Penalty design: punishment and deterrence

How should penalties be set so as to punish breaches of rules while deterring any future breaches? Oxera provided advice to the Irish Commission for Communications Regulation (ComReg) on how financial penalties might be calculated for breaches of regulatory obligations in the Irish electronic communications sector. We concluded that a turnover-based approach would be appropriate, and proposed an alternative ‘tariff-based’ approach for less serious breaches. How did we arrive at our conclusions?

When a person or organisation breaks the rules, it is commonly accepted that there should be some form of sanction, both to punish the rule-breaker and to deter future breaches. This concept applies in a variety of settings, from speeding fines to sentencing individuals for serious crimes, through to fines imposed on firms for breaches of competition law or penalties on energy companies for breaches of regulatory obligations.

In the context of the Irish electronic communications sector, providers with significant market power (SMP) are subject to specific regulatory obligations—imposed and enforced by the Irish Commission for Communications Regulation (ComReg). Where a provider that is designated as having SMP also operates at the downstream retail level—while providing wholesale inputs to other operators (other authorised operators, OAOs)—it must provide these inputs in a way that does not impede the competitive process or harm consumers.

Specifically, in this context we explored whether a turnover-based approach to setting penalties for breaches of ex ante wholesale obligations would be appropriate. Here the penalty is linked to the sales of the breaching party. The European Commission and many national competition authorities employ a similar approach in the context of breaches of ex post competition law, as do some national regulatory authorities (NRAs) in an ex ante regulatory context. Such approaches embody the principle of deterrence (i.e. creating incentives not to breach ex ante wholesale obligations in the first instance).

We considered the theory and practicality of penalty design, and precedent across a variety of contexts. Concluding that a turnover-based approach would be appropriate, we put forward a workable methodology. We also proposed an alternative, tariff-based, approach for less serious breaches.1 (The difference between the two approaches is discussed below.) Taking into account our recommendations, in 2020 ComReg issued a consultation paper on setting penalties for breaches of wholesale obligations.2 After considering the responses, the Commission published its guidelines in 2021.3

Competition and deterrence

ComReg is responsible for enforcing compliance with the SMP obligations set out above (imposed under the Access Regulations).4 Under the current legislative framework, if, following an investigation, ComReg finds that there has been a breach, it has civil enforcement powers to apply to the High Court to request the imposition of financial penalties, as well as to propose the amount of the penalties. Ultimately, the Court decides whether a penalty should be levied and its magnitude, taking into account ComReg’s proposal on the appropriate level. Where penalties for breaches of wholesale obligations have been considered appropriate by ComReg in the past, these have been decided case by case rather than according to a predefined methodology.

In developing a workable methodology, an important starting point for us was that any penalty should be consistent with the Commission’s guidance on setting penalties for breaches of regulatory obligations.5 In this respect, any penalty should be appropriate, effective, proportionate and dissuasive. It is also important to consider the theory of harm concerning breaches of wholesale regulatory obligations. Essentially, where an SMP provider of wholesale services hinders wholesale access by retail competitors, this may dampen competition downstream at the retail level. In this regard, competition and regulatory policy are based on similar economic principles.

Competition law concepts such as refusal to supply and margin squeeze share the same economics as breaches of regulatory requirements relating to non-discrimination, transparency and access. However, ex ante regulatory obligations may go further than ex post competition rules, in that the former are intended to promote a level playing field, and that breaches of these may be expected, a priori, to have a negative impact on competition. This also influenced our approach.

Theory versus practice?

In addition to the theory of harm, there is the issue of what the theory of optimal penalty design tells us. Assuming full rationality and perfect information, the penalty would be one based on a narrow view of ‘proportionality’—one in which the penalty reflects the wrongdoing, in terms of the illicit profits made or the harm caused by the infringement.

However, with imperfect monitoring, an additional ‘deterrence’ element is needed—to take account of the probability that a non-compliant company might not always be caught. Specifically, the penalty must be at least equal to the expected gain from the violation multiplied by the inverse of the probability of the violator being caught.

That said, there are various reasons why, for breaches of wholesale obligations, it may be difficult to implement a theoretical approach to penalty design. For example, a calculation of any exclusionary effect at the wholesale level, and the knock-on impact on competition at the retail level, is required to determine the profits gained by the incumbent or lost by the retail competitor. This may be difficult to assess in practice. The probability of detection would also need to be calculated.

For practical purposes, such data might not be readily available. Moreover, this approach places the burden on the regulator to prove that there has been a negative impact on competition, which itself may not be conducive to effective deterrence (we discuss this further below).

To explore what might be a more practical approach to setting penalties, we looked at a range of precedent regarding the setting of penalties—including:

- the European Commission’s 2006 ex post competition fining guidelines;6

- international precedent on ex post competition law fines;

- ex ante communications fining methodologies in different member states;

- approaches adopted by various UK regulators for ex ante breaches.

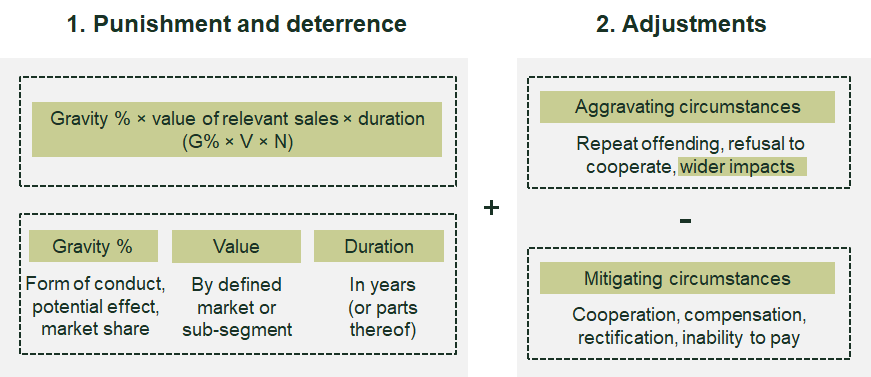

The European Commission’s approach in setting fines for breaches of competition law encompasses both punishment and deterrence by considering the turnover of the business. The fines reflect the seriousness (gravity) of the infringement, its duration, and relevant sales. Once this basic amount has been determined, adjustments can be made to take account of aggravating or mitigating circumstances. While judgement is required in implementing this approach, data on each of the metrics used to calculate such penalties is more readily available than that required to calculate theoretically optimal penalties.

There are also several competition law cases of note in various jurisdictions (including Belgium, Poland and South Africa), and examples of frameworks and penalties levied for ex ante regulation breaches (including in the Netherlands and the UK).7 A number of these examples refer to turnover in determining the level of the financial penalty, although the precise way in which turnover plays a role has varied. The approaches also typically take account of the seriousness of the form of conduct concerned, the assessment of any gains/harm identified (where possible), and any aggravating and mitigating factors.

A workable methodology?

While reflecting the theory of optimal penalty design, a turnover-based approach is practical to implement. As an example, Ofcom (the UK communications regulator) states that ‘penalties should be set at levels which, having regard to that turnover, will have an impact on the body that deters it from misconduct in future and which provides signals to other bodies that misconduct by them would result in penalties having a similar impact’.8

On balance, we proposed that a turnover-based approach would be appropriate, as summarised in Figure 1.

Figure 1 Recommended methodology for setting penalties

The approach involves assessing the following:

- the turnover metric used for relevant sales;

- the determination of gravity;

- the determination of duration;

- the assessment of mitigating/aggravating factors.

As regards defining the value of relevant sales, it would be possible to take a wider or narrower view. A ‘conservative’ approach (i.e. leading to lower potential penalties) would be to start with a narrow definition of relevant retail sales—the specific retail sub-segments that are affected by the breach—and then look at the extent to which there are reasons to support the expansion of the relevant market to consider other retail segments.

Once relevant sales are decided on, it is necessary to apply an assumption on gravity (a percentage of affected sales). Gravity would depend on the nature of the conduct in question, and the market share of the breaching party with wholesale SMP in the affected retail market or sub-segment. The box below provides some purely illustrative ranges (as gravity will vary case by case). Note that, in its 2021 guidelines, ComReg adopted lower ranges for refusal to supply and discrimination.

Potential ranges for the gravity factor to be applied for different types of conduct

- Equivalent to refusal to supply/margin squeeze: 10–15%

- Discrimination/transparency/access breach with a material (although less significant) potential impact on retail competition: 5–10%

- Discrimination/transparency/access breach with a potential impact on retail competition:

- 1–5%Pure regulatory breach with a very low potential impact on competition: <2%

Source: Oxera.

To obtain the ‘basic amount’ for the penalty, the percentage of sales figure obtained would then be multiplied by the duration of the breach (in years, or parts thereof).

Aggravating and mitigating circumstances would also be taken into account, as adjustments to the basic amount. It might be sensible to offer discounts to penalties where a breach was not deliberate, where it has since been remedied, and where there has been cooperation with the regulator. For repeat offending (recidivism), penalties would be increased.

Taking our analysis in the round, we note the following.

- The turnover-based approach is consistent with the theory of optimal penalty design, and recognises the role of both punishment and deterrence in an economic sense.

- The approach recognises that breaches of ex ante regulatory obligations at the wholesale level are inherently serious, in that it is explicitly acknowledged that there is a need to promote a level playing field.

- The approach is transparent and practical to implement, using readily available data (for example, on turnover, duration, and benchmarks on gravity), even if a degree of judgement is necessarily involved.

- The approach is consistent with the EU rules on setting penalties for ex ante breaches in telecoms regulation (i.e. penalties should be appropriate, effective, proportionate and dissuasive).

- There are many examples of a turnover-based approach being used in ex post competition law and ex ante regulatory settings, and turnover is often referred to as a relevant consideration in assessing penalties.

- The recommended approach to gravity takes a conservative view of the seriousness of the breach relative to the approach in ex post competition cases.

- The approach is not completely mechanistic, and it recognises aggravating and mitigating circumstances and the need for a check on proportionality.

Expanding the research base

We also undertook a further review of approaches and precedent across Europe to explore the suitability of the turnover-based approach that we recommended. This included:9

- surveys of the approaches adopted by various European electronic communications NRAs, and additional research on regulators of other sectors in the UK;

- discussions with various regulatory authorities in Ireland (including in financial services, competition and consumer protection, broadcasting and utilities);

- the direction of travel in setting penalties for breaches of data protection and net neutrality rules across the EU.

Given the broad requirements of the European electronic communications regulatory framework to date, we found that there is considerable variation in the national statutory frameworks applied by member states in relation to penalties. Few communications NRAs across Europe have explicitly set out guidelines for assessing penalties for breaches of SMP regulatory obligations beyond the statutory provisions.

While the additional evidence that we took into account is somewhat mixed, there are clear examples—notably in the cases of Ofcom in the UK, the Central Bank of Ireland, and developments in EU data protection—that are consistent with our approach. In particular, these examples emphasise the role of deterrence in levying financial penalties.

Moreover, there is the direction of travel in Ireland more generally across various sectors, and recommendations made by the Law Reform Commission.10 Our report highlights the importance of financial penalties as a core power that allows regulators to enforce compliance effectively. It emphasises the important goal of using financial penalties as a means of deterring non-compliance.

Therefore, on balance, the turnover approach we proposed remains valid.

Less serious breaches?

Some breaches of the Access Regulations may be regarded as less serious in nature, such as delays by the SMP operator in notifying an OAO of a refusal of a Regulated Access Product (RAP) request. For these types of breach, implementing the above general methodology, and applying a pro forma approach to the duration of the breach, may not be appropriate.

From an administrative perspective, the pro forma approach would be time-consuming to implement—it would require the frequent assessment of relevant sales, gravity and other factors.

A simpler and more proportionate approach would be to adopt a tariff-based approach to the less serious breaches listed above. For these types of breach, ComReg could set a tariff for each breach, comprising a fixed penalty (€ per breach) and a variable component (€ per week). Where breaches are repeated (recidivism), the fact that the tariff had been previously levied would be an aggravating factor in applying the subsequent tariff. Other aggravating (and/or mitigating) factors might also be taken into account, as required. The overall penalty would be subject to a cap (in €, potentially related to wholesaler turnover in the market segment concerned).

This approach would be simple, proportionate, timely, administratively low-cost and effective for less serious breaches. It also provides more clarity for operators (analogous to tariffs for speeding or parking violations).

Final thought: the burden of proof?

A potential critique of the turnover-based approach to fines is that it does not require the regulator to quantify harm caused to OAOs at the retail level through the restriction of wholesale access.11 However, UK and other European regulators are clear that breaches of ex ante regulations are serious and that a penalty can be levied even in the absence of proven direct quantified harm in a specific case. This is not to say that harm is not relevant to the assessment; rather, the burden should not be on the regulator to prove direct quantified harm in cases where there are breaches of ex ante wholesale obligations.

The ex ante theories of harm are different for retail and wholesale breaches, as is the ease with which direct harm can be quantified. Direct consumer harm caused by breaches of obligations at the retail level, such as overcharging numerous consumers, may be more readily quantified. In contrast, the indirect long-term harm to the competitive process caused by a breach of wholesale obligations that will affect consumers in future is much more difficult to calculate.

For breaches of obligations at the wholesale level, requiring harm to be calculated in each case would entail an undue burden of proof on the regulator and weaken the objective of deterrence. The proposed turnover approach gets around these issues. The core of our recommendations are reflected in ComReg’s 2021 guidance.12

1 Oxera (2021), ‘Guidelines and Methodology on Financial Penalties in the context of the Access Regulations T07029’, Prepared for Commission for Communications Regulation, Research report to support public consultation, 21/10c, April 2020 (amended January 2021).

2 ComReg (2020), ‘Consultation on Calculating penalties for Access Regulations breaches’, 20/25, April.

3 ComReg (2021), ‘The Financial Penalty Methodology Guidance on ComReg’s approach to the calculation of financial penalties for the purpose of Regulation 19(8) of the Access Regulations’, 21/10a, February.

4 European Communities (Electronic Communications Networks and Services) (Access) Regulations 2011 (S.I. No. 334 of 2011). The Access Regulations transpose Directive 2002/19/EC of the European Parliament and of the Council of 7 March 2002 on access to, and interconnection of, electronic communications networks and associated facilities (as amended by Directive 2009/140/EC).

5 Directive 2002/20/EC of the European Parliament and of the Council of 7 March 2002 on the authorisation of electronic communications networks and services, OJ L 108/21, 24.4.2002, as amended by Article 3, Directive 2009/140/EC of the European Parliament and of the Council of 25 November 2009, OJ L 337/37, 18.12.2009. Also see Directive 2002/21/EC of the European Parliament and of the Council of 7 March 2002 on a common regulatory framework for electronic communications networks and services (Framework Directive), OJ L 108, 24.04.2002, as amended by Article 1 of Directive 2009/140/EC.

6 European Commission (2006), ‘Guidelines on the method of setting fines imposed pursuant to Article 23(2)(a) of Regulation No 1/2003’, (2006/C 210/02) 1.9.2006.

7 See section 4 of Oxera (2021), ‘Guidelines and Methodology on Financial Penalties in the context of the Access Regulations T07029’, Prepared for Commission for Communications Regulation, Research report to support public consultation, 21/10c, April 2020 (amended January 2021).

8 Ofcom (2015), ‘Revising the penalty guidelines: Statement’, 3 December.

9 See section 4 of Oxera (2021), ‘Guidelines and Methodology on Financial Penalties in the context of the Access Regulations T07029’, Prepared for Commission for Communications Regulation, Research report to support public consultation, 21/10c, April 2020 (amended January 2021).

10 The Law Reform Commission of Ireland (2018), ‘Regulatory Power and Corporate Offences’.

11 See Oxera (2021), ‘Financial penalties consultation: Observations on Frontier Economics’ response to Oxera’s methodology for calculating penalties’, prepared for the Commission for Communications Regulation, January.

12 ComReg (2021), ‘The Financial Penalty Methodology Guidance on ComReg’s approach to the calculation of financial penalties for the purpose of Regulation 19(8) of the Access Regulations’, 21/10a, February.

Related

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More

A map of AI policies in the EEA and UK

Oxera offers an overview of AI-related policies in EEA countries and the UK through an interactive map. This AI Policy Map allows users to follow developments in AI regulation and examine national policy approaches in more detail. Artificial intelligence (AI) is driving technological change at an unprecedented pace, transforming industries,… Read More