COVID-19 and damages quantification: key challenges for the post-pandemic world

The COVID-19 pandemic has caused large-scale disruptions to the global economy. One consequence is the emergence of commercial disputes following terminations or breaches of contracts during the pandemic. What challenges are likely to arise when quantifying damages in light of COVID-19 in commercial litigation or arbitration proceedings?

Over recent months, the impact of the pandemic has dominated business and financial news around the world. The International Monetary Fund (IMF) expects the global economy to contract by 3% in real terms in 2020,1 while the European Central Bank forecasts a recession of 5% in the eurozone.2 These projections represent a greater impact than the global financial crisis that began in 2007.3 Many businesses across industries have felt the brunt of the pandemic—many airlines have grounded their fleets, non-essential shops and manufacturing plants have been shut, and sports events and festivals have been cancelled or postponed.

In response, many governments have introduced schemes to minimise job losses and to mitigate the losses suffered by businesses directly as a result of lower consumer demand and government-mandated lockdowns (and other restrictions on movement). Since the beginning of the pandemic, the European Commission has approved approximately €2.5tn of state aid to deal with the impact of COVID-19.4 In the UK, for example, as at the beginning of May 2020, pay for more than 6m workers was covered by the national furlough scheme.5

However, amid all of this, many companies have also suffered losses and damages as a result of the actions of other companies. As an example, force majeure-related claims are currently a hot topic among legal professionals for terminated contracts signed before the pandemic. Indeed, many legal professionals expect to see a large increase in the number of commercial disputes following the pandemic, with companies that have been negatively affected resorting to litigation or arbitration forums to seek compensation for the damage suffered.6

In this article, we set aside the legal question of whether, and the circumstances under which, a violation of contractual terms amid COVID-19 constitutes a breach of contract and results in damages claims. Instead, we discuss the economics—namely the challenges that are likely to arise when quantifying damages in commercial disputes arising from the pandemic.

In particular, we discuss the new challenges introduced by COVID-19 for implementing the two commonly used methods to value companies and assets, and for quantifying damages—the discounted cash flow (DCF) method and the multiples method. We focus on the areas that need to be considered carefully in order to arrive at a robust damages assessment using these methods.

Challenges in applying the DCF method to COVID-19-related disputes

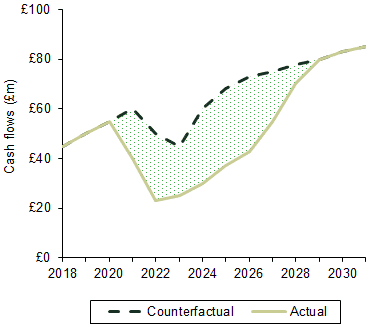

The DCF method typically estimates damages suffered by a claimant as the difference (in present value, PV, terms) between:

- the claimant’s cash flows in the counterfactual scenario (i.e. absent the alleged breach of contract); and

- the claimant’s cash flows in the actual scenario (i.e. with the alleged breach of contract).

The cash flows in the counterfactual and actual scenarios are then discounted to the chosen valuation date at appropriate discount rates, which in turn reflect the time horizon and riskiness of these cash flows. The application of the DCF method to quantify damages is illustrated in Figure 1.

Figure 1 DCF method: damages equal the PV of the difference in cash flows

As shown in the figure, the only distinction between the counterfactual and actual scenarios is the alleged breach and its impact on the claimant’s cash flows. This means that any factors that have the same impact on a claimant’s cash flows both with and without the alleged breach should not affect the quantum of damages.

The construction of an appropriate counterfactual scenario and the cash flows in this counterfactual are key to any DCF-based damages assessment. These are often hotly debated between quantum experts working on opposite sides of a dispute.

This construction of an appropriate counterfactual scenario is likely to be particularly challenging in disputes relating to COVID-19 disputes. This is because, in many cases, the pandemic would have affected the value of a business through multiple channels around the same time, making it more difficult to isolate the impact of the alleged breach from that of other factors unrelated to the breach.

As an example, consider a chain of restaurants in the UK suing its supplier of flour and yeast for failing to deliver the contractual amounts of these ingredients, which are key to making its best-selling pizza for both eat-in and home delivery customers. The restaurant chain may claim that, as a result of this breach, it suffered from lower pizza sales and lower profits.

In this example, the fall in profits of the restaurant chain could be due to any of the following factors:

- Factor 1: a government-imposed lockdown, which has reduced the number of eat-in customers (albeit this is potentially partially offset by an increase in the number of home deliveries) and/or staff members working in the restaurant;

- Factor 2: a deterioration of customers’ economic situation due to job losses or pay cuts, which has reduced its customers’ discretionary spending;

- Factor 3: customers loyal to the restaurant chain switching away from pizza (which is more profitable for the restaurant) to other dishes (which are less profitable) due to the lack of pizza availability;

- Factor 4: customers that are less loyal to the restaurant chain switching from this chain to a competitor in order to still eat pizza.

Factors 1 and 2 would have happened with or without the supplier’s failure to deliver the contractual amounts of flour and yeast, and therefore would have affected the restaurant chain’s cash flows in both the counterfactual and actual scenarios. In contrast, factors 3 and 4 are specifically caused by the alleged breach. These two factors reduced the restaurant chain’s cash flows in the actual scenario relative to the counterfactual scenario without the alleged breach, and thus caused damages to the restaurant chain.

As mentioned above, the complexity that arises in quantifying damages in disputes relating to COVID-19 is that all four factors are likely to have materialised around the same time. This makes it challenging to rely on historical data from before the pandemic to forecast the restaurant chain’s cash flows in the counterfactual scenario. If it is necessary or desirable to rely on such information, the quantum experts would need to ensure that the historical data is adjusted to reflect the impact of the other factors induced by the pandemic (e.g. factors 1 and 2 in the example above).

Another complication is that other suppliers of the restaurant chain may have also breached their contractual obligations towards the chain. For example, the restaurant chain’s supplier of pepperoni may also have been delayed in supplying the restaurant with its ingredient. In this scenario, the impact of factors 3 and 4 on the restaurant chain’s profits would also need to be apportioned between the breach of the flour and yeast supplier and the breach of the pepperoni supplier. Tackling this question is likely to require careful economic and financial analysis, and a good understanding of how this industry works.

Challenges in applying the multiples method to COVID-19-related disputes

The multiples method is based on the principle that two businesses with similar characteristics are worth similar amounts. The application of this method to value a company involves three steps, and the multiples-based valuation of a company in the counterfactual and actual scenarios can be compared in order to arrive at a damages estimate.

- Comparators—the first step is to identify companies that are comparable to the subject company (in terms of nature of operations, competitive position, risk profile, etc.). This normally involves identifying comparable listed companies and/or comparable companies that were acquired around the valuation date.

- Multiples—the second step is to calculate the valuation multiple for each comparable company identified in the step above. One commonly used multiple is the ratio of each comparable company’s enterprise value (EV) relative to its earnings before interest, taxes, depreciation or amortisation (EBITDA), which is often a good proxy for a company’s operating cash flows.7

- Valuation—the third step is to multiply the median (or mean) of the multiple of the comparable companies obtained in the step above (e.g. the EV/EBITDA multiple) by the relevant measure of the subject company (e.g. EBITDA of the subject company) to value the subject company.

Generally speaking, there are two key elements to a robust application of the multiples method. The first is to ensure that the EBITDA estimates used in this analysis reflect the company’s long-term steady-state level of profitability, also known as normalised earnings. The second is to ensure the consistency of the valuation multiples of the comparable companies and the subject company. For example, if the EV/EBITDA multiple is calculated based on a sample of relatively mature companies in a given sector, this multiple should not be applied to the EBITDA of a company in its early stage of development in this sector.8

Applying the multiples-based method to valuing companies amid the COVID-19 pandemic is likely to face some practical challenges. There are two challenges that stand out in particular.

The first challenge relates to estimating the company’s long-term steady-state EBITDA during the pandemic, not least because the EBITDAs of many companies during the pandemic may not reflect the companies’ long-term steady-state levels of profitability. Interestingly, some companies have started reporting a variation of EBITDA, termed EBITDAC (earnings before interest, tax, depreciation, amortisation, and coronavirus), which strips out the impact of the pandemic on their EBITDA.9 If this is estimated correctly, it could be used as a starting point to assess the subject company’s normalised level of EBITDA. If this approach is taken, it will be important to ensure that the impact of the pandemic is reflected separately in the valuation of the company.

A second challenge relates to applying the appropriate multiple to the normalised level of EBITDA for the subject company in an internally consistent manner. As discussed above, it would not be appropriate to apply multiples estimated before the pandemic to EBITDA levels observed during the pandemic. On the other hand, multiples estimated during the pandemic may be too volatile to yield a robust estimate of a company’s value.

One potential way to get around this second problem is to carry out a separate analysis of the company during the pandemic period and the post-pandemic period, using a three-step approach as follows:

- for the pandemic period, one could estimate the expected cash flows and discount them to the present time using the appropriate discount rate. This is similar to the approach set out for the DCF method above;

- for the post-pandemic period, once the company and sector in question are expected to reach a steady-state level of profitability, one could apply the historical multiples (or adjusted historical multiples if there is evidence that the future multiples are likely to be different from the historical ones) to the relevant metrics of the subject company to estimate the value of the company in the post-pandemic period;

- the value of this company would then be the sum of the present value of (i) the cash flows during the pandemic period; and (ii) the multiples-based value of the company in the post-pandemic period.

However, implementing this three-step approach is not necessarily straightforward: it requires an estimation of when the pandemic period will end, a reliable estimation of the subject company’s cash flows during the pandemic period, as well as the appropriate valuation multiple in the post-pandemic period.

Looking forwards…

As businesses look to bounce back following the unprecedented impact of the COVID-19 pandemic, companies and investors are likely to explore legal options to claim damages from parties that have allegedly breached their contractual obligations.

At that point, quantum experts would need to think carefully about how best to tailor the commonly used valuation techniques to robustly quantify damages in disputes relating to COVID-19. It is more important than ever to ensure that the quantum assessment is based on sound economics and finance theory, and that it is consistent with contemporaneous empirical evidence.

1 International Monetary Fund (2020), ‘Global Financial Stability Report – Chapter 1: Global Financial Stability Overview: Markets in the Time of Covid-19’, April, accessed 9 May 2020.

2 This assumes a ‘mild scenario’, while its ‘severe scenario’ projections suggest a 12% contraction. European Central Bank (2020), ‘Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area’, ECB Economic Bulletin 3/2020, 1 May, accessed 9 May 2020.

3 International Monetary Fund (2020), ‘Global Financial Stability Report – Chapter 1: Global Financial Stability Overview: Markets in the Time of Covid-19’, April, accessed 9 May 2020.

4 This is more than two-thirds of the total amount of aid approved by the Commission over the nine-year period from 2008 to 2017 to tackle the financial crisis. Oxera analysis, based on European Commission (2020), ‘State aid rules and coronavirus’, accessed 9 May, supplemented by information in the public domain from the relevant national authorities; and European Commission (2018), ‘State Aid Scoreboard 2018: Results, trends and observations regarding EU28 State Aid expenditure reports for 2017’, section 4, accessed 9 May 2020.

5 Strauss, D. (2020), ‘Pay for more than 6m UK workers now covered by furlough scheme’, Financial Times, 4 May.

6 See Baker McKenzie (2020), ‘COVID-19: Implications for the future of Dispute Resolution’, April, accessed 9 May 2020. See also Quinn Emanuel Urquhart & Sullivan, LLP (2020), ‘Coronavirus Implications for Securities Litigation’, accessed 9 May 2020.

7 Different valuation multiples are often used for valuing companies in different industries, and the choice of the appropriate multiples can be hotly debated among valuation experts. For an example, see Oxera (2018), ‘The curious case of the valueless valuation—the Signia Wealth v Vector Trustees ruling’, Agenda, May.

8 Similarly, it would not be appropriate to apply banks’ valuation multiples during the financial crisis that began in 2007 to value a bank during a boom in the economy five years down the line when the market has evolved to a different stage.

9 Asgari, N. (2020), ‘Pandemic spawns new reporting term “ebitdac” to flatter books’, Financial Times, 13 May.

Download

Contact

Mohammed Khalil, CFA

PartnerContributors

Related

Download

Related

What is venture capital, how does it work, and what are the risks?

In the third and final episode demystifying private equity, we explore the world of venture capital. While venture capital has delivered exceptional returns for some investors and founders, it’s also very high risk. So, is vibrant venture capital essential for economies seeking to boost innovation and drive productive growth? In… Read More

Measuring and inferring anticompetitive effects from an exchange of information

In four rulings1 dated 3 November 2025, the Spanish National Court overturned the Decision of the Comisión Nacional de los Mercados y la Competencia (CNMC) in case S/DC/67/17 Tabacos2 (‘the Decision’). These four rulings are significant because they close one of the first cases that the… Read More