To provide or not to provide access? The Dutch broadband joint SMP case

On 17 March 2020, the Dutch Trade and Industry Appeals Tribunal (CBb) published its long-awaited verdict on the appeal against the Netherlands Authority for Consumers and Markets (ACM) 2018 finding of joint dominance in the Dutch retail broadband market. Why did the CBb rule in favour of the appellants, and what are the implications of this finding for the regulation of wholesale broadband access in the telecoms sector?

Oxera advised VodafoneZiggo during this case.

In its 2018 review of the Dutch broadband market, the ACM found that VodafoneZiggo1 and KPN2 held a position of joint significant market power (SMP) in the retail broadband market, and required both firms to provide wholesale broadband to retail competitors.3 This was the first time that the ACM had found joint SMP in the Dutch fixed broadband market—before this, KPN was the only operator deemed to have market power and subject to wholesale access obligations.

Following a period of rapid growth through mergers and acquisitions, as well as a major programme of network investment, VodafoneZiggo went head to head with, and became more than a match for, KPN.

However, the ACM was not convinced that this new market structure would be sufficient to guarantee effective competition, and it pursued a case of joint dominance. The ACM argued that, in the absence of regulatory obligations to offer wholesale access, the two firms would tacitly coordinate with each other to refuse to open up their networks to third parties, in an effort to keep retail prices at above competitive levels.

VodafoneZiggo and KPN appealed this decision and, in a long-awaited judgment that arrived on 17 March 2020, the CBb quashed the ACM’s joint SMP finding. As a result, no access obligations stemming from the ACM’s finding can be brought into force.

Ghosts of battles past

This decision brings back a question that was extensively debated during the legislative discussions that led to the approval of the European Electronic Communications Code (EECC): does the EU telecoms regulatory framework have a blind spot, limiting the ability of national regulatory authorities (NRAs) to regulate markets effectively?

Back in 2015, the Body of European Regulators for Electronic Communications (BEREC) believed that this was indeed the case.4 Concerned by the prospect that cable operators’ growing footprints would match those of traditional copper and fibre operators, BEREC worried that there might come a time where it would no longer be evident that a single operator held SMP. However, it was also concerned that the conditions for finding collective dominance or joint SMP would be hard to prove, and therefore that there might be no recourse to regulate imperfectly competitive markets with a small number of operators.

Despite BEREC’s concerns, the European Commission determined that the concepts of single and joint SMP remained fit for purpose and, as such, they continue to be the only mechanisms through which NRAs can impose targeted access obligations on telecoms operators.

In what follows, it is not our intention to reopen the debate regarding whether there is a blind spot in the telecoms SMP framework—we have discussed this in some detail in previous articles and reports, and we consider that the Commission made the right decision to retain the existing SMP-based regulatory thresholds.5 Instead, this article explores two important elements of the recent Dutch case:

- first, the CBb’s reliance on game theory-based economic models to reach its conclusions;

- second, the crucial role that commercial access agreements and, more generally, incentives of parties to provide wholesale access played in undermining the joint SMP finding, and the implications of this for how NRAs across the EU must conduct market analyses—especially in situations where cable operators and copper/fibre operators (or multiple infrastructure operators, for that matter) compete head to head in large parts of a country.

A beautiful game

Many will recognise John Nash as the American mathematician depicted in the Oscar-winning film A Beautiful Mind, and as the winner of the Nobel Prize in Economics in 1994 for his contributions to game theory.

Nash’s contribution to Industrial Organisation theory, and hence competition and regulatory economics, had two aspects: he helped to develop the framework that we use to think about how firms interact—that of ‘non-cooperative games’; and he established a way of working out what the outcome of that interaction will be—his famous namesake ‘equilibrium’.6

This particular strand of mathematics—game theory—played a key role in the ACM’s joint SMP finding, and also in the CBb’s evidence to undermine the ACM’s arguments, drawing on Nash’s seminal contribution to the development of non-cooperative game theory.7

A game describes any situation in which two or more ‘players’ (e.g. people or firms) can perform actions (strategies) that affect not only their own ‘payoffs’ (e.g. profit), but also the payoffs of other players with whom they interact. As part of its joint SMP assessment, the ACM considered a simplified two-stage game in which the two operators in the market (KPN and VodafoneZiggo):

- first determine whether to grant or deny access to their ‘wholesale fixed access’ network (the upstream input to the provision of retail fixed broadband services);

- then determine what price they will sell broadband services at on the retail market.

The combination of these two choices determines the profit that the parties can achieve; however, the level of profits for a single operator depends not only on its own choices, but also on the choices of its rival, as follows.

- If either operator provides access then extra retail competition lowers retail profits. However, the operator providing access benefits from profits on the wholesale market, and it will also be able to gain market share from its vertically integrated rival in terms of the overall number of connections, if the access seeker is successful in the retail market.

- However, when the two network operators in this model are competing to provide wholesale access, they can end up competing their wholesale access charges down to cost, thus eroding any wholesale profits.

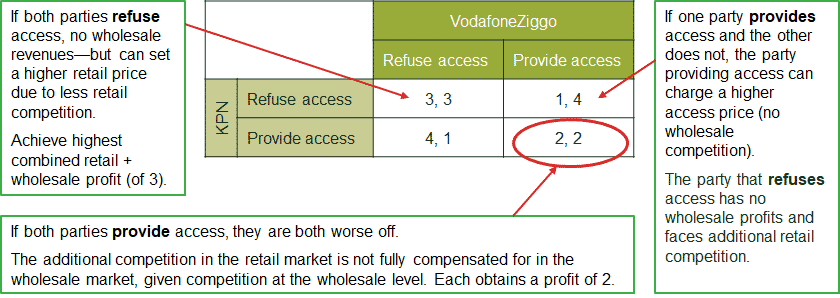

Given this set-up, the ACM modelled the outcome of this game with a stylised ‘payoff matrix’ showing different profits to each firm depending on its decision to ‘refuse’ or ‘provide’ access, together with the decision of the other operator, as set out in Figure 1 below.

Figure 1 ACM payoff matrix: a prisoner’s dilemma

Source: Oxera, based on payoff matrix in Authority for Consumers & Markets (2018), ‘Marktanalyse Wholesale Fixed Access’, 27 September.

This situation results in a ‘prisoners’ dilemma’—the analogy being of two prisoners who face the choice between confessing (providing access) or staying quiet (refusing access).

In Figure 1, given the structure of payoffs, each operator will always choose to provide access, as doing so will always give it the best payoff, taking as a given the choice of the other operator. This means that there is a ‘stable equilibrium’ where both operators choose to provide access, and each obtains a payoff of 2.

The two operators would jointly be better off if they both refused to provide wholesale access, as—according to the ACM—they would then be able to increase prices on the retail market for (bundles with) Internet access to the detriment of the consumer, and each would achieve a payoff of 3.

However, both operators refusing access is unstable: each party would have an incentive to deviate and provide access (in the hope of getting a payoff of 4). As soon as one party deviates, it is then in the best interests of the other party to also provide access. The result? The stable equilibrium where both parties provide access.

Aside from explicit collusion, which would be illegal, the only way to reach an outcome where both parties refuse access would be to have a repeated game with tacit coordination between the two operators supported by a credible punishment mechanism that could be imposed on any party that defected from the coordinated outcome.

In its assessment of the operators’ ability to trigger the credible punishment mechanism needed to maintain effective coordination, the ACM argued that, if one party shifted away from the coordinated outcome (e.g. started to provide access), the other would punish it by also providing access. If the conditions in the market were such that any one party would expect such punishment if it were to deviate, this would be sufficient to enforce the tacitly collusive outcome where both parties refuse access at the wholesale level (and are therefore able to raise prices at retail level).

However, as explained by Oxera in a report for VodafoneZiggo,8 this is unlikely to be an effective punishment mechanism due to lengthy negotiation periods between wholesale access providers and potential access seekers.

Suppose that KPN deviates from the agreement by providing access to third parties. By the time VodafoneZiggo becomes aware of KPN’s deviation, KPN will have had the opportunity to approach and negotiate a wholesale contract with the most important candidates for wholesale access. KPN will thus have gained a first-mover advantage, and punishment by VodafoneZiggo in the form of further wholesale access provision is likely to have a limited impact since the most relevant access seekers will no longer be available. VodafoneZiggo then needs to wait until the deviating network’s wholesale contracts are up for renewal before it can to retaliate.

Therefore, given the long-term nature of the first-mover advantage gained by deviating, the threat of the other operator also providing access is unlikely to be a sufficient punishment to deter deviation at the wholesale level.

Furthermore, once a long-term contract has been signed, the decision to grant access cannot be reversed until the contract period has ended. As the key to effective punishment mechanisms is that they are reversible (so that the coordinated equilibrium can be reached again in future), the specific nature of wholesale agreements undermines this necessary condition.

In the absence of any credible threat of punishment for deviation, the parties will be less inclined to adhere to any coordinated outcome that might be envisaged, making a position of joint SMP unlikely.

Back to reality

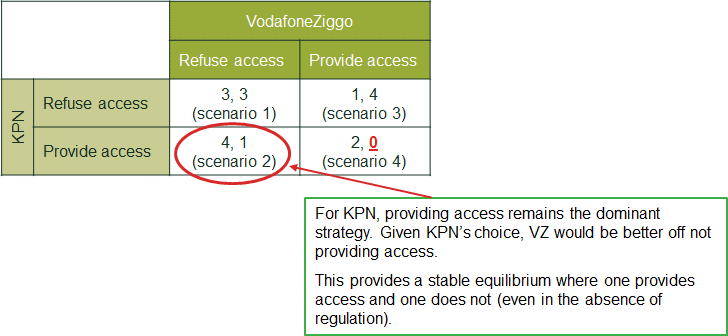

The primary limitation of the ACM’s analysis, nonetheless, is the artificial construct of the payoff matrix (see Figure 1) and the assumption that both parties have a unilateral incentive to provide wholesale access. This was a key point explained by Oxera in its report for VodafoneZiggo.9

In particular, when considering the market realities, the following was shown.

- VodafoneZiggo does not have unilateral incentives to provide wholesale access.

- Simple observation shows that VodafoneZiggo did not provide access even when KPN was regulated to do so.

- There is no compelling business case for VodafoneZiggo to provide wholesale access—an analysis of the break-even wholesale prices that VodafoneZiggo would have to charge to recover the incremental costs of providing wholesale access to a new access seeker showed that such prices would be above KPN’s wholesale price. Thus, if VodafoneZiggo offered wholesale access to a new access seeker at a price that matched that of KPN, this would result in profit losses for VodafoneZiggo.

- KPN does have unilateral incentives to provide wholesale access.

- KPN is already in the market. As such, it has built up a profitable wholesale business over the years, and has already incurred the sunk costs of setting up various wholesale access products and supporting services such as wholesale billing and support functions.

- By continuing to provide wholesale access on a commercial basis, KPN protects its existing wholesale access revenue stream and investments. On the other hand, by stopping the provision of these wholesale access services, KPN would run the risk of inducing market entry by VodafoneZiggo.

- Evidence that KPN had also contracted, on a commercial basis, with some access seekers to provide access, even in the absence of regulation, demonstrates KPN’s commercial incentive to provide access.

In a case where only one of the parties has a unilateral incentive to provide access, the payoffs in the matrix are fundamentally altered (see Figure 2 below). This new payoff structure leads to a new equilibrium in which KPN supplies access but VodafoneZiggo does not. As this is a stable equilibrium, there is no prisoners’ dilemma. Without a prisoners’ dilemma, there can be no joint SMP.

Figure 2 Payoff matrix adjusted to reflect market realities

Source: Oxera.

Citing Oxera’s game theory analysis and the adjusted payoff matrix, the CBb concluded that a credible alternative scenario exists where, absent access regulation, it would be economically rational for KPN to continue to offer access to its network regardless of what VodafoneZiggo would choose to do. The CBb therefore agreed with Oxera that the market outcome would not be characterised by tacit coordination. To our knowledge, this is the first time that economics game theory models have played such a central role in a market review appeal decision in the electronic communications sector.

Given the incentive of KPN to provide access, the CBb concluded that the ACM had not sufficiently proven that, absent regulation, both firms would enjoy joint dominance in the retail market (for broadband Internet or bundles including Internet services). As a result, the ACM’s remedy, requiring both firms to provide regulated wholesale access, was ruled as being without effect and is no longer in force.

The end of open access? Not so fast…

As discussed, a key part of the CBb’s decision was a consideration of the commercial incentive of KPN to offer wholesale access even in the absence of regulatory intervention. As part of this, the CBb considered the assumptions that the ACM had applied in its assessment of competition.

While the CBb found that the ACM was correct in assessing SMP in the relevant market by applying the ‘modified greenfield approach’ set out in the SMP Guidelines (such that ‘the effects of any regulation based on significant market power in place are excluded from the assessment’),10 it rejected the ACM’s interpretation of this in practice.

The ACM had assumed not only that current access regulation would not exist, but also that the threat of access regulation did not exist. Coupled with its conclusion that KPN would not offer access without the threat of regulation, the ACM ignored all access agreements prevailing in the market. This included ignoring some existing commercial access agreements already in place between KPN and access seekers (as well as a commercial offer to extend such agreements to other access-seeking parties).

The CBb rejected the ACM’s position that such commercial agreements should not be taken into account in the market power assessment. Rather, the CBb ruled that they may be taken into account where the motive behind the agreement is a mutual commercial benefit for KPN and the relevant third-party customer, and where KPN has no incentive to restrict competition. The CBb found that the ACM had not properly assessed the relevance of the commercial offer, nor the incentives of KPN to make such an offer on terms that were evidently attractive to access seekers, given they had entered into these commercial agreements.

By not taking into account the commercial offer or the fact that the offer and the contracts would continue to exist in the coming regulatory period, it was determined that the ACM had not complied with the requirements of the SMP Guidelines. Specifically, the ACM had not fully taken into account ‘the existing market conditions as well as expected or foreseeable market developments over the course of the next review period in the absence of regulation based on significant market power’.11

The CBb found, therefore, that the ACM incorrectly assumed that there would be no access agreements (and thus no competition at the retail level from access seekers) in the absence of regulation.

What now?

The consideration of commercial incentives to provide wholesale access and how these should be accounted for in future market analyses is highly relevant when looking at how regulators should assess telecoms markets in future.

In particular, in the roll-out of new full-fibre networks, wholesale access agreements are going to be key to filling in capacity, even where the firm making investments is vertically integrated. This is particularly likely to be the case where there are already strong brands operating at the retail level, as is the case in the UK (brands including Sky, TalkTalk, BT and Vodafone), in Germany (Freenet, Vodafone and Telefónica), and in Ireland (Vodafone and Sky).

The findings of this case are therefore important when considering the evolution of the telecoms market in different EU jurisdictions. Considering the ambitious EU and national targets for coverage of very-high-capacity networks (VHCNs)—such as a target of access to connectivity offering at least 100Mbps for all households (with a pathway to gigabit connections)—investments may be made by a number of competing operators.

In turn, this is likely to result in a growing number of cases where single dominance (SMP) is not a foregone conclusion and market analysis will increasingly be based on the joint dominance paradigm.

However, while any future regulatory analysis needs to be undertaken case by case and market by market, it is clear that consideration of commercial wholesale access agreements is very important to the understanding of the likely competitive nature of the market absent regulation, and is thus likely to become increasingly relevant to the analysis.

For example, in the UK, physical duct and pole access is being pushed as a solution,12 and Virgin Media, CityFibre and some smaller players are rolling out networks, making head-to-head competition in many parts of the UK a reality. In these and similar cases, a close look at commercial incentives to supply access in the absence of regulatory obligations, and the impact of this on retail market competitiveness, will be of key importance to any decision on single or joint SMP and the need for continued regulation, as the CBb ruling shows.

Indeed, wholesale access is likely to be a central element of any infrastructure investor’s business plan, even when vertically integrated, given the high cost and risk of stranded assets.

1 VodafoneZiggo is a Dutch company offering fixed, mobile and integrated communication and entertainment services to consumers and businesses. It is a joint venture of Liberty Global, the largest international TV and broadband Internet company, and Vodafone Group, one of the world’s largest telecoms companies.

2 KPN is a Dutch landline and mobile telecoms company.

3 Netherlands Authority for Consumers and Markets (2018), ‘Market analysis decision on Wholesale Fixed Access’, 28 September.

4 BEREC (2015), ‘Report on oligopoly analysis and regulation’, BoR (15) 74, June.

5 The arguments are summarised in Oxera (2017), ‘Regulating oligopolies in telecoms: a solution in search of a problem?’, Agenda, September.

6 Oxera (2015), ‘A beautiful mind: the Nash legacy’, Agenda, June.

7 Nash, J.F. (1951), ‘Non-cooperative games’, Annals of Mathematics, 54, pp. 286–95.

8 Oxera (2018), ‘Economic review of the ACM’s finding of joint SMP in retail and wholesale fixed access’, prepared for VodafoneZiggo, 10 April.

9 Oxera (2018), ‘Economic review of the ACM’s finding of joint SMP in retail and wholesale fixed access’, prepared for VodafoneZiggo, 10 April.

10 European Commission (2018), ‘Guidelines on market analysis and the assessment of significant market power under the EU regulatory framework for electronic communications networks and services (2018/C 159/01)’, para. 74.

11 European Commission (2018), ‘Guidelines on market analysis and the assessment of significant market power under the EU regulatory framework for electronic communications networks and services (2018/C 159/01)’, para. 17.

12 Ofcom (2020), ‘Promoting investment and competition in fibre networks – Wholesale Fixed Telecoms Market Review 2021-26’, consultation, 8 January.

Download

Contact

Felipe Flórez Duncan

PartnerContributors

Related

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More