The CMA 2020 water appeals: implications for economic regulation

Many key themes have arisen in the context of CMA 2020 water appeal. This appeal is the most significant for the England and Wales water sector since privatisation, in terms of the number of appellants, the proportion of industry revenue being assessed and the interest from across and outside the sector.

So far there have been over 60 third-party submissions to the CMA 2020 appeal, compared to just nine in 2015. The most recent appeal has seen twelve water companies submit evidence—including the four appellants and each of the large water and sewage companies—with only five smaller water companies yet to submit evidence. Other prominent third-party submissions include Ofgem, the Energy Networks Association (representing transmission and distribution system operators in Great Britain), Heathrow Airport and Professor Stephen Littlechild.

Background

Ofwat’s final determinations were published on 16 December 2019. Companies were challenged to cut bills by 12% on average (about £50) before inflation between 2020 and 2025. Bill reductions were driven both by a £6 billion efficiency challenge to costs across the industry and the lowest allowed return on capital (2.96% CPI-real) since privatisation.

Four water companies—Bristol Water, Northumbrian Water, Anglian Water and Yorkshire Water—are appealing Ofwat’s decisions, and their case has been referred to the Competition and Markets Authority (CMA) for a final ruling.

Following Ofwat’s referral to the CMA and initial submission in March 2020,1 the appellants set out the grounds for a redetermination in their statements of case (SoC), published in April.2 Ofwat responded to companies’ SoCs in a reply document in early May,3 with companies responding in late May.4

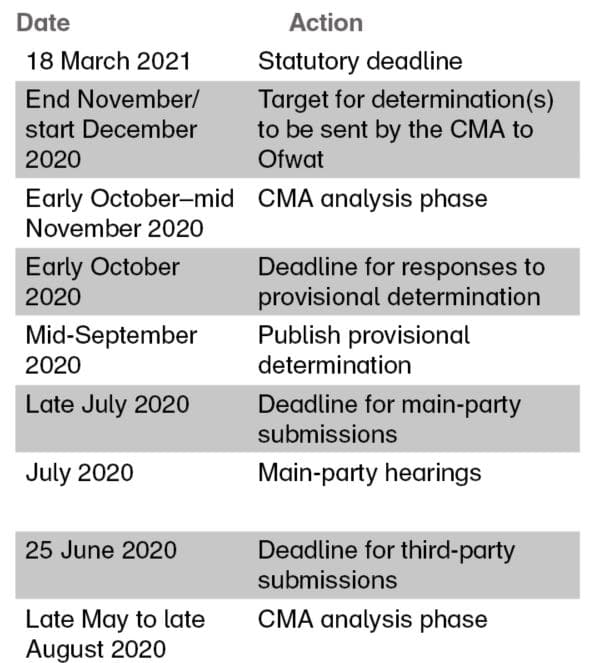

The timetable for the rest of the appeal is set out below, with the final report and decision expected by December 2020.

Key themes

The CMA review process is still at a relatively early stage, with main party hearings in July 2020 and provisional findings expected in September 2020. However, the material already submitted by Ofwat, the four appellants, the rest of the industry and other relevant parties give an indication of the regulatory issues that are likely to form the key areas of dispute. Moreover, the CMA has published its approach to the re-determinations.5

At least some of these issues are likely to remain relevant beyond the 2020 CMA appeal and the specific decisions that are made for the four appellants. These could have an impact on regulation not just for the England and Wales water sector, but across regulated sectors internationally.

- The trade-off between the short run and the long run—regulators need to strike a balance between the level of bills for current and future consumers, the financeability of the company, and provision of sufficient funding for resilience and future investment. This has been raised by a number of water companies and stakeholders from outside the industry.

- On the cost assessment side, specific areas of focus in the appeal include funding for capital maintenance and investment to meet future challenges such as decarbonisation and securing resilience.

- In addition, the appropriateness of bringing revenues forward through adjusting the pay-as-you-go (PAYG) rate and regulatory capital value (RCV) run-off rate to address financeability has been highlighted.

- This will be an area of focus for the CMA:6

[The CMA] note various Parties have argued that there is insufficient emphasis in Ofwat’s determinations on matters of long-term resilience and environmental impacts relative to levels of customer charges and affordability […]

and:7

[…] we will consider the appropriate split between ‘fast’ money (recovered from customers in this period) and ‘slow’ money (added to the RCV) for the relevant company. This will involve setting an appropriate pay-as-you-go (PAYG) rate and RCV runoff rate for each of the disputing companies […].

- Improving service quality and the trade-off with cost—the PR19 price review built on service quality improvements achieved in previous reviews, setting ‘stretching performance standards across all companies’.8 Submissions from both appellants and (third-party) companies that accepted the PR19 settlement have both disputed the extent to which these standards can be funded through allowed expenditure and the balance of risk and reward available through Ofwat’s outcome delivery incentives (ODIs).

- The CMA has stated that this will be a focus of its review:9

[…] [W]e note the disagreement between Ofwat and the four water companies on whether Ofwat’s determinations impose an excessive degree of stretch on the water companies […] When making our redeterminations we will consider the overall determination for each company, including the overall stretch or challenge (in regard to its cost efficiency, productivity improvement, performance and returns) […]. [emphasis added]

- Past performance and corporate behaviour—the England and Wales water sector has a long history of economic regulation—PR19 was the 6th price control since privatisation in 1989. In its submissions to the CMA Ofwat has presented evidence from past reviews, such as the extent of historical outperformance by specific appellants. It has also highlighted historical corporate behaviour, in particular the extent of dividend payments. While such information is valuable, given the possible extent of information asymmetries between companies and regulators, there is a fine line between using such information to inform future determinations and damaging regulatory incentives by extracting historical outperformance ex-post.

- In its approach document, the CMA has indicated that historical performance and behaviour will inform its settlement:10

As further context to our redeterminations, we will also be considering whether water company performance in previous price control periods sheds any light on how we should approach the redeterminations and particularly the matters in paragraph 33 [long term challenges and the stretch on cost and outcomes]. […] such evidence may be relevant in considering the appropriate redetermination on matters such as performance commitments, ODIs and rate of return.

- The COVID-19 context—the COVID-19 pandemic will have a number of implications for water companies over the 2020–25 period, including but not limited to financial markets and access to capital, growth, ability to meet performance commitments (in the short run), bad debt across the retail market and defaults in the business retail market. Ofwat, appellants and third parties have highlighted a number of specific risk or impacts.

- In its approach document the CMA clarifies that the pandemic will inform its determination where there is evidence to move away from the PR19 assumptions, for example using the most recent available market data in setting the weighted average cost of capital (WACC).11 However, it might not address the impacts where: (a) there are regulatory mechanisms in place to address these; (b) Ofwat will be making adjustments across the industry; (c) there is insufficient evidence.12

- Risk and return—the allowed return on capital at the PR19 final was the lowest since privatisation. Submissions from across the industry, including companies that accepted the PR19 final determinations have highlighted the challenges this presents and the impact on financeability. Key regulatory challenges faced by Ofwat (and now the CMA) include the extent to which companies’ historical financing decisions should affect the allowed return on capital and a downside skew on ODIs. Another contentious issue has been Ofwat’s introduction of a gearing outperformance mechanism, with division across the industry on whether this is appropriate.

- The CMA will consider each element of the WACC13 and the introduction of the gearing outperformance mechanism.14

- Stakeholder representation and the future of the RPI-X regulatory model—a number of submissions have highlighted challenges with the existing model of regulation. The customer engagement process leading up to PR19 was the largest to date, appellants have indicated areas in which they consider the customer view from this engagement to have been overridden by Ofwat. A submission by Stephen Littlechild questions the continued efficacy of the RPI-X regulatory model itself, with negotiated settlement presented as an alternative model both for the CMA appeal in progress and future price determinations more generally.15 Scottish Water’s submission outlined the advantages of WICS’ Ethical Business Regulation approach, fostering a collaborative approach across industry stakeholders and a focus on the long term.16 On this issue, the CMA has indicated that it intends to apply the same regulatory model as Ofwat, although it will consider revisions, removal or supplements of components of this:17

We are proposing using the same regulatory building blocks as Ofwat used in its determinations. However, we do not exclude the possibility of revisions to Ofwat’s approaches and methodologies, including consideration of whether approaches may be modified, simplified, or any aspects of the controls removed or supplemented.

Conclusion

The decisions the CMA makes in order to arrive at its redetermination are likely to influence future regulatory decisions in other sectors and jurisdictions. Regardless of the specific outcomes, the issues themselves are relevant across all of the regulated sectors. There is a clear read-across to the energy, transport and communications sectors, in particular with regard to the challenges of addressing climate change, long-term asset health and the impact of the COVID-19 pandemic.

Specific issues—such as setting an appropriate return on capital, establishing the efficient cost to deliver new outputs and accounting for past performance— are likely to be most applicable for water regulation in other jurisdictions and the energy sector. The concurrent NATS appeal to the CMA and third-party submission from Heathrow Airport highlights that some issues underpinning this appeal (in particular the cost of capital) may be relevant for regulation in the aviation sector as well.

For those sectors or jurisdictions that have implemented incentive regulation more recently, there are a number of lessons to be learned from how the regime has evolved in the England and Wales water sector.

1 CMA (2020), References from Ofwat, March.

2 CMA (2020), Statement of Case, April.

3 CMA (2020), Ofwat responses to Statement of Cases, May.

4 CMA (2020), Replies to Ofwat’s response to Statements of Case, May.

5 CMA (2020), ‘CMA’s approach to water redeterminations’, June.

6 Ibid., para. 33.

7 Ibid., para. 39.

8 Ofwat (2019), ‘PR19 final determinations: Overview of companies’ final determinations’, p. 3.

9 CMA (2020), ‘CMA’s approach to water redeterminations’, June, paras 33–34.

10 Ibid., para. 35.

11 Ibid., para. 63.

12 Ibid., para. 62.

13 Ibid., para. 48.

14 CMA (2020), ‘CMA’s approach to water redeterminations’, June, para. 52.

15 Stephen Littlechild (2020), ‘Submission to the CMA on Ofwat price determinations’, May.

16 Scottish Water (2020), ‘Third party submission to the CMA’.

17 CMA (2020), ‘CMA’s approach to water redeterminations’, June, para. 29.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More