The Labour Party’s Rail and Urban Transport Review

Transport policy in the UK is at a critical juncture. The UK’s commitment to decarbonise transport will require adopting new technologies and changing behaviours, including a rapid uptake of electric vehicles, encouraging modal shift and active travel, adopting sustainable aviation fuels, improving aircraft efficiency and managing demand. Further, there are substantial opportunities presented with developments in transport technology such as information systems, micro-mobility, and connected and autonomous vehicles.

These opportunities and challenges come at a time of uncertainty over post-pandemic demand recovery, high inflation, aging road and rail infrastructure and binding fiscal constraints. As the transport sector evolves, connectivity is key, and the benefits of transport investments can be more evenly distributed, given the important role of transport in delivering both economic growth and social benefits.

In a future where policymakers must make limited funding go further in the face of significant uncertainty, sound economic analysis is vital to making the right decisions. Here are our five key recommendations for the Rail and Urban Transport Review.

- Move economic appraisal beyond a single number. Economic appraisal, which informs which transport investments to take forward, is dominated by a single measure—the benefit–cost ratio (BCR). The BCR is often not even linked to the primary objectives motivating the case for investment, often quantifying travel time savings instead of, for example, enabling regeneration of an under-served area. Decision-makers are often attracted to what is quantified, and therefore focus too narrowly on the BCR, which may not accurately capture the benefits of a scheme. By improving how economic appraisal is carried out, we can better choose investments that are aligned with policy objectives.

- Consider different scenarios in investment decision-making. Inflation remains volatile, and it is not yet clear how the pandemic has affected long-term travel demand. Decisions should be taken on a multi-faceted basis rather than a single, point estimate BCR, and they need to be robust to a range of scenarios of the future state of the world. In addition, it is important to build resilient transport networks, ensure investments can be made that are less prone to failure, and reduce the risk of key transport links being unavailable.

- Plan transport investments adaptively. Investments are predicated on the ‘predict and provide’ approach, which is becoming less useful as uncertainty increases, and as we increasingly need to break away past trends to meet future challenges (e.g., net zero). Approaches such as adaptive planning, which does not seek to predict the future but instead sets out how decisions will be made under different plausible circumstances, are a way forward.

- Test transport policy for fairness. While a new government will face a large in-tray in the transport sector, including meeting net zero, there is a risk of an unjust transition. Decarbonising transport by relying heavily on electric vehicles, even if possible, would not be equitable. The Ultra-Low Emissions Zone (ULEZ) expansion in London shows that regressive policies without sufficient mitigations (e.g. strong public transport alternatives) will meet opposition and ultimately risk successful implementation.

- Revisit the economic case for private finance. With borrowing more expensive than before, and inflation biting into the public purse, government will need to meet its objectives with constrained funds. Private finance—and sustainable finance in particular—can potentially bridge this gap if it can overcome concerns around complexity and poor value for money.

Introduction

Oxera Consulting LLP (‘Oxera’) submitted evidence to the Labour Party’s Review into Rail and Urban Transport (‘the Review’). The Review is focused on ‘examining how to accelerate the delivery of better intra- and inter-city connectivity to support a strong and sustainable economy with rail and urban transport networks and infrastructure fit for the century ahead’.1

The rail and urban transport challenge

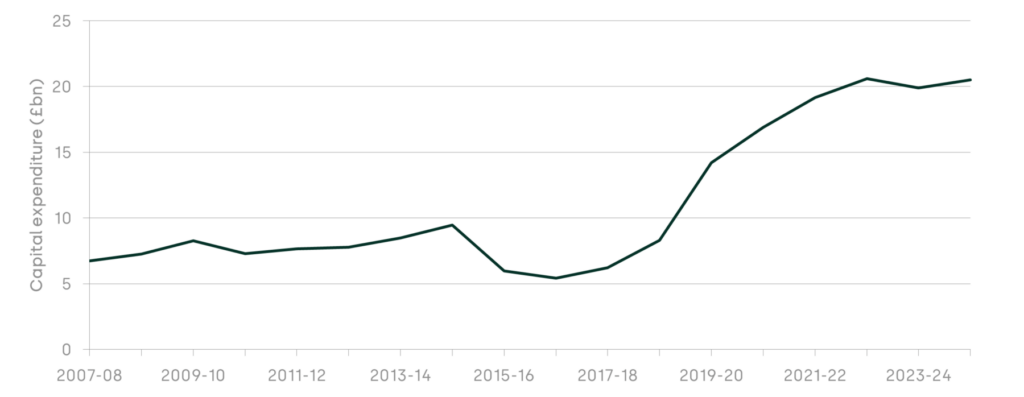

In the face of substantial pressures on public finances and clear signals from all political parties of the need to prioritise investment in the NHS, schools and defence spending, transport, as an unprotected department, cannot rely on ever-growing capital spending, as it has in the last 20 years (see Figure 1 below).

With an increasingly pressing case for investment in transport this presents a significant risk and constraint to rail and urban transport investment potential. As a result, it is vital that the funding that is available best matches priorities to ensure rail and urban transport networks and infrastructure are fit for the future. In this report, we set out the challenges facing the transport sector before providing recommendations on how these challenges can be tackled.

Figure 1 Department for Transport capital budgets have increased

Source: Oxera,

2007–08 to 2013–14 based on Department for Transport (2021), ‘DfT departmental spending 2007-08 to 2016-17’, accessed 24 Jan 2024.

2014–15 to 2017–18 based on Department for Transport, ‘Total departmental spending 2013-14 to 2019-20’, accessed 24 Jan 2024.

2018–19 to 2020–21 and 2023–24 to 2024–25 plans, based on Department for Transport (2021), ‘Autumn budget and spending review 2021’, accessed 24 Jan 2024.

2021–22 to 2022–23 based on Department for Transport (2023), ‘Annual Report

and Accounts 2022-23’, accessed 24 Jan 2024.

Since the pandemic, pressure has begun to mount on the transport sector. Inflation in the UK rose to a 40-year high in 2022.2 However, construction materials inflation has been substantially higher, to a peak of 26.8%), with substantial individual price rises for some construction materials (such as 60% for gravel and 27% for concrete products).3

These price rises are compounded by labour shortages and longer lead-in times for the delivery of materials and plant machinery. A combination of geopolitical events such as Brexit, the wars in Ukraine and the Middle East, and COVID-19 lockdowns in China all contributed to the general and relative price rises.

With the rapid growth in infrastructure programmes, pressure has been building for many years, resulting in government needing to freeze capital budgets and cut back on programmes such as HS2 where the case can no longer be sustained.

Although inflation has subsided and is forecast to go back to target, this has had a permanent impact on transport.4 With the UK government protecting but not raising capital budgets to absorb these substantial pressures, the budgets of infrastructure-focused departments in Whitehall have faced a real-terms cut.

In practical terms, this means the Department for Transport (DfT), its delivery bodies and Mayoral Combined Authorities need to find substantial efficiencies—or more likely be faced with the prospect of less maintenance, renewals and enhancement activity in the coming years.

Perhaps the inevitable combination of these impacts will be delays to projects, with space in future investment periods taken up by an increasing proportion of legacy projects, and larger budgets for renewals and maintenance to offset real-terms cuts in this period. It will be critical for the next government to effectively prioritise what limited capital is available on the projects that best meet its objectives.

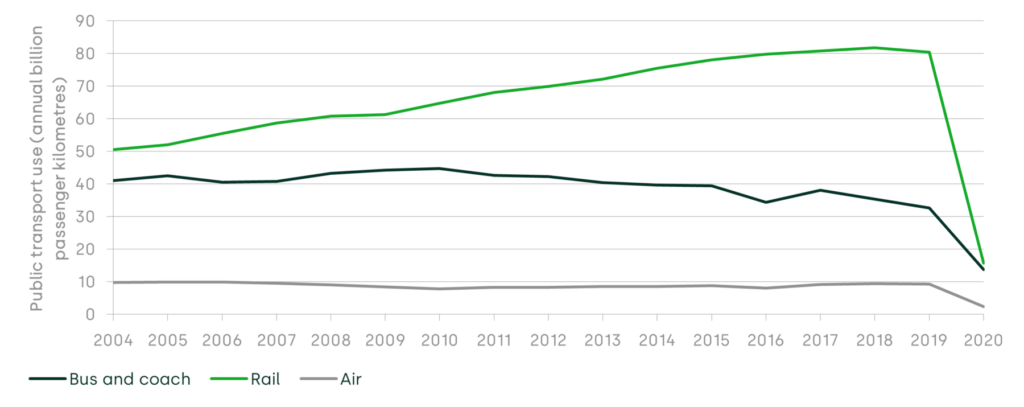

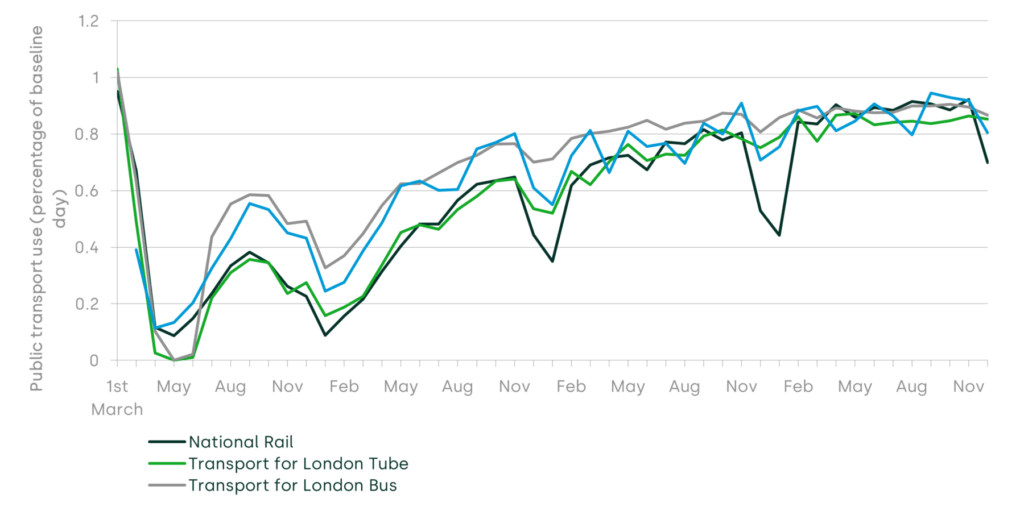

In addition, with cost escalation and public transport passenger growth either slowing or in decline pre-pandemic, the case for some enhancement projects already looked at risk. Post-pandemic, it is becoming increasingly clear that the impact of more working from home and fewer face-to-face business meetings has led to a permanent fall in public transport ridership. Potentially lower migration post-Brexit and a poor economic outlook mean that it will likely take a longer time for public transport demand to recover to pre-pandemic levels.

Figure 2 Public transport growth was slowing pre-pandemic

Figure 3 Public transport ridership has not recovered to

pre-pandemic levels

The combined impact of higher costs and lower demand for public transport will mean that the value for money of projects to improve public transport has worsened.

The first victim of this has been High Speed 2 (HS2). Oxera analysis at the time of Rishi Sunak’s announcement that Phase 2 of HS2 would not go ahead highlighted many of these issues, outlined in the box below. Costs for HS2 have since risen further—up to £66.6bn for Phase 1 in current prices.5,6 At the same time, lower public transport demand means HS2 is predicted to deliver lower benefits. From a transport portfolio perspective, this reinforces the need to make sure that the schemes being taken forward represent the highest priorities for the transport network.

Box 1 HS2: its changing fortunes and what we can learn from it

The case of HS2 offers important lessons for how transport enhancements have been affected by recent events, and the shortcomings of how they are appraised. Our analysis found that demand on the HS2 route was still well below pandemic levels. In addition, business demand has recovered more slowly than leisure demand; HS2’s benefits and revenues are heavily dependent on business travel. Along with spiralling costs, our analysis showed that both Phases 1 and 2 of HS2 would deliver poor value for money.

HS2 also revealed deeper issues in how transport enhancements are assessed. The first is its focus on travel time savings; whereas in practice there are a much wider set of reasons for delivering schemes, such as increasing capacity (as in the case for HS2) or decarbonisation. This one-track approach distorts decision making. Second, funds that are already spent are excluded from appraisal (‘sunk costs’). While in line with Green Book guidance, it leads to perverse incentives to be less transparent on cost increases. Third, focusing on large mega-infrastructure projects means that it is difficult to adapt to changing circumstances. The 2006 Eddington Review found that a set of smaller interventions can often have a much greater overall cumulative impact than large, ‘showpiece’ schemes.

Note: For further details, see Oxera (2023), ‘Rethinking HS2’, 22 October, https://www.oxera.com/insights/agenda/articles/rethinking-hs2/, accessed 26 January 2024.

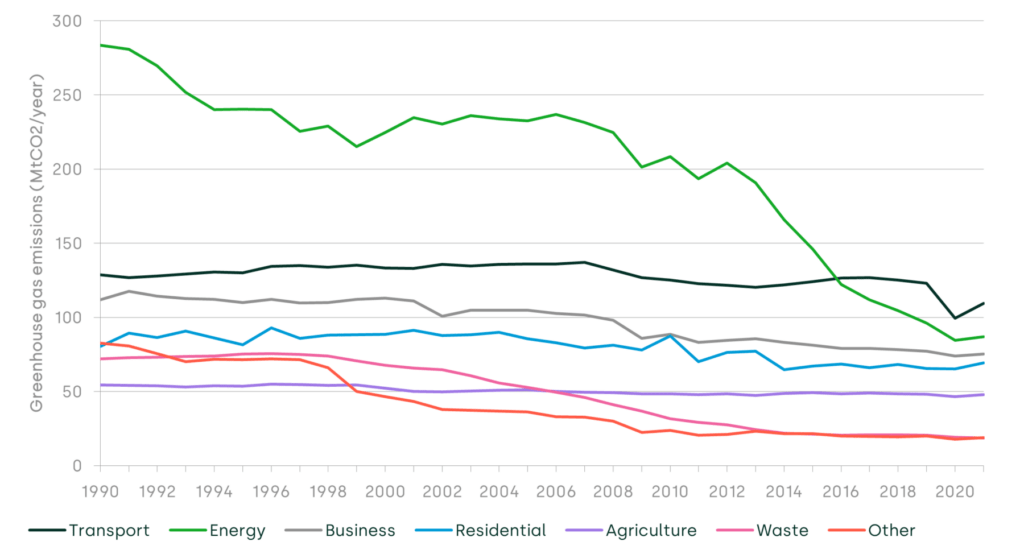

Indeed, given the challenges of inflation, lower patronage and weakening value for money, it is tempting to conclude that the only way forward is to cut back on transport investment. However, this risks ignoring the decarbonisation challenge facing the sector. The transport sector is the biggest emitter of carbon, and it is the only sector in the UK to have seen little progress in reducing emissions since 1990. Air quality and other environmental issues, including bio-diversity net gain, are also increasingly important for policymakers to consider.

The UK was the first to publish a Transport Decarbonisation Plan to decarbonise all modes of domestic transport by 2050.7 It is clear that only through substantial changes in travel behaviour, investment in public transport, and electrification across modes will the UK achieve its environmental obligations.

While vehicle electrification is an essential part of decarbonising transport, it is not sufficient. Managing car demand by shifting to public transport and active travel, and reducing the need to travel, is needed to avoid solely relying on electric vehicles uptake.8

This will be supported by investing in low-carbon public transport to restore connectivity and to provide attractive alternatives to car users. This will require new funding sources to support the capital and operational spend involved. Private finance is one approach (see below for a further discussion). Another would be an extension of clean air zones and parking charges in urban areas, which would provide both incentives to reduce car travel and fiscal headroom to invest.

Figure 4 Transport emissions as a proportion of overall greenhouse gas emissions have increased

The way forward

The combination of construction inflation, lower patronage and the overwhelming need for action on decarbonisation and other environmental issues means a new approach is necessary. Conventional transport interventions continue to have a role to play, but there will be fewer of these types of projects, as well as an increasing need to make the best use of existing assets.

In other words, the portfolio of transport investments to take forward needs to be different. Sound economic analysis will be instrumental in informing which investments to take forward, with a focus on ensuring that they match policy priorities given the limited funds available. Below, we set out five recommendations where economic analysis can support this process.

Looking for additional funding sources and re-visiting the economic case for private finance

Investment in innovation and new technologies in zero- and low-emissions transport will be crucial, and portfolios need to pivot towards these. With less funding available to make public transport more attractive and relieve congestion, there is a growing need to reconsider ways to influence behaviour—with different forms of road pricing, and hypothecation of revenues into public transport one way of achieving this.

There is also a case to reassess how projects are financed if the transport budget will not stretch as far as is necessary to meet the UK’s ambitious objectives. Private finance is a tool that can potentially help to bridge this gap; this is particularly true of sustainable finance, where the door is clearly open to public-transport providers to support fleet decarbonisation. In doing so, there is a need to make the economic case for private finance and overcome concerns that private finance can be considered poor value for money, overly complex, or liable to fail to deliver on what is promised.

Testing the fairness of transport policy

To ensure successful policy, it is also important that investments be designed and carried out in an equitable way. Indeed, lessons on the importance of distributional analysis can be learned from the ULEZ expansion in London. While such expansion has a case from an environmental perspective, it is arguable that there was insufficient consideration of the impact of the policy on low-income London residents, resulting in unintended regressive outcomes.

Although TfL commissioned an Integrated Impact Assessment (IIA) with extensive analysis, the distributional analysis contained within it arguably did not place sufficient weight on the impact on those on lower incomes who do not receive benefits, and who would therefore be acutely affected by the policy. Instead, in the current cost-of-living crisis era, it is necessary to undertaken extensive distributional analysis on a much wider group of people than have been examined traditionally. In this context, economic analysis is more important than ever when determining priorities for transport investment. Given the need to reappraise investment portfolios, economic analysis of the value for money and assessment of schemes against objectives should be a top priority.

Improving the way we do economic appraisal

Shortcomings in the current approach to economic appraisal can lead us to focus on the wrong outcomes. The standard approach measures transport benefits in terms of time savings (showing the impact of a scheme on productivity), when, often, we are also interested in other outcomes, such as economic development and regeneration.

There is therefore a case to think differently about how we appraise transport schemes. The appraisal of benefits cannot be limited or biased by analysis ‘technology’ that can focus too much on the quantification of time savings. This narrow focus on time savings means that the real outcomes of interest are routinely not being ensured.

In line with the recent HM Treasury Green Book update, there needs to be greater focus on the strategic case for projects, and more weight should be given to unquantifiable benefits driving strategic objectives. Techniques such as multi-criteria analysis are effective tools in this type of decision-making.7

With decarbonisation being a binding legal requirement, there is perhaps a pressing case to apply more of a marginal abatement cost lens to decision making, and look at how to use the transport budget most cost-effectively to achieve decarbonisation. This would mean ensuring that the portfolio of transport investments taken forward is consistent with achieving net zero and staying within carbon budgets. This is particularly important if the current approach of project-by-project appraisal leads to too much carbon being emitted on the whole.

Ensure investments are robust to uncertainty

Given the uncertain outlook, the investment that is taken forward must also have a robust business case in a wide range of future scenarios—not just high- and low-demand scenarios, but scenarios encompassing a wide range of future possibilities of travel patterns, behaviours, and technologies—and seek to be flexible to those changing circumstances.

The DfT recognises this challenge and in 2021 released an ‘uncertainty toolkit’ to assist in the analysis of risk and uncertainty in investment appraisals.9 It is critical not only that this analysis be undertaken but considered carefully in investment decision making. Other sectors, such as water, are going further, with Ofwat setting out a strategy of adaptive planning with ‘adaptive pathways [for] how decisions will be made under different plausible circumstances’, enabling flexibility in project delivery.10

Plan transport investments adaptively

In setting out what it expects from water company business plans as part of PR24, Ofwat has stated that ‘Adaptive Planning should be at the heart of the long-term delivery strategy’ and that ‘adaptive pathways set out how decisions will be made under different plausible circumstances’.11 Crucially, according to Ofwat ‘the strategy should present a core adaptive pathway of enhancement activities. It should then set out alternative adaptive pathways which could be triggered depending on how future uncertainties develop’. Transport should take a similar approach with decision-makers ensuring there is sufficient flexibility in projects to adapt to changing circumstances.

1 Urban Transport Group (2023), ‘Rail and Urban Transport Review’, December, https://urbantransportgroup.org/rail-and-urban-transport-review (accessed 26/01/2024).

2 Office for National Statistics (2022), ‘The cost of living, current and upcoming work: February 2023’, October, https://shorturl.at/abgQW, (accessed 26/01/2024).

3 Department for Business, Energy & Industrial Strategy (2022), ‘Monthly Bulletin of Building Materials and Components’, October, Tables 1 and 2.

4 The Bank of England has recently mentioned that it expects inflation to continue to slow and will be back to normal levels by the end of 2025. Bank of England (2023), ‘When will we get back to low inflation?’, accessed 24 January 2024.

5 Sir Jon Thompson, speaking to the Transport Select Committee. See, for example, Wilcock, R. (2024), ‘HS2 costs soar once again, chairman confirms’, Rail Technology Magazine, 10 January, https://www.railtechnologymagazine.com/articles/hs2-costs-soar-once-again-chairman-confirms, accessed 25 January 2024.

6 The cost of HS2 has risen from £45bn in the full business case produced in April 2020 to be between £49bn and £57bn in 2019 prices. See Department for Transport (2020), ‘Full Business Case. High Speed 2 Phase One’, April, para. 2.17, and Thompson, Sir J. (2024), ‘HS2: progress update – oral evidence’, 10 January, https://committees.parliament.uk/event/20066/formal-meeting-oral-evidence-session/, accessed 25 January 2024.

7 Department for Transport (2021), ‘Decarbonising Transport: A Better, Greener Britain’.

8 Climate Change Committee (2023), ’Progress in reducing emissions. 2023 report to Parliament‘, June, p. 109.

9 Department for Transport (2021), ‘TAG: uncertainty toolkit’, 19 May, last updated 8 August 2022, last accessed 18 November 2022.

10 Ofwat (2022), ‘PR24 and beyond: Final guidance on long-term delivery strategies’, April.

11 Ofwat (2022), ‘PR24 and beyond; final guidance on long-term delivery strategies’, April, pp.6, https://www.ofwat.gov.uk/wp-content/uploads/2022/04/PR24-and-beyond-Final-guidance-on-long-term-delivery-strategies_Pr24.pdf (accessed 26/01/2024).

Related

What is venture capital, how does it work, and what are the risks?

In the third and final episode demystifying private equity, we explore the world of venture capital. While venture capital has delivered exceptional returns for some investors and founders, it’s also very high risk. So, is vibrant venture capital essential for economies seeking to boost innovation and drive productive growth? In… Read More

Decoding the Digital Networks Act: the future of the EU electronic communications and digital infrastructure regulatory framework

On 21 January 2026 the European Commission published the long-awaited draft of its Digital Networks Act (DNA)—the proposed new regulation that seeks to ‘modernise, simplify and harmonise EU rules on connectivity networks’.1 As the draft is now being reviewed by the European Parliament and the Council, representing the… Read More