Boding well for bidding analysis

In recent years, bidding data analysis has become a key part of merger assessment in Europe. It has been instrumental in merger decisions across sectors—from energy to complex manufacturing to life sciences. What kinds of analysis are conducted in these cases?

Analysis of bidding data in merger assessments is not new, but its use has increased following economist Paul Klemperer’s work in 2005,1 which dispelled the notion that the bidding process by itself ensures effective competition. Bidding data analysis has gained particular prominence in Europe in recent years through its use in assessing the closeness of competition, and thereby the likely merger effects, in a number of cases.

For example, it has played a critical role in mergers such as Baxter/Gambro and Zimmer/Biomet in the life sciences sector, Siemens/Dresser-Rand and GE/Alstom in the equipment manufacturing sector, and UPS/TNT and FedEx/TNT in the parcel delivery sector.2 In many of these cases, the European Commission’s analysis of bidding data from parties was central to the final decision. For instance, in Siemens/Dresser-Rand, the bidding data showed that the parties were not close competitors and the merger was cleared unconditionally. On the other hand, in GE/Alstom, the analysis showed the opposite and the clearance required divestments.

Similar analysis has been used in many other mergers, such as Acergy/Subsea 7 and Schlumberger/Smith International in the oil services sector.3 While the type of analysis in these cases was less detailed due to data constraints, it is likely to play a critical role in future oil and gas mergers because of the product and market characteristics of the sector (for example, in a number of product markets, oilfield services firms bid for a relatively small number of large contracts that last for several years).

So, what type of analysis is required in the presence of bidding markets, and what are the key elements that drive the results? This article discusses these issues in the context of a merger of two suppliers of a good or service. The same approach can be used to measure market power in other types of competition cases.

Types of bidding analysis

In the context of a merger, the essential questions are whether the merging parties are close competitors, and whether other players would impose sufficient competitive constraints on the merged entity. These questions remain the same irrespective of whether the competition between suppliers occurs:

- in the market, as in the case of ‘standard’ markets where there can be multiple suppliers at any one time; or

- for the market, as in the case of bidding markets where the supplier with the lowest price wins and only the winner of the (typically large) contract supplies the customer/market for a specified period of time.

In the former case, suppliers can change prices at any point, while in the latter, the supplier that wins charges the price agreed at the start of the contract.

In both cases, however, the elements of competition are similar. In a standard market, suppliers trade off the benefit from charging a higher price—i.e. a higher margin—against the ‘cost’ of earning that margin across a smaller customer base (assuming that some customers are put off by the higher price). In a bidding market, a supplier trades off a higher margin from a higher price (bid) against a lower probability of winning the contract.

Unlike in standard markets, the competitive dynamics in a bidding market occur during the bidding process. In the context of merger analysis, questions about the closeness of competition between merging parties, and questions of third-party constraints, can be evaluated using information on this process itself.

This assessment involves a number of questions, to the extent the relevant data is available.

- Participation (or frequency) analysis: how often do the merging parties participate in bidding for the same contracts? How many other suppliers participate in the same bid? If two parties always seem to bid for the same tenders, this might indicate that their product/offering is potentially substitutable and they are close competitors. However, two parties may be offering complementary products and services relating to the same market, and a distinction should therefore be made between different lots with different specifications (as was done in Siemens/Dresser-Rand).

It is also important to take account of the size of tenders in this analysis. For example, the parties might participate in only a limited number of common tenders, but these might be the largest ones. Accounting for the size of the tenders may indicate that parties are close competitors. Other bidders may, of course, impose further constraints on each party.

- Win/loss analysis: how often does one party lose to the other? If one party loses more often when the other participates than when the other party does not participate, this might indicate strong competitive constraints.

A win/loss analysis could involve simple techniques such as counting the number of wins and losses of one party in the presence and absence of the other, or more sophisticated techniques such as econometric analysis. The latter aims to measure whether the presence of one party affects the probability of the other party winning, after controlling for other influencing factors (for example, the number of other competing bidders and their characteristics—such as their experience and cost base).

- Runner-up analysis: for all tenders where both merging parties participate, how often is one party the runner-up when the other wins? This analysis can be very informative, as it shows not only whether competitors are close competitors, but also whether they are each other’s closest competitors.

For example, if the majority of wins for one party involve the other as runner-up, this would indicate that the parties are each other’s closest competitors. Further analysis of the positions and bids of third parties could then indicate whether they impose significant competitive constraints on the merging parties (assuming that the bids submitted by other parties are available).

- Margin analysis: does the participation of one party affect the price or margin of the other party? For example, if merging parties are close competitors, one party might offer a higher discount when the other party participates in the tender.

Not all merger assessments will involve all of the above analyses. The analysis conducted in a particular case will depend on the market characteristics and the data available. One key aspect that could, in principle, influence the type of analysis conducted is the information available to bidders about their competitors.

At one extreme, if bidders do not know the likely identities and strategies of any of the other bidders—even if they know how many suppliers are participating—each bidder will have similar expectations about others’ strategies and will bid based on this. In particular, for a specific level of bid/price, a supplier has a lower chance of winning if more bidders are participating. This in turn means that the supplier will bid more aggressively (i.e. bid a lower price) in the first place to increase its chance of winning. This setting can be approximated by the ‘first-price sealed bid’ auction structure developed in the economics literature, in which each supplier submits a private bid/price (i.e. not visible to anyone but the tenderer), after which the supplier with the lowest bid/price wins and supplies the product at its own submitted price.4 The box below shows the formula for the bid of each supplier under this setting, which depends on the bidder’s own costs and the number of participants in the tender.

How does a merger affect the likely outcome of such a tender and the price paid by the customer?

One simple way to model the effect of the merger is to reduce the number participants (n). This means that all participants would submit higher bids (or charge more) post-merger, as explained in the box. This is intuitive as the reduction by one participant increases the probability of each of the others winning and makes them less aggressive. In this case, all tenders in which the merging parties participated are relevant for the analysis.

In practice, however, suppliers may have some information about the likely strategies of other bidders. For example, with repeated and frequent tenders, bidders may learn the identity of their closest rival and may have a good idea of their likely bid. This might occur if contracts are relatively short, such that the set of potential suppliers are known and the market context is similar to the previous tender.

In this case, suppliers would not have the same expectations about all other bidders, and may indeed focus on the strategies of their closest rival(s). At an extreme, each bidder might focus on only its closest rival and not on any of the other bidders. In particular, each bidder would aim to undercut the expected bid of only its closest rival, irrespective of the number of other bidders or their bids. The outcome of such a tender in terms of the price paid by the customer can be approximated by the outcome of a second-price open-bid auction, or ‘Dutch flower auction’, in which each bidder publicly submits multiple rounds of bids/prices until only one bidder is left. This bidder wins and the customer pays the second-lowest bid/price.5 In this case, the merger would have an effect on the price paid by the customer only if the merging suppliers are the winner and the runner-up.

Closed bid and open outcry auctions

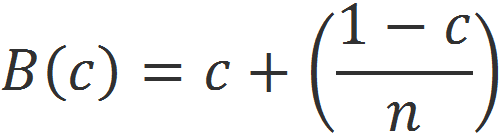

In a first-price closed bid procurement auction where each bidder does not have specific information about others, but only has an expectation about their strategies, the optimal bid depends on a bidder’s own cost (c) and the number of participants (n). Assuming that the bidders’ costs are normally distributed between 0 and 1, theory finds that each participant’s bid is the following:1

This formula shows that a participant’s bid will always go up if the number of participants goes down (as c<1), meaning that a merger will increase the price of all tenders that the two merging parties participate in.

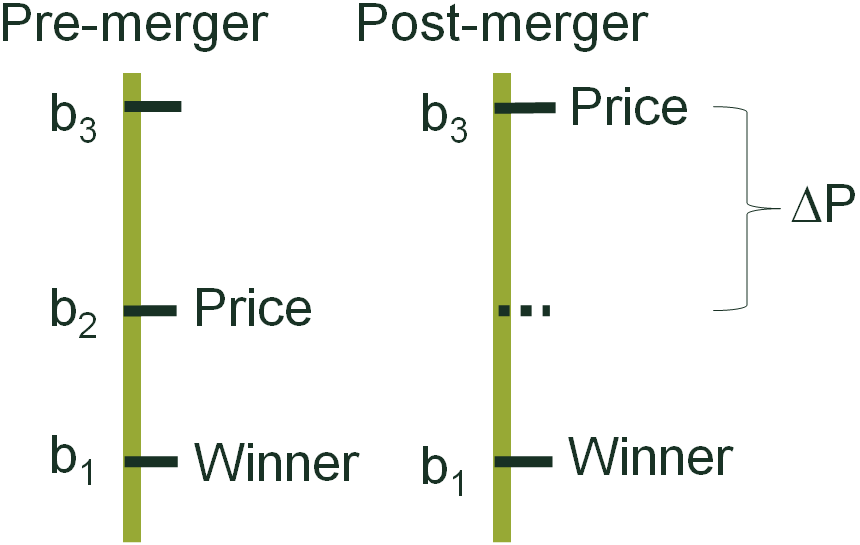

On the other hand, when bidders have information about other bidders’ costs and bids, for example in an open outcry auction, the price paid by the customer can be approximated by the theoretical model of a second-price auction. For example, suppose that there are three players, with bids b1<b2<b3 in a second-price auction. Pre-merger, firm 1 wins and the customer pays b2. Suppose that firm 1 and firm 2 are the merging parties. In this case, post-merger, if the merged entities’ costs are reflected by that of the more efficient party—i.e. by b1—it submits a bid equal to b1, and the runner-up is firm 3 with its bid at b3. Hence, the customer pays b3 post-merger instead of b2. This (b3 – b2) is therefore the price increase due to the merger.

Note: 1 Paarsch, H.J. and Hong, H. (2006), An Introduction to the Structural Econometrics of Auction Data, The MIT Press, p. 363.

How has bidding analysis been applied in recent cases?

The salient cases where such analysis was conducted recently were in the pharmaceutical and heavy equipment manufacturing sectors. Not all of the above analysis was conducted in each case due to the challenge of obtaining the required amount and quality of data.

For example, the European Commission applied some of the methods in Zimmer/Biomet, a merger between two large pharmaceutical firms where the main overlapping areas were the production of knee, hip, shoulder and elbow implants in multiple national markets in Europe. In this case, the Commission was able to perform participation tests and a win/loss test for some countries, which indicated that in several markets the two merging parties were each other’s closest competitors. The Commission used this finding, along with other evidence on the lack of switching between products among certain customer groups (here, hospitals), to conclude that the merger would raise concerns in several markets. The Commission was unable to conduct other analyses, such as margin analysis, because of difficulties with data collection.

However, a recent case in which most of the above analyses were possible was GE/Alstom, where the main area of concern was in the supply of heavy-duty gas turbines. In this case, the Commission had access to detailed tender data on the relevant date, customer, product/service, identities of winner and runner-up, number of other participants, and bids and margins of merging parties, and could perform participation, win/loss, margin and runner-up analysis. It found that GE encountered Siemens the most, followed by Alstom. It also found that, in a large number of tenders, GE and Alstom competed with only one other participant. The margin analysis indicated that GE’s margins, and its probability of winning, were both lower when Alstom participated in the tender.

There was also a debate about the design of the auctions. The parties submitted that the merger influenced only those tenders where GE and Alstom were numbers one and two, which fitted under the framework of an open second-price auction. This implies that the runner-up analysis is the relevant assessment, and, because Siemens was a significant third player, the impact of the merger would be limited as Siemens would be likely to be number one or two, or a close number three. However, the Commission found that bidders faced significant uncertainty and that a sealed bid auction framework was more appropriate, thereby implying that the merger would have had an impact on a wider set of tenders. The merger was ultimately cleared with the divestment of Alstom’s heavy-duty gas turbines business.

Bidding analysis has also been conducted in many other cases, although the level of complexity varies due to data constraints. For example, in Acergy/Subsea 7, only participation analysis was possible due to the limited data available. While this analysis helped the UK Office of Fair Trading to identify the markets in which there were a small number of competitors, the data did not allow extensive analysis of which competitors were the closest.6

Concluding remarks

There is no doubt that bidding analysis is now an integral part of merger assessment. While this does require quite detailed data for a comprehensive analysis, even simple analysis with limited data can be instructive. It is also important to ensure that the theoretical framework is appropriate. This is particularly so in cases where contracts are short and tendering is frequent, and where participants may have some information about their competitors, as in such cases the pure sealed bid auction framework, as often used in case assessments, may not be appropriate.

1 Klemperer, P. (2005), ‘Bidding Markets’, Competition Commission discussion paper.

2 European Commission (2013), Case No COMP/M.6851 – Baxter International / Gambro, 27 February; European Commission (2015), Case No COMP/M.7265 – Zimmer / Biomet, 30 March; European Commission (2015), Case No COMP/M.7429 – Siemens / Dresser-Rand, 29 June; European Commission (2015), Case No COMP/M.7278 – General Electric / Alstom, 8 September; European Commission (2013), Case No COMP/M.6570 – USP / TNT, 30 January; and European Commission (2016), Case No COMP/M.7630 – FedEx / TNT, 8 January. For further details of the European Commission’s approach in the GE/Alstom case, see Claici, A., Coublucq, D., Federico, G., Motta, M. and Saurí, L. (2016), ‘Recent Developments at DG Competition: 2015/16’, Review of Industrial Organisation, 22 October, pp. 1–27.

3 See Office of Fair Trading (2011), ‘Anticipated acquisition by Acergy SA of Subsea 7 Inc’, ME/4689/10, 2 February; European Commission (2010), Case No COMP/M.5839 – Schlumberger/ Smith International, 26 July. Oxera advised the merging parties in Acergy/Subsea 7.

4 In practice, the bid can be a combination of price, quality, service and other qualitative factors; it does not necessarily have only a monetary value. However, all relevant factors could be evaluated to assign an overall number to each bid, which could then be used to determine the winner.

5 Technically, the paid bid is one increment above the second-highest bid, as the winner has to overbid the runner-up by, say, €0.01, or €1,000, in order to win.

6 Office of Fair Trading (2011), ‘Anticipated acquisition by Acergy SA of Subsea 7 Inc’, ME/4689/10, 2 February.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More