlantic has been subject to investigations by competition authorities into such settlement agreements. In essence, this form of agreement refers to a deal between the manufacturer of a patent-protected drug (the originator) and a manufacturer of the generic version of the same drug which settles an ongoing dispute or litigation about patent validity and/or infringement, and prevents the generic supplier from entering the market for a set period of time. Such settlements are often used to end disputes about patents relating to the process of manufacturing a drug (called ‘supplementary protection certificates’), and not the drug (or molecule) itself. The settlements may also involve a transfer of the generic companies’ patents to the originator, and a monetary payment by the originator to the generic company.

What do the authorities say?

The US Federal Trade Commission (FTC) has been pursuing these settlement agreements before the courts since the early 2000s.1 In Europe, a burst of activity by competition authorities followed the European Commission’s investigation into the sector in 2008.2 The first investigation under competition law, launched by the Commission in July 2009, was into agreements between the pharmaceutical company Servier and several generic manufacturers of a blood pressure drug.3 This was followed by probes into separate agreements entered into by Lundbeck (for an antidepressant), Cephalon (for a sleep-disorder medicine), and Johnson & Johnson (for a painkiller).4 In the UK, the Office of Fair Trading has also started its own investigations into similar agreements, such as those between GlaxoSmithKline and other generic manufacturers.5

According to both the FTC and the European Commission, such agreements can be anticompetitive by their very nature because they prevent generic entry which, in the absence of the agreements, would have led to direct competition and lower drug prices. In June 2013, the Commission imposed a fine of €93.8m on Lundbeck, and of €50.2m on eight generic companies, for infringing Article 101 TFEU by agreeing to delay generic competition in the market for the antidepressant, Citalopram.6 This is the only decision so far that the Commission has taken with regard to these agreements; the other investigations are ongoing.

The Lundbeck decision is a milestone in the debate on how to treat such agreements. In particular, it is notable that:

- the Commission considers these agreements anticompetitive by their very nature—i.e. by object. It therefore does not have to show that the agreement had negative effects on the market;

- the Commission’s case is not limited to the originator; it also holds the generic companies in breach of Article 101 TFEU because they entered into these settlement agreements instead of continuing the litigation.

The Commission has stated that it hopes that this approach and the Lundbeck decision will discourage pharmaceutical companies from entering into such agreements. The presumption is that, without such agreements, generic entry would occur and prices would fall. However, this presumption may not be correct in some cases because, depending on the market conditions, early entry may not have occurred in any event.

Before discussing whether such a presumption is appropriate from an economics perspective, we take a closer look at the situations that lead to settlement or litigation decisions, and the associated timeline for the originator and generic firms. Understanding the timeline is key to understanding why the competition authorities’ reasoning might not apply to all cases.

The agreements: a closer look

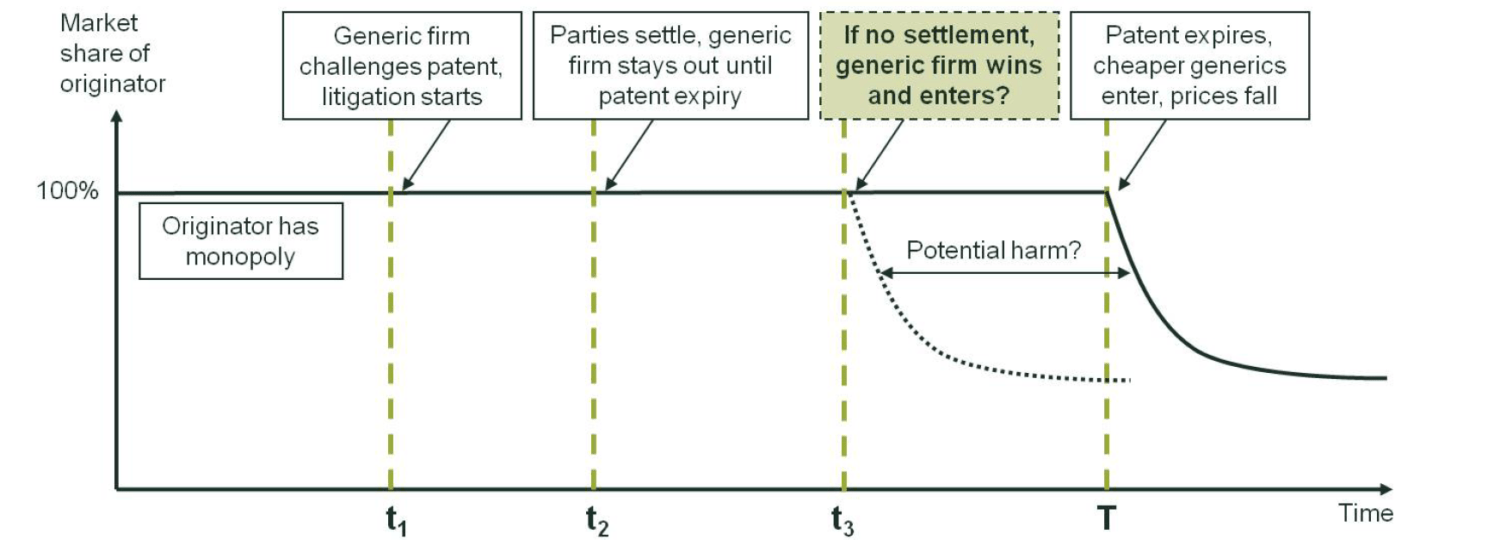

Although the settlement agreements used by different companies vary in the details—such as the specific conditions imposed on the entry of the generic manufacturer or the accompanying transfers (e.g. the monetary value or the generic firm’s patent)—they share several characteristics. This is illustrated in Figure 1 below, which shows a stylised timeline of a patent litigation.

The originator enjoys a monopoly position as granted by the relevant patent, which is valid until time T. However, a generic firm may, at an earlier date t1, challenge the validity of the patent, or claim that its own product does not infringe the patent. (As noted above, most of the cases that have been scrutinised relate to process patents for making the same drug). In the period after the start of such a (invalidity/non-infringement) litigation, the originator and generic firms have two options:

- settle the litigation (at time t2 in Figure 1) and agree that the generic firm would enter only at T;7 or

- not settle and continue to litigate until a court decision.

In addition, the generic firm has a third option not to settle and continue to litigate until a court decision:

- discontinue the litigation at some time before T and simply wait until patent expiry.

Figure 1 Stylised timeline of a patent litigation (with potential settlement)

Source: Oxera.

Of these, the first and third options (settle at time t2; discontinue litigation) involve no or limited uncertainty once the decision about the option has been taken. However, if the originator and generic firms continue to litigate, the outcome of the litigation and the timing of entry, and thereby the impact on consumer welfare, are uncertain.

First, the date of the court decision is uncertain. For example, the litigation may not be resolved before the originator’s patient expires at T. Even if the litigation is resolved before T (e.g. at t3 in Figure 1), there is no guarantee that the generic firm would ultimately win the litigation. The outcome would depend on factors such as the strength or necessity of the originator’s patent(s), the precise process used by the generic firm, and properties of the generic firm’s product (e.g. the stability of the final product). In this case, if the generic firm wins, entry would occur at t3, which may in turn reduce the prices thereafter (the extent to which this might happen depends on the market context and is discussed further below). If, however, the originator wins, the market continues without any entry until patent expiry at T, after which generic firms enter. In this case, any price reduction would occur only after period T.

The price reduction will therefore start at t3, not after T—hence improving consumer welfare in the short run—only if all of the following three conditions hold:

- both firms continue to litigate in the absence of settlement;

- the litigation is resolved before the patent expiry date;

- the generic firm wins the litigation.

Indeed, the treatment of these agreements as an object infringement by originators and the corresponding generic companies is based precisely on this scenario. However, as highlighted above, there are significant uncertainties and complexities inherent in the process of patent litigation, and the scenario assumed by the object infringement might not have occurred in the absence of the agreement. For example, even in the absence of the settlement, the generic firm might not have the ability and/or the necessary incentives to litigate. An effects-based approach may therefore be more appropriate to capture the specific market context and uncertainties relevant to each case.

Why do we need an effects-based approach?

Article 101 TFEU and its national equivalents prohibit agreements between undertakings that have as their object or effect the prevention, restriction or distortion of competition. If such agreements are concluded between undertakings at the same level of the supply chain (e.g. between the originator and generic producer of a particular drug), they would generally be expected to harm competition only if the concerned undertakings are actual or potential competitors.8

In the context of patent litigations, this requires that, in the absence of the settlement agreement (i.e. in the ‘counterfactual’—a hypothetical scenario in which there is no option to settle), the generic firm would be in a position to supply the market in the near future. In addition, the agreement can lead to consumer harm only if the generic firm would also have had the incentive to continue litigation and enter in the counterfactual. However, as mentioned above, the ability and incentives to litigate and enter are not present in all cases.

The decision of a generic firm to continue litigation depends on the trade-off between the expected benefits and the costs of litigation—i.e. the trade-off between the expected profits if the generic firm prevailed and entered, and the expected costs (legal and potentially other non-monetary costs) of litigation. Inherent in this trade-off is the uncertainty surrounding the success in litigation and the timing of the court’s decision.

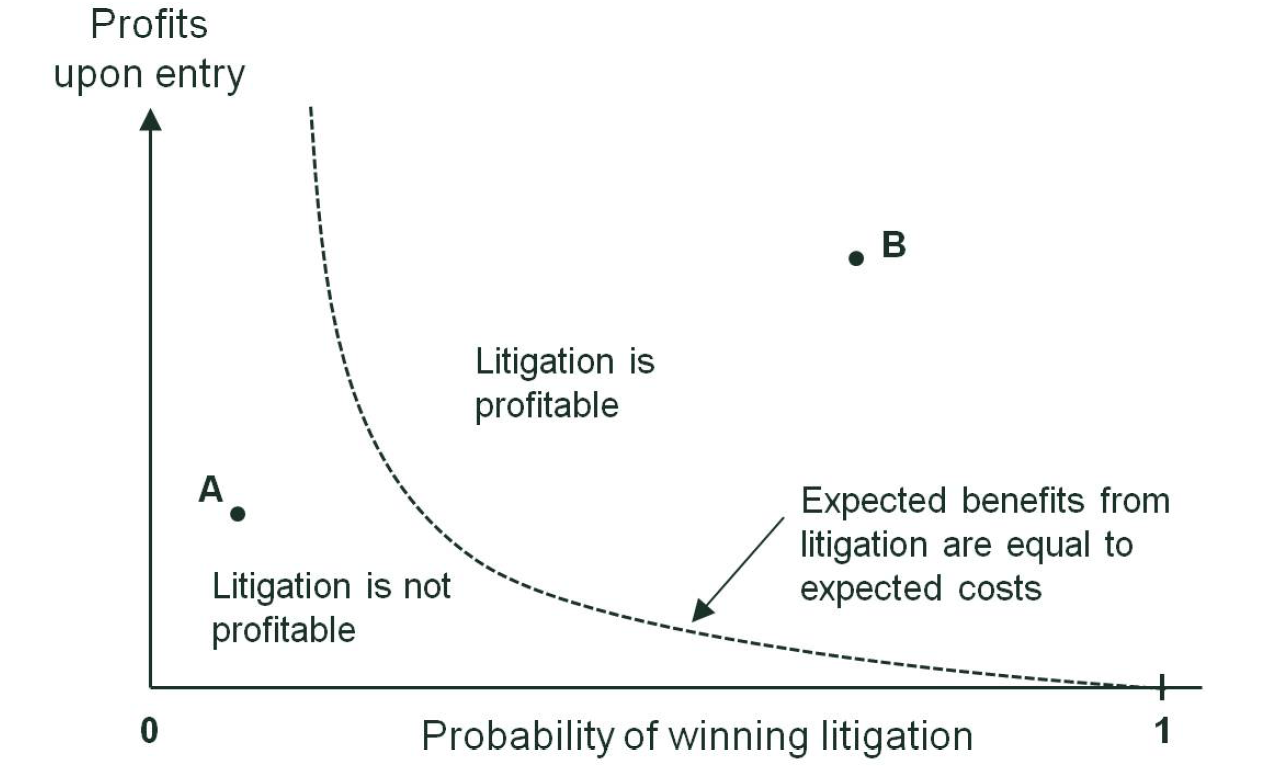

Figure 2 below provides a stylised illustration of how this trade-off may affect the incentive of a generic firm to litigate in the counterfactual. For simplicity, only two factors are presented: profits upon entry (which depend on factors such as the market size for the drug and the number of competitors) and the probability of winning litigation.9 Each point in the figure represents a possible market environment within which the generic firm may decide whether to litigate. In the area left of the dotted line of the chart (for example, at point A), the profits and/or the winning probability are low. This area of the chart therefore represents market environments in which the generic firm would not find it profitable to litigate. If, on the other hand, the profits upon entry and/or the probability of winning are sufficiently large (e.g. at point B), litigation would be profitable. An economic assessment of the market context is therefore necessary to determine whether the generic firm would have continued with the litigation in the counterfactual.

Figure 2 Stylised illustration of incentives to litigate

Source: Oxera.

The main factors that affect the incentives of a generic firm to litigate, and which therefore need to be addressed as part of the counterfactual analysis, are as follows.

- Probability of success—in general, the (perceived) probability of a successful outcome of litigation depends to an important extent on the (perceived) strength of the originator’s patent, as well as the generic firm’s own process/product.

- Other obstacles to entry—even if the generic firm is confident of winning the litigation, it will not necessarily be able to sell its product because pharmaceutical companies must first obtain the relevant market authorisation. Without the authorisation—or, at least, without the imminent prospect of obtaining it—a supplier is not an actual or a potential competitor in the market. Moreover, pharmaceutical companies often need to overcome other commercial obstacles to entry, such as capacity problems and distribution contracts.

- Profits upon entry—as discussed above, the profits that a generic firm expects to earn after entry are a critical determinant of its incentive to litigate. These profits depend on factors such as the size of the current market, the future development of demand, whether the generic firm is the first to enter, and the total number of generic entrants expected in future and expectation about the timing of their entry.10

- Expected duration and cost of litigation—during the litigation process, firms may encounter significant legal costs. For example, studies suggest that the total cost of patent litigation in the UK typically amounts to several million pounds.11 Moreover, patent proceedings often take a long time, which not only increases legal costs but also delays the potential profit stream that follows from successful entry. Studies have found that patent litigation in the UK lasts about three years on average.12

In addition, when multiple generic firms are involved in litigations on the same patent (as is often the case), a specific generic firm may ‘free-ride’ on the litigation of another generic firm. For example, the incentive of a generic firm to challenge a patent of the originator may be weakened if a rival generic firm has already started (or is expected to start) litigation against this patent.

A firm would have continued the litigation in the counterfactual only if its expectations of profits were high enough. It is also important that the analysis of incentives takes account of any monetary transfer made by the originator as a part of the settlement. In theory, any payment should be such that the settlement is acceptable for both parties, and it should reflect the expected benefits and costs that both parties face if they continue with litigation. In practice, the final payment may be larger or smaller than this theoretical amount, depending on the (possibly asymmetric) expectation of each party. (For example, the payment can exceed the expected profits of the generic firm if the originator’s expectations about the generic firm winning and/or its profits are more than the generic firm’s own expectations.)13 A case-by-case analysis is therefore needed to assess the incentive of the generic firm in the counterfactual to see whether it would have been likely to enter absent the settlement agreement.

In addition, it is important to consider the implication of the competition authorities’ interventions for the incentives for pharmaceutical companies to innovate, as provided by the patent settlement regime and patent law more broadly.

The implications for patent law

As discussed above, the competition authorities’ approach focuses on the impact of these agreements on generic entry and the price in the relevant market. However, a regime without the option of such settlements may also have a negative impact on incentives for companies—both originators and generic firms—to innovate in general, and may therefore reduce consumer welfare in the longer term.14

Indeed, the rationale of the patent regime is to deliver this dynamic benefit to consumers by providing the incentive to make risky investments. Patent settlements, in particular, play a critical role in maintaining the right incentives, for both the originator and the generic company that may seek to challenge an existing patent, as follows.

- Incentives for originators to innovate: in essence, a claim of invalidity (or non-infringement) of the originator’s patent by a generic company before the expiry of the patent increases the risk of losing part of the profit stream that an originator expects from the patent. While the risk of such challenges occurring cannot and should not be eliminated, such a risk may affect the incentives of originators when making the up-front decision of whether to invest time and money in developing new and better drugs and treatments. Furthermore, such litigation is often lengthy and can involve multiple separate litigations across different jurisdictions, and therefore significant costs. The patent settlement regime, by reducing the uncertainty of the outcome of future litigations and the associated costs, maintains the incentives to invest to a certain extent.

- Incentives for generic firms to challenge patents: equally, patent settlements reduce the risks that generic companies face when deciding to challenge an existing patent. In investing in developing and bringing to market their own versions of a drug before patent expiry, generic companies also face the risk of their patents infringing on other existing patents, and the possibility of lengthy litigation. Hence, patent settlements, by providing an ‘outside option’, reduce this risk, which in turn encourages challenges to existing patents.

Therefore, if settlements are not allowed, this may reduce the originator’s incentives to innovate through increased future risks and costs. Forcing generics to continue a litigation once started implies significant costs, which may have a ‘chilling effect’ on challenges brought by generic companies (although this effect may, to some extent, reduce the negative impact on originators). Overall, long-term consumer welfare may be reduced if such settlements are not allowed.

Concluding remarks

Some caution is needed when judging the agreements in question by their nature or object only. While some such agreements may delay generic entry, this is not necessarily the case for all of them. A careful effects-based assessment is therefore needed, especially given the significant uncertainties and risks inherent in patent litigation, in order to determine whether the generic firm in question is indeed a realistic competitor. The impact on the incentives to innovate and challenge patents, and therefore the impact on long-term consumer welfare, should also be assessed.

In any event, the issues identified by the competition authorities appear to result mainly from a market failure at the patent award stage. There is a case for addressing such failures when the patent office is granting the patent.

5 Office of Fair Trading (2013), ‘OFT issues statement of objections to certain pharmaceutical companies’, 36/13, press release, 19 April. Oxera is advising two generic firms involved in the GlaxoSmithKline, Lundbeck and Servier investigations.

6 European Commission (2013), ‘Antitrust: Commission fines Lundbeck and other pharma companies for delaying market entry of generic medicines’, press release, IP/13/563, 19 June. Lundbeck has appealed the decision to the General Court; see Lundbeck (2013), ‘Lundbeck appeals European Commission decision’, corporate release. 7 In some cases, the originator and the generic firm may agree to delay entry until a specific date that is before or after point T. 8 The European Commission defines ‘potential competition’ in paragraph 10 of its Horizontal Co-operation Guidelines. See European Commission (2011), ‘Guidelines on the applicability of Article 101 of the Treaty on the Functioning of the European Union to horizontal co-operation agreements’, Official Journal of the European Union, 2011/C 11/01. 9 While the figure is based on simplifying assumptions, it is likely to remain valid in the context of a more comprehensive assessment. For example, litigation costs could be incorporated by replacing profits upon entry with net profits (i.e. profits upon entry minus the litigation costs that the generic would have to pay if it prevailed in litigation). In this case, the dotted line would need to be adjusted to incorporate litigation costs in the event that litigation is unsuccessful. 10 In the USA, under the Hatch–Waxman Act 1984, the first generic firm remains the only authorised generic producer for six months. No such exclusivity is granted in Europe. 11 See, for example, Helmers, C. and McDonagh, L. (2012), ‘Patent Litigation in the UK’, LSE Law, Society and Economy Working Papers, December. 12 Helmers, C. and McDonagh, L. (2012), ‘Patent Litigation in the UK’, LSE Law, Society and Economy Working Papers, December. 13 For a discussion of incentives to settle, see, for example, Lemley, M.A. and Shapiro, C. (2005), ‘Probabilistic Patents’, Journal of Economic Perspectives, 19:2, p. 75.14 For a more detailed discussion, see, for example, Bär-Bouyssière, B. (2013), ‘Pay...for delay? The incredible saga of reverse payment patent settlements’, MLex AB Extra.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More