Class actions: the end of the road for mobility scooters

In 2016 Dorothy Gibson made legal history by being the first representative to bring an action for competition damages under the UK’s new ‘opt-out’ collective proceedings regime. What can that case, which was ultimately withdrawn in May 2017, tell us about the economic and legal issues that will be central to these new class actions in the future?

Class action lawsuits have long been a hallmark of US litigation. These cases involve a lead set of representatives bringing a claim on behalf of a larger collective of unnamed individuals. In the USA, class actions can cover a wide variety of legal issues, from product liability to price-fixing cartels.1

Many European countries have recently developed, or are currently developing, class action-style regimes, including France, the Netherlands, Italy and the UK. These regimes have some similarities with the US framework, in that they typically allow claims to be brought on behalf of a large number of unnamed individuals (who have all suffered the same alleged harm) on an opt-out basis. ‘Opt-out’ means that if an individual fits the definition of the class, they will become bound by the outcome of the collective action unless they take the necessary steps to opt out in advance.

The rationale for these systems is twofold.

- First, class actions allow consumers to effectively bring claims that otherwise would be too costly to justify individually.

- Second, the opt-out nature of the system addresses a ‘chicken and egg’ problem that can prevent consumer associations and others from bringing claims on an ‘opt-in’ basis. Such cases need a large number of participants to get started, secure funding and obtain a reasonable position for settlement negotiations. However, until these aspects are in place, it is difficult to make the cases attractive enough for potential participants. In Europe, there have been two prominent opt-in actions in the last decade for competition-related consumer harm: one in the UK regarding replica football shirts (Which? vs JJB Sport); and another in France concerning mobile phone tariffs (the UFC Que Choisir ‘Cartel Mobile’ case).2 Both faced challenges in reaching sufficient scale.

It has yet to be seen whether this shift towards opt-out systems will lead to a large increase in the volume of class action claims. In addition, for the most part, the values of claims being brought through them are much smaller than seen in the USA. The European Commission has highlighted collective redress as an area that it would like to see develop across EU countries. In 2013, the Commission issued common principles that it was keen for member states to adopt—for example, that compensation should generally be calculated on a compensatory basis.3

There have been substantial developments in the UK class action framework in the last few months. The UK’s opt-out regime was implemented via the Consumer Rights Act 2015, which allowed cases to be brought from October 2015 for competition law infringements. The first case under this regime was brought in May 2016. As with any first-of-its-kind case, it faced many hurdles, and substantial legal and economic analysis was needed to advance the matter. This case had its class-certification court hearing in December 2016 and was concluded in May 2017, with the claim being withdrawn.

This article summarises the key points of the case, which concerned a claim about mobility scooters; and draws lessons from it for future cases of this kind.

The first UK case: mobility scooters

The UK’s national competition authority, the Office of Fair Trading (OFT; now subsumed into the Consumers and Markets Authority, CMA), has conducted numerous investigations into the market for mobility scooters in recent years. These are battery-powered scooters used predominantly by elderly or infirm people to allow them to be independently mobile.

In April 2012, the OFT issued a decision against one of the leading manufacturers of mobility scooters, Pride Mobility, and eight of its retailers, which concluded that Pride had engaged in practices that had the objective of preventing, restricting or distorting competition in the supply of mobility scooters in the UK.4

The OFT noted that it was Pride’s intention ‘to reduce price competition from the Internet in order to protect its brand and maintain retailer margins, thereby enabling Pride to achieve its “biggest revenue gain”, by maintaining demand for and sales of its products’.5

Specifically, Pride had sought to prohibit retailers from advertising online discounts that the retailers were applying to the recommended retail price (RRP) for certain models of mobility scooter. This was termed the ‘Below-RRP Online Price Advertising Prohibition’.

Are vertical agreements so bad?

Pride’s agreements with retailers are a form of vertical restraint, whereby the terms agreed between two firms at different stages of the value chain (i.e. an upstream and a downstream firm) establish restrictions on one or both parties’ behaviour. Competition authorities have raised concerns regarding consumer harm from certain types of vertical restraint in several markets—in particular, those regarding restrictions on minimum Internet prices6—but it is widely accepted that vertical restraints can also have procompetitive effects.

One potential rationale for wholesale businesses to impose vertical restraints is to prevent or limit ‘free-riding’ between retailers, and therefore maintain the pre- and after-sales service quality.7 Free-riding refers to a situation where it is costly for retailers to provide a pre-sales service for consumers, and therefore an individual retailer (perhaps an Internet-focused retailer) might have an incentive not to provide such a service itself and instead rely on other retailers (perhaps physical stores) to provide the service to consumers. Such free-riding can in turn reduce the incentive for the retailers that are offering the pre-sales service to continue to do so.

For example, consider a case in which a consumer tries out a range of laptops under the advice of an experienced salesperson in a city-centre electronics store, and then purchases their preferred laptop from a different online retailer at a discounted price. If this occurs repeatedly over time, the city-centre store may decide that it is no longer worth its while bearing the cost of providing the pre-sales service. In the longer term, therefore, free-riding unchecked by vertical controls could bring about lower retail service standards and a poorer quality experience of the underlying product.

Pride made similar arguments to justify its conduct, stating:8

[I]f service-oriented, showroom-based stockists ceased to be able to earn sufficient margin across a sufficient number of sales to cover their overhead costs, the service and choice provided by such stockists would, in time, cease to be accessible to end-users living in some geographical areas […].

In this case, however, the OFT disagreed and concluded that ‘the Below-RRP Online Price Advertising Prohibition, and the restriction of competition that flows from it, are not reasonably necessary for the attainment of these potential benefits’ regarding pre-sales and post-sales service.9 The OFT reported that a consequence of the practices was that ‘end consumers potentially paid higher prices’, and noted a particular concern that the practices were likely to have had a disproportionate impact, as consumers of mobility scooters are more likely to be vulnerable.10 This OFT decision formed the basis of the UK’s first-ever opt-out damages claim.

The claim on behalf of scooter buyers

The claim was brought by Dorothy Gibson, the chair of the National Pensioners Convention. She sought to represent buyers of certain Pride-branded mobility scooters in the UK on an opt-out basis. The proposed claimant class included around 30,000 individuals, and an estimate of pre-interest damages of around £4m, giving an average claim value in excess of £100 per class member.11 The claim was brought in the Competition Appeal Tribunal (the Tribunal), and Oxera acted as economic experts to the claimant.

Price rises, but for whom?

There was agreement between the claimant and defendant experts that Pride’s infringement could have had an upward impact on consumer prices for mobility scooters, including those consumers who had purchased scooter models from retailers that were not explicitly identified in the OFT decision. The Tribunal also noted that the OFT found that the online advertising restrictions had a ‘not insignificant’ impact on competition, and were ‘liable to lead to consumers paying higher prices’.12

However, there was disagreement about the size of the price effect and, in particular, the coverage of the claim.

Assessing the counterfactual

A key question addressed by the Tribunal was the appropriate counterfactual scenario—i.e. what the market would have looked like in the absence of Pride’s infringing conduct.

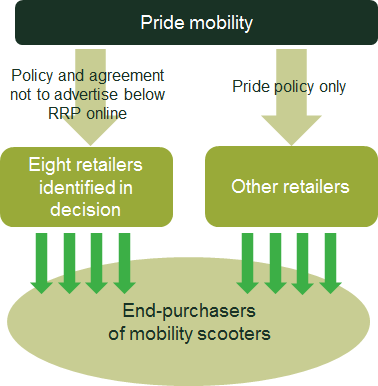

The definition of the counterfactual was complicated by the OFT’s finding that Pride followed a widespread policy of encouraging retailers not to advertise below-RRP prices online. This policy extended to retailers beyond the eight that, according to the OFT, had explicit agreements not to advertise online Pride reductions (see Figure 1). This raised the question of whether the factual situation should be compared with a counterfactual in which:

- there were no specific agreements with the eight retailers and no general policy to discourage advertising with other retailers; or

- there were no agreements with the eight retailers but Pride still applied a general policy to discourage advertising with all retailers.

The claimant’s case adopted counterfactual 1, assuming that the overall policy, and thus Pride’s strategy to interact with retailers, would have been different in the absence of the infringement. This would mean that Pride’s behaviour, that of the eight retailers that were the subject of the OFT’s decision, and that of Pride’s other retailers, would all have been different in the counterfactual. This leads to a wide class of consumers being directly affected.

In contrast, the defendant’s analysis followed counterfactual 2, focusing only on the agreements between Pride and the eight retailers that were identified in the OFT’s decision. This would mean that in the counterfactual, only these eight retailers would have behaved differently. This leads to a small class of consumers being directly affected, with a smaller ‘umbrella effect’ for other consumers (prices for these other consumers having risen underneath the raised ‘umbrella’ prices at the eight focal retailers).

Figure 1 Pride’s agreements and policy

There was extensive legal debate about this issue at the hearing. Pride was not in a dominant position, and thus the policy itself was not a breach of competition law. However, the agreements identified in the decision arose as a result of the policy, and therefore it is unclear if a realistic situation can be conceived in which there were no agreements, but the general policy persisted.

Ultimately, the Tribunal concluded that it was ‘correct that the OFT found that Pride had such a market-wide policy’ and that ‘since the policy applied across the dealer network and Pride had some 250-300 active dealers, it would be surprising if in fact only eight agreed to adhere to the policy’.13 However, the Tribunal also maintained that the policy was an antecedent of the eight infringements, not a consequence.

In the context of a follow-on action, this causal distinction was found to limit the scope of the conduct that could be included in the claim.14 The Tribunal concluded that allowing the claimant to include the ‘policy’ in its claim, as well as the eight agreements, would allow the claimant to expand its claim beyond the boundaries of the conduct that the OFT had found to be in breach of competition law,15 and include additional infringements within its damages calculation which had not been proven to exist.16

Despite the Tribunal inviting Dorothy Gibson to restate the claim, this decision was ultimately the factor that meant that the claim was unable to proceed. The lead lawyer for the claimant said that ‘it simply wouldn’t be worth enough to proceed because the costs of litigation would substantially exceed the amount of damages that could be recovered for consumers’.17

Lessons for future claims

There are a number of interesting lessons to draw from this claim that may inform future cases. We draw out two here.

First, it has been suggested that a market that is focused on negotiation-based pricing is not suitable for a collective proceeding. However, this judgment makes it clear that negotiation-based pricing alone is not an insurmountable barrier to the claims raising sufficient ‘common issues’ to be regarded as a class. The mobility scooter market was characterised by prices being agreed individually in stores or over the phone at a discount to the RRP. As such, a range of prices were charged for individual scooter models. The defendant argued that this meant that there was insufficient commonality between claimants to form a class, and that each individual claimant’s journey should be examined individually. However, the Tribunal noted that the method proposed by the claimant had recognised that there were likely to be ‘person-specific factors’ affecting the analysis, and that the method to calculate damages focused ‘on estimating the differential shift in prices across the sub-classes’.18

This issue matters, as many markets are subject to some degree of individual negotiation. For example, the fees charged for estate agency services (when selling a house) and freight forwarding (when shipping goods internationally) are typically negotiated rather than based purely on list prices. Both of these markets have been subject to investigations or decisions regarding anticompetitive conduct in recent years.19

Second, the rules under the UK system mean that economic evidence is key to whether a collective proceedings order (CPO) will be granted and a class action can go ahead. However, this evidence has quite a different emphasis to that found in a typical damages hearing. The Tribunal will look to be satisfied that the scale of the harm is such that the costs of the claim are justified, and that a suitably robust method can be conceived to calculate and allocate the damages in the later stages of the claim. Economic evidence can also play a role in defining the common issues of fact that are at issue for any proposed class or subclass. All of these points need to be addressed in order for a CPO to be granted. The mobility scooters case involved three substantial economic expert reports: two written by the claimant’s expert, and one by the defendant’s expert. It also involved almost a third of the court’s time being spent examining and cross-examining the claimant’s testifying expert.

The second case to seek to gain a CPO—a claim against Mastercard regarding its interchange fees levied for using its card network—also involved a substantial role for economic evidence, with expert reports being produced, and substantial court time being devoted to examining the experts orally.20

These cases are a reminder that in the UK, as in other regimes before it, opt-out class actions will require a close interplay between factual, legal and economic analyses.

Oxera acted as economic experts to the claimant in the Dorothy Gibson case.

1 See, for example, United States District Court, Eastern District of Louisiana, MDL – 2047 Chinese-Manufactured Drywall Products Liability Litigation and United States District Court, Northern District of California, MDL – 02420 Lithium-Ion Batteries Antitrust Litigation.

2 The Consumers Association vs JJB Sports PLC, Competition Appeal Tribunal; case registered in 2007. UFC Que Choisir operated the website cartelmobile.org to seek to gain critical mass for its claim; see the discussion in Hodges, C. (2008), The Reform of Class and Representative Actions in European Legal Systems, Bloomsbury, pp. 83–4.

3 European Commission (2013), ‘COMMISSION RECOMMENDATION of 11 June 2013 on common principles for injunctive and compensatory collective redress mechanisms in the Member States concerning violations of rights granted under Union Law’, Official Journal of the European Union, June.

4 Office of Fair Trading (2011), ‘OFT1374, Mobility aids, an OFT market study’, September.

5 Office of Fair Trading (2014), ‘Case CE/9578-12: Mobility scooters supplied by Pride Mobility Products Limited: prohibition on online advertising of prices below Pride’s RRP’, 27 March, para. 3.215.

6 See, for example, an Agenda article by CMA Inquiry Chair, Dr Philip Marsden: Marsden, P. (2015), ‘Competition and exercising consumer choice in online markets’, Agenda, February.

7 Oxera (2016), ‘Vertical restraints: new evidence from a business survey’, prepared for the Competition and Markets Authority by Oxera Consulting LLP and Accent, 24 March. See also Oxera (2016), ‘Why vertical restraints? New evidence from a business survey’, Agenda, April.

8 Office of Fair Trading (2014), ‘Case CE/9578-12: Mobility scooters supplied by Pride Mobility Products Limited: prohibition on online advertising of prices below Pride’s RRP’, 27 March, para. 3.234.

9 Office of Fair Trading (2014), ‘Case CE/9578-12: Mobility scooters supplied by Pride Mobility Products Limited: prohibition on online advertising of prices below Pride’s RRP’, 27 March, para. 3.237.

10 Office of Fair Trading (2014), ‘Case CE/9578-12: Mobility scooters supplied by Pride Mobility Products Limited: prohibition on online advertising of prices below Pride’s RRP’, 27 March, para. 1.20.

11 Competition Appeal Tribunal (2016), Case No. 1257/7/7/16 between Dorothy Gibson and Pride Mobility Products Limited, hearing transcript, 15 July, p. 9.

12 Competition Appeal Tribunal (2017), Case No. 1257/7/7/16 between Dorothy Gibson and Pride Mobility Products Limited, judgment, 31 March, para. 117c.

13 Competition Appeal Tribunal (2017), Case No. 1257/7/7/16 between Dorothy Gibson and Pride Mobility Products Limited, judgment, 31 March, para. 109.

14 As was made clear in the judgment, stand-alone or hybrid actions were time-barred by the Tribunal’s limitation rules.

15 Competition Appeal Tribunal (2017), Case No. 1257/7/7/16 between Dorothy Gibson and Pride Mobility Products Limited, judgment, 31 March, para. 106.

16 Competition Appeal Tribunal (2017), Case No. 1257/7/7/16 between Dorothy Gibson and Pride Mobility Products Limited, judgment, 31 March, para. 112.

17 Global Competition Review (2017), ‘Claimant withdraws UK’s first opt-out class certification request’, 15 May.

18 Competition Appeal Tribunal (2017), Case No. 1257/7/7/16 between Dorothy Gibson and Pride Mobility Products Limited, judgment, 31 March, para. 106.

19 Estate agency: Competition and Markets Authority (2017), ‘Somerset estate agents admit to price fixing’, press release, March. Freight forwarding: European Commission (2017), ‘Antitrust: Commission imposes €169 million fine on freight forwarders for operating four price fixing cartels’ press release, March.

20 Walter Hugh Merricks CBE vs Mastercard Incorporated and Others, Competition Appeal Tribunal.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More