A promise of protection: a behavioural experiment into pension decisions

How does the presence of consumer protection affect decisions at retirement? Oxera undertook a behavioural experiment for the UK Financial Services Compensation Scheme (FSCS) to understand the role of FSCS protection—in both how consumers select their retirement income products, and whether they choose to obtain financial advice. This revealed how people behave in a realistic environment, providing insight into actual consumer behaviour and the importance of the FSCS in their decision-making.

Since the introduction of pension freedoms in the UK in April 2015, people have had more options for how to allocate their pension pot (before or at retirement). Retirees with defined-contribution pensions no longer need to buy an annuity, as was the case before the reforms. However, the new pension options come with differing degrees of risk and may have increased the need for consumers to seek financial advice.

Most people choose a retirement income product when they reach retirement. As this is a one-off decision, there is little opportunity to learn from past experience. There is currently also little opportunity to learn from others’ experiences, as the market is relatively new and the consequences of choosing an inappropriate retirement income product materialise over many years.

What is the impact of the FSCS on our pension decisions…?

The FSCS protects consumers when an authorised financial services firm goes bust.1 It provides some cover for retirement income products and for taking financial advice (see the box). The amount that the FSCS protects varies according to the product that the individual decides to buy, and ranges from £50,000 for investments to unlimited cover for long-term insurance such as pensions.2

In this context, the FSCS wanted to understand the role of FSCS protection both in how consumers choose their retirement income products, and in whether they decide to obtain financial advice. It therefore commissioned Oxera and the Centre for Experimental Social Sciences (CESS) to conduct a behavioural experiment into consumer decision-making.3

FSCS protection

The FSCS protects consumers in certain situations where (authorised) financial firms fail. It provides differing levels of cover for different retirement income products, and provides cover for using financial advice. Since its inception in 2001, the FSCS has helped 4.5m people and paid out over £26bn.1

The FSCS pays compensation to consumers of retirement income products when the authorised financial firm is unable to meet its commitments, with the amounts varying depending on the circumstances. FSCS protection covers:

- annuities from authorised financial firms—annuities are considered to be long-term insurance products, and the FSCS compensation limit is therefore no less than 100% of the value of the annuity;

- investment products from authorised financial firms—certain retirement income products are considered to be investments, which the FSCS covers up to £50,000 per person per firm. Income drawdown products invested in investment funds are thus covered if the provider of either the income drawdown product or the investment fund fails. However, peer-to-peer (P2P) lending is not covered by the FSCS—an income drawdown product invested in P2P lending would be covered if the income drawdown provider failed, but not if the P2P provider failed;

- cash deposits with authorised financial firms—cash deposits, such as those in a typical high-street bank savings account or cash ISA, are covered by the FSCS up to £85,000 per person per firm.

Some retirement income products are not covered by the FSCS. For example, if the consumer withdraws their savings to invest in property or the stock market, the FSCS would not cover the investment.

However, the FSCS does cover consumers if they obtain advice from an authorised financial adviser and make a claim against that firm for bad/misleading investment advice and the firm is unable to pay. The limit for compensation in the case of bad investment advice is £50,000 per person per firm.

Note: 1 See Financial Services Compensation Scheme (2017), ‘Annual Report and Accounts 2016/17’.

Source: Oxera, FSCS.

…Oxera and CESS conducted an innovative experiment to find out

A behavioural experiment was conducted rather than a survey of customer views. The experiment revealed what people actually choose in a realistic environment, whereas a survey would have provided information only on people’s stated preferences (which may deviate from what they would actually do in practice).

The realistic environment

The experiment was conducted online in a carefully created simulated environment. It used a sample of people reflective of the population as a whole (2,056 participants from the UK aged 45+). Participants were asked to make decisions about what to do with a pension pot on retirement, and whether they wanted financial advice, and were paid for their participation and the extent to which they paid attention.

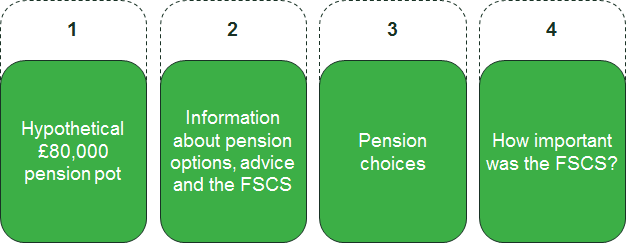

As shown in Figure 1, they were given a hypothetical £80,000 pension pot (1); provided with information about pension options (2); and then asked to make their product and advice choices (3).4 After this, participants were asked questions about these choices, including about the importance of the FSCS (4).

Figure 1 Structure of the experiment

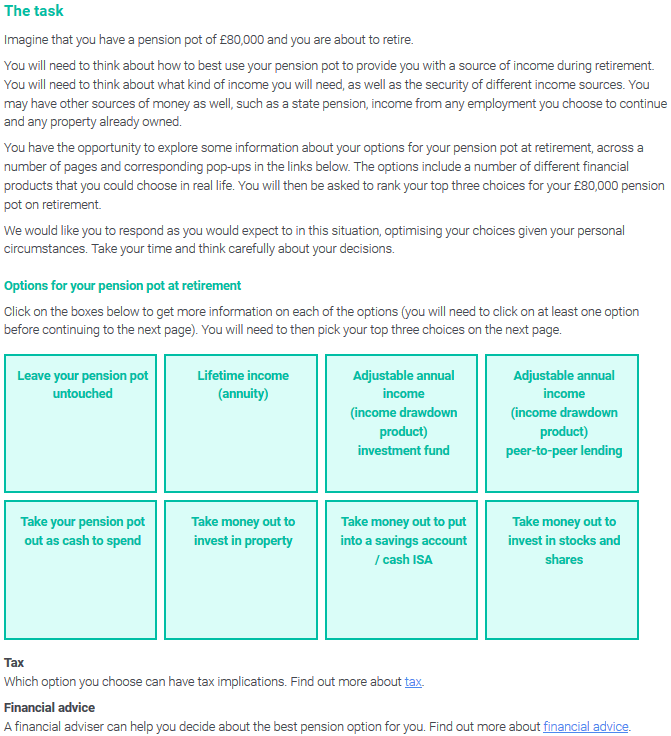

Participants in the experiment were presented with information on various retirement income products, modelled in a format similar to the UK government Pension Wise website, which provides pension advice to those nearing retirement.5

Information was provided on the product characteristics of eight options for retirement income; obtaining financial advice; taxation; scams; and FSCS coverage (which was varied in the different information treatments). Figure 2 shows how the product exploration choice screen looked.

Figure 2 Product exploration main screen

Source: Oxera and CESS.

The eight products that respondents were asked to choose from incorporated a variety of FSCS-protected and unprotected options, with a range of FSCS compensation limits. The experiment could therefore test whether views about the FSCS and the salience of the FSCS in the experiment nudged people towards FSCS-protected options.

Participants were then given the following two options.

- To select their preferred retirement income products. Participants were asked to choose their top three products (rather than just one product), to allow them to indicate relative preferences between products.

- To decide whether to take financial advice. If chosen, this would reduce the size of their pension pot by £1,500.

Participants also answered questions that explored their comprehension of the choices available to them and their preferences.

It is important to remember that, in this experiment, there was no ‘right’ or ‘wrong’ answer to the retirement product selections and choice of advice; the focus was on the choices made by participants in different circumstances. Participants were incentivised to pay attention only: after making their decisions, participants could earn a larger payout by correctly answering multiple-choice questions based on their comprehension.

It was found that participants were highly engaged in the experiment. Many provided quite lengthy comments in the open-text boxes about the drivers behind their choices, including issues around costs, trust in the financial system, protection from risk, and rates of return.

The treatments

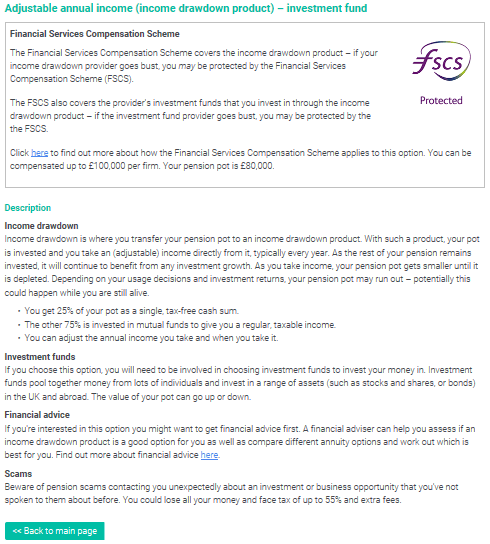

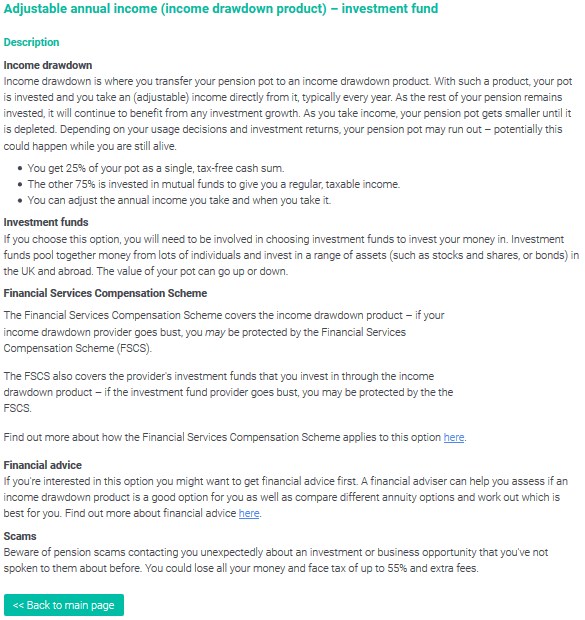

At this point came the main focus of the experiment. Participants were given differing sets of information about the FSCS, referred to as ‘treatments’. Some were given standard information (the ‘plain’ treatment), some were given more prominent, upfront information (the ‘salient’ treatment), and some were given no information at all about the FSCS (the ‘control’). The aim was to see how participants who were faced with different treatments varied in their decisions.

Figures 3 and 4 provide screenshots of the salient and plain treatments (for one particular pension income option).

Figure 3 Example: ‘salient’ information treatment

Figure 4 Example: ‘plain’ information treatment

What did the experiment find?

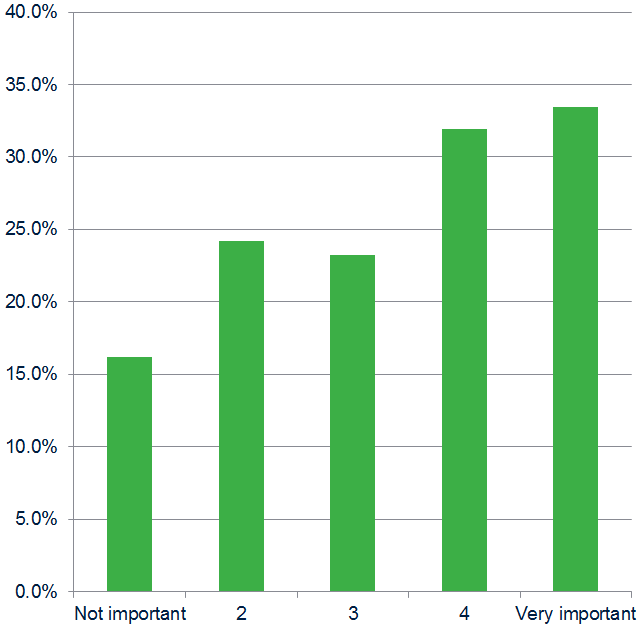

The research confirmed a high awareness of, and familiarity with, the FSCS among the over-45 age group: 70% of participants reported that they had previously heard about the FSCS. Furthermore, one-third of participants stated that the FSCS was very important to their pension decisions.

Despite high awareness of the FSCS, the presentation of more information on the FSCS still affected participant choices.

The results highlight the important role that the FSCS plays in the choice of retirement income product and financial advice. In particular:

- those who are aware of the FSCS or think that the FSCS is important are more likely to take independent financial advice (see Figure 5) and to choose retirement income products that are protected by the FSCS (although further work is required to see whether this relationship is causal);

- people think more carefully about what risks they are willing to take when they hear more about the FSCS. Upon being shown information about the FSCS at the point of decision, fewer people choose to withdraw their pension pot to invest it in stocks and shares;

- those choosing income drawdown products are more likely to take financial advice.

Figure 5 Proportion of participants choosing advice, by FSCS importance for product choice

Wider implications

With increased choice, the range of options now available to people means that the pension income decision has greater consequences for their future welfare. This makes it vital that people consider their pension choices carefully.

The results of this experiment highlight the important role that the FSCS played in the choices of many (but not all) of the participants in terms of retirement income products and financial advice. Demand for FSCS-protected products and advice is linked to the role of the FSCS in providing protection.

Furthermore, the provision of additional information about the FSCS in the experiment lowered the demand for products not protected by the FSCS. It is important that people are aware of the differing levels of coverage that the FSCS provides, depending on which retirement products they choose to purchase.

The experiment confirms that there is a fairly high degree of awareness of the FSCS, and that, while consumers may not be familiar with the precise details of FSCS protection, they do appear to be broadly aware of what it does, and does not, cover. It also shows that people use this information to inform themselves about the risks of the different products and the pension decisions that they make.

1 See Financial Services Compensation Scheme, ‘Thought leadership’.

2 See Financial Services Compensation Scheme, ‘What we cover: Pensions (Retirement savings)’, accessed 26 September 2017.

3 This article is based on Oxera (2018), ‘Choices for retirement income products and financial advice: the role of the Financial Services Compensation Scheme’, prepared for the Financial Services Compensation Scheme, 18 January.

4 The pension pot size of £80,000 was chosen as being above the current average defined-contribution pension pot size in the UK, since this figure is currently increasing due to the shift from defined-benefit to defined-contribution pension schemes. It was also chosen so that the difference in FSCS protection of annuities and investment products was a relevant consideration (the FSCS covers 100% of annuities and up to £50,000 per investment product). See Association of British Insurers (2017), ‘The new retirement market: the evolution continues’, 11 April, accessed 26 September 2017. An area for future research would be to test how the impact of the FSCS on consumer choices varies with the pension pot size.

5 See: https://www.pensionwise.gov.uk/en.

Download

Contact

Leon Fields

Senior ConsultantContributor

Related

Download

Related

Ofgem RIIO-3 Draft Determinations

On 1 July 2025, Ofgem published its Draft Determinations (DDs) for the RIIO-3 price control for the GB electricity transmission (ET), gas distribution (GD) and gas transmission (GT) sectors for the period 2026 to 2031.1 The DDs set out the envisaged regulatory framework, including the baseline cost allowances,… Read More

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More