Investing in distribution: ED3 and beyond

In the first quarter of this year the National Infrastructure Commission (NIC)1 published its vision for the UK’s electricity distribution network. Below, we review this in the context of Ofgem’s consultation on RIIO-ED32 and its published responses. One of the policy priorities is to ensure that the distribution network is strategically reinforced in preparation for the forecast increase in demand for distribution capacity, and to make the network resilient to future threats. We highlight areas for additional development, not least to improve the attractiveness of the Distribution Network Operators (DNOs) to investors for the RIIO-3 period and beyond.

NIC’s vision

In its report, the NIC states:3

There must be a step change in the approach to the distribution network. This will involve investing proactively in the network though greater strategic planning and simplified price controls

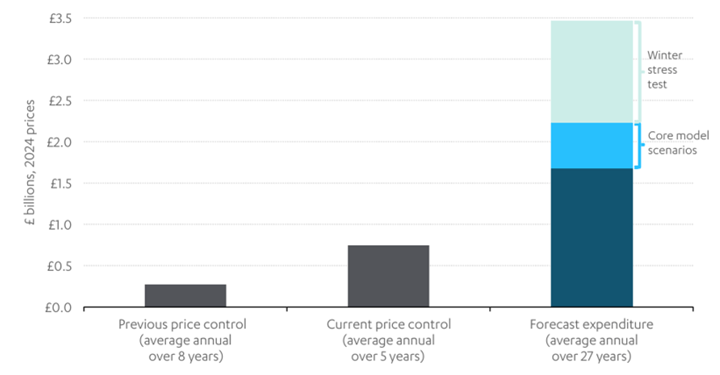

The NIC characterisation of a ‘step change’ is justified, as it projects that annual investment levels in the DNOs are due to double relative to the previous price control, and potentially treble for some scenarios. This is illustrated in Figure 1—which also shows that there would be an even higher investment required to meet a stress test if flexibility over demand were not exercised, and if existing reliability standards were applied.

Figure 1 Average load expenditure 2015–50

To cope with this step change, there is a need to act now to ensure that there is sufficient capacity in the future.

Below, we summarise the NIC’s view on this step change, then examine its consistency with Ofgem’s consultations and responses. The NIC recommends eight system-wide reforms, as follows.4

- Going further and faster on digitalising the network and deploying flexibility in a way that maximises national benefits for the electricity system and for consumers

- Reviewing security of supply standards so that networks are designed appropriately for future loads

- Developing more effective strategic planning to enable and de-risk proactive investment, including Regional Energy Strategic Plans that align stakeholders around a clear trajectory for the future needs of the network

- Reforming and simplifying price controls by:

- rebalancing them around long term objectives that deliver wider social and economic benefits, as well as efficient delivery

- reorientating funding mechanisms to focus on allowances set before the price control begins, using re-opener mechanisms only where there is genuine long term uncertainty

- accelerating ‘no regrets’ activities such as unlooping and off-gas grid reinforcement.

- Government adjusting its relationship with Ofgem to provide the necessary steers and vision to enable proactive investment, including by strengthening the strategy and policy statement

- Improving the connections process through the introduction of minimum service standards and stronger incentives for major connections, to ensure high quality customer service and timely connections for all network customers throughout the full connections process

- Making targeted reforms to the planning and consenting system to speed up the delivery of distribution infrastructure and reduce uncertainty for operators

- Government should urgently identify the skills challenges and actions required to ready the workforce to deliver the energy transition.

In the following sections, we review the NIC’s recommendations in the context of Ofgem’s recent framework consultation on RIIO-ED3.

Ofgem’s RIIO-ED3 consultation

Ofgem’s RIIO-ED3 framework consultation provided the context for the UK’s commitment to reaching net zero by 2050. It stated that electricity demand in the UK is expected to increase during the 2030s, and emphasised the need to support the UK government’s ‘Clean Power 2030’ action plan. The National Energy System Operator will engage with the DNOs to produce Regional Energy Strategic Plans to improve network performance. The consultation was based around four consumer outcomes, as follows.

- Net zero:use of a more proactive approach to the provision of new capacity through asset investment is necessary to deliver the network that is needed for a net zero future, rather than waiting for demand to materialise in the short term.5

- Responsible business:adopting a progressive regulatory approach, taking a long-term view and providing greater certainty to the supply chain and investors who will provide the necessary investment.6

- Smarter networks: the network must become digitalised to enable demand-side response, storage and distributed generation.7

- Resilience and sustainability:better asset stewardship is central to ensuring that networks remain resilient to increasing climate, cyber and deliverability risks.8

The first item represents a change in emphasis from ED2, while the other three follow current themes. During ED2, the emphasis was on low-regret investment pathways to minimise investments that may turn out to be unnecessary. Ofgem comments:9

Going into ED3, the role of strategic planning means that the incentives on DNOs are likely to need to change. Whereas in previous periods of lower demand growth lower investment was seen as good for consumers… ED3 period is the point at which growth in peak demand should begin to accelerate if we are on track to meet net zero.

Ofgem then elaborates on the need to move on from the ‘flexibility first’ approach:10

Even if capacity is managed for the demand that materialises within the regulatory period, through a combination of network upgrades and flexibility (something that we have promoted through our ‘flexibility first’ approach in RIIO-ED2), without more anticipatory investment, the total costs over the period to 2050 could potentially be higher. This is because the risk and costs of capacity not being available during a critical period for decarbonisation, when demand is growing very quickly, could outweigh the risk and costs of building assets early and these being underutilised for a period of time.

Industry response to Ofgem’s consultation

A consolidated view of the industry response is provided by the Energy Networks Association (ENA).11 It is supportive of the view that further investment in electrical distribution networks is essential, as well as Ofgem’s approach to incentive-based regulation which it states has been successful to date. However it notes that ‘Ofgem’s consultation covers some, but not all, of the key elements of the regulatory framework’.12

The ENA welcomes recognition that consumer prices will need to rise, but argues for a longer-term focus on decision-making to support investability and financeability of the whole package of investment. The backdrop to all of this is a change in macroeconomic conditions, leading to rising interest rates coupled with new operational risks.

Excluding financeability, the ENA response notes the need to refine the balance of existing incentives to reflect the challenges of net zero and climate change, and to adopt incentive targets beyond the avoidance of penalties.

Concern over incentives is also expressed regarding network investment. The Network Asset Risk Metric is endorsed and its expansion is advocated—however, the ENA is concerned about the monitoring of delivery outcomes, stating:13

Any use of regulatory mechanisms whereby Ofgem monitors/assures delivery of outputs and outcomes in period (e.g. output monitoring metrics or price control deliverables) must be proportionate and carefully developed to ensure they fully factor in deliverability and other external challenges, e.g. supply chain.

Finally, attention is drawn to the need to adequately recover efficiently incurred costs, especially given supply-chain risks and workforce availability.

Goal congruence—but room for development

It is reassuring to note the alignment of the NIC’s vision with the ED3 consultation and the industry response. There is agreement that there is a need for substantial investment. There is also presumptive or stated alignment about the benefits from clearer policy statements, better strategic planning, accelerating digitalisation and adjusting security standards to reflect the potential of flexibility. There is also likely to be common recognition of the benefits of a streamlined connection process, reduced planning obstructions and increased availability of key skills. In other words, it can be argued that seven of the eight categories in the NIC’s recommendations provide a useful summary of a consensus view on the necessary future developments to support ‘creating capacity for the future’.14

In the case of the remaining category, i.e. reformed price control, the need for change potentially extends beyond the three items noted by the NIC and listed above.15 There could also be a need to further adapt the price control to address the balance of risk and return for DNOs in RIIO-ED3 and beyond. The NIC touches on this in its report, noting that ‘Ofgem may also need to consider other measures to maintain financeability over the long term’,16 whileOfgem itself notes that a future investability17 assessment ‘may also require new tools to be developed’ given the undisputed need to raise equity finance for network reinforcement.

Oxera has commented on this in the context of transmission investments.18 Key factors identified include the following.

- Dividend yield: the types of investors that choose to invest in utilities prefer strong and stable dividends. However, Ofgem’s assumptions regarding the dividend yield—the base case assumption of 3%19 with the potential to cut dividend yields to address financeability issues—do not facilitate an investable regulatory settlement, not least because the dividend yields of other European-listed electricity networks show that they have, over the past 15 years, systematically maintained dividend yields largely above 3%.

- Return on Equity Allowance (RoE): Ofgem should consider how it can adjust its allowances to improve the likelihood of returns being sufficient. The process for setting the return on equity allowance that Oxera suggests is illustrated in Figure 2 below.

Figure 2 Illustration of the process for setting an investable return on equity allowance

Source: Oxera.

First, several factors support setting an allowed return on equity in the upper half of Ofgem’s proposed range, as risks have increased compared with the previous price control. Second, there is a potential for incentives to be skewed towards the downside due to asymmetric risk factors such as supply chain constraints becoming increasingly prevalent. Third, as the welfare impact of underinvestment (e.g. social welfare losses from inadequate investment in decarbonisation) is potentially larger than the additional costs of setting an allowed RoE higher than a mid-point estimate, there is a case for opting for this higher estimate.20

A priority for further development during the ED3 review is to consider enhancements to the investability of the sector to ensure the availability of the capital needed to transform the sector during the regulatory period and beyond.

1 On April 1st the NIC was subsumed into the newly created National Infrastructure and Service Transformation Authority (NISTA). NIC’s website will close at the end of this month and will be archived on the National Archives.

2 RIIO-ED3 refers to Ofgem’s price control for the electrical distribution sector in Great Britain, and will run from April 2028 to March 2031.

3 National Infrastructure Commission (2025), ‘Electricity distribution networks: Creating capacity for the future’, February, p. 7.

4 National Infrastructure Commission (2025), ‘Electricity distribution networks: Creating capacity for the future’, February, p. 9.

5 Ibid., para. 1.10.

6 Ibid., para. 1.14.

7 Ibid., para. 1.18.

8 Ibid., para. 1.21.

9 Ibid., para. 5.13.

10 Ibid., para. 5.14.

11 Energy Networks Association (2025), ‘ENA response to Ofgem ED3 Framework consultation’.

12 Ibid., p. 4.

13 Ibid., p. 7.

14 National Infrastructure Commission (2025), ‘Electricity distribution networks: Creating capacity for the future’, February.

15 These are rebalancing price controls towards long-term objectives, focusing on allowances set before the price control begins, and accelerating ‘no regrets’ activities.

16 National Infrastructure Commission (2025), ‘Electricity distribution networks: Creating capacity for the future’, February, p. 78

17 Ofgem defines ‘investability’ as follows: ‘Investability considers whether the allowed return on equity is sufficient to retain and attract the equity capital that the sector requires’. Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – Finance Annex’, 18 July, para. 3.230.

18 Oxera (2024), ‘RIIO-3 risks and investability topics’, 9 December.

19 ‘Our working assumption for SSMD is to maintain the 3% dividend yield base case’; see Ofgem (2024), ‘RIIO-3 Sector Specific Methodology Decision – Finance Annex’, 18 July, para. 3.82.

20 This is in keeping with the CMA’s statement in its PR19 redetermination: i.e. ‘we consider that the need to promote investment should be a consideration in setting the point estimate’. See Competition and Markets Authority (2021), ‘Anglian Water Services Limited, Bristol Water plc, Northumbrian Water Limited and Yorkshire Water Services Limited price determinations’, 17 March, para. 9.1394.

Related

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More

A map of AI policies in the EEA and UK

Oxera offers an overview of AI-related policies in EEA countries and the UK through an interactive map. This AI Policy Map allows users to follow developments in AI regulation and examine national policy approaches in more detail. Artificial intelligence (AI) is driving technological change at an unprecedented pace, transforming industries,… Read More