To be fair: what does economic justice look like?

What is meant by economic (or distributive) justice has far-reaching implications for economic policies and their outcomes. However, in policymaking the interpretation is often implicit, with limited awareness and discussion of alternative concepts or their merits and drawbacks. What are these key concepts of economic justice, and what is their role in competition policy, regulation and regional state aid?

In broad terms, economic policies have two main objectives: descriptive—in particular, to pursue avenues that increase economic efficiency; and normative—to bring about outcomes according to how things ‘ought to be’.

Normative objectives involve the notion of ‘distributive justice’: for example, should the rich be taxed more than the poor? Should competition authorities focus on consumer outcomes and let producers look after themselves? Should all consumers receive the same quality of service in telecommunications services? And should producers be forced to pay taxes even if governments make deals with them?

As descriptive economics focuses on economic efficiency, it can provide only partial answers to these questions. However, it can be complemented by normative economics, which builds on moral theory and ethics to examine different notions of justice.

The distinction between efficiency and a fair distribution of wealth can be imagined in terms of making a cake for a party—while efficiency maximises the overall size of the cake given the available ingredients, fairness splits it among the party-goers in a certain way. What this split should look like, however, is highly controversial, and requires a normative judgement. At the same time, the split is often implicit in the context of economic policy or legislation, rather than being explicitly spelled out.

This article takes some basic notions of economic justice,1 and illustrates their application to three aspects of economic policy.

- Competition. What are the potential justifications for the consumer welfare standard that is used in competition policy for the assessment of market outcomes in various jurisdictions, including the EU?2 This measure excludes producer welfare and hence does not allow the profits of a business to offset any detrimental effect on consumers.

- Regulation. What is the normative basis of regulations that require firms to provide a basic service to all consumers? For example, the EU’s Universal Service Directive stipulates that telecoms providers must make their services available to all consumers; that emergency calls must be free of charge; and that there must be sufficient coverage of payphones.3 Similar rules exist for postal service providers, to ensure that they deliver to all consumers while maintaining a certain service quality, even if this is not profitable for some consumers (such as those in rural regions).

- Regional state aid. What is the rationale for regional state aid? State aid provisions aim to promote the common good of all EU member states by prohibiting subsidies that distort competition between firms and lead to subsidy competition between jurisdictions in order to attract international investment. However, regional aid provisions allow for support to projects in regions where the average GDP per capita is less than 75% of the EU average, albeit still subject to certain rules to ensure efficiency.4

Concepts of distributive justice

First, it is useful to explore what is meant by distributive justice. Economists, philosophers and others have argued in favour of a range of concepts.

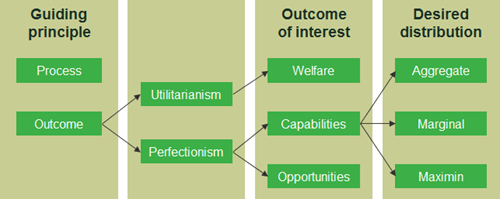

Figure 1 groups together the key concepts of justice according to their objectives. At the highest level, proponents of an ‘equality of rights’ focus on the processes that bring about distributions of wealth, such as compliance with the rule of law or an action motivated by the intention to increase welfare. Here, therefore, the means through which an outcome is achieved are more important than the end itself. A central figure in this school of thought was the philosopher, Immanuel Kant.5 In contrast, ‘consequentialists’ focus on the outcome of an action—which is regarded as the only standard of right or wrong. Jeremy Bentham propounded this argument (as founder of the utilitarianism movement, a branch of consequentialism).6 There is clearly a tension between these two schools of thought.

Figure 1 Selected concepts of distributive justice

Source: Oxera.

These concepts are implicit in various laws and regulations. There are few examples of policies with a focus on process, although contract law often permits a wide range of outcomes within the limits of the rules defined by the contract. Outcome-focused policies, in contrast, are much more widespread. These judge actions according to their effects, such as whether an agreement between firms increases prices (while a process advocate would focus on the intention of the original action).

The distinction between these theories of justice relates to their underlying concept of ‘a good life’—whether this is adhering to certain rules, enjoying a certain utility, or being given certain opportunities. This question can play into many arguments about economic policy, such as:

- the allocation of government budgets (how much should be spent on pensions, education or health?);

- the taxation of inheritance (to what extent should all children be starting from a similar economic position?);

- the regulation of companies (should firms be obliged to provide certain services even where they would not choose to do so voluntarily?).

Utilitarianism

Among the outcome-focused concepts, utilitarianism is the most widely known. In principle, it considers all kinds of ‘utility’ obtained by individuals within a society, where utility can be thought of as the ‘enjoyment’ or ‘benefit’ that individuals receive.

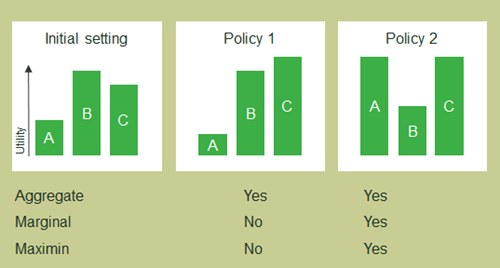

Utilitarians can hold very different ideas about a ‘just’ distribution of utility. This is illustrated in Figure 2, which shows three groups in a society—A, B and C—and two proposed policy changes. For example, it shows that Policy 1 reduces the utility of Group A compared with the initial setting; increases the utility of Group C; and leaves Group B unaffected.

Figure 2 Assessment of policy changes under different utilitarian approaches

Some utilitarians argue that the aggregate utility of a society (i.e. the sum of the welfare of all individuals) should be maximised, regardless of its distribution. This view promotes economic efficiency under all circumstances and is referred to in economic policy as the total-welfare approach. As both policies in Figure 2 increase the sum of the welfare that Groups A, B and C enjoy, according to this approach they would each be an improvement over the initial state of the world.

Other utilitarians aim to equalise the marginal utilities across individuals within a society, implying that, irrespective of the absolute utility enjoyed, it should be equally difficult to increase their utility by an additional unit. For example, two individuals enjoy the same marginal utility if spending €1 leads to the same utility increase for both—even though one person may obtain it from buying ice cream and the other from donating the €1 to charity. While marginal utility is not evident from the figure, it is often assumed to be equal if the groups or individuals have the same utility—so it becomes more unequal under policy 1, rendering this inadmissible.

In contrast, proponents of a maximin distribution envisage a society in which the worst-off person has the highest utility compared with the alternative distributions available. This view often involves substantial redistribution. It would consider policy 1 bad, as it reduces A’s welfare, while policy 2 would be desirable because the minimum level of utility across the three groups increases.

Perfectionism

Perfectionist approaches are consequentialist and therefore also focus on outcomes, but emphasise only certain types of utility. One reason for excluding certain forms of utility is that they are perceived to be counterintuitive or morally questionable—such as greed, sadism or other antisocial preferences.

Perfectionists therefore look at a limited range of outcomes, such as ‘intermediate’ outcomes that enable individuals to pursue a ‘good life’—an idea debated since the time of the ancient Greeks. One example is the capability approach developed by economist, Amartya Sen, which inspired the Human Development Index, comprising factors such as life expectancy, literacy and income.7 In a similar vein, philosopher, John Rawls (and others), has argued that the relevant measure is equality of opportunities.8 In this respect, different individuals get the same chances to pursue a life with access to resources that cover basic needs, while bearing the consequences of their choices (e.g. whether they wish to work hard or enjoy more free time).

The challenge for proponents of these approaches is to justify the choice of outcomes included and those left aside. The types of utility that are relevant will vary depending on whether a ‘good life’ is understood to manifest itself in, for example, a high degree of physical wellbeing, self-determination, or living in and contributing to a peaceful environment. However, through their impact on laws and regulation, such considerations have a tangible impact on economic policy, as discussed further below.

Measuring outcomes

Even if a common standard is agreed, it is challenging to measure to what extent an actual distribution is ‘just’. Most theories of justice involve measures that are not easily observable, such as utility or opportunities. A measure needs to have the same meaning for different individuals (be ‘interpersonally comparable’) for a comparison to be meaningful and for a distribution within a society to be assessed. If a theory of justice is intended to guide actions of individuals or institutions, it needs to provide some way of examining the current ‘level of justice’.

In practice, economists and politicians often take income or wealth as an approximation of welfare or utility, with GDP as the national indicator. However, this is problematic for at least three reasons.

- Decreasing marginal utility: a billionaire is likely to value receiving €1,000 less than someone living on €1,000 a month would (this is referred to as the ‘decreasing marginal utility’ of income). This is because the relative change in income is smaller, the more wealth a person has.

- Things that money doesn’t buy: individuals derive utility from many things, such as free services, social interaction, or even good weather. While economists often aim to express the value of these sources of utility in monetary units, it is difficult to obtain a reliable estimate for all relevant aspects.

- Individual variability: it is difficult to produce individual estimates of a person’s utility, because people receiving the same level of income derive different amounts of utility from it, as well as from things that they do not purchase. This means that it is hard to assess the distribution of utility (or opportunities, or other metrics that are considered relevant) and the aggregate utility associated with a certain level of GDP.

One alternative measure is ‘Gross National Happiness’,9 which the government of Bhutan has adopted as its measure of choice. While this may alleviate the first and second concerns above, it is still likely to be individually variable, thereby requiring more effort to measure.

Justice in practice

Many economic policies invoke a certain idea of justice, although this is often implicit. Returning to the three examples in the introduction, choices about the approach to distributive justice are at the centre of each one and affect regulators and competition authorities’ day-to-day decisions.

Competition policy

Competition policy in many countries focuses on consumer welfare, as highlighted above. Agreements between firms or mergers are therefore prohibited if there is harm to consumers.

Competition policy would look different, however, if an alternative standard were adopted. For example, if the distribution of consumer welfare had to be considered, competition policy would be more restrictive. In such a case, it would be necessary to understand changes implied by a merger for different groups or even individual consumers. For example, under a maximin approach, mergers could be blocked even if a minimal price rise were expected for one of many products, irrespective of the outcome for other products. In contrast, a total welfare approach might make more mergers admissible. Higher post-merger profits earned by firms would be taken into account, but only if they were larger than the loss in consumer welfare.

Regulation

Some firms are required to provide a certain service to all consumers, as noted above. This kind of policy is likely to be rooted in a theory of justice that is more sensitive to distribution than the aggregate consumer welfare approach.10 It may also be related to a perfectionist approach that puts emphasis on giving everyone access to specific services in order to ensure equality of opportunity.

Under a pure aggregate consumer welfare approach, such universal service obligations would not be seen as optimal; a fundamental result in microeconomics is that welfare is not maximised if people receive services when their willingness to pay is lower than the cost of delivering that service. In contrast, proponents of utilitarianism who demand equal marginal utilities might require universal provision to cover a wider range of services (especially if people living in rural areas derive as much utility from these services as people living in cities).

Regional state aid

State aid rules allow for differential treatment across regions, based on relative GDP. This indicates an underlying idea of justice that supports a certain degree of equalisation of income across the EU. However, it does not lead to a direct intervention, unlike in the examples above: regional aid allows states and firms to exploit specific rules, but it does not oblige them to do so. This combination is complex to characterise in terms of the ideas of justice discussed above. While state aid as such is motivated by efficiency concerns, it allows for a redistributive element when the efficient outcome is ‘unequal enough’ (i.e. if there are regions with less than 75% of average GDP).

State aid provisions prohibit spending tax money in ways that counteract certain principles of the EU. Tax, more generally, is a key tool for achieving or increasing distributional justice in a society. For example, many countries have an increasing marginal income tax rate and some kind of support for individuals who earn less than a certain minimum amount. Such redistribution, according to textbook economics, is likely to reduce aggregate welfare as measured by total income; however, the basic premise of a more equal distribution appears to be widely accepted. This can be justified with decreasing marginal utility of income, but also with maximin utilitarianism.11 Experimental studies have shown that individuals place significant value on fairness in income distribution.12

Concluding observations

Economic policy is not only driven by efficiency considerations. It usually also considers some notion of distributive justice. However, this notion is rarely made explicit, even though its choice has a direct impact on policy and day-to-day decisions made by public bodies.

The choice of the consumer welfare standard in competition law is more restrictive than some alternatives, and focuses on outcomes rather than on the process by which the outcome is brought about, such as the consumer’s choice. What is more, concepts of distributive justice in different areas of economic policy do not always coincide—with competition law focusing on consumer welfare in aggregate while elements of sector-specific regulation focus more on distribution. This raises the question of whether the choice of a specific concept is the result of an explicit policy debate or whether such choices have implicitly evolved over time and diverged in different areas.

A better and more explicit understanding of normative choices would assist policymaking. This applies not only to existing policies and their underlying concepts, but also to the assessment of future policy proposals.

For example, should there be stronger regulation of online firms that displace some activities of offline firms in order to create a level playing field? Should firms be obliged to publish the ratio between their lowest- and highest-paid workers, or should this ratio even be restricted? Should there be a basic income that guarantees a certain living standard for people, even when they are unemployed? The answers to these questions, at least in part, depend on which of the many approaches to distributive justice is used.

1 Building on Roemer, J. (1998), Theories of Distributive Justice, Harvard University Press, revised edition.

2 Madill, J. and Mexis, A. (2009), ‘Consumers at the heart of EU competition policy’, Competition Policy Newsletter, 1.

3 Directive 2002/22/EC of the European Parliament and of the Council of 7 March 2002 on universal service and users’ rights relating to electronic communications networks and services.

4 European Commission (2013), ‘Guidelines on regional State aid for 2014-2020’, Official Journal C209, 23 July.

5 Kant, I. (1993) [1785], Grounding for the Metaphysics of Morals, 3rd ed., translated by J.W. Ellington, Hackett.

6 Bentham, J. (1907), An Introduction to the Principles of Morals and Legislation, Clarendon Press.

7 Sen, A. (1980), ‘Equality of what?’, lecture delivered at Stanford University on 22 May 1979, in S.M. MacMurrin, The Tanner lectures on human values, 1, 1st ed., University of Utah Press. Sen, A. (1983), Choice, Welfare, and Measurement, Basil Blackwell.

8 Rawls, J.A. (1971), A Theory of Justice, Harvard University Press.

9 This index comprises nine domains: psychological wellbeing, health, education, time use, cultural diversity and resilience, good governance, community vitality, ecological diversity and resilience, and living standards.

10 However, it is not possible to tell from the rule, as such, which theory of fairness it is based on, as different theories may lead to similar policies. A maximin approach, for example, would imply that the universal service is the highest level of service that can be made available to everyone.

11 Maximin utilitarianism is more likely to underlie strong redistributive systems, as it requires the person earning the least to have the highest income compared with alternative distributions.

12 Economists have carried out experiments that asked people to play an ‘ultimatum game’ where person A can split a certain amount between themselves and person B; person B can accept the offer or refuse it, in which case both players get nothing. This experiment has been played in many versions since the 1980s, with the central result that individuals refuse offers if they feel they are being offered an unfairly small amount. This is an important result, because standard economic theory predicts that person B would prefer any non-negative amount (even $0.01) rather than refuse the offer and receive nothing.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More