A practical guide to the state aid rules to tackle the impact of COVID-19

At the time of writing this note, the health crisis caused by the COVID-19 pandemic has severely affected a number of EU Member States.

In addition to the severe impact of the pandemic on public health, its impact on the economy is expected to be significant: the European Commission estimates that real GDP growth in 2020 could decrease by 2.5 percentage points as a result. As real GDP growth in the EU was expected to be 1.4% in 2020, the Commission’s estimates suggest that real GDP growth could decline to -1% in 2020.1 Some sectors, such as healthcare, retail, tourism and transport, are likely to be more affected than others. For other sectors, such as banking, insurance, and financial services more generally, the impact as yet is unclear.

In addition to deploying the EU budget to bring immediate relief to the economy2 and setting up bespoke measures to respond to the pandemic,3 the Commission has responded to the crisis by publishing guidance to member states and companies as to the channels that state authorities can use to provide support. As the Commission has acknowledged, the main fiscal response to the pandemic will have to come from Member States’ national budgets, as opposed to the EU budget.4

Which state aid avenues are available?

In these exceptional circumstances, state aid rules provide Member States and companies three broad avenues to address the economic impact of the pandemic, as illustrated opposite.

Possible state aid avenues

Option 1: Art. 107(2)(b). Compensation for damages suffered as a result of the pandemic1

Option 2: Art. 107(3)(c). The Commission has introduced certain changes to the guidelines on staite aid for rescuing and restructuring of non-financial companies in difficulty2

Option 3: Art. 107(3)(b). State aid measures to remedy a serious disturbance to the economy such as the ongoing pandemic3

Note: 1 On 12 March the Commission approved the first state aid damages scheme as a result of the COVID-19 pandemic. See European Commission (2020), ‘State Aid SA.56685 (2020/N) – DK – Compensation scheme for cancellation of events related to COVID-19’, 12 March. The Commission has subsequently approved two more schemes under this option in Denmark and France. 2 European Commission (2014), ‘Guidelines on State aid for rescuing and restructuring non-financial undertakings in difficulty (2014/C 249/01)’, Official Journal of the European Union, 31 July. 3 At the time of writing, the Commission has approved various aid schemes, in Denmark, Estonia, France, Germany, Ireland, Italy, Latvia, Luxemburg, Portugal, Spain and the UK. For example, see European Commission (2020), ‘Aide d’État SA.56709 (2020/N)–France–COVID-19: Plan de sécurisation du financement des entreprises’, 21 March. For further information on the framework, see European Commission (2020), ‘Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak’, 19 March.

For options 1 and 3, the Commission has recently provided special guidance that Member States and aid beneficiaries need to comply with.5

Option 1. Compensation for damages incurred by a company as a result of the pandemic

On 17 March 2020, the Commission issued a checklist of the steps that claimants need to follow to request state aid for damages incurred as a result of the pandemic.6 The main details are illustrated in the following diagrams.

Checklist to claim for state aid damages

1. Description of the exceptional occurrence

- date of first case reported in the country and number of people affected at the time of notification

- data on economic impact of pandemic in the country and sector covered by the scheme

- sequence of main events between the occurrence and adoption of the scheme, including official recommendations / prohibitions from competent authorities

2. General description of the aid scheme1

- objectives of the scheme

- budget

- geographical scope

- form of aid and financing mechanism

- beneficiaries

- duration

- aid intensity

3. Description of the damage covered

- description of causal link between pandemic, damage sufferend and aid

- detailed description of type of damages compensated (e.g loss of income, additional costs)

- methodology used to assess damages (including certification of the documents by independent experts)

4. Description of the aid measure

- granting authority / competent authority

- description of the aid mechanism

- how does the mechanism ensure that the aid does not exceed damage suffered?

- how does the mechanism ensure that the scheme does not compensate for difficulties unrelated to the pandemic?

Note: 1 Damages could also be notified under an individual aid notification. Source: Oxera based on European Commission (2020), ‘Notification under Article 107(2)(b) TFEU’, 17 March.

Additional requirements for the transport sector

Option 2. Relieving acute liquidity needs under the rescuing and restructuring guidelines

On 13 March 2020, the Commission highlighted that certain exceptions to state aid rules for rescue and restructuring aid would apply in light of the COVID-19 pandemic. In particular:

- in light of the exceptional circumstances, companies that are not yet in financial difficulty could receive such support if they could demonstrate that their liquidity issues are linked to the pandemic; and

- companies that have received state support within the last 10 years may still be eligible for rescue aid in light of the circumstances.

The compatibility of the aid would still need to be assessed against criteria such as the common interest objectives of the aid, its appropriateness, the incentive effects, the proportionality of the aid, and the avoidance of undue negative effects on competition and trade.

Option 3. Remedying a serious disturbance to the economy

On 19 March 2020, the Commission issued a temporary framework setting out three main ways for member states to provide additional support to SMEs and large businesses:7

- up to €800,000 in direct grants, repayable advances, tax advantages (regardless of the size of the aid beneficiary) for urgent liquidity needs;8

- subsidised guarantees on bank loans, to cover both investment and working capital needs. The maximum underlying loan amount could be based on factors such as the company’s liquidity needs. The minimum guarantee premium is dependent on the length of the guarantee and the size of the aid beneficiary, as illustrated in the table below. Alternatively, member states may notify schemes that have been designed with reference to the minimum guarantee premia set out in the table, with appropriate adjustments to reflect any changes to the maturity, pricing and guarantee coverage (e.g. lower guarantee coverage offsetting a longer maturity).

Minimum guarantee premia, by type of recipient and timeframe

| Type of recipient | 1 year | 2–3 years | 4–6 years |

| SMEs | 25bps | 50bps | 100bps |

| Large enterprises | 50bps | 100bps | 200bps |

Source: European Commission (2020), ‘Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak’, 19 March.

- subsidised interest rates on state loans, which must carry an interest rate of at least the base rate plus a credit risk premium, in line with the requirements illustrated in the previous table.

The measures above are temporary, and as such, aid can be granted until 31 December 2020 only. In addition, the aid beneficiary will need to demonstrate that it was not in difficulty on 31 December 2019 (i.e. prior to the COVID-19 outbreak).9

In addition, the Commission points out that private financial institutions (e.g. private banks) can be used to channel aid, provided that the benefit of the aid is passed on to the final beneficiaries. As such, the financial intermediary would need to demonstrate the pass-through rate in a number of ways, including riskier portfolios, lower collateral requirements, or lower interest rates. Importantly, the Commission has stated that aid of this nature would not act as a trigger for bank resolution. This will avoid the need to meet the conditions for resolution (including burden-sharing by shareholders and subordinated creditors), before the aid is granted.10,11,12

Areas where a timely preparation of the economic and financial evidence will make a difference

Timely and robust economic and financial evidence is necessary to support a swift notification to the Commission (in case of individual aid) or to a Member State (in case of an aid scheme)—in particular in the following areas.

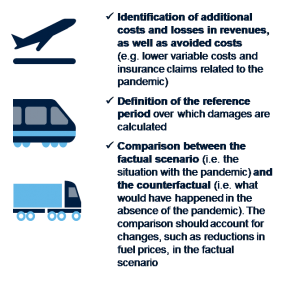

It will be important to isolate the impact of the coronavirus on the financial conditions of the aid beneficiary and to provide details on the types of damage (applicable to option 1) As recommended by the Commission for companies in the transport sector, a counterfactual analysis should be undertaken that involves designing and comparing a ‘factual scenario’ (i.e. the financial situation that the beneficiary finds itself in due to the COVID-19 pandemic) against a ‘counterfactual scenario’ (i.e. the beneficiary’s most likely financial situation in the absence of the COVID-19 pandemic).

The counterfactual scenario could be developed based on historical data and/or forecasts prepared by/for the beneficiary prior to the outbreak. This could include a review of business plans, strategic documents, industry reports, and contractual arrangements in place with suppliers and customers. The factual scenario will depend on the beneficiary’s degree of exposure to the crisis and how long it is expected to be influenced by it—i.e. the reference period, as well as the extent to which it is able to avoid certain costs, such as refunds from insurance companies, and lower commodity prices due to the crisis itself. As noted above, this is an area where the Commission has explicitly asked for certification by independent experts and where we expect to see greater scrutiny.

For companies seeking liquidity support under the rescuing and restructuring guidelines (applicable to option 2), it will be particularly important to assess the extent to which the undertaking is already suffering (or is likely to suffer) from liquidity issues due to the pandemic, the period over which it would need liquidity support, and what other financing support is available, e.g. undrawn credit facilities.

This analysis will need to be developed based on the latest financial data available prior to the COVID-19 outbreak. For example, to demonstrate that the liquidity issues are linked to the pandemic, the aid beneficiary should not have been in financial difficulty prior to 31 December 2019. Furthermore, any notification would need to consider the undertaking’s degree of exposure to the crisis, in terms of both revenues and costs, net of any expected cost reductions. For example, in the case of an airport that was required to close due to the impact of COVID-19, it is conceivable that its revenues will be close to zero. As for costs, it will need to be assessed whether the company would have the ability and incentive to rationalise its cost structure until the end of the crisis. At the same time, it will need to be borne in mind that, as economic theory suggests, in the short term a significant proportion of a company’s costs are likely to be fixed (i.e. cannot be altered in the short term).

It will also be important to demonstrate that the other compatibility criteria of the rescuing and restructuring guidelines are met, and in particular that the aid does not lead to significant distortions to competition and trade.

It will be necessary to demonstrate that the aid requested is limited to the minimum amount necessary (applicable to all options) and, as such, proportionate. For example, state guarantees and loans provided under option 3 should be limited to the company’s liquidity needs.13 This could be developed by reviewing any business plans or forecasts prepared before the outbreak and taking into account changes, such as cost rationalisation measures.

In light of the Commission’s flexibility around the use of guarantees on loans (applicable to option 3), it will be necessary to adjust the magnitude of the credit risk margin to reflect the selected maturity of the loan and guarantee coverage if beneficiaries decide to diverge from the combinations predetermined by the Commission.

Why Oxera?

Oxera is the leading economics and finance consultancy in the area of state aid. We have a strong track record in helping clients to achieve their objectives on a range of state aid issues in sectors ranging from transport, financial services, infrastructure and tourism, to energy, post and telecoms, and others.

Over the past two years alone, we have advised clients on over 40 state aid cases. We also have an excellent working relationship with the European Commission and the Chief Economist Team.

- During the financial crisis, we advised a number of financial institutions on state aid matters relating to rescuing and restructuring aid. In particular, we assisted them to design their restructuring plans in accordance with state aid rules. More generally, we supported them in notifying restructuring aid to the Commission in a timely manner. We undertook financial analysis to estimate and justify the amount of aid due. We also assessed the fundamental soundness and future viability of the financial institution’s core business and the appropriate amount of own contributions.

- We have in-depth knowledge of the transport sector, with a dedicated team of expert transport economists. We regularly advise airlines, airports, rail operators, ferry operators, sea ports, and bus companies on state aid issues. Our advice ranges from the compatibility of aid (including rescuing and restructuring aid) to the assessment of the market economy operator principle (MEOP). We have successfully supported many clients with their aid notifications and, in particular, demonstrated that their aid request is limited to the minimum, among the other required compatibility criteria, leading to the Commission approving the aid.

- We have in-depth experience advising clients on rescue and restructuring state aid matters. In particular, we advised DG Competition on the development of the Commission’s rescuing and restructuring guidelines that were introduced in 2014.14 Combined with this, and our extensive experience advising clients on rescue and restructuring aid cases in the financial services sector, we have advised several companies in the aviation and rail sectors on the successful notification of rescue and restructuring aid.

- We have advised clients on the design of state aid schemes across sectors including pharmaceuticals. We have also undertaken ex post evaluations to assess whether the design of the aid scheme led to its intended objectives being met.

1 European Commission (2020), ‘Annexes to Communication from the Commission to the European Parliament, the European Council, the Council, the European Central Bank, the European Investment Bank and the Eurogroup. Coordinated economic response to the COVID-19 Outbreak’, COM(2020) 112 final, 13 March, Annex 1.

2 The Commission has announced that the EU budget will be used to support hard-hit, small-to-medium sized enterprises (SMEs), and that credit holidays will be provided to existing debtors. In addition, the Commission will provide €37bn under the Coronavirus Response Investment Initiative. See European Commission (2020), ‘Communication from the Commission to the European Parliament, the European Council, the Council, the European Central Bank, the European Investment Bank and the Eurogroup, Coordinated economic response to the COVID-19 Outbreak’, COM(2020) 112 final, 13 March.

3 In addition to deploying €37bn under the Coronavirus Response Investment Initiative, the Commission has proposed to extend the scope of the EU Solidarity Fund to cover the public health crisis, which could mobilise up to €800m for the hardest-hit member states. See European Commission (2020), ‘COVID-19: Commission launches European team of scientific experts to strengthen EU coordination and medical response’, 17 March.

4 European Commission (2020), ‘Communication from the Commission to the European Parliament, the European Council, the Council, the European Central Bank, the European Investment Bank and the Eurogroup. Coordinated economic response to the COVID-19 Outbreak’, COM(2020) 112 final, 13 March, section 5.

5 In addition to these options, member states could provide de minimis aid and aid under the General Block Exemption Regulation (GBER). However, no changes are expected to the application of de minimis aid or the GBER. Aid provided under option 3 may be cumulated with de minimis aid.

6 European Commission (2020), ‘Notification under Article 107(2)(b) TFEU’, 17 March.

7 On 27 March 2020, the Commission announced that it is investigating possibilities to extend the Temporary Framework with further support measures, such as greater support for coronavirus related research and development, the construction and upgrades to testing facilities, the production of products to tackle the pandemic, targeted support in the form of tax deferrals and wage subsidies. An amended Temporary Framework is expected to be in place over the next few days. European Commission (2020), ‘Coronavirus: Commission Statement on consulting Member States on the proposal to extend State aid Temporary Framework’, 27 March.

8 These aid measures could be cumulated with other aid measures, such as state guarantees and loans. Specific provisions have been set out for companies in the agricultural, fishery and aquaculture sectors. See European Commission (2020), ‘Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak’, 19 March.

9 Subsidised guarantees on bank loans and subsidised interest rates on loans cannot be cumulated.

10 European Commission (2020), ‘Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak’, 19 March, p. 2.

11 The Temporary Framework also sets out measures for short-term export credit insurance. For further details, see European Commission (2020), ‘State aid: Commission amends Short-term export-credit insurance Communication in light of economic impact of coronavirus outbreak’, 27 March.

12 The Commission has also issued a notification template to facilitate compliance with the requirements set out in the Temporary Framework. See European Commission (2020), ‘Notification Template. Temporary Framework for state aid measures to support the economy in the current COVID-19 outbreak’, 25 March.

13 European Commission (2020), ‘Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak’, 19 March, sections 3.2 and 3.3; and European Commission (2014), ‘Guidelines on State aid for rescuing and restructuring non-financial undertakings in difficulty (2014/C 249/01)’, Official Journal of the European Union, 31 July, pp. 1–28, paras. 3.5.1 and 3.5.2.

In its recent approval of the Danish aid scheme, the Commission emphasises the need to ensure the proportionality of the aid: ‘in order to be compatible with Article 107(2)(b) TFEU (i.e. option 1), the aid must be proportional to the damage caused by the exceptional occurrence. Aid must not result in overcompensation of damage; it should only make good the damage caused by the exceptional occurrence’. See European Commission (2020), ‘State Aid SA.56685 (2020/N) – DK – Compensation scheme for cancellation of events related to COVID-19’, 12 March, paras 36–40.

14 Oxera (2009), ‘Should aid be granted to firms in difficulty? A study on counterfactual scenarios to restructuring state aid’, prepared for the European Commission, December, accessed 18 March 2020.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More