Paying it forward: is COVID-19 accelerating the transition to digital payments in Italy?

On 25 March 2020, the European Banking Authority published its ‘Statement on consumer and payment issues in light of COVID-19’, in which it encouraged retailers to ‘facilitate consumers’ ability to make payments without the need for physical contact’.1 In May, the Italian National Institute for Insurance against Accidents at Work (INAIL) published a technical document in which it stated that ‘it is appropriate to privilege contactless electronic payments’.2 These two official statements, together with consumers’ fears of possible contagion via cash, may boost the use of digital payment solutions in Italy.3

Over the last years, digital payments have become increasingly popular in the ‘Bel paese’. In 2019, the total spent using digital payment methods amounted to €270bn in Italy, registering a 11% increase compared to 2018. Among card payments, contactless payments registered the highest yearly increase (up by 56%). More innovative payment methods, such as mobile payments and smart-object payments,4 also saw a significant increase in 2019, growing 109% compared to 2018; however, they still accounted for only 1% of digital payments.5

Despite these encouraging increasing trends, in 2019 Italy was still lagging behind other European countries. The best performing countries, such as Denmark, Sweden, and Finland, recorded more than 300 digital transactions per capita, compared to 83 in Italy.6

Against this backdrop, the COVID-19 crisis is likely to accelerate the digitalisation of payments. During the lockdown, many shops had already turned to innovative payment solutions to enable them to continue to operate by offering home delivery. This means, in turn, that butchers, bakeries, greengrocers and many traditional shops (which used to predominantly receive cash payments) have dramatically increased their use of digital payments, reaching peaks of more than 350% in terms of number of digital transactions compared to before the crisis.7 This acceleration towards digital payments imposed by the COVID-19 crisis has been continuing during phase 2 of the pandemic management.

In particular, digital payments companies have launched new initiatives that could further facilitate the transition to digital. We illustrate some of these below.

New initiatives in the Italian digital payments landscape

In response to the unprecedented challenges posed by the COVID-19 crisis, many digital payments providers are launching new products and services aimed at encouraging the adoption of digital payments in Italy.

PayPal, a well-established digital payment company, has launched QR-code payments with no commission until September 2020, allowing merchants to conduct contactless transactions without purchasing additional hardware.1

SumUP, a fintech company specialising in point-of-sale appliances (POS) and payment solutions for small and medium enterprises (SMEs), has signed an agreement with the Italian Red Cross for the supply of over 200 SumUP card readers throughout the country.2

Skrill, the online payments company behind Skrill Money Transfer, has removed all fees and foreign exchange charges for anyone using Skrill Money Transfer to send money to Italy.3

Note: 1 Trabucchi, M. (2020), ‘PayPal lancia i pagamenti a distanza via Qr code anche nei negozi fisici’; 2 SumUP (2020), ‘Fase 2, accordo tra SumUP e Croce Rossa Italiana: “Il tempo della gentilezza” diventa contactless.’; 3 Paysafe group (2020), ‘Skrill offers free money transfers to Italy’, March.

Source: Sole24Ore, SumUp, Paysafe group.

Some of the policies recently enacted by the Italian government also seem to promote the shift to digital payments. For example, from July 2020, merchants whose revenues and fees relating to the previous year did not exceed €400,000 will be entitled to a tax credit equal to 30% of the commissions on electronic payments.8 This government decision is expected to further encourage the use of digital payments, which have traditionally been hampered by commission fees.

All these initiatives seem to have a positive impact in boosting cashless payments. We looked at two complementary measures to analyse the recent change in the prevalence of digital payments in Italy: (i) the increase in the user base of digital payment applications, and (ii) the percentage change in the number of electronic payments being made.

The number of users of digital payments seems to have increased exponentially in the first months of 2020. Consider the case of Satispay—a digital payment application that is rather popular in Italy. At the end of 2018, Satispay had roughly 500,000 users; by the end of 2019, it reached 700,000 users, a 40% increase in one year. In Q1 2020, however, Satispay reached 1m users—is user base increasing by 43% in just three months. Additionally, Satispay saw a 30% increase in the use of its services, in particular for phone top-ups.9

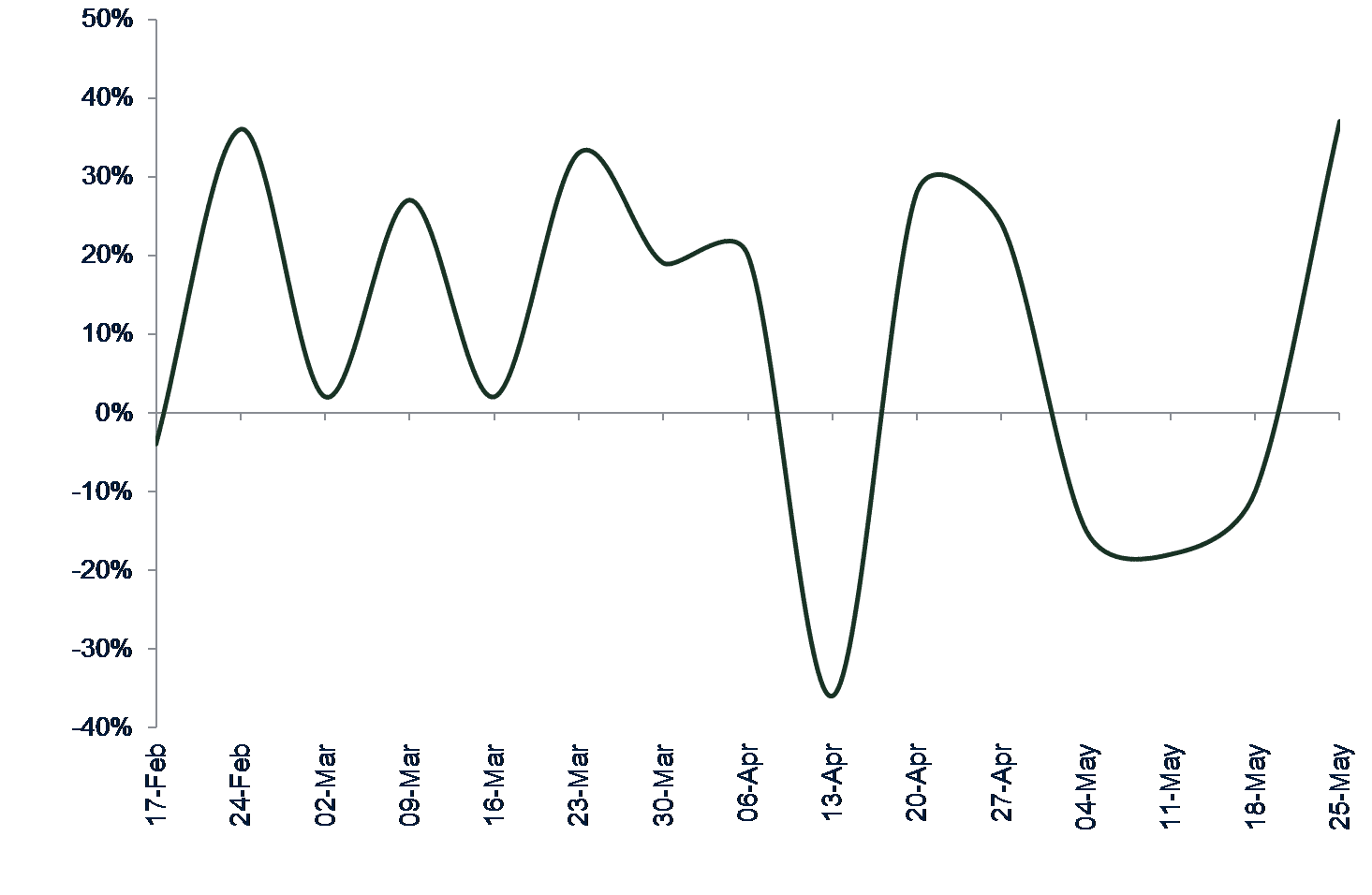

The number of electronic transactions has also spiked.10 According to data collected by SumUP, food and grocery shops had already seen various increases in electronic payments during the lockdown period (see Figure 1 below).11 Such increases were followed by a drop in mid-April—probably due to the fact the people have amassed enough stockpiled food and/or have returned to work (and so are spending less time at home). However, the second week of phase 2 saw the highest percentage increase in the number of electronic transactions for food and groceries—almost 40%. Given that the SumUP Observatory follows SMEs, the trend suggests that small, traditional shops are making an important shift to digital payments, and this shift might have not occurred at such a rapid pace absent the COVID-19 crisis.

Figure 1 Percentage change in electronic payments in the Italian food and grocery sector compared to the same period in 2019—SMEs

Moreover, SumUP data registered an increase of 97% in the number of digital payments for cafés, pubs and restaurants during the first week of phase 2 (18–24 May).12 Handicraft saw an increase of 19% during the same period, but during previous weeks it registered peaks of 57%. Outdoor and farmers’ markets, which traditionally make more use of cash, saw an increase in digital payments of 26% during the first week of phase 2.13 However, barbers and the beauty sector recorded the highest increase in digital transactions—up by 1,940% compared to the pre-COVID-19 situation.14

Why are Italian consumers increasingly using digital payments during the COVID-19 crisis, and will this trend persist in the medium term?

The data we have analysed suggests that the use of digital payments in Italy has significantly increased since the beginning of the COVID-19 crisis. It is likely that this rapid change was prompted by the drastic change in consumer behaviour triggered by the spread of the virus. During the lockdown period, government restrictions precluded or limited consumers from buying goods in physical shops other than supermarkets and pharmacies.15 Many consumers switched to online shopping for both essential and non-essential purchases, and they increasingly relied on home deliveries for food. Both retail online shopping and food home-delivery are services that are very well suited to digital payment solutions.

An additional explanation for the increase in the use of digital payments during the COVID-19 crisis may be found in the behavioural economics notion of ‘nudging’ (or the ‘default effect’). This refers to reinforcements and indirect suggestions that can influence the decision-making process of groups and individuals. This includes, for example, when a firm uses automatic-enrolment saving plans; employees are automatically enrolled in the scheme unless they explicitly opt out. The presence of a default option has been proven to dramatically increase the rate of participation in employee savings schemes.16

Similarly, the possibility of COVID-19 contagion via cash may be acting as an ‘exogenous nudge’ (or ‘social default effect’), boosting the use of digital payments as a ‘default option’. Moreover, opting out of digital payments is becoming more difficult, with both authorities and merchants increasingly encouraging the use of digital payments to reduce the possibility of contagion.

However, the fact that a relatively high proportion (roughly 23%) of the Italian population is more than 65 years old may constrain the shift to digital payment.17 The level of financial literacy is, in fact, relatively low among this share of the population: only 35% of individuals who fall in this bracket have a good level of financial literacy, while the average across the major advanced economies is roughly 45%.18 Moreover, the general level of digital literacy among Italians is considerably below the European average; roughly 45% of Italians have a good level of digital knowledge, while the average in Europe is 55%.19 The development of projects aimed at promoting digital and financial literacy may help not only to accelerate a shift to digital payments, but also to promote more active and effective use of financial services by Italian citizens.

It remains to be seen which factor will prevail in the medium and long run. Currently, Italian consumers seem to be comfortable with using digital payments more frequently. More than half of the respondents to a survey run by Paysafe stated that they are ready to increase their use of contactless payments in the short term due to health and safety concerns.20

Meanwhile, the increased use of digital payments seems to be part of a bigger trend affecting the whole Italian banking system; the COVID-19 pandemic has triggered significant changes in customer behaviours with respect to banking services, with more than half of the Italian population ready to increase their usage of online and mobile banking.21 All these factors appear to suggest that there is a great momentum for innovation in the Italian payment and banking sectors.

1 European Banking Authority (2020), ‘Statement on consumer and payment issues in light of COVID-19’, March.

2 Istituto Nazionale per l’Assicurazione contro gli Infortuni sul Lavoro (2020), ‘Documento tecnico su ipotesi di rimodulazione delle misure contenitive del contagio da SARS-CoV-2 nel settore della ristorazione’, May.

3 ‘Digital payments’ here refer to card payments, contactless payments, mobile payments and smart-object payments.

4 Smart-object payments are payments via objects such as e-Watches and smart speakers.

5 Osservatori Digital Innovation del Politecnico di Milano (2020), ‘Innovative payments: collaborare paga’, Infografica Osservatorio Innovative Payments.

6 Asaro, I. (2020), ‘I pagamenti innovativi in Italia valgono oltre 3,1 MLD di euro grazie a smartphone e wearable’, Osservatori Digital Innovation del Politecnico di Milano, May.

7 Indemini, L. (2020), ‘Col coronavirus crescono I pagamenti digitali e triplica il numero dei consumatori online in Italia’, Il Corriere.

8 Garavaglia, R. (2020), ‘Pagamenti elettronici, 30% di sconto sulle commissioni ai negozianti: ecco come’, AgendaDigitale.

9 Retail&Food (2020), ‘Satispay sancisce l’alleanza fisico-digitale’, June; Distribuzione Moderna (2020), ‘Satispay taglia il traguardo di 1 milione di utenti’, March.

10 Data refers only to transactions conducted with SumUP.

11 Indemini, L. (2020), ‘Col coronavirus crescono I pagamenti digitali e triplica il numero dei consumatori online in Italia’, Il Corriere.

12 Salvioli, L. (2020), ‘Lockdown e riaperture: gli effetti sul commercio al dettaglio in 6 grafici’, Il Sole 24 Ore, May.

13 Salvioli, L. (2020), ‘Lockdown e riaperture: gli effetti sul commercio al dettaglio in 6 grafici’, Il Sole 24 Ore, May.

14 Fortune Italia (2020), ‘Aumentano del 1.940% I pagamenti digitali per estetica e parrucchieri’, May.

15 Oxera (2020), ‘How are Italian consumers reacting to COVID-19?’, April.

16 Thaler, R. H. and Benartzi, S. (2004), ‘Save more tomorrow: using behavioural economics to increase employee saving’, Journal of Political Economy, 112:S1, pp. S164-S187.

17 TuttiItalia (2020), ‘Indici demografici e struttura della popolazione’.

18 Econopoly (2015), ‘Tutela del risparmio, perché non possiamo fare a meno dell’educazione finanziaria’, Il Sole 24 Ore, December.

19 Gabanelli, M. and Magatti, M., ‘L’Italia sta pagamento caro l’analfabetismo digitale. Le colpe e i rimedi.’, Il Corriere della Sera.

20 Paysafe group (2020), ‘Over half of UK consumers have tried a new payment method since the outbreak of COVID-19. New consumer research from Paysafe shows 84% of people are thinking about payments differently in 2020’, May.

21 Boston Consulting Group (2020), ‘Retail Banking in the New Reality’, May.

Download

Related

Future of rail: how to shape a resilient and responsive Great British Railways

Great Britain’s railway is at a critical juncture, facing unprecedented pressures arising from changing travel patterns, ageing infrastructure, and ongoing financial strain. These challenges, exacerbated by the impacts of the pandemic and the imperative to achieve net zero, underscore the need for comprehensive and forward-looking reform. The UK government has proposed… Read More

Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure… Read More