AT&T–Time Warner: ‘Humans and Econs’ in merger assessment

In June 2018, the US District Court issued its decision to clear the proposed merger of AT&T and Time Warner, following an in-depth investigation and subsequent lawsuit by the Department of Justice (DOJ)—making this the first vertical merger to go to trial in the USA in 40 years. Oxera Partner, Maurice de Valois Turk, discusses the economics underlying the DOJ’s main theory of harm and why did it not convince the court.

Maurice joined Oxera in September 2018 after spending six years at Liberty Global. All views expressed in this article are his own.

The review of the vertical merger between US network operators AT&T and its satellite subsidiary DirecTV, and broadcaster Time Warner, has played out over the better part of the last two years. The case provides a wealth of topics to interest observers from industry, the legal community and the economics profession. In the words of the judge presiding over its appeal:1

If there ever were an antitrust case where the parties had a dramatically different assessment of the current state of the relevant market and a fundamentally different vision of its future development, this is the one. Small wonder it had to go to trial!

This article discusses the main theory of harm from the DOJ that attracted extensive debate during the court proceedings; namely that, following the transaction, the merging parties would have both the ability and incentive to increase the price of TV channels to rival broadcasting networks, ultimately to the detriment of consumers. More specifically, the case illustrates how the court assessed the economic analysis and other evidence to capture the effects of the merger on the ‘Kabuki-dance-like’ negotiations between broadcasters and network providers.2

The transaction and regulatory process

In October 2016 AT&T and Time Warner announced their intention to merge, in a transaction valued at US$85bn.

AT&T provides fixed and mobile communication services to more than 170m customers and 3m business-users in the USA, generating revenues in excess of US$150bn in 2017. In addition, it provides retail television services, following its acquisition in 2015 of satellite TV provider, DirecTV. The acquisition made AT&T the largest TV services provider in the USA, with over 25m customers.3 Time Warner is active as a content producer and channel broadcaster, operating the Warner Bros. movie studio; the HBO suite of channels; and the Turner family of channels (including CNN, TNT and Cartoon Network).

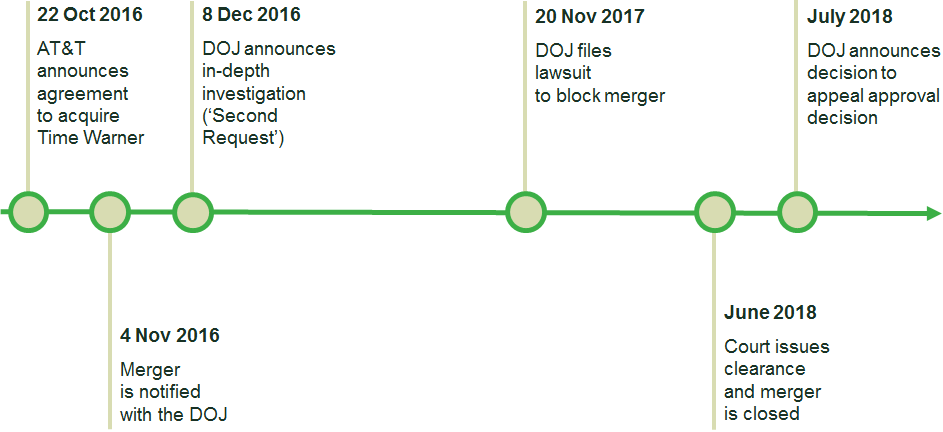

A timeline is shown in Figure 1, and the sequence of events ran as follows. On 4 November 2016, the parties submitted a regulatory filing to receive clearance from the DOJ. After a month of initial review, on 8 December 2016 the DOJ issued a second request initiating an in-depth investigation of the merger.

On 20 November 2017, the DOJ filed a lawsuit at the federal courts in a move to block the transaction,4 making this the only vertical merger to go to trial in the USA in the last 40 years.5

On 12 June 2018, the US District Court for the District of Columbia issued an ‘Opinion’ setting out why it concluded that the DOJ had not adequately proven the negative effects of the merger. In contrast to the DOJ position, the District Court proposed unconditional clearance. As such, on 14 June 2018, the parties were allowed to finalise their transaction, 20 months after signing. However, in July 2018, the DOJ appealed the decision, and announced that it would seek a review during the second half of 2018.

Figure 1 Timeline of the DOJ’s review of the deal

The DOJ’s theory of harm on bargaining leverage

The central theory of harm pursued by the DOJ was that the merger would lead to increased prices for consumers, as a result of worsened terms for AT&T’s network rivals (which purchase important channels and content from Time Warner). The DOJ claimed that the merged entity would enjoy an improved bargaining position as it negotiates terms of carriage for its content with rival broadcasting networks. In the terminology of the European Commission’s non-horizontal merger guidelines, this represents a ‘partial input foreclosure’ theory—i.e. AT&T’s broadcast network rivals will still be able to procure the Time Warner channels and content inputs they require from the merged entity, but on less favourable terms and conditions.6

Failure to reach an agreement typically results in a channel no longer being carried and the network’s customers seeing only a black screen—hence the term ‘blackout’. The content provider loses both the carriage fees on offer and the reach that the network provides (valued by advertisers), while the network loses the content it depends on to attract and retain subscribers.

The DOJ’s theory of harm was that the outcome of the negotiation would change because, post merger, Time Warner’s losses from not concluding a deal would be lower. The model used by the DOJ is based on the notion that, before a merger, reaching a content carriage agreement creates value for both the broadcast network (e.g. AT&T) and the content provider (e.g. Time Warner). Each party compares its outcome under an agreement with its outcome in the case of no deal (the outside option) and also its outcome during a temporary blackout, during which negotiations continue (the inside option).

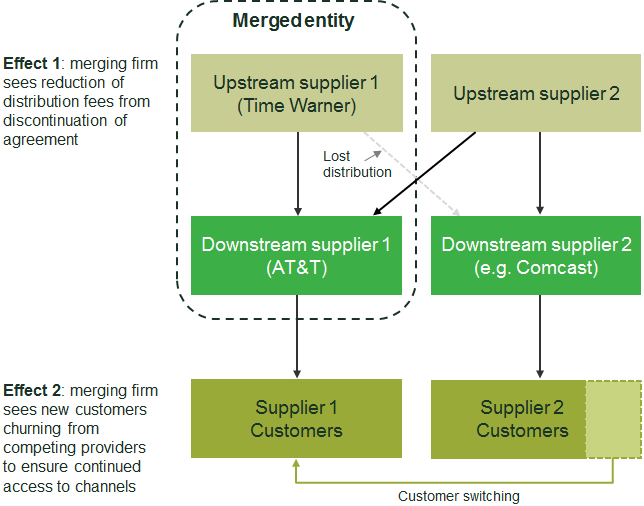

Under this framework, the transaction would reduce the loss in value faced by the merged parties if Time Warner failed to reach a deal with a rival broadcast network (such as Comcast). On the one hand, a blackout would have negative effects for Time Warner as it would forgo wholesale carriage fees and its advertising revenues would be weakened. On the other hand, the prospect of new customers switching to AT&T’s pay-TV service to access the Time Warner content that they value following the rival’s blackout would act to mitigate the lost Time Warner revenues. This would have the effect of improving Time Warner’s outside option in the negotiations, thus reducing its need to conclude a deal and increasing the price Comcast must pay to equally divide the gains from trade. This suggests that, even without a blackout (a ‘full input foreclosure’, in European Commission parlance), the increased threat of a blackout would be sufficient to worsen conditions for rivals and hence harm consumers. These effects are illustrated in Figure 2.

Figure 2 Effects of blacking out a rival broadcast network post merger

The (economic) evidence presented

One of the most interesting aspects of the case is how the judge assessed the economic evidence provided by the DOJ and the parties in respect of the principal theory of harm described above. The case saw a rich variety of evidence presented. Although one can argue that the weighing of evidence and the evidentiary thresholds are legal topics, some economic points are noteworthy for merging firms and their legal advisers. The three main issues are discussed below.

Testimonies from industry executives

Both sides made extensive use of testimonies from industry executives to argue their case. The DOJ put a number of third-party distributors on the stand, which indicated that they saw concerns around increased prices for content following the transaction. The merging parties, on the other hand, introduced testimonies by executives of broadcasters that were formerly part of vertically integrated firms. This group of executives included individuals from Time Warner as well as from Comcast/NBCU, a competing vertically integrated firm.

This second set of testimonies highlighted two points. The first was that the Comcast/NBCU executive at the broadcasting division was in no way (explicitly) instructed to bargain harder after merging with a network business. The second was that this executive’s colleague from Comcast’s network division was not aware of the DOJ’s theory of harm, either through direct knowledge or from company documents.

A number of managers from the merging parties, as well as from third-party broadcasters, were also asked to testify. These managers consistently reiterated their view that the value of broadcast rights is best maximised by wide distribution, and that total foreclosure would not be in the interests of broadcasters and network operators alike.7

These managerial testimonies indicated that there was no pressure on the broadcasting business from headquarters or the network side of the business to be more aggressive in negotiations with third-party broadcasters. Rather, the managers appeared to suggest that they were able to negotiate distribution agreements in relative isolation. Indeed, some of the managers referred to the fact that their business constituted a separate profit centre; this implied that they had the autonomy to consider the economic effects of a new distribution agreement on their own part of the business only.

No effects from prior transactions

Another significant piece of evidence was a study concluding that prior transactions that created or dissolved vertical integration between broadcasters and network operators did not have a material effect on the terms of distribution agreements. The parties highlighted the fact that both Time Warner and DirecTV had, in recent years, been part of vertically integrated firms. Furthermore, the parties had data from new carriage agreements with NBCU after Comcast acquired it in 2011.

The analysis aimed to test whether there was a statistically significant difference in the prices of content distribution agreements when such agreements were concluded by vertically integrated firms, as opposed to by stand-alone content businesses. The study claims to have been unable to establish such an effect.

Although this evidence did not account for the specific facts of the case at hand, the study had value as the data captured a period before and after similar transactions. It could therefore be argued to be a credible ‘natural experiment’.

Quantitative effects model

The third piece of evidence was the model developed by the DOJ’s economic expert. The model simulated the effects of partial foreclosure, in which third parties could still carry Time Warner channels, but on less favourable terms. It did this by simulating the revised outcome of a bargaining game (e.g. following the merger), where the cost for Time Warner from not reaching a distribution deal with a third-party network provider, and a subsequent blackout, were reduced following the merger.

The model estimated the effect of this change in bargaining leverage in terms of a total price increase for US consumers.8

A plausibility test on economic logic?

The above indicates that the evidence presented by the parties sought to discredit the DOJ’s theory of harm.

The effect of the parties’ evidence on the judge became apparent when Judge Richard Leon interrupted the testimony of the DOJ’s economic expert to test him on two key assumptions: (a) that it would be in the best interests of the vertically merged business to more extensively threaten to withhold content from third-party network operators; and (b) that it mattered for the negotiations whether a broadcaster was part of the vertically integrated firm.9

Judge Leon was highly sceptical of the validity of these assumptions in the DOJ’s economic analysis, in light of what in his view was very strong real-life evidence. In other words, he was questioning a central tenet in economics regarding joint profit maximisation post merger.

Economic theory has been challenged in this way in earlier cases, but rarely has it happened on this scale. For anyone preparing and working with economic evidence, this highlights two important perspectives: one old and one very new.

Perspective 1: Humans and Econs in (the US media) business

Let’s start with the new perspective. Does this case highlight that firms are not rational profit-maximising organisations, and that economics as we know it is dead?

No, but it does serve as an illustration of how practice does not always follow (economic) theory. In the last few years, there has been a surge of work in the field of behavioural economics. For example, the Nobel Prize for Economics has been awarded in recent years to two individuals—Daniel Kahneman in 2002, and Richard Thaler in 2017—whose extensive research is used to illustrate how individuals do not behave in the rational utility-maximising way that accepted economic theory sets out.

Thaler brings this point to life when he refers to ‘Humans’ and ‘Econs’ in his 2008 book, Nudge10 (written together with Cass Sunstein) and in his 2015 book, Misbehaving.11 It seems just a small (and not uncomfortable) step to make the further claim that a mix of Humans and Econs working together in an organisation would lead to a combined behaviour that is not optimal from the perspective of the firm as a whole. As such, there should be an opportunity for competition concerns based on economic theory to be validated in practice.

The ultimatum game

An example of how behavioural economics principles can play out in a bargaining situation is the ‘ultimatum game’. In this game, two players are presented with an award (normally a sum of money) that they must split between them. Player 1 is asked to propose a split of the award with Player 2. If Player 2 accepts the offer, both players get to keep their agreed share of the award. If player 2 rejects the proposed split, both players get nothing.

Traditional economic theory (based on rational profit maximisation) dictates that Player 1 should offer Player 2 a minimal amount, and that Player 2 should accept it (since any offer beats the alternative of no pay-out). However, in real-life experiments with real people and real awards, very different outcomes are observed.1

Perhaps unsurprisingly, the range of outcomes does tend to congregate around a 50:50 split, albeit with significant variation around this. This supports the notion that, with Humans, there is more at play during a negotiation than the Econs would like to admit. Beyond rational profit maximisation, there are also issues of fairness, business relationships, informational asymmetries, and bias.

Note: 1 Güth, W., Schmittberger, R. and Schwarze, B. (1982), ‘An Experimental Analysis of Ultimatum Bargaining’, Journal of Economic Behavior and Organization, 3:4, December, pp. 367–388; and Güth, W. and Kocher, M.G. (2014), ‘More than thirty years of ultimatum bargaining experiments: Motives, variations, and a survey of the recent literature’, Journal of Economic Behavior & Organization, 108(C), pp. 396–409.

Another possible explanation for why the joint profit maximisation assumption may not always hold is the agent–principal problem. This problem looks at incentive structure and how to ensure that the agent representing the principal is incentivised in such a way that its behaviour aligns with the principal’s objectives.12 Originally, the notion focused on shareholders as the principal and corporate executives as the agent. However, there is no reason to assume that it could not equally apply to a large corporate group, with headquarters being the principal and division management the agent. This theory aligns with some testimonies where managers from the broadcast division indicated that they focused simply on maximising distribution (as the main goal for their part of the business).

By providing a real-life example of the application of behavioural considerations in a merger context, the AT&T–Time Warner decision will have significance not just for US authorities, but also across the globe. For instance, the standard European Commission model applied to concerns about foreclosure introduces a framework that looks at ability, incentive, and effect on consumers. In this context, in terms of incentive, the test takes the idea of a single profit-maximising merged firm as a given. However, as the AT&T–Time Warner decision illustrates, an assumption is just that, and should be open to challenge and validation.

Of course, the context in which a theory is said to unfold matters, and again the AT&T–Time Warner case provides a useful insight. The DOJ’s vertical theory of harm requires that two disparate groups of managers in different parts of the newly merged firm are aware of each other’s strategic objectives and businesses operations. Furthermore, one of those management groups must also be willing to walk away from negotiations with a long-standing business partner, bringing an immediate negative consequence for them in return for the prospect of improved results in another part of the company. This requires a substantial degree of alignment in the managers’ understanding of the wider corporate strategy, and—importantly—in the personal incentives they face. As the testimony from executives in this case has shown, achieving this degree of alignment in the real world is a tall order. Care is needed when identifying theories of harm based on rational economic incentives alone, to ensure the anticipated behaviour is exhibited in real life.

Perspective 2: compelling economics still looks the same

As for the old perspective, this case underlines the fact that the hallmarks of compelling economic evidence remain the same as ever.

The DOJ presented a theory of harm that centred on the merged parties extracting a higher price for their content from rival broadcast networks (partial foreclosure), due to their improved outside option making the threat of a blackout (full foreclosure) more credible. However, it was unable to explain convincingly how the facts in this case were different from those in prior transactions where such effects had not materialised.

While the choice of economic model and parameters used forms a critical part of many competition cases—and rightfully so—it is rare to see the choice of the model and its central assumption being contested in this way. The AT&T–Time Warner case demonstrates the importance of ensuring that the theory aligns with real-world behaviour. The DOJ was not able to do this—at least not to Judge Leon’s standard. Following the Opinion, the DOJ has announced it will appeal the decision. In its appeal brief, the DOJ rightly claims that the notion of a rational profit-maximising firm has a solid foundation in economics and in law. It also claims that it has met the burden of proof to allow the court to prohibit the merger. At the same time, the parties are expected to reiterate their position that the DOJ’s model does not adequately reflect the real-world facts of the case. It will be interesting to see how the US courts weigh up these arguments.

In more than one way, this is a case to watch…although perhaps not on TV.

1 United States District Court for the District of Columbia (2018), ‘Memorandum opinion, 12 June (the ‘Opinion’), p. 1.

2 See Opinion, p. 17.

3 See Opinion, p. 28.

4 The US merger control regime is a prosecutorial model as opposed to the administrative model used by the European Commission. As such, the US competition authorities—the DOJ and the Federal Trade Commission—cannot block a merger. Rather, they need to prosecute the case before a court.

5 AT&T (2017), ‘DOJ: Vertical Merger Precedent’; and The Hill (2018), ‘AT&T-Time Warner ruling a milestone for vertical mergers’, 14 June.

6 European Commission (2008), ‘Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings’, 2008/C 265/07.

7 See Opinion, pp. 9–11. The Opinion also refers to one distinct difference between the US and European practices of selling TV advertising—namely that, in the USA, the network operator can also sell TV advertising space on the channels it carries (see Opinion, p. 10).

8 This approach is similar to those of ‘vertical GUPPI’ models deployed in other vertical cases. For an overview, see Oxera (2018), ‘Mind the vGUPPI! A new approach to vertical mergers in local markets’, Agenda, June.

9 See Opinion, pp. 112–116.

10 Thaler, R. and Sunstein, C. (2008), Nudge: Improving decisions about health, wealth, and happiness, Springer.

11 Thaler, R. (2015), Misbehaving: The Making of Behavioural Economics, Allen Lane (Penguin Books).

12 A landmark article in this area is Jensen, M.C. and Meckling, W.H. (1976), ‘Theory of the firm: Managerial behavior, agency costs and ownership structure’, Journal of Financial Economics, October, 3:4, pp. 305–360.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More