Piping down? Gassled tariff reductions and the price of regulatory risk

In June 2013, the Norwegian Ministry of Petroleum and Energy (MPE) reduced the tariffs for access to Gassled’s offshore gas transport infrastructure located primarily on the Norwegian continental shelf (NCS). As in other cases where similar actions have been implemented, there is often a price to pay for greater regulatory risk. What are the implications of the MPE’s tariff decision, upheld by the Oslo District Court, for future investment on the NCS?

On 25 September 2015, the Oslo District Court published its judgment in a litigation initiated by four participants in the Gassled joint venture against the MPE, following the latter’s decision in June 2013 to significantly reduce Gassled’s third-party access tariffs.1 The complainants are all infrastructure owners without interests in upstream gas production or downstream marketing activities (similar to Gassled itself), and acquired their stakes from oil and gas companies that were already active on the NCS between June 2011 and January 2012, shortly before the initial consultation on the proposed tariff changes in January 2013.2 The complainants unsuccessfully argued that the MPE’s tariff decision should be overturned, and that damages should be paid in the event that the decision was deemed valid, owing to the MPE’s failure to provide sufficient guidance on the future operation of the tariff regime.3

It is apparent that the MPE’s tariff decision has brought about a significant change in the perception of the risk of investing in gas network infrastructure on the NCS.4 This has the potential to affect Gassled’s existing investors’ incentives to acquire assets from upstream companies (as has happened on several occasions in the past), particularly where such assets are not already backed by existing capacity bookings.5 This could make it more costly to extend the NCS gas pipeline network where the benefits of investment in ‘oversized’ capacity could be desirable from a policy perspective (due to economies of scale in the provision of pipeline capacity), but may not be economically viable for upstream companies that are primarily interested in pipeline capacity for their own production.

This article summarises the Norwegian regime for regulating offshore gas pipeline tariffs, and the developments in the Gassled case, before illustrating how the MPE’s recent tariff decision affects the risks faced by Gassled and developers of new NCS gas pipelines.6

Gassled tariff regulation

Gassled’s tariffs are defined for specific assets grouped into ‘tariff areas’, and are expressed in Norwegian krone per standard cubic metre of gas. The tariff in any particular area is calculated as the sum of four cost terms:7

- K, a unit cost annuity to remunerate construction capital expenditure (CAPEX), based on forecast capacity bookings and a discount rate of 7% (real, pre-tax), considered by the MPE to be a reasonable rate of return;8

- U, a unit cost annuity to remunerate CAPEX to increase pipeline capacity, based on forecast capacity bookings and the same discount rate as above;

- I, the annuitised cost of maintaining existing infrastructure, evaluated using the same discount rate as above and levied on each unit of actual booked capacity;

- O, annual operating expenditure, levied on each unit of actual booked capacity.

Note that the K and U parameters are seemingly subject to a price cap, implying that Gassled bears volume risks—to both the upside and the downside—associated with future capacity bookings (a function of oil and gas prices, production costs, and resource discoveries) and technical availability being different from forecast levels. Indeed, that is what the complainants in the Gassled litigation had understood to be the case until 2013. Moreover, having been established in 2003, Gassled’s K parameter was expected to be fixed until the end of Gassled’s licence period in 2028.9

It is therefore unsurprising that the complainants were ‘surprised and upset’ by the MPE’s proposal to reduce the K tariff by 90% or more in the majority of Gassled’s tariff areas, resulting in an initial estimate of the value transfer from Gassled’s owners to shippers (i.e. the upstream companies, and Gassled’s customers) of NOK 34bn–40bn (about £4bn).10

The MPE’s rationale for the tariff reductions was that they facilitated good resource management on the NCS, in particular by maximising the economic recovery of oil and gas resources.11 Furthermore, the MPE cited analysis conducted in 2012 by Gassco, the state-owned operator of the Gassled network, which showed that returns would be at or above a reasonable level for the period 2013–28.12

Implications for regulatory risk

It is clear that the direct effects of the MPE’s tariff decision, supported by the Oslo District Court, would be to reduce future revenues and to shift investors’ perceptions of the operation of the regulatory regime from an ex ante price cap to an ex post cap on the rate of return.13

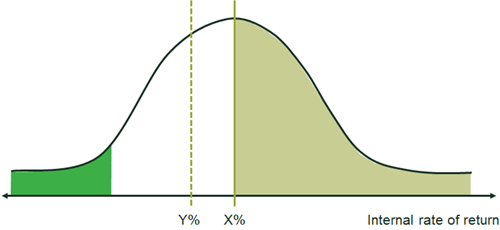

Figure 1 illustrates the distribution of returns subject to a cap. The distribution of asset returns principally reflects the uncertainty over future volumes at a particular point in time for a given operational asset. Moreover, it is assumed that the original forecast of volumes that went into the K parameter corresponded to the investors’ (central) expectation.

Figure 1 Illustration of the distribution of returns with an ex post rate of return cap

Source: Oxera.

Where both the upside and downside risks are unconstrained, and there are no contractually committed volumes, the expected return shown in Figure 1 is X%. The lighter shaded area on the right-hand side shows that the upside returns are capped by the MPE’s tariff decision. The darker shaded area on the left-hand side represents shippers’ booked volumes, which also limit the downside risks to Gassled. The truncation of the distribution of returns would reduce overall expected returns from X% to Y% and so, for any given cost of capital, the probability that Gassled would be incentivised to acquire the asset would decrease.

The implication of Figure 1 is that the MPE’s tariff decision could prevent capital from being ‘recycled’ into future upstream projects, something that could be particularly detrimental to the development of the NCS given that smaller, independent upstream companies, which may also have a more limited debt capacity, have accounted for roughly half of all NCS exploration investment since 2010.14 Moreover, to the extent that dedicated infrastructure investors (such as the complainants in the Gassled case) are able to finance and manage gas pipeline assets more efficiently than the upstream companies on their own, the impact of the MPE’s decision could be to raise costs of NCS investment over the long term.

This is relevant to the case of Polarled, a 480km pipeline being developed to serve the Aasta Hansteen field in the Norwegian Sea.15 As suggested by Gassco’s modelling in 2012, Polarled was deliberately oversized by 25% and the original plan was for it to merge with the Gassled network prior to commissioning in 2016.16 As a result of the MPE’s tariff decision, Njord Gas Infrastructure AS, a complainant in the Gassled litigation, announced that it would not acquire Polarled.17

Implications for investment

The MPE’s tariff decision could also affect the incentives of upstream companies to invest in oversized capacity. The economic cost of regulatory risk on the NCS could therefore manifest itself as underinvestment in new capacity and/or delayed investment compared with what would be economically efficient from a policy perspective.

This is especially relevant given that NCS investment is increasingly focused on the development of ‘frontier’ areas, such as the Barents Sea, due to the expected fall in gas production from mature fields elsewhere on the NCS in the 2020s.18 Indeed, Gassco has already noted that ‘gas developments in the Barents Sea will be characterised by a large share of CAPEX in infrastructure…and a large share of [economically] marginal resources’, and that ‘alternative models to finance gas infrastructure investments may be needed to maximise the value creation [on the NCS]’.19

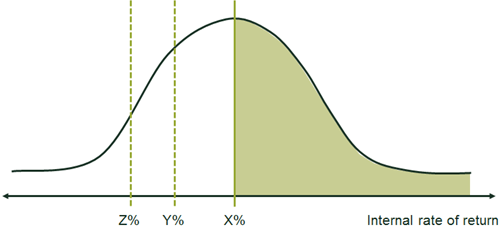

Figure 2 illustrates how an ex post cap on returns could fail to incentivise investment under uncertainty. It shows the distribution of returns to an oversized asset, as in the case where a pipeline with a larger diameter is installed where a smaller pipeline could have been used.

Figure 2 Illustration of the distribution of returns for ‘oversized’ capacity with an ex post rate of return cap

Source: Oxera.

Two key implications can be drawn from Figure 2. First, the MPE’s tariff decision would increase the probability that pipeline investments are distorted as tariffs are reduced below long-run marginal costs (LRMC), which would be consistent with the reduction in the expected returns from X% to Y% shown above.20 As in the Gassled case, if tariffs are reduced after pipeline construction once excess returns have been realised (and, following the MPE’s decision, this could seemingly occur at any point over the life of the asset), upstream companies might anticipate this and defer development of marginal fields. Alternatively, upstream companies might be incentivised not to book capacity on pipelines where tariffs include remuneration of the initial investment, in favour of other pipelines that have been subjected to tariff cuts. In short, distortions to the development of pipeline capacity could arise from tariffs not being cost-reflective.

Second, the reduction in expected returns from Y% to Z% represents the loss of the ‘real option’ to delay the investment in oversized capacity, which implies that the MPE would need to account for this cost when setting tariffs in order to incentivise efficient investment. This follows from the fact that investments in pipeline capacity are dominated by large sunk costs (that are also irreversible); they are subject to uncertainty (e.g. demand risk); and the upstream company may have the option of delaying the investment to take advantage of better business conditions later. Oxera’s experience of valuing delay options for UK continental shelf offshore gas pipelines suggests that this could have a significant impact on returns for similar infrastructure on the NCS, notwithstanding the differences in the regulatory regime.21

What next?

Whatever the merits of the legal arguments made by the parties in the Gassled case and the outcome of any prospective appeal, the case is a reminder of the challenges that infrastructure investors face when assessing regulatory risk, even in jurisdictions with seemingly stable regimes.

Given the opportunities associated with the development of new resources on the NCS, there continues to be a need to attract investment in pipeline assets with large sunk costs in the face of uncertain demand. Based on the MPE’s recent tariff decision, supported by the Oslo District Court, this highlights the potential requirement for mechanisms to strengthen the regulatory authority’s commitment to sunk cost recovery. Recognition of the value of investment timing options exercised during the construction of new pipelines could also help in meeting the MPE’s objective of efficient resource management.

The complainants in the Gassled case have six weeks from the publication of the judgment on 25 September to decide whether to appeal.

Contact: Jostein Kristensen

1 Gassled was established on 1 January 2003 and is the owner of a network of offshore gas pipelines and other associated infrastructure located primarily in the North Sea and the Norwegian Sea. The complainants in the case were Infragas Norge AS, Njord Gas Infrastructure AS, Silex Gas Norway AS, and Solveig Gas Norway AS. Together, these companies own approximately 44% of Gassled, with 46% owned by Petoro, the licensee for the Norwegian state’s direct financial interest in NCS petroleum activities. The remaining share (c. 10%) is primarily held by oil and gas companies. See Gassco website, ‘Gassled’. For details of the case, see Oslo District Court (2015), Judgment in case number 14-010957TVI-OTIR/08, 25 September, p. 3.

2 Oslo District Court (2015), op. cit., pp. 3 and 23.

3 Oslo District Court (2015), op. cit., pp. 26–30.

4 Oslo District Court (2015), op. cit., p. 54.

5 Since Gassled was established in 2003, its network has grown as it has acquired a number of pipelines. These include Langeled (2006), Tampen Link (2007), Norne Gas Transport System (2009), and Gjøa Gas Pipeline (2010). See Gassco website, ‘Pipelines and platforms’.

6 The Norwegian Petroleum Act 1996 (LOV-1996-11-29-72, sections 4–8) allows the MPE to require licensed pipeline owners to offer regulated third-party access subject to considerations relating to efficient resource management and providing a reasonable profit to the licensee.

7 Regulation 2002-1724 (FOR-2002-12-20-1724).

8 Oslo District Court (2015), op. cit., pp. 12 and 26.

9 Njord Gas Infrastructure AS (2013), ‘Submission to the Norwegian Ministry of Petroleum and Energy on its consultation paper dated 15 January 2013 proposing amendments to Gassled capital tariffs’, 15 March, p. 2.

10 PSP Investments (2013), ‘Proposed reduction of the tariffs for transportation and processing of gas on the Norwegian Continental Shelf’, 15 March, p. 1. Olje- og energidepartementet (2013), ‘Forslag til endring i forskrift 20. desember 2002 nr. 1724 om fastsettelse av tariffer mv. for bestemte innretninger’, 15 January, pp. 10–11. Silex Gas Norway AS (2014), ‘Infrastructure investments on NCS’, 21 January, p. 11. Solveig Gas Norway AS (2013), ‘Høringsuttalelse til forslag til endring i forskrift 20. desember 2002 nr. 1724 om fastsettelse av tariffer mv. for bestemte innretninger’, 15 March, pp. 3–4.

11 Oslo District Court (2015), op. cit., p. 25.

12 Oslo District Court (2015), op. cit., p. 23.

13 It is unclear whether the MPE will consider increasing tariffs at a later date in the event that the rate of return is lower that the allowed rate of return.

14 Norsk Petroleum website, ‘Leteaktivitet’.

15 Statoil (2013), ‘Aasta Hansteen and Polarled plans submitted for government approval’, press release, 8 January.

16 Gassco (2012), ‘NCS2020 – En studie av fremtidens gassinfrastruktur’, pp. 21–2. Statoil (2013), ‘Gas field development’, 16 October, p. 35.

17 Njord Gas Infrastructure AS (2013), ‘Submission to the Norwegian Ministry of Petroleum and Energy on its consultation paper dated 15 January 2013 proposing amendments to Gassled capital tariffs’, 15 March, p. 8.

18 Gassco (2012), ‘NCS2020 – En studie av fremtidens gassinfrastruktur’, pp. 21–2. Statoil (2013), ‘Gas field development’, 16 October, pp. 4–11.

19 Gassco (2014), ‘Barents Sea gas infrastructure’, 10 June, p. 36.

20 LRMC is the increase in total cost (i.e. the sum of fixed and variable costs) associated with an increase of one unit of capacity.

21 Future Agenda articles will return to this topic in more detail.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More