The rise of the cryptoexchange giants: what next for trading cryptocurrencies?

Since the inception of Bitcoin over a decade ago, trading in cryptocurrencies has exploded. There are now thousands of cryptocurrencies and hundreds of cryptoexchanges to trade on, of which Binance is by far the largest. What is the secret of the few big cryptoexchanges, and is the high number of smaller cryptoexchanges sustainable? We look at the current landscape and competitive dynamics of the fast-evolving cryptoexchange market.

A cryptocurrency is a digital or virtual currency secured by cryptography. Bitcoin, invented by the elusive Satoshi Nakamoto and released in 2009, is commonly regarded as the first cryptocurrency.

Nakamoto’s original vision, as set out in his ‘White Paper’ that marked the start of the cryptocurrency era,1 was to create a peer-to-peer electronic cash system that would rely on a decentralised, consensus process to verify and validate individual transactions, rather than established financial institutions. The process is described in the box below.

How cryptocurrencies work

Bitcoin and other cryptocurrencies are permissionless forms of blockchain technology that rely on a ‘proof of work’ concept to verify transactions.

In such a system, transactions are verified by third parties (commonly referred to as ‘miners’) racing to be the first to solve a unique, complex mathematical problem that is specific to each transaction and the history of preceding transactions. The first miner to solve the problem records the answer in the decentralised blockchain along with its private key, thereby lengthening the chain. If the network confirms that this is the correct answer—by other miners also identifying the same solution—the first miner is rewarded with coins in the system.

Three features of the system make it robust to fraud: first, transactions are verified on a consensus basis (i.e. the majority of the network must agree that the transaction is correct). Second, the verification (mining) process is time- and energy-intensive and intentionally difficult to solve. Third, all transactions are linked, such that if someone wanted to change an earlier transaction they would need to redo all the subsequent mining and do so before the rest of the network approved the next block. Effectively, someone attempting to cheat a proof of work blockchain system would need to possess over 50% of the network’s computing power to do so.

Cryptocurrencies are yet to become common for payment purposes, and, given the technical and regulatory barriers, there is some debate about whether they ever will.2 However, they have sparked interest within the trading community, with some spectators estimating that as many as 50m people (globally) actively trade cryptocurrencies,3 and a survey by Fidelity Investments reporting that 22% of US institutional investors have some exposure to digital assets.4

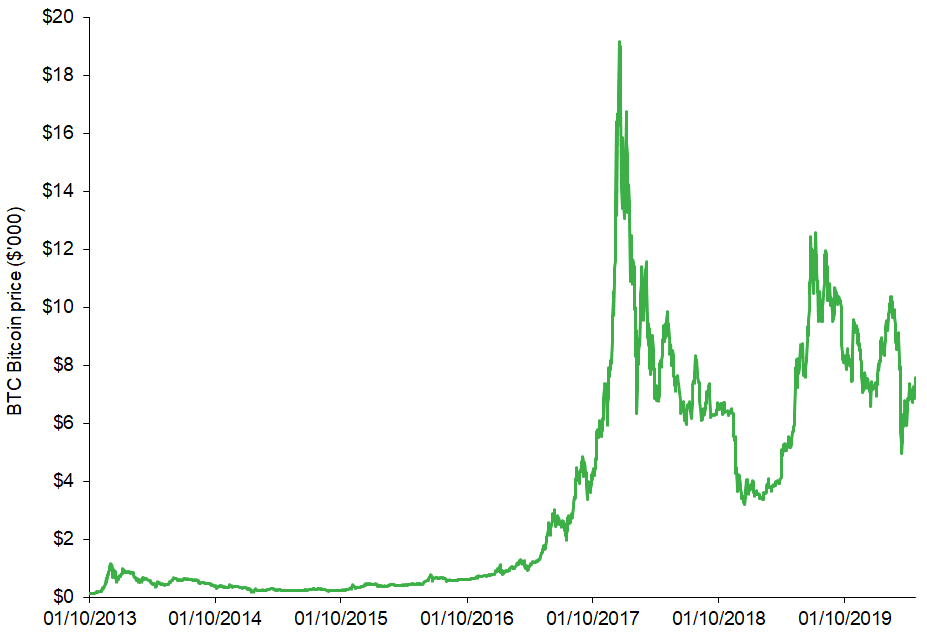

So how has trading in cryptocurrencies evolved? Bitcoin, the first cryptocurrency to be traded, is understood to have first been traded in 2013 for around $0.05,5 and its value has since increased greatly—but it has also suffered from extreme volatility. As shown in Figure 1, the price of BTC (the most widely held Bitcoin) peaked in December 2017 at close to $20,000, but a subsequent sell-off has resulted in fluctuations between $3,000 and $14,000 over the last two years.6

Figure 1 BTC Bitcoin price since October 2013

Source: CoinDesk, data accessed 24 April 2020.

Today there are over 7,000 cryptocurrencies in circulation.7 In comparison with other financial instruments, regulation of cryptocurrencies—and the exchanges on which they are traded—has only recently started to emerge and currently varies across countries. In February 2020, the International Organization of Securities Commissions (IOSCO) published its list of key issues and risks associated with the trading of cryptoassets to inform regulatory authorities.8

The prevailing limited scope of regulation has some important implications for cryptotraders and cryptoexchanges.9 Although the lack of regulation may make it easier for an exchange to set itself up, cryptotraders do not benefit from the same level of protection from market manipulation, insider trading and counterparty default that traders of regulated financial instruments (e.g. equities) would do.

The platforms on which cryptocurrencies can be traded are known as cryptoexchanges. In contrast to exchanges in other financial markets, there are hundreds of cryptoexchanges. For example, CoinGecko—a popular source of information on crypto markets—lists over 400 exchanges.10 Is demand for cryptotrading sufficient to sustain this number of exchanges, or is market consolidation inevitable? To answer this question, we need to look at the key economic features of cryptoexchanges.

The emergence of cryptoexchanges

Before the invention of cryptoexchanges, individuals could acquire Bitcoin only through mining or by arranging transactions in online forums.11 Early traders would transfer fiat (traditional, government-issued) currency in exchange for Bitcoin, via means such as bank transfer or PayPal. Bitcoin would then be deposited into their private crypto wallets.12

Following the emergence of cryptoexchanges, acquiring Bitcoin and other cryptocurrencies has become much simpler, but arguably more susceptible to fraud. The way trading has been organised resembles the traditional structure of the financial system for other financial instruments such as equities and derivatives—it consists mainly of centralised exchanges, with intermediary services such as wallets where the private and public keys to the cryptocurrencies in the blockchain are held. This means that, without a strong regulatory regime and supervision, these systems can be vulnerable to fraudulent activities, theft and market manipulation.

There are some decentralised exchanges that do not require an intermediary to act as a wallet provider, such as dYdX.13 However, these have not yet managed to attract the same liquidity as the largest centralised cryptoexchanges: dYdX is currently the largest decentralised exchange on CoinGecko, ranking 72nd out of all cryptoexchanges by 24-hour ‘normalised’ (i.e. averaged and sense-checked) trading volumes.14

bitcoinmarket.com is understood to have been the first cryptoexchange, going live on 17 March 2010.15 However, it no longer exists today, having suffered from issues such as fraudulent trades.16 Another exchange, Mt. Gox, was launched later in 2010 and grew to become the largest cryptoexchange in the world, reportedly handling 70% of all global Bitcoin trades by the start of 2014.17 However, by the end of February the same year it was bankrupt, having been the victim of a large-scale hack whereby a hacker manipulated the price of BTC and effectively managed to steal 750,000 coins out of the exchange’s crypto wallets, equivalent to around $480m at the time.18 Fraud and hackers remain important challenges that cryptoexchanges must protect against today.

So, what are the main cryptoexchanges now? Some of the largest are Binance (established in 2017), Coinbase Pro (established in 2012), Kraken (established in 2011) and Huobi Global (established in 2013). We discuss these further below.19

What services do cryptoexchanges provide?

As in other financial markets, cryptoexchanges provide a number of important functions, including:

- trading services—the ability to buy and sell cryptocurrencies;

- price formation—information about the consensus market value of cryptocurrencies;

- asset storage—most cryptoexchanges offer accounts or wallets typically stored in the cloud, where individuals can store their cryptoassets (i.e. public and private keys to access their coins in the blockchain) to make these directly available for trading on the exchange.

On this last point, once a coin has been bought or sold, the exchange will ensure its immediate transfer. Cryptocurrencies can also be stored in private wallets, either in hot wallets (which are connected to the Internet), or in cold wallets—which are not connected to the Internet and allow you to store your funds offline; one can still receive funds at any time, but no-one can transfer them out.

As with any marketplace, cryptoexchanges benefit from network externalities.20 As the number of traders on a cryptoexchange grows, the opportunities for traders to trade on that exchange increase and the exchange becomes more attractive to other traders. This can create a virtuous cycle whereby userbase growth perpetuates and the market tips to a small number of providers.

Will such tipping occur for cryptoexchanges? Has it already happened? Or are there other factors to consider? For example, as discussed in last month’s Agenda in focus article ‘Home advantage? Who wins in multi-sided platform competition?’,21 when the costs to users of multi-homing between platforms are low and/or the platforms are differentiated, tipping might not occur.

The current market landscape

It is difficult to know the exact number of cryptoexchanges at any moment, as they do not need to register with a central authority. What is certain is that there are many. While CoinGecko currently tracks over 400 cryptoexchanges, another website, Cryptimi, estimates that there are more than 500 in operation.22

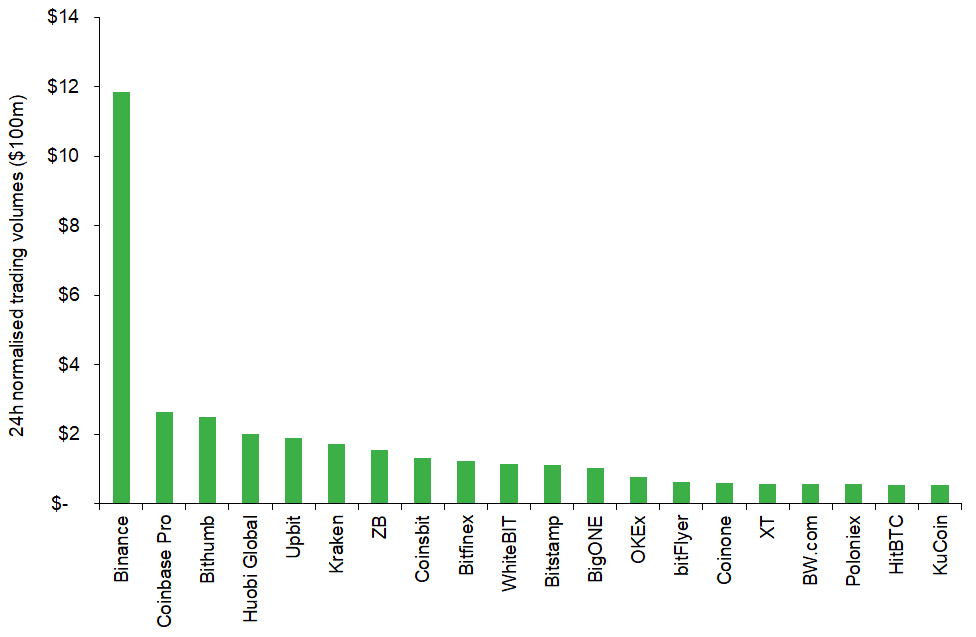

These cryptoexchanges handle very different volumes. Figure 2 shows the 20 cryptoexchanges with the highest 24-hour trading volumes, which demonstrates that Binance—the largest exchange—transacts over four times the trading volume of the next highest-ranking exchange.23 Cryptotrading volumes are volatile, but, according to CoinGecko trading value data, the five largest cryptoexchanges account for around half of all cryptotrading.24

Figure 2 Top 20 cryptoexchanges by 24-hour normalised trading volume

Source: CoinGecko, data accessed 27 April 2020.

As well as trading volume, the number of coins and coin pairs that are offered differs significantly across exchanges.25 Fewer than 20 cryptoexchanges currently offer more than 200 coins, and around 15 exchanges offer more than 400 coin pairs.26 Most cryptoexchanges are much smaller and offer fewer coins and coin pairs.

This gives rise to three questions:

- why are some exchanges larger than others?

- why are there so many small exchanges?

- is this many exchanges sustainable?

Why is there such a large difference in sizes across cryptoexchanges?

A couple of main factors seem to be key in determining whether a cryptoexchange becomes one of the largest providers:

- liquidity—in particular, liquidity in many coins and coin pairs;

- secure processes, which are perceived as (relatively) trustworthy by cryptotraders and market observers alike.

The influence of both factors was arguably compounded by the surge in trading activity that began in Q4 2017, which has been referred to as the ‘Crypto Gold Rush’.27 The largest cryptoexchanges entered ahead of this surge, and may thus have benefited from a first-mover advantage that at least some smaller exchanges missed out on.

Below, we explain why differences in liquidity and trust may lead to barriers in becoming a large exchange, and why smaller cryptoexchanges can struggle to catch up.

Liquidity

A liquid market allows traders to quickly buy and sell reasonable volumes of an asset at a similar price without having a significant impact on prevailing market prices.

There are network effects associated with liquidity. As the number of people trading a financial asset on an exchange increases, the number of opportunities for other traders to trade that asset also increases and, generally speaking, the exchange becomes more attractive.

Liquidity in one financial asset can also have positive externalities for liquidity in other financial assets—when traders wish to have exposures in both assets. This may be particularly relevant for cryptoexchanges, given the high number (over 7,000) of cryptocurrencies available, and as 22% of respondents to a 2018 cryptoexchange survey cited ‘lack of crypto pairs’ as a problem with current exchanges.28

One common measure of liquidity is the ‘bid–ask spread’. This reflects the difference between the highest price that a buyer is willing to pay for a financial instrument and the lowest price that a seller is willing to sell at. Other measures of liquidity include the volume that can be bought and sold at these prices, and price volatility.

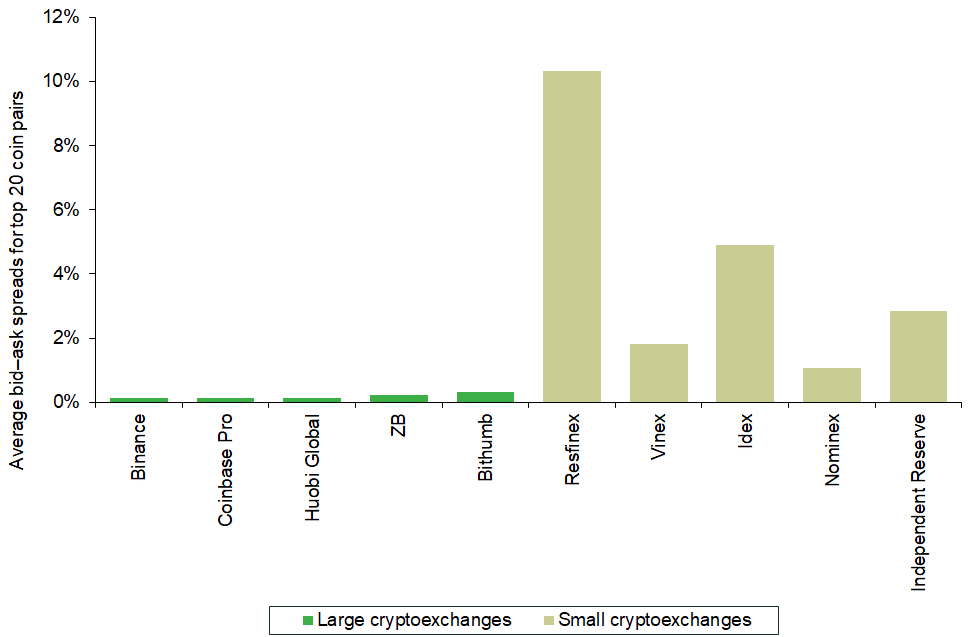

Figure 3 shows the average bid–ask spreads for the top 20 coin pairs for five large and five small cryptoexchanges. It shows that, for traders wishing to trade across multiple coin pairs, the cost of doing so is much higher on small exchanges than on large exchanges. Does this mean that small exchanges will be driven out of business? Not necessarily. There may be other features that attract traders to smaller exchanges. For example, two of the five most popular coin pairs on Resfinex, one of the small exchanges in the figure, are NPXS/ETH and RES/ETH, coin pairs that are currently not available on any of the five large exchanges presented.

Figure 3 Bid–ask spreads of coin pairs on cryptoexchanges

Source: CoinGecko, data accessed 24 April 2020.

Security and trust

As with any service that people entrust with their financial assets, security is paramount for cryptoexchanges to protect the coins held in the exchanges’ wallets.

Security and trust may be particularly important for cryptoexchanges, given the relatively limited protection that is currently provided by regulation, and given that hacks are not rare events—estimates of thefts from hacks to cryptoexchanges amounted to $164m in 2019.29 40% of respondents to the 2018 cryptoexchange survey mentioned above cited ‘security’ as the biggest problem with current exchanges, and that having assets that are safe from hackers is vital.30

Some of the largest exchanges have introduced measures to secure traders’ coins, such as Binance’s Secure Asset Fund for Users (SAFU) implemented in July 2018. The exchange pledged that 10% of all trading fees would be stored in a cold wallet to offer protection to users and their funds in extreme circumstances.31 Actions such as these create levels of trust that a smaller exchange may, in practice, struggle to compete with. This leads to a puzzle…

Why, then, are there so many small exchanges?

An important reason why so many cryptoexchanges exist, and why the active number is ever-changing,32 is likely to be the limited entry barriers.

Small cryptoexchanges may also have certain features that attract specific traders. For example, as mentioned above, some small exchanges specialise in more obscure coin pairs that are not available on larger exchanges. In addition, exchanges in countries with more volatile (fiat) currencies can still be cost-effective to local traders despite much wider crypto–crypto bid–ask spreads, by removing the need for local traders to first exchange their currency into foreign fiat currencies such as USD or GBP.33

Emerging academic research on price arbitrage opportunities in cryptocurrency markets finds that capital controls and differences in regulatory oversights may further explain why price differences between cryptoexchanges may persist.34

Is this many exchanges sustainable?

Overall, while small exchanges may not catch up in terms of trading volumes with large cryptoexchanges, had the market not changed, there would have been no strong reason to expect the long tail of smaller exchanges to disappear. However, there have been two important changes to the market in the first part of 2020: regulation, and the wide-ranging changes in market conditions caused by the COVID-19 pandemic.

Major regulatory bodies such as the EU and IOSCO are looking to tighten their policies on cryptoassets and cryptoexchanges respectively this year.35 The crypto markets have also been hit hard by the COVID-19 crisis. For example, the Bloomberg Galaxy Crypto Index (BGCI) fell by 58.5% between February and March, which is much greater than the 33.7% drop in the FTSE 100 during the same period.36

These events will increase costs, and may also alter demand for trading cryptocurrencies. All exchanges will need to be agile and adapt to both factors, but some smaller exchanges, particularly those with weaker security processes, may find these shocks too much to handle.

1 Nakamoto, S. (2008), ‘Bitcoin: A Peer-to-Peer Electronic Cash System’. The White Paper explained how Bitcoin would work and the underpinning ideology.

2 For example, questions have been raised over potential scalability issues regarding blockchain technology—see Yli-Huumo, J., Ko, D., Choi, S., Park, S and Smolander, K. (2016), ‘Where is Current Research on Blockchain Technology?—A Systematic Review’, PLOS ONE, 11:10. There are also monetary policy concerns—see He, D., Habermeier, K., Leckow, R., Haksar, V., Almeida, Y., Kashima, M., Kyriakos-Saad, N., Oura, H., Sedik, T.S., Stetsenko, N. and Verdugo-Yepes, C. (2016), ‘Virtual Currencies and Beyond: Initial Considerations’, IMF staff discussion note SDN/16/03, January.

3 Bucquet, P., Lermite, M. and Jo, A. (2019), ‘How many active crypto traders are there across the globe?’, Chappuis Halder, June.

4 Businesswire (2019), ‘New Research from Fidelity finds institutional investments in digital assets are likely to increase over the next five years’, 2 May.

5 Sedgwick, K. (2018), ‘Bitcoin History Part 6: The First Bitcoin Exchange’, bitcoin.com, 25 December.

6 See CoinDesk, ‘Bitcoin’.

7 CoinGecko (2020), https://www.coingecko.com/en

8 IOSCO (2020), ‘Issues, risks, and regulator considerations relating to crypto-asset trading platforms’, February.

9 Some security regulators have introduced regulation. For example, Malta passed its Virtual Financial Assets Act in 2018, providing rules to protect investors and support the industry’s growth. See Laws of Malta (2018), ‘Virtual Financial Assets Act’.

10 CoinGecko (2020), https://www.coingecko.com/en. CoinGecko is quoted here because its normalised trade volume methodology acts against potential misreporting of figures by cryptoexchanges.

11 Such as bitcointalk.org.

12 A crypto wallet is where keys are stored to access cryptocurrency that is stored on the blockchain system.

13 See: https://dydx.exchange/company/.

14 CoinGecko, accessed 27 April 2020. CoinGecko explains that it normalises trading volume data by combining it with web traffic data to reduce the impact of potential ‘wash trading’ and other manipulative behaviour. See Ong, B. (2019), ‘CoinGecko Introduces “Trust Score” to Combat Fake Exchange Volume Data’, CoinGecko, 13 May.

15 Sedgwick, K. (2018), ‘Bitcoin History Part 6: The First Bitcoin Exchange’, Bitcoin.com, 25 December.

16 Ibid.

17 Norry, A. (2020), ‘The History of the Mt Gox Hack: Bitcoin’s Biggest Heist’, Blockonomi, 31 March.

18 McLannahan, B. (2014), ‘Bitcoin exchange Mt Gox files for bankruptcy protection’, Financial Times, 28 February.

19 CoinGecko (2020), ‘Cryptocurrency Exchange Ranking by Trust Score (Spot)’.

20 See Oxera (2020), ‘Home advantage? Who wins in multi-sided platform competition?’, Agenda in focus, February.

21 See Oxera (2020), ‘Home advantage? Who wins in multi-sided platform competition?’, Agenda in focus, February.

22 Cryptimi (2020), ‘How many cryptocurrency exchanges are there?’.

23 CoinGecko, accessed 27 April 2020.

24 Based on trading values on 27 April 2020, when the concentration ratio for the top five exchanges was 47%. CoinGecko, accessed 27 April 2020.

25 A coin is a cryptocurrency used as an exchange of value, such as Bitcoin. A coin pair indicates the currencies being traded against each other, such as USD/BTC.

26 CoinGecko, accessed 27 April 2020.

27 For example, see Cellan-Jones, R. (2017), ‘Scenes from the crypto gold rush’, BBC News, 7 September.

28 Medium (2018), ‘Encrybit Revealed Real-time Cryptocurrency Exchange Problems — Survey Insights’, 14 May.

29 For example, see Watts, A. (2020), ‘Crypto Exchange Security: Approaches and Trends’, coincodex, 25 January.

30 Medium (2018), ‘Encrybit Revealed Real-time Cryptocurrency Exchange Problems — Survey Insights’, 14 May.

31 Binance Academy, ‘Secure Asset Fund for Users (SAFU)’.

32 Cryptimi (2020), ‘How many cryptocurrency exchanges are there?’.

33 Mikhelidze, G. (2019), ‘What could happen to smaller cryptocurrency exchanges in the future?’, The Cryptonomist, 19 September.

34 Makarov, I. and Schoar, A. (2018), ‘Trading and arbitrage in cryptocurrency markets’, working paper no. 63, December.

35 See Houben, R. and Snyers, A. (2020), ‘Crypto-assets: Key developments, regulatory concerns and responses’; and IOSCO (2020), ‘IOSCO publishes key considerations for regulating crypto-asset trading platforms’.

36 The BGCI is a an index that measures the performance of the largest cryptocurrencies traded in USD. Data from London Stock Exchange; and Bloomberg.

Download

Related

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More

Consumer Duty board reports: are firms prepared for the July 2024 deadline?

The UK Financial Conduct Authority’s (FCA) Consumer Duty, a new outcomes-based regulation for financial services firms, has now been in force for over six months. July 2024 will see the deadline for the first annual Consumer Duty board reports. We share our reflections on the importance of these documents and… Read More