Fair ground: a practical framework for assessing fairness

Regulators are increasingly looking to firms to ensure that their practices are ‘fair’ in terms of the process followed (e.g. the type of data used) and the outcomes delivered (e.g. which consumers pay more). So, how can boards and senior managers satisfy themselves that practices are indeed fair and in line with their firm’s principles and risk appetite? We present Oxera’s practical framework, which has been used as a tool by senior decision-makers in financial services firms.

In a world where different people can pay quite different prices for the same good or service, the fairness of personalised pricing practices has risen to the top of the consumer protection agenda. Regulators in the UK, and increasingly elsewhere in Europe, are interested in the fairness of firms’ practices. This article looks at how to inform boards’ and senior management’s assessments of the fairness of ‘outcomes’ and whether these outcomes are in line with their firm’s risk appetite. We find that economic frameworks can help firms to create space for meeting commercial objectives while delivering on long-term customer needs. The right fairness approach may differ among different firms with different purposes and different brands.

Context: a focus on fairness

The current focus on fair pricing is the culmination of many years’ progress in understanding consumer outcomes. Increasingly, the responsibility for those outcomes is being placed on firms.

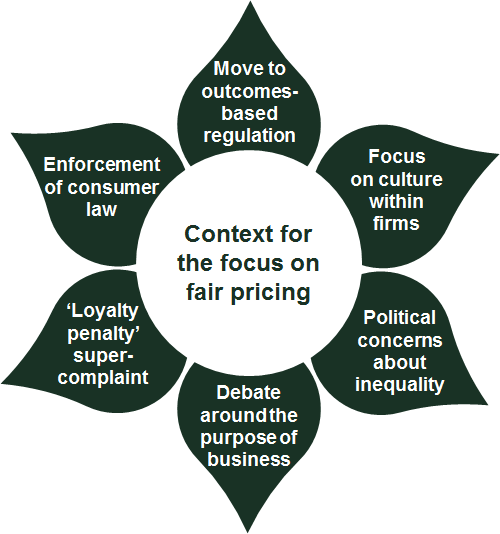

It is important to recognise the wider regulatory and political context, as summarised in Figure 1, in understanding what is driving the focus on fair pricing, and the direction of travel of this important debate.

Figure 1 Context for the focus on fair pricing

The ‘loyalty penalty’

The main focus is currently on the ‘loyalty penalty’, whereby companies charge higher prices to existing customers than they do to new customers. The 2018 ‘loyalty penalty’ super-complaint to the UK Competition and Markets Authority (CMA), submitted by UK consumer body Citizens Advice, asked questions about the fairness of certain pricing practices in five retail markets (three in financial services, and two in telecoms).1 Both the public response to the super-complaint and academic research in behavioural economics point to the importance to consumers of fairness.2

Outcomes-based regulation and supervision in financial services

In addition, there is a more general move towards outcomes-based regulation and supervision. Rather than ‘just’ complying with a prescribed set of rules, providers are being encouraged to think about what outcomes they want to achieve for their consumers and how best to deliver those. Leading this change in thinking is arguably the UK’s Financial Conduct Authority (FCA), which wishes to see that firms are meeting the objectives of ‘treating customers fairly’, and, more broadly, ensuring that markets function well. Its supervisory approach is judgement-based, but importantly it is informed by empirical analysis, using a new toolkit based on behavioural economics, competition economics, business model analysis and quantitative techniques.3

For example, the FCA requires that firms demonstrate that the ‘fair treatment of customers is at the heart of their business model’.4 Economics provides the framework for assessing whether this is indeed the case. One of the main insights from behavioural economics is that consumer behaviour can often be predicted—even when it is ‘irrational’ or sub-optimal—because we understand what drives preferences, decision-making and choice. The disclosure of information is no longer enough, as we can predict how different consumers will access, assess and act on that information.5

Outcomes-based regulation in other sectors

It is not only the FCA that is focusing on outcomes-based regulation—Ofgem (the energy regulator for Great Britain), Ofcom (the UK communications regulator) and other authorities are increasingly concerned about whether pricing practices are delivering good consumer outcomes.6

In January 2019, Ofgem implemented price caps that aimed to benefit vulnerable customers and people on standard variable tariffs (i.e. those who are not actively switching provider and thereby benefiting from competition in the market).7 In September 2018, Ofcom consulted on whether providers should be required to automatically introduce lower tariffs when a mobile customer has ‘paid off’ their handset (at the end of the minimum contract period).8

There is also a move to improve consumer outcomes through greater enforcement of existing consumer law (outside of regulated sectors).9 For example, in December 2018 the CMA launched an investigation into whether anti-virus software providers are complying with consumer law, focusing on the use and design of auto-renewal contracts.10

Fair outcomes are also a priority in the UK government’s Consumer Green Paper, and are of increasing focus in product oversight and governance across Europe.11

Understanding fairness

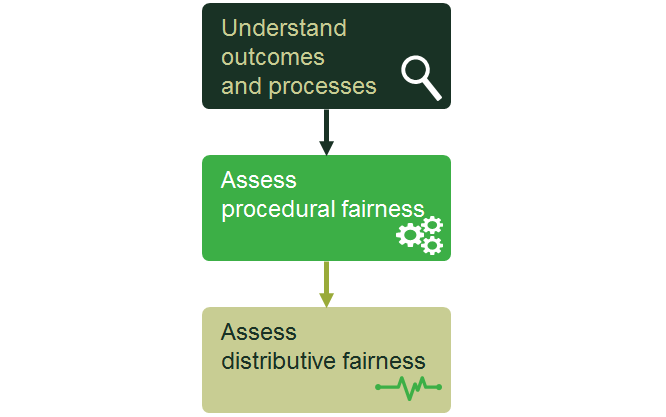

A comprehensive definition of fairness is elusive. Ultimately, however, judgements over fairness can be categorised as concerning either the ‘means’ (known as procedural fairness) or the ‘ends’ (distributive fairness).12

- Procedural fairness. The fairness of the process in arriving at a particular outcome—how prices are set; how information is communicated.

- Distributive fairness. The fairness of the outcome—distribution of prices; extent of cross-subsidy.

To assess procedural fairness, we can consider what data is used in pricing model(s), how the product is communicated to customers, and the expectations of customers from one year to another. For example, are key product features highlighted to customers at the appropriate times in a clear and not misleading way? Do consumers realise or accept that social media data may be used in pricing algorithms?

On the other hand, assessing distributive fairness involves understanding the varied outcomes that different customer segments enjoy in terms of price and value for money (i.e. taking both quality and product features into account). This requires insightful customer segmentation—informed by behavioural economics and data science tools—such as clustering according to usage behaviour.13

There are therefore three high-level steps to assessing fairness (see Figure 2).

Figure 2 Three high-level steps to assessing fairness

We now explain how these three steps can be turned into a practical framework for firms, by translating theoretical concepts into quantifiable metrics based on a business’s management information.

A practical tool for assessing fairness

Why a framework?

Oxera’s framework achieves three objectives. First, it specifies which questions need to be answered in order to understand the processes and outcomes (i.e. it informs the design of management information). Second, it enables firms to inform their assessment of the fairness of these processes and outcomes. Third, it answers questions relating to the issues raised by the first two objectives.

The framework has been used as a tool by senior decision-makers in financial services. It represents a fundamental change in how boards operate, placing the focus on measuring and assessing customer outcomes using microeconomics, behavioural economics and business model analysis. The concepts and metrics are applicable across products, markets and sectors.

The framework can be applied to individual products or a portfolio of products. The objective is to help individual firms ensure that they are treating their customers fairly and delivering good outcomes, rather than to inform a market-wide view on the need for regulatory intervention.

Bringing together business and consumer perspectives

The framework highlights the role and importance of two (potentially competing) perspectives: those of customers and those of the business.

It uncovers the tension between the different perspectives, highlighting trade-offs. Businesses may already be striking such a balance—but the framework makes these trade-offs explicit, and provides a tool that management can use to take decisions on them.

The framework allows for some flexibility over these management decisions. Different firms may make different decisions, given different core product purposes or business strategies (e.g. relating to the stated purpose of the business, or the values of the brand).

Core product purpose

In Oxera’s experience, identifying the core product purpose is an important step in assessing fairness, as it provides a definition of the product that can be used as a yardstick for both processes and outcomes.

Any product needs to have a reason for existing, from the perspectives of the customer paying for and using it, and the firm supplying it. This is its core purpose.

Customers’ understanding of the core purpose can be identified from marketing material, focus groups, analysis of customer complaints, and survey data. From the firm’s perspective, this can be done by talking to the product lead, and looking at the financial contribution and input from the marketing team on how they see the product contributing to the firm’s overall strategy.

The alignment of the consumer and business perspectives can then be considered through the lens of business model analysis.14 One can expect that the commercial returns to the business should arise predominantly from consumer outcomes that are consistent with the core purpose of the product. With hindsight, misalignment of business and consumer interests often seems obvious—such as with banks selling payment protection insurance to people not in employment (and therefore unable to claim). But in practice, inappropriate use of products can continue unchallenged if the core purpose has not been well defined. For example, the FCA found that many overdraft customers were using overdrafts to provide credit over long periods, which may not be the most appropriate form of borrowing for them.15

Having identified customers who are not using the product as intended, firms have the opportunity to correct customers’ understanding of the product’s purposes and, if necessary, amend the product design or direct customers to other products. Firms can use data on product usage to predict which prospective customers might be best suited to a different product.

Four perspectives on fairness

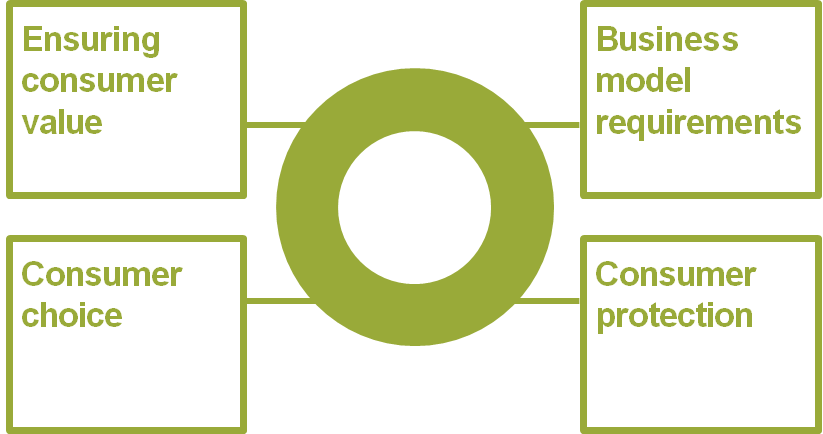

Once the core purpose is defined, assessing fairness requires a suitable balance to be found between four (potentially competing) objectives:

- business model requirements—sustainable and profitable product provision, which is in the long-term interests of customers, subject to market conditions and competitive dynamics;

- ensuring consumer value—meeting the fundamental demand for the product;

- consumer protection—ensuring good outcomes and avoiding the exploitation of vulnerable customers;

- consumer choice—considering the alternatives that customers may or may not have, hence avoiding the exploitation of customers with limited alternative choice.

These concepts, shown in Figure 3, assist in assessing consumer outcomes from a range of perspectives, identify the relevant questions, highlight potential trade-offs, and help firms to define the ‘space’ within which fairness is achieved.

Figure 3 Four perspectives on fairness

Quantifiable metrics

For each of the four perspectives, the framework identifies the required analysis and quantifiable metrics that are needed to understand the outcomes and process, assess procedural fairness, and ascertain distributive fairness.

Where relevant, the framework also identifies thresholds to be monitored to maintain an appropriate balance, given the firm’s purpose and strategy. The interpretation of each metric may vary by market. Examples are as follows.

- From the perspective of the business model requirements—the key metrics consider what the business model requires in order to be sustainable in the long term. For example, what is the cost to a firm of attracting new customers, and what return does it need to make on that investment in order for the business model to be sustainable? That is a key question in understanding the common practice of offering discounts to new customers or paying intermediaries (such as price comparison websites or advertisers) to attract new customers.

- From the perspective of ensuring consumer value—the metrics look at the fairness of procedures, and ask: would a well-informed consumer choose to buy this product? For example, can the price of an insurance product be justified in terms of the willingness of consumers to pay to avoid risk? Behavioural economics provides the tools for assessing the extent to which consumers are willing to pay to avoid losses and to avoid small-probability but undesirable events. Value for money can also be considered in behavioural terms for other products, such us investment funds, where the investor is paying for the chance of out-performance due to the skill of the fund manager. How much would a well-informed investor be willing to pay for this chance?

- From the perspective of consumer protection—the focus is on distributive fairness, particularly regarding consumer groups where there may be specific concern, such as vulnerable or disengaged consumers. One test might ask whether the business model relies on the profitability of customers who are exhibiting ‘behavioural biases’, and not making the best decisions in their own interest. Payday lending provides an example of an industry that was, before FCA regulation, largely reliant on profits from consumers who were extending loans, typically at very high cost. Business model analysis—linking the sources of profitability to the behaviour of consumers—highlights where such a dynamic has arisen, and how it may be addressed.

- From the perspective of consumer choice—there are several metrics for assessing procedural fairness. For example, are there restrictions to discourage consumers exercising choice? The business should not act to restrict the choice of consumers without good reason. This does not mean that a firm cannot limit the availability of new customer discounts to existing customers, for example, but it would need to be confident that sufficient choice exists for consumers to shop around for the best deal.

In practice, a range of metrics can be developed in line with the core purpose of the product, the purpose of the firm and the governance of the firm. Firms can then track outcomes against these metrics through management information.

Conclusions

The current focus on fair pricing is the culmination of many years’ progress in understanding consumer outcomes. Increasingly, the responsibility for those outcomes is being placed on firms.

There are many facets to understanding fairness. We have presented a practical tool for this purpose—which we have used with our clients. The framework has been used as a tool by senior decision-makers in financial services, informing their assessment of the fairness of these processes and outcomes. It represents a fundamental change in how boards operate, placing the focus on measuring and assessing customer outcomes using microeconomics, behavioural economics and business model analysis.

1 Citizens Advice (2018), ‘Citizens Advice issues super-complaint as loyal customers continue to be penalised by over £4 billion a year’, 28 September.

2 For the public response see, for example, BBC (2018), ‘Consumer loyalty “rip off” faces probe’, 28 September. For academic insights from behavioural economics see, for example, Kahneman, D., Knetsch, J.L. and Thaler, R.H. (1986), ‘Fairness and the Assumptions of Economics’, Journal of Business, 59:4, Part 2: The Behavioral Foundations of Economic Theory, October, pp. 285–300; Rabin, M. (1993), ‘Incorporating Fairness into Game Theory and Economics’, American Economic Review, 83:5, December, pp. 1281–1302; and Xia, L., Monroe, K.B. and Cox, J.L. (2004), ‘The Price Is Unfair! A Conceptual Framework of Price Fairness Perceptions’, Journal of Marketing, 68, October, pp. 1–15.

3 Over at least the last decade, the FCA has pursued the fair treatment of customers through firm supervision and, where this is insufficient, more interventionist regulation (demand-side and/or supply-side). Supervision tends to place greater responsibility for defining fairness on firms, with demand- and supply-side regulation involving greater input from the regulator on what constitutes fair. Fairness is also legislated for (in part) by the UK Equality Act and European legislation such as the Insurance Distribution Directive. Equality Act 2010, 8 April. The European Parliament and the Council of the European Union (2016), ‘Directive (EU) 2016/97 of the European Parliament and of the Council of 20 January 2016 on insurance distribution’.

4 Financial Conduct Authority (2015), ‘Fair treatment of customers’, last updated 13 February 2018.

5 Oxera (2015), ‘Behavioural economics, competition and remedy design (revisited)’, Agenda, April.

6 Ofcom (2018), ‘Consultation: Helping consumers get better deals – consultation on end-of-contract and annual best tariff notifications, and proposed scope for a review of pricing practices in fixed broadband’, 14 December. Ofgem (2017), ‘Decision to publish a statutory consultation on proposed changes to the domestic and non-domestic Standards of Conduct’, 4 July.

7 Ofgem (2019), ‘About energy price caps’.

8 Ofcom (2018), ‘Helping consumers to get better deals in communications markets: mobile handsets’, consultation, 26 September.

9 See The Consumer Protection from Unfair Trading Regulations 2008; The Consumer Contract (Information, Cancellation and Additional Charges) Regulations 2013; Consumer Rights Act 2015.

10 Competition and Markets Authority (2018), ‘Anti-virus software’, 19 December.

11 Department for Business, Energy & Industrial Strategy (2018), ‘Modernising Consumer Markets: Green Paper’, April. European Banking Authority (2015), ‘EBA publishes final product oversight and governance requirements for manufactures and distributors of retail banking products’, press release, 15 July.

12 While economists have a long history of attempting to quantify the relative importance of procedural and distributive fairness to individuals in different contexts, they are treated with equal emphasis in Oxera’s framework. See Alexander, S. and Ruderman, M. (1987), ‘The Role of Procedural and Distributive Justice in Organizational Behavior’, Social Justice Research, 1:2, June. See Oxera (2017), ‘To be fair: what does economic justice look like?’, Agenda, January.

13 For example, credit customers could be clustered according to their propensity to pay back a loan on time. This type of clustering was also done by the FCA for overdraft customers and high-cost short-term credit customers. Oxera (2018), ‘Should we be cross about cross-subsidies? Experience from the financial services sector’, Agenda, March.

14 This approach was previously explored in Oxera (2018), ‘Should we be cross about cross-subsidies? Experience from the financial services sector’, Agenda, March.

15 Financial Conduct Authority (2018), ‘High-Cost Credit Review: Overdrafts consultation paper and policy statement’, December, CP18/42.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More