Common ownership and market entry

Investors’ holdings in multiple firms give rise to what is known as ‘common ownership’. Are the strategic decisions of competing firms affected by the presence of common ownership? Albert Banal-Estañol of Universitat Pompeu Fabra, Barcelona GSE and City University of London, and Melissa Newham and Jo Seldeslachts of DIW Berlin and KU Leuven, provide evidence on the impact that common ownership has on market entry, one of the most important strategic decisions that firms make, in US pharmaceutical markets.

This article is based on Newham, M., Seldeslachts, J. and Banal-Estañol, A. (2018), ‘Common Ownership and Market Entry: Evidence from the Pharmaceutical Industry’, Barcelona GSE Working Paper 1042. For a general discussion of the debate on the potential anticompetitive effects of common ownership, see Franks, J. and Vig, V. (2018), ‘The threat of common ownership: real or imagined?’, Agenda, October.

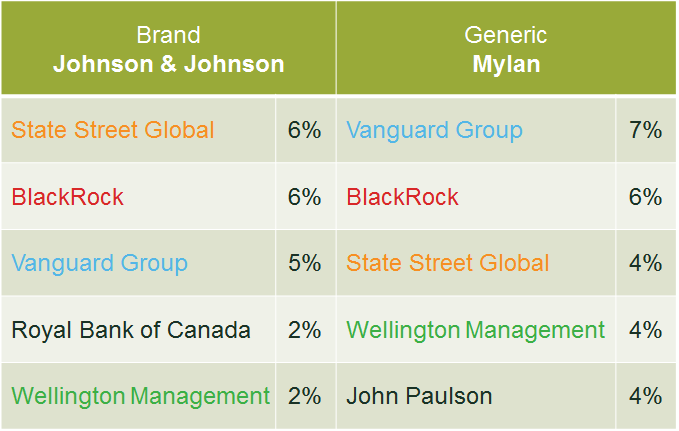

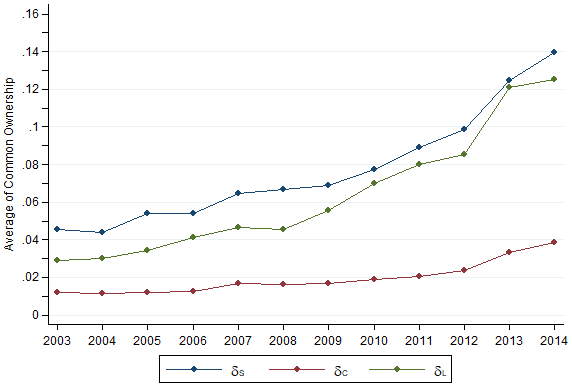

BlackRock and Vanguard, two of the world’s largest institutional investors, are the two largest shareholders in Johnson & Johnson, Pfizer, Abbott Laboratories, Perrigo and Allergan, some of the largest brand and generic pharmaceutical companies in the world. Many of the large pharmaceutical companies worldwide share the same top shareholders. As an example, Table 1 below shows the top five investors of Johnson & Johnson and Mylan in 2014. Moreover, as shown in Figure 1, the trends of three measures of common ownership between pharmaceutical firms have increased significantly from 2003 to 2014.

Table 1 Top five largest investors (2014)

Figure 1 Evolution of three measures of common ownership

Source: Newham, M., Seldeslachts, J. and Banal-Estañol, A. (2018).

Common ownership is a pervasive feature not only of pharmaceutical companies, but of many industries in the USA and in Europe. While large institutional investors may at most own 5–8% of a single company, this is normally enough to position them as top investors with privileged access to the firms’ management. Firms that are owned largely by shareholders who also have sizeable stakes in competitors might simply act in these shareholders’ interests, which leads them to maximise the return of their shareholders’ portfolios, rather than maximising their own profits.

Competition concerns

The ongoing concentration of ownership in the hands of a few large investors, and the corresponding escalation in common ownership, is unprecedented. Dubbed ‘an economic blockbuster’ and ‘the major new antitrust challenge of our time’, common ownership is undoubtedly an important issue.1 However, empirical research on the topic is still in its infancy. Previous work has provided empirical evidence that links common ownership in the airline and banking industries to higher ticket prices and bank fees, respectively.2 The results of these studies are subject to ongoing debate.3 Nevertheless, there is a resounding agreement that more research is required to understand the implications of common ownership.

Our paper, Newham, M., Seldeslachts, J. and Banal-Estañol, A. (2018), analyses the influence of common ownership on market entry. Specifically, we study generic firms’ entry decisions into US pharmaceutical markets opened up by the end of regulatory protection of the rival branded drug’s product.4 We believe that shareholders (and common owners) may have a particular influence in such decisions. Whereas pricing decisions are typically made on a regular basis by specialised pricing teams, market entry is a one-off decision with substantial consequences for the firm.

Theoretical framework

Given that generic entry results in substantial revenue losses for the brand firm that can be much higher than the generic firm’s gains from entry, a simple theory model shows that higher common ownership reduces generic entry as common owners have both the incentive and ability to push back entry.

We also show that common ownership may make a generic firm more likely (rather than less likely) to enter as the probability of having a competing generic product increases, thus making entry decisions ‘strategic complements’ rather than the usual ‘strategic substitutes’. This is because, as the other generic firm is more likely to enter, the effect of the focal generic firm’s entry on the brand firm is less detrimental, as the reduction of brand profits in the presence of another competing generic drug is smaller. Still, independent of whether entry decisions are complements or substitutes, the overall number of entrants in equilibrium is reduced as a function of the average level of common ownership of the generic firms with the brand firm.

The pharmaceutical industry

Maintaining monopolised markets is crucial for brand firms. With the event of generic firm entry, brand firms’ revenues can decline by as much as 90%. Moreover, losses to the brand firm and gains to the generic firm are highly asymmetric. According to one estimate, brand firms value deterring entry on average at about $4.6bn.5 In contrast, generic firms value the right to enter at about $236.8m. Therefore, entry decisions may crucially depend on whether owners of generic firms also have an interest in brand firms. Common ownership may lead generic firms to internalise the negative externalities that they would impose on the profits of the rival branded firms upon entry.

The US pharmaceutical industry is an attractive industry for studying entry because: (i) pharmaceutical markets are well defined; (ii) one can identify clear entry windows; and (iii) US healthcare expenditure as a percentage of GDP is among the highest in the world, and generic medicines are crucial to keeping down healthcare costs. Indeed, promoting generic entry has become an important goal for the US Food and Drug Administration (FDA) in recent years, and several hundred off-patent branded drugs still do not face any generic competition. Our data combines patent and drug approval data from the FDA Orange Book with ownership data of publicly listed pharmaceutical companies from the Thomson Reuters Global Ownership Database.

Findings

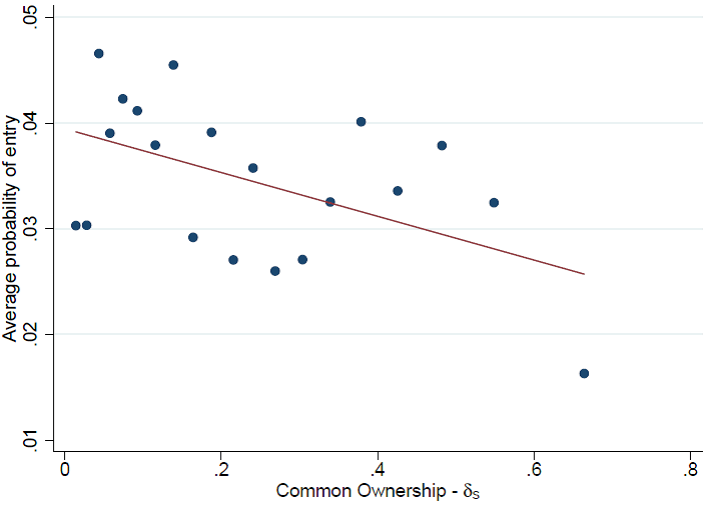

Equipped with a very rich database that consists of 451 drug product markets and 58,737 drug product-brand-generic observations, we show that a higher level of common ownership between a brand firm and a potential generic entrant is robustly linked with a lower probability of generic firm entry. This result is robust to several measures of common ownership, different econometric methods, different definitions of the set of potential entrants, different time horizons for the decision-making process, and different definitions of market size. The scatter plot of (the perfect substitute measure of) common ownership and the average probability of entry in Figure 2 illustrates the result.

Figure 2 Scatter plot on the probability of entry

Source: Newham, M., Seldeslachts, J. and Banal-Estañol, A. (2018).

All in all, the effect is large. A one-standard-deviation increase in the measures of common ownership decreases the probability of entry by that generic firm by 9–13%. Furthermore, our results indicate a non-linear impact of common ownership on entry, where high levels of common ownership have a much stronger impact than low levels. Still, the effect of any level of common ownership between the generic firm and the brand firm is smaller than the effect of the generic firm being fully owned by the brand firm (cross-ownership).

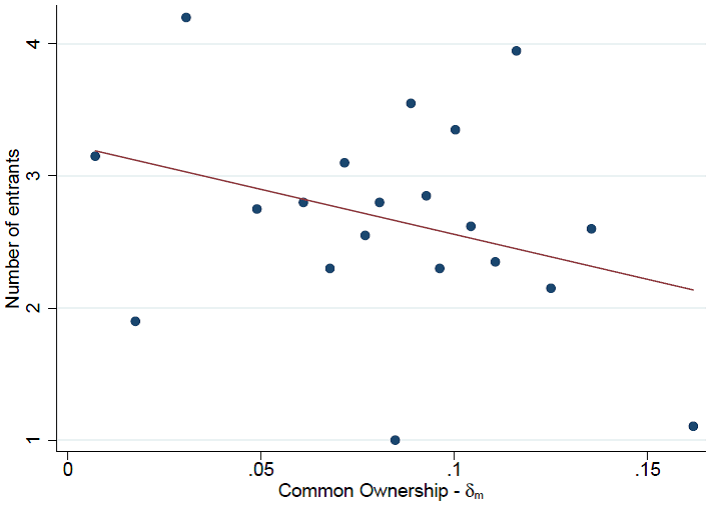

We also find that common ownership has an economically significant effect on total generic entry. We find that a one-standard-deviation increase in overall common ownership between the brand and all potential entrants decreases the total number of generics in that market by 11–13%. Our findings are robust to different potential sets of entrants, estimation methods and time windows, and account for endogeneity concerns. The scatter plot in Figure 3 illustrates this result.

Figure 3 Scatter plot on the number of entrants

Source: Newham, M., Seldeslachts, J. and Banal-Estañol, A. (2018).

Conclusion

This research contributes to the literature on the product market effects of common ownership, and informs the current debate. We provide evidence that is consistent with the hypothesis that common shareholders indeed influence strategic decisions of companies in an anticompetitive way. Given the importance of generic firm entry in terms of reducing drug prices and therefore overall healthcare costs, common ownership in the pharmaceutical industry may have the potential to raise the cost to consumers.

Economic theory is not unanimous on the impact of common ownership on product markets. Potentially, the impact could be so broad that some have described institutional investors’ interests in competing firms as the major new antitrust challenge of our time: they may lead to reduced competition, higher prices and, as we show here, less market entry. However, common ownership may be harmful in some contexts and beneficial in others, as it may also stimulate innovation.6 More in-depth research is required to ascertain which scenarios give rise to the various effects, and what the policy implications may be.

Albert Banal-Estañol, Melissa Newham and Jo Seldeslachts

1 Posner, E.A., Scott Morton, F.M. and Weyl, E.G. (2017), ‘A proposal to limit the anticompetitive power of institutional investors’, Antitrust Law Journal, forthcoming.

2 Azar, J., Schmalz, M. and Tecu, I. (2018), ‘Anti-competitive effects of common ownership’, Journal of Finance, forthcoming; and Azar, J., Raina, S. and Schmalz, M.C. (2016), ‘Ultimate ownership and bank competition’.

3 O’Brien, D.P. and Waehrer, K. (2017), ‘The Competitive effects of common ownership: we know less than we think’, Antitrust Law Journal, 81:3.

4 Pharmaceutical firms can be categorised as brand firms or generic firms. Brand firms undertake costly research and development to discover new medications and bring them to market. Generic firms, on the other hand, produce biologically identical replications of brand drugs at a much lower cost, after they have already been marketed as brand-name products. Generic firms are able to enter a particular drug market once the regulatory protections afforded to the brand product have expired.

5 Jacobo-Rubio, R., Turner, J. and Williams, J. (2017), ‘The Distribution of Surplus in the US Pharmaceutical Industry: Evidence from Paragraph (iv) Patent Litigation Decisions’.

6 Lopez, A.L. and Vives, X. (2018), ‘Cross-Ownership, R&D Spillovers, and Antitrust Policy’, Journal of Political Economy, forthcoming.

Download

Contact

Please get in touch at [email protected]

Guest authors

Albert Banal-Estañol

Melissa Newham

Jo Seldeslachts

Related

Download

Related

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More

A map of AI policies in the EEA and UK

Oxera offers an overview of AI-related policies in EEA countries and the UK through an interactive map. This AI Policy Map allows users to follow developments in AI regulation and examine national policy approaches in more detail. Artificial intelligence (AI) is driving technological change at an unprecedented pace, transforming industries,… Read More