Stock-ing up: the design of equity trading markets in Europe

Equity markets, where investors buy and sell shares, are crucial to the European economy. Regulatory change has opened up competition, leading to more choice and lower trading fees, but also fragmentation and risks to price formation. There is an ongoing debate about the provision of market data services that often overlooks the links between market data services, trading and price formation. How is equity trading functioning from a market design and an end-investor perspective?

This article is based on Oxera (2019), ‘The design of equity trading markets in Europe: an economic analysis of price formation and market data services’, prepared for Federation of European Securities Exchanges, March.

Equity markets are where investors meet to buy and sell shares in a firm. These markets lie at the heart of all modern economies. Strong equity markets can unlock investment and channel it to firms that need to expand and create jobs. They provide households with better options to meet their retirement goals, and they help to connect financing to investment projects.

The typical place where investors meet (nowadays, virtually) to buy and sell shares in a firm is the stock exchange. These have been around for many years. Their origins can be traced back to the trading of shares in the Netherlands in the early 17th century, and perhaps even to the trading of notes and bills in the medieval markets of Frankfurt in the 11th century.

Over the last two decades, equity trading in Europe has witnessed radical transformation. Regulatory reform and technological change have reshaped its competitive dynamics and market design.

This article looks at the impact of the EU’s Markets in Financial Instruments Directive (MiFID I, 2004) and MiFID II (2018) on equity markets, and the current debate about the design and functioning of equity trading.1 It also discusses the links between trading, price formation, and the provision of market data.

Introducing competition

In the past, a stock would typically trade on only one, or possibly two, exchanges. Businesses would trade on the exchange on which they were listed—i.e. there was a direct connection between the primary and the secondary markets.2

In Europe, this changed in 2007 with the introduction of MiFID I. Since then, trading of a stock has no longer been limited to the platform on which it is listed. Competition for equity trading was opened up, leading to a rise in trading venues that competed for trading activity in the secondary market with the traditional stock exchanges.

New-entrant trading venues, including BATS (now part of Cboe), Chi-X (now also part of Cboe), Turquoise (now part of the London Stock Exchange Group) and Burgundy (now part of Oslo Børs) have emerged to compete for equity trading.

As a result, market shares of order book trading have shifted from the primary stock exchanges to alternative trading venues. For example, the market share of French (CAC-listed) shares and Norwegian (OBX-listed) shares trading on the primary stock exchange (Euronext and Oslo Børs, respectively) fell to around 60% in 2018.3

Cboe and Turquoise have emerged as two strong players and they have captured significant market share. In 2018, about 25% of European shares were traded on a Cboe platform and 5% on Turquoise.4 Dark trading (i.e. trades where orders are hidden prior to execution such as on dark pools and over-the-counter, OTC, trading) has also grown significantly. When all off-exchange trading is taken into account, the share of equity trading on primary stock exchanges has fallen below 40%.5

A similar pattern has occurred in other parts of the world, including the USA, Canada and Australia. Regulatory reforms have resulted in substantial competition for trading services in these markets.6

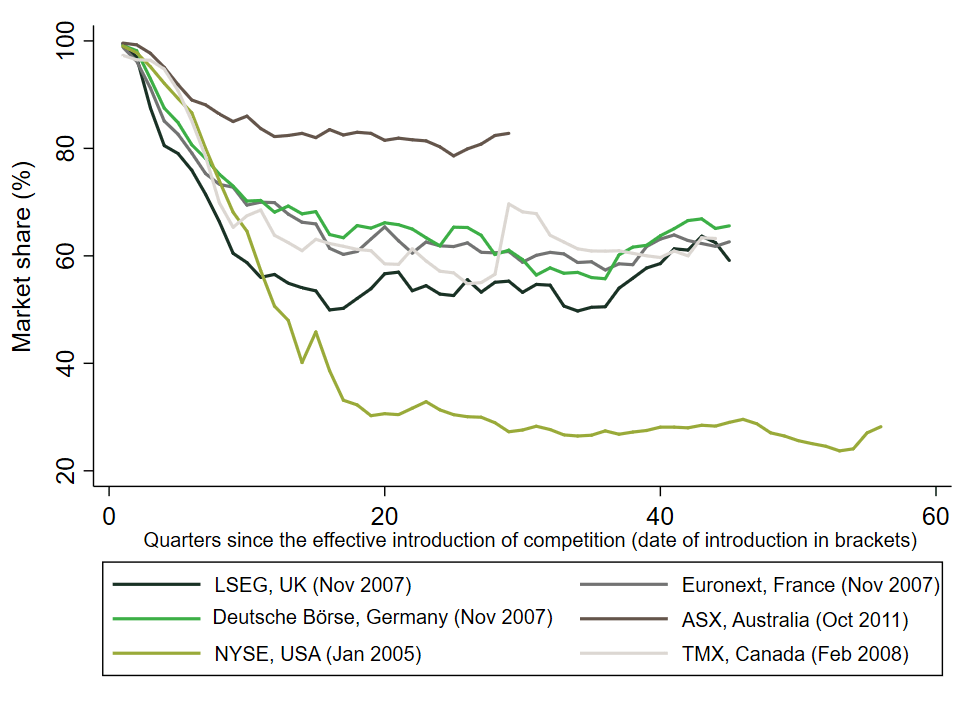

The new-entrant trading venues have been successful in gaining market share, and traditional primary stock exchanges have lost significant market share over relatively short timeframes (see Figure 1).

Figure 1 Market share of primary exchange markets following the introduction of competition

While MiFID I has introduced competition for equity trading, the flip side of this is liquidity fragmentation of the equity markets. The impact of fragmentation on price formation has been a source of academic and policy debate, as explained below. Furthermore, a market with multiple trading venues requires a regulatory level playing field to avoid regulatory arbitrage. For example, it is advisable that venues trade at the same minimum tick size.7

Since 2018, the implementation of successor legislation (MiFID II) has continued the trend of promoting competition for equity trading, with a focus on improving transparency and price formation in financial markets.

What matters is the impact on end-investors and companies raising capital: MiFID has delivered more choice and lower trading costs to the benefit of investors. Importantly, this can also have a positive impact on the wider economy by reducing the cost of capital for listed companies and therefore stimulating investment.

Price formation

From a market design perspective, it is interesting to explore how competition was introduced in the market for equity trading services.

Trading involves not only the matching of buyers and sellers, but importantly also a process through which information is revealed and incorporated into prices: the ‘goods’ being exchanged in equity markets are claims to uncertain future cash flows, and therefore a price formation process is required to determine the prices of these goods.

Stock exchanges deliver a price formation process and make this available to the users of their own platform, but also to other market participants and trading venues (that do not have their own price formation process) through the provision of market data (i.e. quotes and orders and respective volumes—pre-trade information; and execution prices and volumes—post-trade information).

Indeed, stock exchanges fulfil two core functions in relation to equity trading:

- the provision of trading—enabling traders to easily buy or sell assets;

- price formation—the process of determining the price of an asset in the marketplace.

The mechanisms and wider benefits (see the box below) of price formation are described in detail in the economics literature on market microstructure.8 Two important implications from the literature are as follows.

- The order flow to and from the order book on a stock exchange conveys information that makes a meaningful contribution to price formation.

- By setting out the rules of the game and undertaking market surveillance, as well as coordinating and managing the flow of information, the activities of the exchange facilitate the price formation process.

Therefore, an important aspect of a stock exchange is its information-gathering and distribution role, which ensures that market participants are sufficiently informed about the prices of the assets being traded in the market.

The MiFID framework has facilitated the emergence of alternative transparent trading venues as well as increased dark trading. Both have benefited from the quality of the price formation provided by transparent trading on stock exchanges and continue to use, to different extents, the price formation process of the primary stock exchanges. For example, multilateral trading facilities (MTFs) may execute trades based on referenced prices (typically the midpoint) from primary exchanges.

Stock exchanges undertake a range of activities and fulfil several economic functions. These include continual investment in matching engines, system testing, risk prevention tools and techniques, improving connectivity, liquidity programmes, rule setting, monitoring, and enforcement programmes. These activities deliver both the trading and price formation functions of the exchange.

Indeed, from an economic perspective, trading and price formation are ‘joint products’—given the structure of electronic order books, it is not possible to generate one without the other. This has important implications for how exchanges recover their fixed costs for delivering the provision of trading and price formation.

Benefits of price formation in equity markets

The ultimate beneficiaries of an effective price formation process are the investors, businesses, fund managers, regulators and market authorities that take decisions based on those prices. Accurate prices from stock exchanges lead to a number of benefits.

- More efficient markets—better price formation leads to reduced frequency of costly price shocks.

- Fairer markets—fairness in markets requires a reliable price formation process with effective detection and deterrence against improper trading. Confidence in the prices leads to the use of these prices.

- Lower cost of capital—if information is incorporated quickly and effectively into asset prices, this contributes to lower asset volatility and lower cost of capital for businesses.

- Improved products and new business models—the price formation provided by exchanges has led to new products and business models, resulting in more choice and competition for trading and new propositions for consumers.

- Wider benefits—for example, the accurate prices formed on stock exchanges are used by the broader finance and valuation industry to determine the value of other assets.

Source: Oxera.

Joint products and pricing of market data

The economics literature suggests that, for joint products, it is efficient to generate revenues by charging fees on both products. Indeed, this is what stock exchanges do in practice: they recover their joint costs through market data fees and trade execution fees.

During the preparation of MiFID II, questions were raised about the cost of market data to users. Different charging structures may have different distributional consequences, generating winners and losers. For example, shifting costs from trade execution services to market data services could worsen the competitive position of the brokerage firms with the highest data needs given their trading activity.

However, from a public policy perspective, the key question is whether the current practice of recovering costs through a combination of trade execution and market data fees has negative implications for the functioning of equity markets and their end-users. As explained in the box below, the market data provided by stock exchanges is a small part of a longer value chain. Market data services fees charged by stock exchanges do not have a large impact on end-investors, given that:

- the costs are small;

- market data revenues have been fairly stable over time;

- unit costs (combined revenues as a proportion of the value of trading) have declined in recent years;

- the economic analysis finds that the current charging structures for market data are unlikely to lead to detrimental effects on market outcomes for end-investors.9

Market data fees and revenues

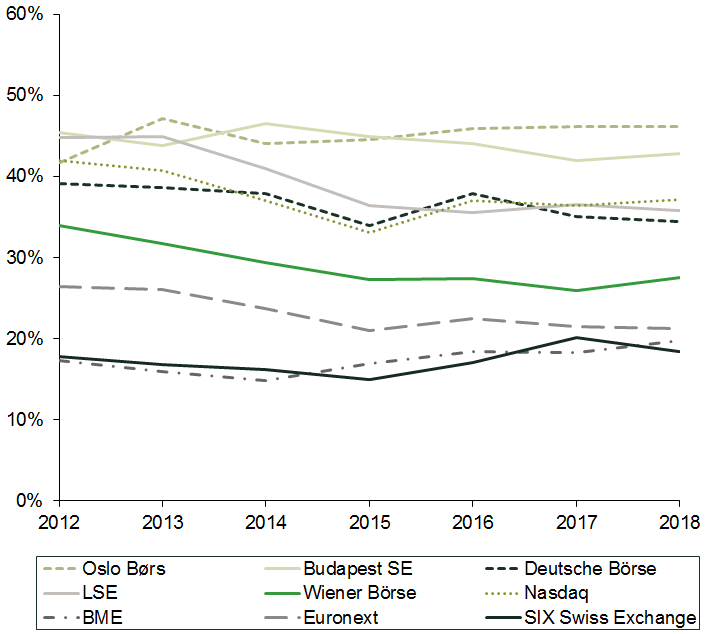

The recent trends in market data provided by European stock exchanges reveal the following (see the figure below).

- The contribution of market data provided by stock exchanges represents around 15% of the total European spending on market data and analytics. In other words, this is only a small part of a much longer value chain, which includes data vendors and other distributors of data (analytics) services.

- The share of revenues that comes from market data services (as a percentage of the total combined revenues from trade execution and market data) has been relatively stable over time—on average 31% in 2018 and 2017, compared with 32% in 2016 and 30% in 2015 (see the figure below). The ratio ranges between 20% and 50% across exchanges in Europe.

- In terms of fee trends for market data, for most exchanges fee changes have been small (for example, for Level 1 and Level 2 data packages, fees have risen by less than 1.5% per year in real terms since 20121). Aggregate market data revenues have increased by only around 1% per year in real terms.2

- Unit costs (calculated as the total combined revenue from trade execution and market data as a proportion of the total value of trading in relevant securities) have declined in recent years for all except one exchange.

- Overall, the costs to end-investors are small—aggregate market data revenues (of stock exchanges that are members of the Federation of European Securities Exchanges, FESE) amounted to approximately €245m in 2018, which represents 0.003% of total assets under management.

Figure 2 Proportion of total combined revenues attributed to market data revenues

Source: Oxera analysis of data provided directly by participating stock exchanges, and annual report data.

The policy agenda—new challenges

The history of equity markets began in Europe, with the first recorded equity trading on the Dutch East India Company in Amsterdam in 1602. More recently, Europe has fallen behind in global terms, and public equity market activity is far behind that in the USA, despite its similar size. Europe, too, has experienced the global trend of declining listings on public markets.

Therefore, a key objective of European policymakers has been to develop equity markets in Europe—as part of the EU’s ‘Capital Markets Union’ agenda.10

In recent years, European legislators have prompted developments in equity markets. Although MiFID I and MiFID II have been successful in introducing competition and creating a market that delivers well in terms of choice and competitive trading fees, the shift of trading from primary exchanges to other trading venues has led to increased fragmentation, and more trading occurring off-exchange has resulted in less transparency and a risk to the quality of price formation. While one intention of dark trading is to protect investors from market impact, this is relevant mainly to larger trades—it does not contribute to price formation, and dark trading may also include smaller transactions that do not necessarily require protection from market impacts.

MiFID II introduced some measures aimed at protecting price formation, thereby addressing some of the problems caused by dark trading and market fragmentation. New rules were put in place to limit the amount of dark trading, and to promote trading on the more transparent exchanges, which lie at the heart of the price formation process in equity markets.

One year on from the introduction of MiFID II, and the objectives of the Capital Markets Union agenda are as important as ever. The European Commission and the European Securities and Markets Authority (ESMA) are therefore closely reviewing the outcomes of these regulatory interventions. ESMA is currently reviewing measures put in place to preserve price formation, including the effectiveness of the caps on dark trading, and it has recently proposed changes11 to level the playing field for on- and off-exchange trading in terms of minimum tick sizes.

However, more may be needed to ensure the broader development of transparent equity trading markets in Europe.

1 European Commission (2004), ‘Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC’.

2 The primary market refers to companies issuing or selling shares directly to investors. The secondary market is where investors trade securities among themselves.

3 Oxera analysis of Cboe data. See section 3.2 and Figure 3.2. in Oxera (2019).

4 The figure is in terms of notional value and includes both ‘lit’ and ‘dark’ trading executed on the Cboe and Turquoise platforms (based on data from Cboe).

5 Oxera analysis of Fidessa data.

6 For example, see the regulatory changes in the Regulation National Market System (Regulation NMS) and Regulation Alternative Trading System (Regulation ATS) in the USA, the ATS regime in Canada, and the ASIC Market Integrity Rules in Australia.

7 A tick size represents the minimum amount that a price of a traded instrument can move up or down on an exchange.

8 For example, see Harris, L. (2002), Trading and exchanges: market microstructure for practitioners, OUP USA.

9 Oxera (2019), section 5.

10 European Commission, ‘Strengthening the capacity of EU capital markets’.

11 European Securities and Markets Authority (2018), ‘ESMA publishes final report on the tick size regime’, 14 December.

Download

Contact

Please get in touch at [email protected]

Contributor

Related

Download

Related

Economics of the Data Act: part 1

As electronic sensors, processing power and storage have become cheaper, a growing number of connected IoT (internet of things) devices are collecting and processing data in our homes and businesses. The purpose of the EU’s Data Act is to define the rights to access and use data generated by… Read More

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More