A flood of interest: Flood Re makes its mark

Flood Re, a pioneering flood insurance levy scheme in the UK, is celebrating its third birthday. Since its launch in April 2016, the scheme has helped over 200,000 households, and is now increasingly looking at how it can help the market to transition to ensure that Flood Re is no longer needed by 2039. Aidan Kerr, Director of Operations at Flood Re, explains the scheme’s history and underlying social purpose.

The views expressed in this article are those of the author.

Flooding is a traumatic experience. One of the key sources of anxiety for flooded householders is the uncertainty about whether insurance will, as a result, become unavailable or unaffordable—indeed, I have seen this create such stress that it can cause people to be hospitalised. This need—to ensure that affordable home insurance is available to those in need—drove the creation of Flood Re. Three years in, we can see that we have helped to make this a reality.

Difficult negotiations

Flood Re’s predecessor, the Statement of Principles (where insurance companies committed to make flood insurance a standard part of property insurance for domestic and small business policies, and the government committed to reducing flood risk),1 had been in place for the best part of a decade. However, it had a short-term shelf life, and was only ever intended to act as a sticking plaster to ensure that insurance options remained in place, in return for the government’s continued investment in flood risk management.

The Statement of Principles fell short as a framework for the provision of flood insurance: it never sought to ensure affordability for customers; it didn’t apply to new entrants to the home insurance market; and it wasn’t supported by data from government or the UK Environment Agency.

During the Statement of Principles’ shelf life, advances in mapping leaped forward and created better predictions of the places most at risk of flooding—meaning that we knew the challenges we were facing, but didn’t have the resources to tackle them.

It was clear that the Statement of Principles was no longer fit for purpose—for the market, for government and, most importantly, for customers. So the UK Association of British Insurers (ABI) asked Oxera to develop a new, sustainable market model for the provision of flood insurance by the private sector.2 The UK was unique in having a vibrant market where insurance against floods was widely available. This provided support to people who had the misfortune to experience flooding.

Building the right solution relied on building out from our common objectives and understanding the context and environment that we were operating in. The following were key factors that affected the design of the new policy.

- Designing a policy that would fit the UK’s social and economic context. Different societies will have different appetites for intervention in the free market—what is good for one country may not work for others. Enabling the availability and affordability of flood insurance in a proportionate way—by tackling just the problematic parts of the home insurance market—was clearly the preferred approach in the UK.

- Understanding the government’s core objective. The government was focused on doing what was necessary to make sure that taxpayers in areas at risk of flooding did not find themselves unable to recover from a flood. This was important both financially, as such communities would inevitably look to local and national government for support, and socially, as the public would see this as a public policy issue. However, the government was driven to make sure it wouldn’t become the ‘default insurer of last resort’, and wanted to avoid ending up with a contingent liability for flood risk. Such a contingent liability would mean it would hold on its balance sheet a liability relating to the chance of it incurring a big loss if a flood happened, which was not an attractive prospect.

- Ensuring that we delivered an affordable and accessible policy. For customers, it was simple: people in areas at risk of flooding needed to be able to access insurance. The significant uncertainty about the extent of surface water flooding means that many more customers could ultimately benefit from Flood Re than originally thought—an issue which is likely to worsen with climate change.

- Putting the customers at the heart of the solution. From the outset, Flood Re insurers had customer interests at the centre of their priorities. The industry did not want to be in a position where it was unable to help the very people who needed it most.

By constantly looking for the overlap in our objectives, we reached the point in June 2013 where we agreed a Memorandum of Understanding between government and the ABI, and Flood Re was born.

Delivery and implementation

Designing and agreeing the Memorandum of Understanding proved to be the easy stage. The hard work started when we began to build Flood Re itself.

For large parts of the programme, it felt like we were powering ahead and delivering real milestones for both the sector and customers, but with barely any time to celebrate or acknowledge successes before the next major milestone called.

Flood Re’s driver is to provide affordable flood cover for customers and communities by reinsuring the flood part of a home insurance policy at a rate that is lower than the technical (i.e. risk-reflective) price.

The funding for this comes from a national levy that every insurer that offers home insurance in the UK must pay into. This levy raises £180m every year, which covers the flood risks in home insurance policies.

A unique success of Flood Re is the use of ‘premium thresholds’—a key aspect which helps to ensure affordability. Under the premium thresholds, the scheme provides a progressive fee cost—ensuring that a lower reinsurance premium is applied to a Council Tax band A policy than to a band H home—delivering a public policy objective that was set early on.

Setting up the programme was complex and time-consuming; it required new systems, policies and processes to be designed from scratch. Not only did they need to be tested robustly, but they also had to secure the passage of legislation through Parliament, achieve regulatory authorisation by the Prudential Regulation Authority and Financial Conduct Authority, and secure data-sharing agreements with both government agencies and the insurers.

Finally, overnight on Sunday 3 April 2016, we received ten quote requests via our newly launched portal. These were for a certain Number 10 Downing Street, submitted by insurers to test connectivity to the system. It was at the point that we received a quote request relating to a Band B property in Leeds that we knew we had finally launched Flood Re, and we could start making a difference to the lives of people who live in areas at risk of flooding.

Progress to date

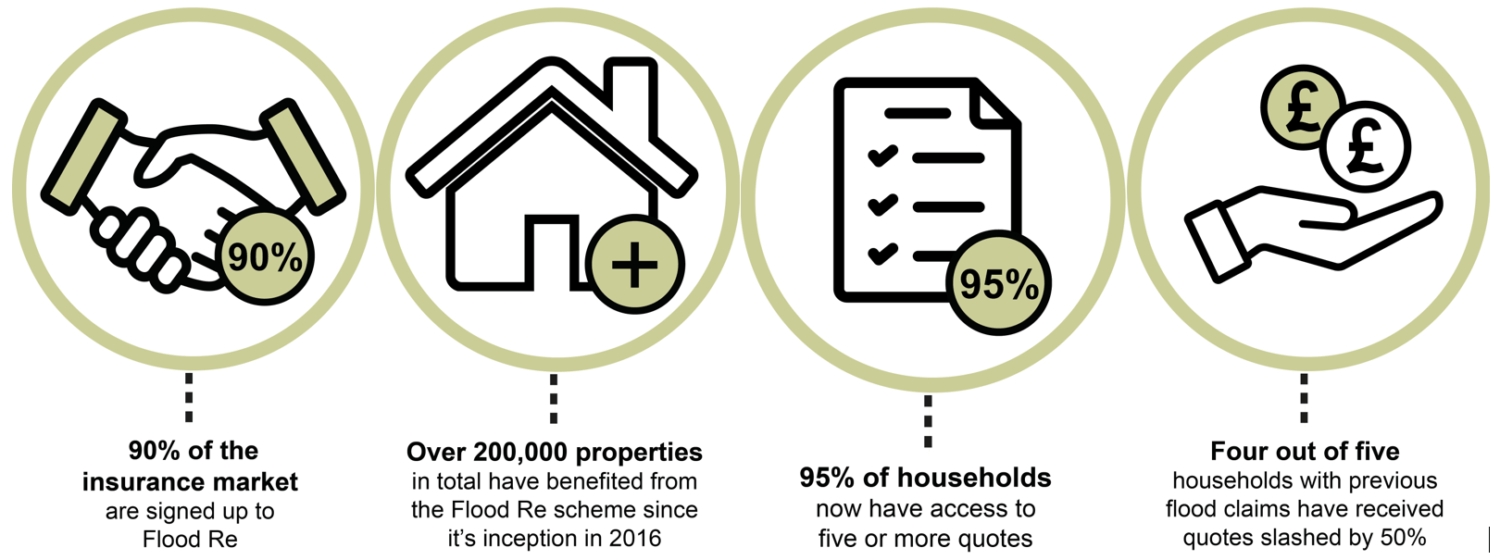

The figure below shows how far we have come.

Figure 1 Progress to date

The insurers that are signed up to use Flood Re represent 90% of the home insurance market. Over 80% of the market is available to customers, whether via direct insurers, affinity partnerships, brokers or software houses, and this number is continuing to grow.

By the end of our second year, over 150,000 policies had been ceded to Flood Re. Due to the dynamic nature of the scheme and the competitive nature of the home insurance market, over 200,000 properties in total have benefited from the Flood Re scheme since its inception.

More important, however, is what Flood Re has meant for customers.

- Before the introduction of Flood Re, only 9% of householders who had made prior flood claims could get quotes from two or more insurers. Now, 95% of those households have access to five or more quotes, and 81% of previous flood claimants can get ten or more quotes.

- Four out of five householders with previous flood claims have seen a reduction in the price of policies available to them of over 50%.

As we look to the future, we’re continuing to monitor our progress towards enabling the affordability and availability of home insurance for those living in areas at risk of flooding. But as these statistics show, and as hundreds of thousands of customers in areas at risk of flooding can now testify, Flood Re has already played the role we hoped it would.

Equally, our decision to reduce our premiums in January 2019 will further enhance affordability for many people with homes at risk of flooding.

Looking to the future

Alongside our aim to increase the availability and affordability of flood insurance, Flood Re is focused on managing the transition to affordable risk-reflective pricing over its lifetime.

In other words, when the Flood Re scheme expires in May 2039, home insurance premiums and excesses are expected to return to an open market, with flood risk fully reflected in the quotes offered to customers.

Flood Re’s aim and focus of work is to ensure that home insurance continues to remain widely available and affordable in areas at risk of flooding.

In July 2018 Flood Re released its second transition plan, ‘Flood Re, Our Vision: Securing a future of affordable flood insurance’.3 This vision sets out 12 areas where Flood Re believes things need to change.

These include limiting the risks of flooding; reducing the costs of flooding; promoting a competitive insurance market; and understanding the limits of affordability.

Key themes include the following.

- Defining affordability. An affordable market will be in place in 2039 if Flood Re can cease to exist without household insurance premiums and excesses for the majority of at-risk properties increasing, and without the penetration of household flood insurance reducing significantly in at-risk areas.

- A recognition that limits apply. For some households at the greatest risk of flooding, the investment needed to reduce risks will always be uneconomic. This means that, even with a successful transition, there will be a small number of households for which flood insurance is likely to be viewed as unaffordable. To tackle this, policymakers will need to decide whether some form of support continues beyond 2039. It is important that during the course of the next 21 years action is taken to reduce the number of properties that would fall into this category.

- Responsibility. Action will be needed from government bodies, the insurance industry and from householders.

To both achieve a transition to risk-reflective pricing and ensure that premiums and excesses remain affordable for the majority of households at risk of flooding, action will be needed from all interested parties, including the government, the insurance industry, communities, and individual householders themselves.

Flood Re will play an important role in supporting this activity, convening and coordinating and, where it can, taking direct action.

It is an ambitious vision. But given the difficulty in getting this far, and the obstacles we’ve overcome together—as a sector, government, communities and customers—even the most ambitious vision is possible if all our partners are committed and share a common purpose.

Aidan Kerr

1 For further details, see Association of British Insurers (2008), ‘Revised statement of principles on the provision of flood insurance’, July.

2 Oxera’s work was outlined in Oxera (2015), ‘Why does it always rain on me? A proposed framework for flood insurance’, Agenda, April.

3 Flood Re (2018), ‘Flood Re, Our Vision: Securing a future of affordable flood insurance’, July.

Download

Related

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More