5G spectrum: the varying price of a key element of the 5G revolution

The latest auction for 5G frequencies in the UK has generated lower prices than in the past, surprising some commentators. We share some reflections on this outcome by also comparing previous 5G auctions in Italy and the UK.

Devices such as mobile phones require signals to connect to one another and send information wirelessly. These signals are carried as radio airwaves, which must be sent at designated frequencies to avoid any kind of interference with other wireless signals. The radio spectrum that governments license to operators and the price of those licences is thus central to the quality and affordability of mobile services.

Whether or not you believe that the 5G revolution is right around the corner, there is no doubt that the allocation of spectrum frequencies is a crucial ingredient for it to be possible. The promise of 5G, relying on suitable frequencies, is to deliver enhanced broadband for mobile phones, much faster and reliable (real-time) communication, and widespread machine-to-machine communication. By unlocking the potential of the Internet of Things (IoT), 5G could have a substantial impact on our economies, having diverse applications in smart manufacturing, health monitoring, and the development of connected cars, as well as boosting sustainability and limiting the environmental impact of a better-connected economy.1

For all of this to happen, substantial upfront investment is necessary, including into spectrum rights acquisition through auctions. Indeed, auctions, much more than other types spectrum assignment mechanisms (such as beauty contests and administrative procedures), are taking the lion’s share as the tool chosen to distribute 5G frequencies by competent authorities in most jurisdictions.

In spectrum auctions, successful bidders obtain term-limited (and regulated) proprietary use of the spectrum. While the merit of this proprietary model is debated, and while some have advocated non-proprietary exploitation models (see, for instance, the prescient discussion in Noam 1998),2 the allocation of 5G frequencies is mostly carried out in the same way as the allocation of 4G, 3G and 2G frequencies. Given that these allocation mechanisms essentially confer exclusivity in the use of the precious 5G frequencies, telecommunications operators are once more first in line when auctions are held.

For this reason, although the scale of the economy that could be ‘served’ by 5G should well influence the price of spectrum rights held for nationwide exploitation, the interaction of two other factors—i.e. the specific auction rules and the underlying structure of the communications industry in each country—seems to play a crucial role when it comes to the prices of the frequencies for 5G (as previously for 4G and 3G).3 This interplay can lead to unexpected results: spectrum prices in countries with larger economies may end up being lower than prices in countries with smaller economies, while spectrum prices in the same country may vary appreciably over time.

For example, the prices emerging from the latest UK auction for the 700MHz and 3.6–3.8GHz bands (held by Ofcom in March 2021)4 appear to be lower than some commentators had expected.5 The UK’s four mobile network operators (MNOs) competed—albeit with some rules-driven restraint due to a cap limiting the total share of all spectrum designated for mobile services to 37%6—in a Simultaneous Multi-Round Ascending auction (SMRA), reverting to the ‘old norm’ after a season of complex Combinatorial Clock Auctions.7

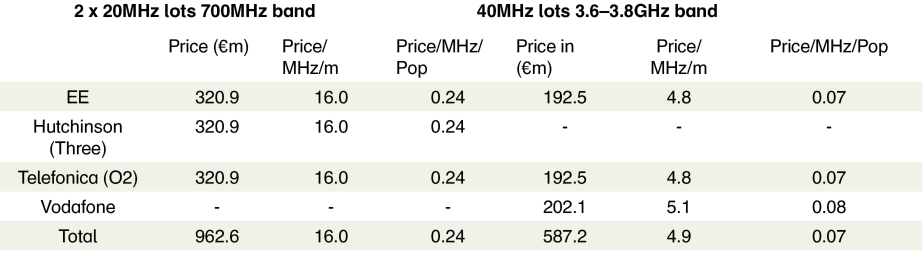

Table 1 2021 UK 5G auction: prices per band

Source: Oxera, based on Ofcom’s press release on the principal stage results.

Comparing the prices of the 2021 auction presented above with those of the 2018 auction, considering the 3.6–3.8GHz bands (i.e. the spectrum bands earmarked for 5G), prices per MHz in 2021 appear considerably lower. In 2018, the average price per MHz per unit of population for spectrum lots in the 3.4GHz band was €0.13, nearly twice the 2021 average price for spectrum lots in the 3.6–3.8GHz band (€0.07).8

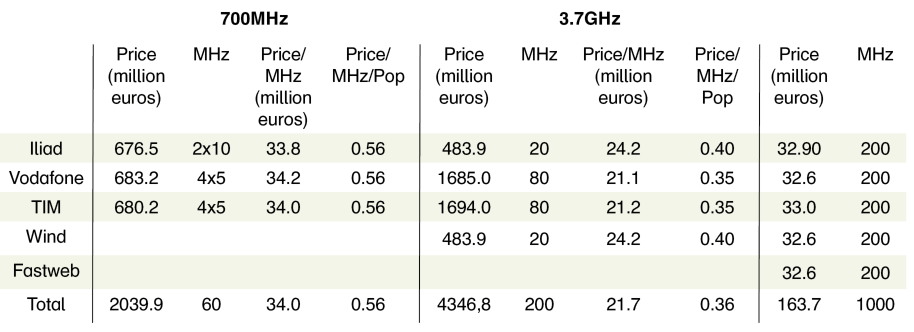

Essentially the same spectrum (in the bands of 700MHz and 3.7GHz) was auctioned in Italy in 2018. As in the UK, the Italian auction bidders included four MNOs, three major MNOs and a new entrant, i.e. the merger remedy taker Iliad, as well as Fastweb (which, however, did not win any lot in the 3700MHz band).9 The bidders participated in an ascending (again non-combinatorial) auction. Contrary to the UK, however, the spectrum prices in Italy in 2018 appeared to be higher than a number of commentators expected.10

Although Italy’s economy is about 80% the size of the UK economy (in terms of GDP),11 the auction price was higher than in the UK. Whereas little happened in terms of rivalry for the 700MHz band, and the lack of competition for the 26GHz spectrum led to a lot being allocated to each participant, competition was fierce in the 3.7GHz band: the contrast between the prices in Italy in the 3.7GHz band and in the UK in the 3.6–3.8GHz band could not be starker.

Comparing per band the price increases between the UK and Italian auctions, we note that Italian prices for the 3.7GHz band were more than five times those of the UK (for the 3.6–3.8GHz band), while in the 700MHz band Italian prices were (although still higher) ‘only’ 2.3 times those of the UK. This would seem to indicate that the high prices in the 3.7GHz band in Italy were in part driven by the particular design of the lots auctioned: whereas in the UK auction operators could bid for 24 symmetrical lots of 5MHz in the 3.6–3.8GHz band, in Italy the asymmetry between the two smaller lots (20MHz each) and the two larger lots (80MHz each) made the 3.7GHz band artificially scarce, creating space for only two real winners (efficient lot size is deemed to be in the region of 40MHz). As a result, prices spiralled upwards.

Last but not least, markets and public authorities take the opposite view regarding the differences in the results of the 5G auctions in Italy and the UK. Whereas public finances benefit from high-price auctions, markets react negatively. The shares of listed telecom companies increase if no upward price wars occur in the auctions, as in the latest UK auction,12 or drop suddenly in case of high prices (as was the case for the 2012 4G auction in the Netherlands).13

In this respect, we note that, since regulatory choices help shape market outcomes, policy instruments such as auctions require a clear understanding of the impact of their design on social welfare, especially when they alter the structure, capacity, timing, or firm composition of the sector.14

Table 2 2018 Italian 5G auction: prices per band

1 Orange (2021), ‘Much more than just gigabits: the promises of 5G’. Forbes (2020), ‘Delivering On The Promise Of 5G, Why Should You Rethink Timing?’.

2 Noam, E. (1998), ‘Spectrum Auctions: Yesterday’s Heresy, Today’s Orthodoxy, Tomorrow’s Anachronism. Taking the Next Step to Open Spectrum Access,’ Journal of Law and Economics, 41:2, pp. 765–90.

3 See Bahia, K. and Castells, P. (2019), ‘The Impact of Spectrum Prices on Consumers,’ TPRC47: The 47th Research Conference on Communication, Information and Internet Policy 2019; and Hazlett, T. W. and Muñoz, R. E. (2009), ‘A Welfare Analysis of Spectrum Allocation Policies,’ The RAND Journal of Economics, 40:3, pp. 424–54.

4 Ofcom (2021), ‘Award of 700 MHz and 3.6-3.8 GHz spectrum by auction’. Although the auction is not complete yet, as there will be a final round, the missing allocation phase is not expected to have a large impact on the overall price tag.

5 See, for example, Fildes, N. (2021), ‘5G spectrum auction raises just £1.3bn for UK government’, Financial Times, 17 March.

6 Ofcom (2020), ‘Statement on the final regulations for the award of spectrum in the 700MHz and 3.6–3.8GHz frequency bands’, para. A2.28.

7 Ibid., paras A2.32–A2.34.

8 Ofcom (2018), ‘Results of principal stage of auction for mobile airwaves’.

9 Fastweb S.p.A. is the Swisscom-owned fibre operator that is also focusing on growing a converged offer as an MVNO player.

10 See, for example, Corriere Comunicazioni (2018), ‘Asta 5G, così l’Italia fa lievitare il valore della banda “pioniera”’.

11 GDP in purchasing power standards at current prices in 2019 in Italy was 80% of that in the UK. In Italy, it was equal to €1.8bn, while in the UK it amounted to €2.2bn. See Eurostat (2021), ‘Gross domestic product at market prices’.

12 See, for example, Economic Times (2021), ‘Lower-than-expected spectrum auction bid prices lift telecom stocks’.

13 Arthus, C. (2013), ‘4G auction to be investigated by audit office after poor return’, The Guardian, 16 April.

14 Hazlett, T. W., Muñoz, R. E. and Avanzini, D. B. (2012), ‘What Really Matters in Spectrum Allocation Design’, Northwestern Journal of Technology and Intellectual Property, 10:3.

Download

Contact

Dr Barbara Veronese

PartnerContributors

Related

Download

Related

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More