Risky business: political uncertainty and the cost of capital for regulated firms

Statements by politicians about nationalising or intervening in the functioning of regulated industries have attracted substantial media attention in recent times, leading to an increase in political and regulatory risk for regulated industries. A case study focusing on National Grid, the energy transmission company in the UK, suggests that increased political and regulatory risk can affect the valuation of regulated utilities through a combination of lower expected cash flows and a higher cost of capital.

There are a number of examples from Europe where politicians have threatened to intervene in regulated industries. For instance, at the UK Labour Party’s annual conference in September 2018, the Shadow Chancellor, John McDonnell, stated:

Rail, water, energy, Royal Mail: we are taking them back.

This has been followed by the Labour Party’s plans to nationalise water and energy networks in the UK at below market prices, should it win the next general election.1

Similarly, in July 2019, Luigi di Maio, Deputy Prime Minister of Italy, told reporters during trading hours that he could start the process for revoking the toll road licence of Atlantia (an Italian infrastructure company) in August.2

The political pressure and threats to renationalise have led to an increase in the political risk faced by regulated industries. This has been coupled with increased regulatory risk.

An example of regulatory risk is where companies are put under pressure to make ‘voluntary contributions’ to customers. For instance, over the 2015–17 period, a number of UK energy networks made voluntary contributions to customers through lower bills. Ofgem, the energy regulator for Great Britain, stated that:

In total, voluntary commitments made by network companies so far will result in more than £650 million being returned to consumers. Ofgem encourages the remaining gas distribution and electricity transmission companies to follow suit.3

The impact of these risks on investment decisions and required returns is two-fold.

First, the risk of political and/or regulatory intervention reduces expected business profitability and cash flows from an investment. This asymmetric downside-only risk leads to a decrease in expected returns, which reduces investors’ willingness to invest in assets for any given cost of capital (rate of return). An Agenda article from October 2015 discusses the impact of political and regulatory risk on cash flows in more detail.4

Second, the risk of political and/or regulatory intervention may lead to an increase in returns required by investors (i.e. a higher discount rate or cost of capital).

This article describes a framework to assess the impact of political and regulatory uncertainty on returns required by investors. Evidence suggests that the increase in political and regulatory risk is priced by investors and is affecting the valuation of regulated utilities. As a case study, we present evidence on National Grid, which owns the electricity and gas transmission networks in England and Wales.

How does political and regulatory uncertainty affect investors’ required returns?

The total risk of a stock (as measured by share price volatility) can be broken down as follows:

Total risk =

systematic market risk + other systematic risk + idiosyncratic risk

Political and regulatory risk can therefore have three impacts:

- exposure to market-wide risk (i.e. systematic market risk)—captured by the equity beta5 in the standard Capital Asset Pricing Model (CAPM);

- exposure to other systematic risks—factors that affect multiple companies and where investors cannot eliminate their exposure to these risk factors by investing in a larger, more diversified portfolio of companies;

- exposure to company-specific risk—i.e. company-specific consequences of political and regulatory actions.

The extent to which these types of risk affect the rates of return required by investors depends on which asset pricing theory best explains the actions of investors and capital markets.

Exposure to market-wide risk

Finance theory predicts that investors will expect a higher rate of return as compensation for exposure to systematic and non-diversifiable sources of risk. The widely used CAPM considers only the covariance of individual asset returns with the total equity market as a proxy for exposure to systematic risk. If the CAPM is assumed to be a reliable description of reality then all exposure to political and regulatory risk is assumed to be reflected already in the equity beta (which measures the covariance described above).

While the CAPM’s clear theoretical foundations and simplicity contribute to its popularity among regulators, academic literature has challenged the CAPM’s predictive ability, highlighting empirical and theoretical shortcomings. Alternative models have therefore been developed (such as the multi-factor models discussed below), which have introduced new risk factors (other than the market equity beta) in order to improve precision and explain equity returns.6

Exposure to other systematic risks

Within a more general asset pricing framework, such as Arbitrage Pricing Theory (APT), there are potentially multiple sources of systematic risk.7

Political and regulatory risk is frequently manifested in actions that affect an entire sector or multiple sectors of the economy. As such, investors cannot eliminate their exposure to these risk factors by investing in a larger, more diversified portfolio of companies. If investors price in exposure to such risks, the CAPM will tend to understate required returns for companies with higher exposure to political risk than the average company (i.e. they will require more return to compensate for these risks). Conversely, the CAPM will tend to overstate required returns for companies with lower exposure to political risk than the average company.

In principle, multifactor models should be used to estimate the risk premium that investors require for exposure to political and regulatory risk factors, and the respective sensitivity of the returns required by investors to each of these factors (i.e. the betas). However, there are empirical challenges in applying multifactor models to political and regulatory risk (such as defining variables to measure political and regulatory risk). This is exacerbated in the regulated utilities sector, because a large proportion of the sector is not listed on a stock market.

Exposure to company-specific risk

Academic research frequently assumes that company-specific risks are diversifiable and do not affect the required rate of return. However, research that relaxes the assumptions of the CAPM and incorporates the impact of market frictions may, under some circumstances, predict that equity returns will be positively related to total risk and not just systematic risk. For example, Merton’s 1987 model of capital market equilibrium with incomplete information posits that investors hold only those stocks whose risk and return characteristics they are familiar with (‘investor recognition hypothesis’)—i.e. investors invest only in stocks on which they have perfect information. Therefore, relaxing the assumption that all investors are perfectly informed results in investors holding sub-optimally diversified portfolios and therefore requiring compensation for the idiosyncratic risk of stocks.

Merton’s model therefore states that in equilibrium, cross-sectional stock returns will be positively correlated with idiosyncratic risk (i.e. returns required by investors also increase with an increase in idiosyncratic risk, not just systematic risk).8

Empirical research has subsequently found that Merton’s prediction holds true in the data, although this remains an area of live debate.9

Research therefore suggests that investors may price some of the company-specific consequences of political and regulatory risks (i.e. idiosyncratic risks) by requiring a higher rate of return.

While it is difficult to reliably apportion the impact of political and/or regulatory risk across the three impact areas discussed above, there is evidence that political risk has increased and is being reflected by investors in their investment decisions.

Evidence of the impact of political and regulatory risk on valuation

In the UK, the recent increase in political and regulatory uncertainty is affecting valuations of regulated utilities (for example, National Grid). As discussed below, this is evident from:

- more frequent political and regulatory news triggering falls in share prices (i.e. sharp declines in reaction to news);

- an increase in share price volatility;

- a decline in the status of regulated utilities as ‘defensive stocks’;

- an increased focus on regulatory and political risk as a valuation driver in analyst assessments.

More frequent political and regulatory news triggering falls in share prices

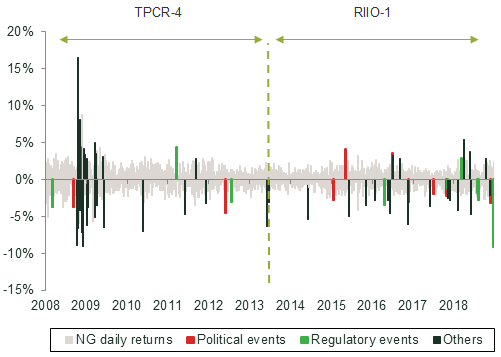

There has been an increase in share price falls linked to political and regulatory news across the utilities sector. For instance, since the start of the Ofgem RIIO-1 price control in April 2013, the frequency of political and regulatory news announcements that have triggered falls in National Grid’s share price has increased. One example is the 9% decline on the day of publication of the sector-specific consultation by Ofgem in December 2018.10 This was the largest drop in National Grid’s share price on a single day since 1998 (see Figure 1 below).

Figure 1 National Grid’s share price reaction (a sharp increase or decrease in price), 2008–18

Source: Oxera analysis, based on Thomson Reuters data.

Increase in share price volatility or total risk of the stock

National Grid’s total risk (as measured by share price volatility) has increased more than the market-wide risk (FTSE All-share) since July 2016, a period during which the UK Labour Party has asserted its commitment to renationalise utilities if it were to come to power.

The risk of other utilities (e.g. United Utilities and the Utility Index) has also increased during this period.

Decline in status of regulated utilities as ‘defensive stocks’

There is evidence to suggest that, since the start of 2013, regulated utilities have been viewed as less of a hedge against economic uncertainty than they were before. For instance, there have been fewer days when the wider stock market declined and the utilities’ share prices increased compared with the previous five years (2008–13).

Increased focus on regulatory and political risk as a valuation driver in analyst assessments

Since 2016, political and regulatory risk has become more prominent as a valuation factor in reports published by utilities equity analysts. There appears to be a consensus that such risks are increasingly important when deciding whether to invest in UK utilities, particularly when compared with investment opportunities outside the UK. This sensitivity of investors to political risk is indicated by the following comment from an investment bank on the subject of National Grid’s businesses in the UK and the USA:

Overall, we feel that National Grid was seeking to move investor focus away from the UK – where the political risk is high and growth low, in our view – and onto growth in the US business.11

Implications for the cost of capital?

The range of theories for how risk is reflected in asset prices suggests that the CAPM is unlikely to provide a full description of how investors determine required rates of return. While this may not matter for the average company, the CAPM will tend to underestimate (overestimate) the rate of return that investors expect for investing in companies with higher (lower) than average exposure to political and regulatory risk.

In principle, the premium that investors require for exposure to political and regulatory risk factors could be estimated using multifactor models. An intermediate step in the development of such models is to define variables and collect evidence that quantify exposure to political risk and how this varies over time and across companies. Such information can already be used when interpreting the outputs from the CAPM.

Whatever the motivations or the intended effects of political intervention in regulated industries, such moves often raise risk. Economics can help to clarify how these risks affect the cost of capital for the companies concerned.

1 Pickard, J. and Thomas, N. (2019), ‘Labour plans to nationalise energy networks at below market value’, Financial Times, 14 May.

2 Sanderson, R. (2019), ‘Italy’s anti-business sentiment is ringing alarm bells’, Financial Times, 11 July.

3 Ofgem (2017), ‘Ofgem welcomes SGN’s contribution to consumers’, 27 November, accessed 4 September 2019.

4 Oxera (2015), ‘Piping down? Gassled tariff reductions and the price of regulatory risk’, Agenda, October.

5 The equity beta measures the scaled covariance of the returns on a stock to the returns on the entire equity market—i.e. how sensitive, on average, the stock price is to a change in the overall market.

6 For instance, see Fama, E. and French, K. (1993), ‘Common risk factors in the returns on stock and bonds’, Journal of Financial Economics, 33, pp. 3–56.

7 Ross, S. (1976), ‘The Arbitrage Theory of Capital Asset Pricing’, Journal of Economic Theory, 13, pp. 341–360; Chen, N., Roll, R. and Ross, S. (1986), ‘Economic Forces and the Stock Market’, The Journal of Business, 59:3, pp. 383–403.

8 Merton, R.C. (1987), ‘A simple model of capital market equilibrium with incomplete information’, The Journal of Finance, 42, pp. 483–510.

9 For example, see Boehme R.D., Danielson, B.R., Kumar, P. and Sorescu, S.M. (2009), ‘Idiosyncratic risk and the cross-section of stock returns: Merton (1987) meets Miller (1977)’, Journal of Financial Markets, 12, pp. 438–68; Ang, A., Hodrick, R., Xing, Y. and Zhang, X. (2006), ‘The cross-section of volatility and expected returns’, Journal of Finance, 61, pp. 259–99.

10 Ofgem (2018), ‘RIIO-2 sector specific methodology consultation’, 18 December.

11 Credit Suisse (2017), ‘National Grid: US business strong. But UK remains weak’, p. 4.

Download

Related

Oxera AI policy map – October 2025

Drawing on Oxera’s combined expertise in digital policy and regulation, as well as in analytics, data science and AI, we have developed a database that tracks key national and supranational AI policy developments across the European Economic Area (EEA) and the UK. This curated collection brings together legal texts, strategy… Read More

Ofgem’s RIIO-ED3 SSMC

On 8 October 2025, Ofgem published its Sector Specific Methodology Consultation (SSMC) for the forthcoming RIIO-ED3 (ED3) price control for GB electricity distribution networks. We look at some of the key themes emerging from the consultation ahead of the final methodology decision, which is expected to be published in December… Read More