Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by the Netherlands Environmental Assessment Agency (PBL) and France’s national Court of Auditors.2

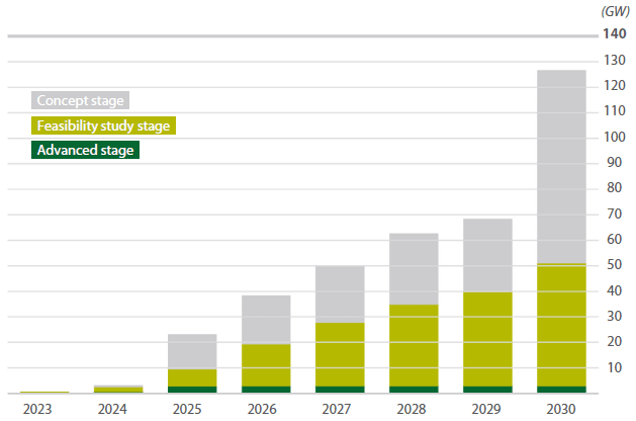

The ECA notes that, while the European Commission has made good progress in laying the groundwork (e.g. the legal framework) for the hydrogen market to develop in the EU, actual project delivery is lagging. Current plans are unlikely to meet the 2030 target of 10MT of renewable hydrogen production.3 Achieving this goal would require around 140GW of electrolyser capacity—far more than is currently in the pipeline (as shown in the figure below).4

Figure 1 EU electrolyser capacity planned to 2030 (vs 140GW target)

Source: ECA, based on data from the International Energy Agency.

In the Netherlands, the story is similar. The PBL highlights a significant gap between ambition and delivery: the government’s target of 4GW of electrolyser capacity by 2030 compares with only 1.2–1.5GW expected to be realised—and just 200MW currently under construction.5 Hydrogen import infrastructure is also delayed, and the cost estimates for domestic transport infrastructure are rising sharply. Hynetwork, the future national hydrogen network operator, has revised its cost estimate for the hydrogen backbone from €1.5bn to €3.8bn.6

Clearly, setting ambitious targets is not enough. Bridging the gap requires a coordinated industrial policy and regulatory framework to ensure that the hydrogen market scales efficiently and at the right pace—a point also made in the Draghi report7 and recent EU policies and plans.8

The implications for network operators, regulators and tariff regulation

A key market failure underlying the gap between ambition and delivery is the coordination problem between supply, demand and the infrastructure linking the two. Potential industrial off-takers are reluctant to commit without certainty on the timing and price of hydrogen supply. Electrolyser investors, in turn, are delaying final investment decisions due to uncertain off-take and infrastructure delays. Meanwhile, networks face the risk of stranded assets if capacity is built out too far ahead of demand (i.e. not justified by bankable volumes).

This chicken-and-egg dynamic complicates future tariff regulation. High upfront costs, combined with initially low network utilisation, risk creating a negative feedback loop: high tariffs suppress demand, which in turn pushes tariffs even higher.9 National Regulatory Authorities (NRAs) will thus need to balance two core objectives in tariff regulation:

- cost recovery for the network operator;

- tariff affordability for users.

The challenge goes beyond the hydrogen market itself. It also involves coordinating with related infrastructure—such as gas transport networks and carbon capture and storage (CCS)—which are increasingly interconnected in decarbonisation strategies.

To address these challenges, NRAs are beginning to explore regulatory tools that can balance cost-reflectiveness and affordability, while still incentivising investment. Notably, both the Dutch Autoriteit Consument & Markt (ACM) and Great Britain’s Ofgem published methodology consultations in May outlining their thinking on early-stage hydrogen regulation.10 While many of the tools being discussed are not new, the context in which they are being applied—characterised by deep uncertainty and overlapping coordination challenges—is.

The ACM’s recent market report is especially instructive. It lays out a broad menu of tools under consideration, alongside key trade-offs, implementation challenges, and alignment with regulatory principles.11 We summarise this below, to illustrate the toolbox that regulators and governments are evolving as regards hydrogen network frameworks.

Case study: the Netherlands’ evolving hydrogen regulation framework

For context, it is worth highlighting some of the strategic government decisions and principles underlying the Dutch regulatory approach.

- Mandated anticipatory network roll-out. To reduce coordination failures, the Dutch government has committed to building hydrogen transport capacity ahead of (as yet uncertain) demand.12 According to Hynetwork’s December 2024 roll-out plan, most of the backbone infrastructure will now be delivered between 2031 and 2033—three to five years later than initially planned.13

- Low-carbon hydrogen as a bridge. With renewable hydrogen expected to remain five to six times more expensive than grey hydrogen for the next 15 years,14 the Netherlands is treating low-carbon (‘blue’) hydrogen as a transitional fuel. While there is a recognition of potential ‘lock-in’ risks, it is seen as necessary to develop the value chain and boost early transport volumes, which in turn can reduce tariffs through economies of scale (at least until renewable hydrogen becomes cost-competitive).15

- Network regulation may apply from 2031 (latest, 2033). The ACM, like other NRAs in the EU, is required to regulate hydrogen network tariffs from 1 January 2033.16 However, the Dutch government is aiming to bring this forward to 2031. Until then, tariff levels are fixed by the Dutch government, as part of the subsidy grant decision,17 and non-discriminatory third-party access rules apply.18

- Cost-causation and non-discrimination. Tariffs should reflect the costs caused by users19 and be applied equally across comparable users. EU and Dutch legislation usually require a separation of network assets and prohibit cross-subsidisation (e.g. between electricity and gas assets), but limited exceptions to this rule exist between gas and hydrogen assets.20

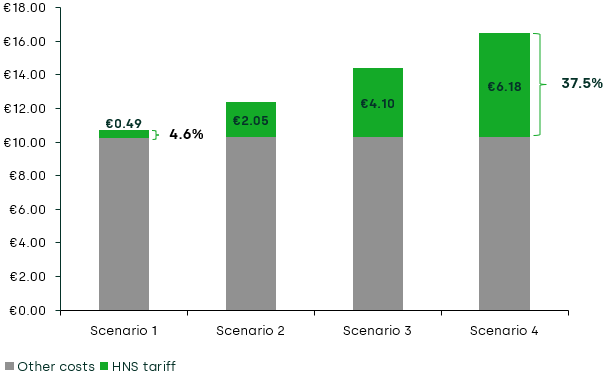

With investment cost estimates rising and volumes uncertain, the ACM’s focus is on limiting the gap between anticipatory capacity roll-out and utilisation in order to keep tariff levels affordable in the short term. The ACM’s concern is illustrated in Figure 2 below. Based on the ACM’s indicative estimates, the figure compares network tariffs under the initial low-cost, high-uptake plans (scenario 1), Hynetwork’s updated (medium) network cost estimate and updated views of likely uptake (medium and low uptake in scenarios 2 and 3), and in a notional high-cost, low-uptake scenario 4. In a high-investment, low-uptake scenario (4), per-kilo tariffs could be over 12 times higher under Hynetwork’s initial planning—also significantly increasing the total levelised cost of hydrogen to users.21

Figure 2 Levelised cost per kg of hydrogen under different network uptake scenarios

Source: Adapted from Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May.

Tools for future tariff regulation

To balance investment incentives and affordability, authorities could consider (a combination of) a number of tools, including:

- smoothing tariffs over time—allocating more costs to later users;22

- reducing costs via subsidies or efficiency measures;

- using tariff structures to encourage uptake in areas where there are lower system costs of doing so (e.g. due to lower network constraints or co-location of energy production, consumption and storage).

Below we discuss some of the specific tools in more detail.

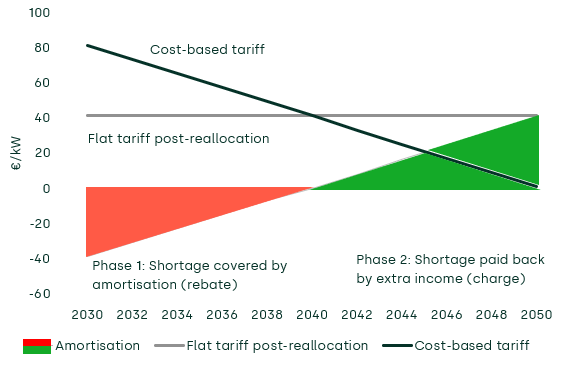

1 Intertemporal cost allocation (amortisation vehicle)

This approach allows early costs to be recovered from future users, who are expected to benefit more from the network. An amortisation vehicle—involving state guarantees, loans or regulatory accounts—can spread cost recovery over time and limit the burden on early adopters (as shown in Figure 3). However, this typically requires some form of public risk-sharing. Otherwise, it would tend to lead to unsustainably high risk premiums or financeability issues for the network operator.

Figure 3 Tariff-smoothing via amortisation vehicle

2 A progressive depreciation and/or real WACC regime

Implementing a progressive depreciation regime23 or applying a real (rather than nominal) weighted average cost of capital (WACC) achieves the effect of smoothing tariffs over time.24 Both methods defer cost recovery to later years and reduce early tariffs, but shift risk to future consumers. Unlike amortisation vehicles, these measures can be implemented directly by regulators without needing government coordination and funding guarantees.

Similar principles are being applied in electricity regulation, where similar pre-emptive grid investments are needed to support electrification (and where eventual demand is also still uncertain). In contrast, some NRAs (including the ACM) have implemented accelerated depreciation profiles to reduce the risk of asset stranding in the gas sector—given the still uncertain phase-out trajectory of natural gas use25 and assets (or the extent the latter may be repurposed, inter alia for hydrogen).

The ACM provides some modelling to show the impact of these smoothing tools.26 This mirrors modelling that has also been considered for smoothing EU electricity grid tariffs in light of grid expansion investments (see for example from tank Bruegel27). A key takeaway is that it is important to consider the profile of user uptake and expected volumes, over time, in designing and calibrating an appropriate regulatory regime. Nonetheless, if sufficient levels of uptake do not materialise over time, smoothing alone will not prevent an (eventual) marked increase in tariffs. Tariff-smoothing can thus be helpful principally to the extent that it facilitates early uptake.

3 (Cross-)subsidy

The Dutch government has already committed up to €750m in start-up subsidies for the national hydrogen backbone build-out (about half of its initial estimated costs).28 It could expand this through further direct support29 or by offering guarantees to reduce Hynetwork’s borrowing costs—similar to its backing of the electricity TSO, TenneT’s, Dutch network.30

While cross-subsidies are generally prohibited under EU law, Regulation (EU) 2024/1789 allows temporary levies on gas users to support hydrogen networks.31 The ACM, however, warns that such measures may breach cost-reflectiveness and unfairly burden the last remaining gas users—who may be least able to switch (although it also notes that it would remain open to considering such a case on its merits).32

It is worth noting that, given the potential physical overlap between existing natural gas assets and hydrogen assets that are to be developed, it is likely that some allocation of the repurposing costs will need to be made. This may implicitly result in a cross-subsidy, depending on the asset valuation methodology used and how repurposing costs before and after the transfer of the assets are allocated. This is the focus of a recent Ofgem consultation in Great Britain.33

4 Efficiency tests

While early-stage volume risk and financeability will clearly be the focus of the initial hydrogen network’s regulatory methodology, the ACM notes that measures to ensure cost efficiency may also have a role to play in keeping hydrogen network tariffs low. Potential approaches cited include:

- benchmarking (e.g. cost comparisons with peers or across projects);

- project-specific efficiency assessments;

- financial incentives within the tariff methodology (to achieve and/or reveal information about cost efficiencies);

- internal improvement programmes.

A parallel process by the ACM may be informative in this regard: the ACM is developing a new methodology for electricity and gas networks to take effect from 2027.34 The aim of the new method is to facilitate energy transition-related investments, given the large-scale and uncertain expansion required for electricity grids in particular. To do this, the ACM is developing a cost-plus-type methodology—moving away from the current incentive regulation regimes.

The ACM states that it wants to conduct a more proactive assessment, identifying processes, standards, potential inefficiencies and network-specific interventions on an ex ante basis (accompanied by ongoing monitoring). This would replace the current backward-looking approach based on benchmarking using historical data.

This suggests a more supervisory approach focused on providing networks with more flexibility in an uncertain environment and prioritising the speed of network roll-out. Checks on efficiency would be maintained, but with a focus on learning and ensuring that improvement loops are ingrained in network processes.

A similar approach may be suitable for hydrogen. Like electricity networks, it is expected that there will be an increased level of future demand for hydrogen infrastructure.

However, compared with electricity, hydrogen will tend to have relatively low levels of firm baseline demand, and operators in the hydrogen market will tend to face higher levels of cost uncertainty both in running the network and in installing (or repurposing) new assets, at least in the early stages of infrastructure development. Any efficiency testing will therefore be based on more uncertain information and wider confidence intervals.

The network and regulator would also need to ensure that anticipatory investments are not completely out of step with industry uptake, to limit asset stranding risk. A needs-case assessment and potential -take commitments may thus be required before each new stage of network roll-out (as the ACM also suggests35).

5 Tariff structure design

The ACM discussed several design choices for how hydrogen transport tariffs could be calculated and allocated across users. These choices affect not only cost recovery but also affordability, market access and user incentives.

Two key aspects are highlighted in this regard.

- Capacity-based vs volume-based tariffs. The ACM is minded to require users to pay based on the capacity that they book (instead of volumes used), at least initially, as this offers more predictable revenues and encourages long-term contractual commitments.

- Geographical tariff differentiation. Tariffs may vary by entry/exit point location, provided that the variation reflects objective cost drivers and remains non-discriminatory. This could help to signal efficient clustering locations and reduce overall system costs.36

Beyond targets: coordinating for scale and certainty

Several coordination challenges will need to be navigated if the EU is to close the gap between hydrogen ambitions and actual uptake. A key element in this is providing certainty to both investors and users, including that the necessary transport infrastructure will be there to connect early users and suppliers at an affordable cost.

During the start-up phase, regulators will thus need to balance cost-reflectivity against affordability, especially in the short term. The key to navigating these twin challenges will be ensuring sufficient early uptake (users and volumes), while ensuring that this does not move completely out of step with anticipatory network build-out. The ACM’s market report provides a menu of tools that may be considered as part of a framework to achieve this.

However, ultimately the challenge is not just technical or financial—it is institutional. Regulators and governments will need to coordinate to create a framework that shares risk fairly, encourages scale, and retains the flexibility to adapt as the hydrogen economy evolves. The role of regulators is thus also evolving, including increasing their responsibilities as market facilitator and coordinator.

Footnotes

1 European Court of Auditors (2024), ‘The EU’s industrial policy on renewable hydrogen’, November, p. 1.

2 Planbureau voor de Leefomgeving (2025), ‘Groene waterstof: de praktische uitdagingen tussen droom en werkelijkheid’, 27 February. Cour des comptes (2025), ‘Soutien au développement de l’hydrogène décarboné – Synthèse de l’enquête réalisée à la demande de la commission des finances du Sénat’, 5 June.

3 European Court of Auditors (2024), ‘The EU’s industrial policy on renewable hydrogen’, November, p. 10. Renewable (or ‘green’) hydrogen is produced using renewable energy sources. Traditional ‘grey’ hydrogen is produced from fossil fuels (usually natural gas). ‘Blue’ hydrogen is typically produced from natural gas but has a lower carbon intensity than grey hydrogen as it is produced in combination with carbon capture and storage.

4 European Court of Auditors (2024), ‘The EU’s industrial policy on renewable hydrogen’, November, p. 28.

5 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May, p. 9; PBL (2024), ‘Klimaatverkenning en Energieverkenning’, 24 October, p. 91.

6 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May, p. 19.

7 Draghi, M. (2024), ‘The Draghi report: A competitiveness strategy for Europe (Part A)’, 9 September, pp. 8 and 47.

8 European Commission (2025), ‘The Clean Industrial Deal: A joint roadmap for competitiveness and decarbonisation’, 26 February; European Commission (2025), ‘Action Plan for Affordable Energy: Unlocking the true value of our Energy Union to secure affordable, efficient and clean energy for all Europeans’, 26 February.

9 That is, in principle network tariffs are calculated by dividing efficiently incurred costs by transport volumes (or contracted capacity), and allocating that figure across the number of users at a given point in time. In a context of high upfront fixed costs and initially low transport volumes (or contracted capacity), costs may be unbearably high for the first users.

10 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May. Ofgem (2025), ‘Natural Gas asset repurposing valuation methodology’, 20 May.

11 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May.

12 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May, p. 17.

13 Hynetwork (2024), ‘Conceptvoorstel aanpassing uitrolplan’, 10 December.

14 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May, p. 15.

15 Planbureau voor de Leefomgeving (2025), ‘Groene waterstof: de praktische uitdagingen tussen droom en werkelijkheid’, 27 February, p. 64; Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May, pp. 13–15.

16 Regulation (EU) 2024/1789 of the European Parliament and of the Council of 13 June 2024 on the internal markets for renewable gas, natural gas, and hydrogen, Article 5(4). See also ACM (2025), Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, p. 25.

17 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May, p. 18.

18 Autoriteit Consument & Markt (2024), ‘Publicatie derdentoegang waterstofterminals’, 18 November.

19 In other instances, this may also be referred to as cost-reflectivity, or the ‘user pays’ principle.

20 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May, p. 25; Regulation (EU) 2024/1789 of the European Parliament and of the Council of 13 June 2024 on the internal markets for renewable gas, natural gas, and hydrogen, Article 5(4).

21 The levelised cost of hydrogen (LCOH) represents the average cost of producing and delivering one unit (e.g. one kg) of hydrogen over the lifetime of a project, considering both capital expenditure (CAPEX) and operational expenditure (OPEX). It is a key factor in evaluating the economic viability of different hydrogen projects and production methods.

22 When uptake is expected to have increased sufficiently and costs can be distributed over more users.

23 There are several accounting techniques that could be used (some of which are illustrated in the ACM report), including extending asset lives or opting for an alternative, progressive depreciation profile relative to linear depreciation (e.g. annuity, variable declining balance or sum of year digits methods). See discussion in Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, pp. 26–27.

24 The difference between a nominal and a real WACC regime lies in the treatment of inflation: in the former, the return includes full, immediate compensation for inflation, whereas in the latter inflation is added to the regulatory asset base (RAB) and its recovery is thus deferred over time.

25 From increased electrification and the use of other renewable energy sources for heating and industry.

26 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, pp. 25–28.

27 Bruegel (2025) ‘Upgrading Europe’s electricity grid is about more than just money’, 12 February (accessed 2 June 2025).

28 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, 1 May, p. 2.

29 Within the confines of state aid regulation.

30 The Dutch government has proposed to provide state guarantees for the approximately €90bn of TenneT’s investments required in the Netherlands over the next decade. This aims to lower the network’s borrowing costs, given that it elevates TenneT Netherlands’ credit rating to the triple-A status of the Dutch state. See Heinen, E. and Hermans, S. (2025) ‘Structurele oplossingen TenneT Nederland en TenneT Duitsland’, ministerial letter to the second chamber of Dutch parliament, 17 April.

31 Regulation (EU) 2024/1789 of the European Parliament and of the Council of 13 June 2024 on the internal markets for renewable gas, natural gas, and hydrogen, Article 5(4).

32 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, p. 25.

33 Ofgem (2025), ‘Natural Gas asset repurposing valuation methodology’, 20 May.

34 Autoriteit Consument & Markt (2024), ‘ACM to work out new regulatory method for system operators’, 13 December (accessed 3 June 2025).

35 Autoriteit Consument & Markt (2025), ‘Marktrapportage waterstoftransporttarieven in perspectief van de waterstofmarkt’, p. 18.

36 For example, higher tariffs based on longer transport distances would both be cost-reflective and incentivise users to locate (or cluster) in cost-efficient locations.

Contact

Sahar Shamsi, CFA

PartnerContributors

Related

Related

Access to land for mobile telecoms networks: a framework for negotiation and regulation

Mobile towers serve as the backbone of mobile telecoms networks, hosting radio access network equipment that enables us to receive calls, texts and to access the internet on our mobile devices. In turn, the ability of the builders of mobile towers to access land—whether that is on the ground,… Read More

What is venture capital, how does it work, and what are the risks?

In the third and final episode demystifying private equity, we explore the world of venture capital. While venture capital has delivered exceptional returns for some investors and founders, it’s also very high risk. So, is vibrant venture capital essential for economies seeking to boost innovation and drive productive growth? In… Read More