How best to create an enduring framework for investment in world-class broadband connectivity in the UK?

The Future Telecoms Infrastructure Review by the UK Department for Culture, Media and Sport (DCMS) is investigating ‘what longer term changes could be made to market structures and policy frameworks to encourage investment’, and is aiming to reach initial conclusions in the summer. In the spirit of open and constructive debate, Emily Clark, Chief Economist at BT Group, sets out BT’s emerging thinking on what UK policymakers can do to support investment in ultrafast broadband networks across the UK.

The outcome of the DCMS review is critical to BT and Openreach, given BT’s ambitions to serve the country’s fixed and mobile connectivity needs.1 We agree with government that the long-term goal should be to have world-class digital connectivity in the UK that is ultrafast, reliable, long-lasting and widely available to homes and businesses. We also share the government’s aspiration that the UK should be a world leader in the deployment of 5G mobile connectivity.

Demand will evolve in ways that cannot be fully anticipated and will, to an extent, be stimulated by the availability of better connectivity (i.e. demand will be ‘pushed’ by supply). Devices will be more central to the consumer experience, and connectivity will be experienced seamlessly (from wired to wireless devices consuming common services in and out of the home).

But, at the moment, consumers broadly have the broadband speed they need for the things they need it for, and they can buy it at reasonable cost. They will migrate to new technologies when they see additional value from doing so but, for now, demand is unclear and experience in other countries suggests that demand can take time to emerge.2

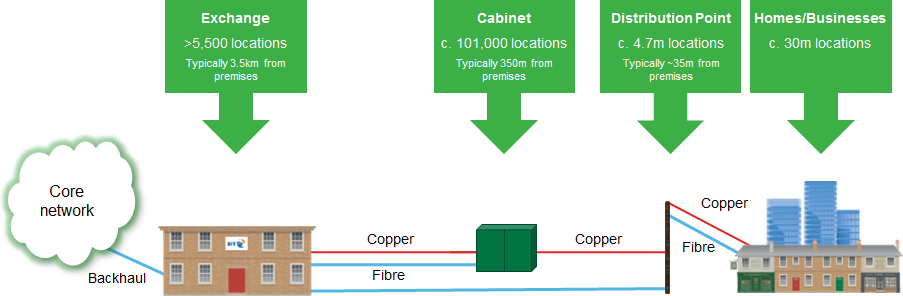

The costs of investment are significant (tens of billions for a national deployment of full fibre), putting national ultrafast broadband among the largest UK infrastructure projects (alongside HS2 and a third runway at Heathrow Airport). We will learn more as broadband is deployed—but we already know that laying fibre to the premises (FTTP) involves intense civil engineering activity and that this takes time.3 In Figure 1 below, FTTP is indicated by the fibre connection (in light blue) from the exchange to a distribution point, and from there into homes and businesses (as distinct from fibre to the cabinet—FTTC, and copper thereafter, which is nearly ubiquitous in the UK and delivers superfast speeds).

Figure 1 The costs of investment in broadband

The economics of FTTP deployment (large, upfront costs, uncertain demand and a ‘payment when delivered’ cost recovery model)4 mean that there are significant risks involved, and these need to be allocated.

For previous investments in connectivity, risks have been borne by private investors, and this has been done (importantly) without the regulatory mechanisms for sharing risks that are commonly seen in other infrastructure sectors. Ofcom, the UK communications regulator, does not have a duty to ensure that functions are adequately financed, and the mechanism for charging network users for the costs of BT’s regulated networks leaves risk largely with BT.

The risks going forward, however, are different by orders of magnitude. The ‘payment when delivered’ model will be stretched to its limits and will require a shift towards clearer and more enduring regulatory rules that provide clarity on how risks are to be allocated.

DCMS is right, therefore, to explore the long-term policy framework (beyond the three-year regulatory review cycle) that is required to help mitigate the inherent supply and demand uncertainties and incentivise investment. A key question is how risks might be allocated going forward, and what arrangements between Openreach and its large wholesale customers will support investment.

An objective assessment of infrastructure competition is required

Competition is seen (by the government and Ofcom) as an important driver of investment in 5G and full fibre. It is envisaged that there will be rival—overlapping—FTTP build, potentially using Openreach’s ducts and poles to reduce upfront engineering. This is expected to drive investment because network rivals will strive to win or protect their consumer base by providing better services than competitors.

BT agrees that this effect is important—our mobile and fixed investment cases already reflect the need to remain competitive given the capabilities and resources of the other mobile network operators and Virgin Media, an established and vertically integrated fixed operator.

But this model cannot deliver a very wide roll-out at similar prices across different geographies as is currently the case for the Openreach FTTC superfast network.5 Infrastructure competition will eventually lead to differentials in the availability and price of ultrafast FTTP services between the more densely populated areas of the country and elsewhere, as cross-subsidies between them become unviable.

Competition has this effect because entrants will not deploy full fibre at scale but will target areas where the economics are most favourable. Scale players (such as Openreach) will see volumes in low-cost and high-value areas contested, driving prices towards local costs, and undermining the option of using margins in these areas to fund provision in higher-cost areas.

The sustainability of a higher degree of infrastructure competition is also unclear. Commercial cases are already difficult due to high fixed costs and limited demand, but are even harder when there are multiple networks fighting for the same consumers.

Comparison with alternative models highlights key trade-offs

Although there are benefits associated with increased infrastructure competition, its ability to serve all consumers, rather than just those lucky enough to be fought over in densely populated areas, is less clear.

Some countries with significant penetration of FTTP have opted for a designated national (or regional) provider of ultrafast broadband—for example, New Zealand, Singapore and Japan—often combined with a significant degree of government support.6 In these countries, a stable and predictable regulatory regime has underpinned investment rather than pressures from infrastructure rivals (although downstream competition is encouraged through wholesale access to the designated provider’s network).

We recognise that this model may not seem aligned with the infrastructure competition zeitgeist. But it aligns well with the principle of universality and addresses a low tolerance for inequality of outcomes.

In any event, the UK version of this model would still have a large dose of infrastructure competition courtesy of Virgin Media—already an established and semi-national network provider capable of offering ultrafast speeds.

In fact, it is odd that so little weight is given to the rivalry between Virgin Media and Openreach when telecoms markets are assessed for regulatory purposes, given that it is credited with driving BT to invest in its superfast network,7 and will do the same in relation to ultrafast broadband.

Why? Because BT Consumer (BT’s retail division) and other users of the Openreach network will lose consumers to Virgin Media if the Openreach network does not keep pace. In fact, we already know that Openreach’s superfast network will not do so: Virgin Media recently upped its top speed from 300 to 350 Mbit/s, just beyond Openreach’s (copper-based) G.fast products.8 Future versions of Virgin Media’s technology could, in theory, support download speeds of up to 10 Gbit/s and upload speeds of up to 1 Gbit/s.9 This is a risk that Openreach cannot afford to ignore, and FTTP investment constitutes a good response.

BT considers that competition between cable, incumbent FTTP and, increasingly, 5G networks will deliver good consumer outcomes. Studies have demonstrated that competitive leapfrogging between cable, the incumbent telecoms provider and mobile have led to significant increases in speed over the past 25 years and are expected to continue to do so.10

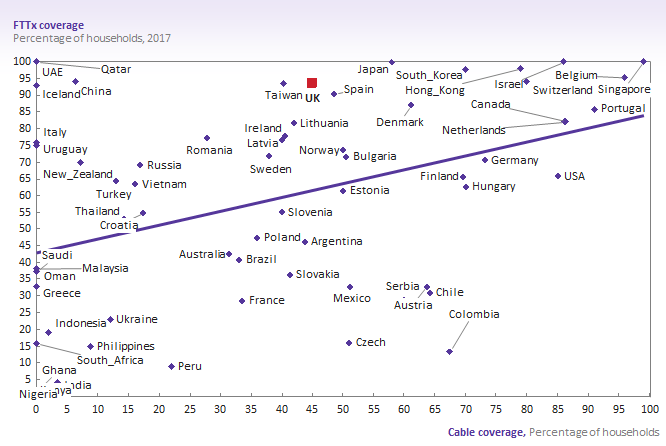

Figure 2 provides a comparison of FTTx11 (including FTTP and FTTC) coverage rates with cable penetration rates. It demonstrates that the presence of cable as a competitive threat is highly correlated with fibre investments from fixed providers.

Figure 2 FTTx coverage

Complementing these competitive pressures with a supportive regulatory regime (that creates clear and enduring rules for the allocation of risk) could accelerate the scale deployment of full fibre that the UK government wants to see. For example, the current regime could usefully:

- support a comprehensive switchover of all Openreach’s wholesale customers to the enhanced network within a certain period to reduce demand risk by accelerating migration;

- allow flexibility for Openreach to offer products and prices on the new network to recover costs and to reflect enhanced services, albeit within the constraints exerted by Virgin Media (and subject to appropriate protections for certain customer groups);

- provide greater clarity upfront on the terms of any ‘fair bet’ (which would determine if—and when—price regulation might be imposed further down the line).

We hear the calls (in particular from investors) for a regulatory regime that provides greater visibility and predictability of returns, perhaps by creating a utility-style regulatory asset base. This approach is typically used in sectors where market disciplines do not exist, or are weak. In the UK telecoms market, however, there are market disciplines that influence technology choice, the capital put at risk, and the execution of the build and marketing of associated services.

If, however, these constraints are not recognised (by Ofcom or the government) as driving investment incentives in a socially optimal manner, a regulatory approach that more closely resembles utility-style frameworks may be appropriate to drive the requisite capital programme. For example, such a capital programme could be agreed with Openreach’s wholesale customers through constructive engagement with a clearly defined mechanism for sharing the associated risks.

Put simply, a scale deployment of an ultrafast capability by Openreach, with a supportive and predictable regulatory regime, could deliver world-class connectivity in the UK in an equitable and efficient manner (i.e. widely and with minimal asset duplication). Whatever you call this model, it has much to recommend it.

If greater infrastructure competition is the preferred model then de-regulation should follow (sooner rather than later)

But if the favoured model is one that seeks greater infrastructure competition than this (i.e. rival FTTP networks in addition to cable and 5G networks), then we agree with Ofcom that de-regulation becomes an option.12 Specifically, this would involve removal of the obligation on Openreach to provide wholesale access to its network to downstream competitors. In fact, we consider that lifting such regulation earlier rather than later would assist in bringing forward investment.

Why? Because, as things stand, Openreach’s large customers have little incentive to support investment by sharing the risks associated with ultrafast investment. Why should they? They benefit from the competition between Openreach and Virgin Media in driving investment, but can choose when to take up enhanced services, ideally when the anchor tenant—BT Consumer—has cultivated demand through its own investment, and thereby ‘created’ the market. If returns start to look too healthy, these large customers can also rely on regulation to deliver lower access prices. In short, the current wholesale access regime allows access takers to bear very little risk.

But the future is different. For consumers to get world-class connectivity on the timescale that the government would like, we need incentives to be supportive of large-scale investment and for the associated risks to be shared across all wholesale customers of the network, rather than relying on cheap access to Openreach’s network and expecting the regulator to mediate the relationship with Openreach.

Without the regulated access regime, these wholesale customers would fend for themselves—and could readily do so given the retail volumes they command and the ability this gives them to underpin the entry or expansion of a rival network provider. Put simply, without regulated wholesale access, Openreach’s customers would be far more likely to get behind ultrafast investment and strike risk-sharing deals, and would do so on good terms given their bargaining position. Openreach might seek the same sorts of ‘enablers’ for its investment as described above, or it might seek others depending on the appetite of customers to share risk, but it would have the commercial freedom to do this, rather than seeking changes to the regulatory rules.

We don’t need to wait for rival networks to be built before de-regulating; in doing so, we could lose the opportunity to harness the benefits of risk-sharing in supporting investment cases now. Other countries with a high proportion of FTTP, such as Spain and Portugal, have been far bolder. They have refrained from imposing wholesale access obligations on operators to incentivise full fibre deployment and allow a return on new investment, with considerable success (alongside other conducive factors).13

In fact, BT is not aware that any other country seeking to encourage a widespread deployment of FTTP has adopted the regulatory model that we have in the UK (i.e. a model that intervenes at multiple levels of the value chain, and which is not differentiated by geography—certainly not in the wholesale local access market).

Government involvement cannot be avoided

In some parts of the country, full fibre is not economic to deploy by any operator because of the disproportionately high costs of doing so. Public subsidy will be needed to support deployment in these areas (as is the case under the existing BDUK programme of publicly supported rural deployment).

But the interactions with the models described above are important. Where the option of funding universality objectives through cross-subsidy is lost, more is left to be done by taxpayers through public subsidy (or a sharing mechanism).

Conclusion

We look forward to the conclusion of the review and to participating fully in the establishment of a market and regulatory framework in the UK that will endure and that will be pursued transparently and predictably. This will enable decisions on investment (by BT and other investors) that are inevitably long-term in nature to go ahead.

What is clear is that, whichever model is preferred, risk needs to be shared more widely than has occurred in the past. An enduring framework is required to signal whether this will be commercially led or mediated through regulation, and to specify the models/rules that will apply in different parts of the country.

Emily Clark

1 See DCMS, ‘Future Telecoms Infrastructure Review: Call for Evidence’.

2 In Australia, where full fibre is already available to many consumers, the uptake of speeds of even 50 Mbps is limited, with more than 80% of end-users choosing speeds of 25 Mbps or lower.

3 In Europe, only Spain has managed to deploy fibre to more than 1m homes each year, which, to a large extent, may have been possible only due to the concentration of apartment blocks.

4 Payment through charges levied on future beneficiaries.

5 Openreach’s wide geographic presence allows it to charge national prices that reflect average costs (i.e. to cross-subsidise between high- and low-cost areas).

6 In New Zealand, for example, the government (through Crown Fibre Holdings) has provided a significant amount of financing on favourable terms to help make the business case for building the ultrafast network ahead of demand and acknowledging the significant risks involved.

7 Ofcom has said, ‘Historically, we have seen benefits from network competition. BT announced its rollout of superfast broadband shortly after Virgin Media’s upgrade to DOCSIS 3.0. Similarly BT’s recent announcement on G.fast investment plans was made in the context of Virgin Media offering a maximum service speed of 200 Mbit/s compared to a maximum of 80 Mbit/s available from Openreach using its FTTC network.’ Ofcom (2017), ‘Wholesale Local Access Market Review: Promoting network competition in superfast and ultrafast broadband’.

8 G.fast provides higher bandwidth broadband (at speeds of up to 330Mbit/s) using a copper/fibre infrastructure of local access connections.

9 Kenny, R. and Williamson, B. (2016), ‘Connectivity for the Gigabit Society: a framework for meeting fixed connectivity needs in Europe’, Liberty Global Policy Series, November.

10 Cable Europe, ‘Reaping the benefits of continuous investment’, factsheet.

11 FTTx is the collective term for any broadband network architecture using optical fibre to provide all or part of the local loop used for the last stretch of telecommunications networks.

12 Ofcom stipulates: ‘In places where there is evidence of competitive pressure emerging, we would expect to deregulate.’ For details, see Ofcom, ‘Wholesale Local Access Market Review: Statement — Volume 1’, para. 5.69.

13 Market outcomes reflect country-specific factors, including network topology, housing density and demand.

Download

Contact

Felipe Flórez Duncan

PartnerGuest author

Emily Clark

Chief Economist at BT Group

Contributor

Related

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More