A taxing question: the proposed financial transaction tax and public finances

The European Commission first presented its proposal for an FTT in 2011,[1] as a tax that would apply to buyers and sellers of tradable financial securities that are classified as financial institutions.[2] There has since been considerable debate around the proposal, and some countries, including France and Italy, have brought in their own (less wide-ranging) forms of the FTT in recent years.[3] The Commission’s proposal remains on the table, and the debate about the pros and cons continues. Among those member states that support the FTT, there is still no consensus on its appropriate scope.

To inform the debate, Oxera examined the potential economic impact of applying the FTT to different financial instruments.[4] This was the first study that considered a wide range of possible impacts within a comprehensive macroeconomic model to assess whether the proposed tax could improve the condition of public finances relative to the costs of the taxation.[5] The implications for government finances were central to the study, as this is a concern for many European countries, given their high levels of government debt.

The study found that the proposed FTT could have a severe economic impact relative to the amount of revenue that it would raise. For countries with high government debt, the loss of other sources of government revenues (due to the impact of the FTT on the economy and government funding costs) is estimated to be greater than the expected revenues from the FTT. This means that the FTT could ultimately result in further reductions in public spending in those countries.

How would the FTT affect the economy?

The Commission’s impact assessment for the FTT focused on the increase in the cost of business investment, and the resultant wider economic impact. However, it did not focus on the cost of debt or the economic implications of taxing financial derivatives or repurchase agreements (‘repos’).[6] Consequently, to assess the implications of the proposed FTT for government finances, in its study Oxera needed to address two important gaps in the existing literature:

- the need for quantitative estimates of the economic impacts of taxing other financial transactions, including debt, derivatives and repos, that take into account the potential impact of the tax on trading behaviour, particularly regarding the volume of trading with the tax in place;

- independent estimates of the broader macroeconomic impact of the tax, bringing together the wide range of economic impacts into a single consistent and comprehensive appraisal.

The Commission’s proposal would cover a broad range of financial transactions between different counterparties trading different instruments. In general, the FTT would raise the cost of trading for all parties involved, which could be expected to result in some trades no longer being conducted because their economic value to the trading parties would be insufficient to justify the payment of the tax. Put simply, the economic impact of the tax would be equal to the sum of:

- the burden of the tax on the parties involved in those transactions that continue (and would be subject to the tax); and

- the economic impact of transactions no longer being conducted.

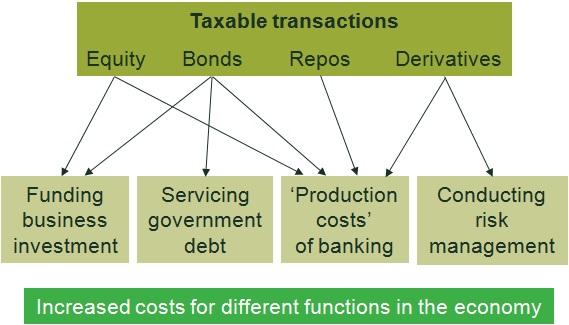

There are many ways in which the FTT could affect the economy (some of which are summarised in Figure 1). Arguably, any tax could have such an impact, so it is important to quantify costs where possible and compare these with the expected revenues. This provides the basis for assessing the potential overall economic impact of the tax.

Figure 1 Impacts of the FTT on the wider economy

To illustrate how such an assessment can be conducted, and how the findings were developed in the Oxera study, this article focuses on assessing the impact of the proposed FTT on the cost of debt, before summarising the impact on public finances as follows:[7]

- the impact on the cost of a bank loan;

- the impact on the cost of servicing government debt;

- the overall impact on public finances.

Impact on the cost of a bank loan

As the proposed FTT would not apply to bank loans directly, at first sight it is not clear why the tax would affect the cost of such a loan. But the tax would affect the ‘cost of production’ of retail banking operations, and, to provide the loan, banks would need to undertake a number of tasks that would be taxed by the FTT. The Commission acknowledged this in the economic impact assessment: ‘other sources of financing [including bank lending] are affected by about 50%’[8] (which is close to the finding of Oxera’s analysis).

There are three main routes through which the FTT would affect the cost of banking:

- the cost of capital for the bank, which would be increased by the FTT (in line with the analysis above) just as it would be for all other companies;

- the cost of hedging risk using derivatives, which is a major function of modern banking and is required to manage credit risk inherent in lending. The proposed FTT would be applied to such hedging positions;

- the cost of conducting repos, which banks use to access liquidity for their day-to-day banking operations. Again, the proposed FTT would apply to repos.

The study considered the financial positions of banks and building societies that focus on retail lending and deposit-taking, without significant investment banking divisions. Examples include Nationwide Building Society in the UK and Rabobank in the Netherlands. The FTT would be expected to significantly reduce the modelled banks’ non-retail activity in terms of taxable transactions, but the focus on retail lending in the Oxera study meant that relatively straightforward assumptions could be applied.[9]

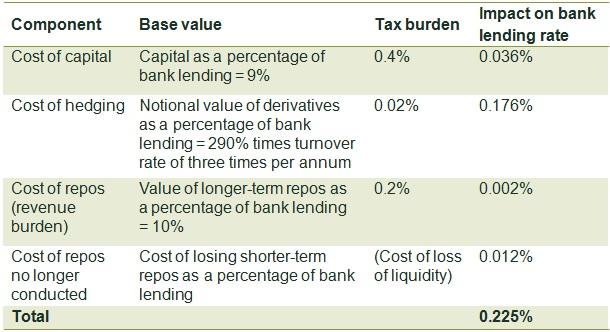

With these assumptions, the Oxera study was able to estimate the burden of the FTT on bank lending as a percentage of the value of bank loans (see Table 1). At 0.225 percentage points, the total impact is roughly 50% of the estimated impact on the cost of equity (0.4 percentage points), in line with the Commission’s own assumption.

Table 1 Estimates of the impact of the proposed FTT on bank lending rates

What would this figure mean in practice? To put it into perspective, consider the impact on a small business borrowing €100,000, to be repaid steadily over ten years. The FTT would increase the annual interest rate by 0.225 percentage points (e.g. from 5% to 5.225%). Assuming that the company repays €10,000 of the principal each year plus the interest due, this would suggest that the company has to pay an additional €1,237.50 of interest as a result of the FTT. Similar results would be appropriate for other loans, such as mortgages. The proposed FTT rate would be only a small fraction of the total cost, but it could add a significant amount over the lifetime of a loan.

The results of this modelling on bank lending rates were also incorporated into the macroeconomic model to estimate the overall economic output, as summarised below.

Impact on the cost of servicing government debt

Governments issue bonds with promised interest payments (the ‘coupons’) that are sufficient to attract enough demand from investors to raise the required amount for financing purposes. If those investors expect to pay the FTT[10] when they sell the bond, they are likely to demand higher coupons, but how much higher? This depends on the burden of the tax, which in turn depends on the frequency with which the bonds are traded once the FTT is in place. This frequency can be expected to fall because many transactions will no longer make economic sense if the tax has to be paid.

Current trading volumes for different FTT-zone government debt vary considerably. During 2012 German bonds turned over almost five times, on average, as the secondary market trading volume was €5.4 trillion with €1.1 trillion of bonds in circulation.[11] Turnover ratios in other countries tend to be lower, with the ratio in Spain in 2012 being under two.[12] The study used an assumption that the current FTT-zone-wide turnover ratio is around three.

If all the current trading (in financial instruments covered by the FTT) in FTT-zone government debt were to continue and be taxed by the FTT, the total burden of the tax would be approximately 0.6% of the value of the sovereign debt per year, as each bond is traded three times a year, on average, and the tax rate is typically 0.2%. This would suggest that, in the long run, either bond yields will increase by 0.6 percentage points to compensate investors for the cost, or investors will accept a lower (post-tax) return.

As the profit margins involved in trading government debt are typically quite small (as price movements are typically small compared with those for equity), one might expect the FTT to result in a marked decline in trading activity. The Commission’s original proposal implied that trading in bonds would reduce by 31% due to the tax.[13] However, much of the trading is between financial institutions for ‘on-the-run’ bonds (bonds that have recently been issued) where the speed of circulation is high. This suggests that the reduction in trading could be significantly greater than the assumed 31%.

So what might be the trading levels with the FTT? Analysis of the market suggests that they could be much lower than at present. In the currently more liquid markets, most institutional investors could simply trade with one another when required, without a need for market makers or other intermediaries, with transactions facilitated by electronic trading platforms. This suggests that a prudent assumption could be a turnover rate of one, in line with equity markets, which would mean that only one-third of current trading continued.

A reduction in trading volumes would mean that the direct burden of the FTT would be lower. If only a third of trading continued, the total burden of the FTT would fall to 0.2 percentage points, based on the calculations above. However, this estimate ignores the costs associated with reduced trading due to the loss of market liquidity. The price-discovery process would be hindered, and trading significant amounts on the market could affect the price. This suggests that the implicit cost of trading would increase.

Research by the European Central Bank (ECB) finds that liquidity affects bond yield spreads.[14] The findings of Bernoth et al. (2004) suggest that the difference between the liquidity of the most traded bonds (those in Germany) and that of bonds of a small country (all else being equal) could account for a spread of around 0.15–0.2 percentage points.[15] Given the relatively severe impact on bond trading assumed here, the top of this range (0.2 percentage points) was used.

The overall impact on the cost of sovereign debt is therefore estimated to be 0.4 percentage points, equal to the 0.2 percentage point burden of the FTT plus the impact on liquidity based on ECB research, which adds another 0.2 percentage points.

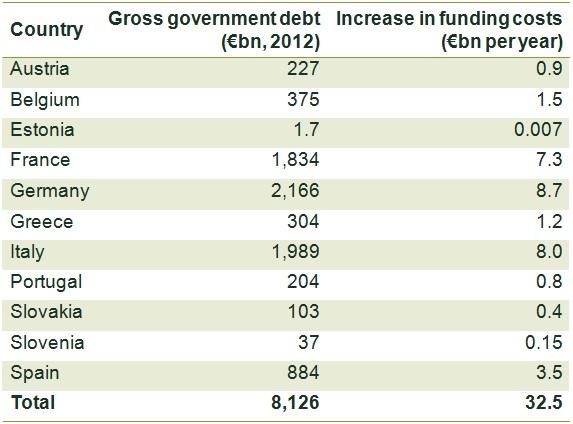

What would this mean in practice? The increase in the cost of funding government debt was calculated as the increase in the cost of debt (0.4 percentage points) times the gross outstanding debt of each country, using Eurostat data for 2012.[16] This apparently small percentage increase equates to a significant increase in the cost of funding government debt of €32.5bn per year, due to the scale of government debt (totalling some €8 trillion[17] among the FTT-zone countries). Table 2 presents the estimates for all of the FTT-zone countries.

Table 2 Impact on the cost of funding government debt (€bn per year)

The results of this modelling on government funding costs were also incorporated into the macroeconomic model to estimate the overall economic output, as summarised below.

An efficient tax?

The modelling produced three key outputs that were used to assess the overall impact on public finances:

- the expected FTT revenues, which are equal to the volume of financial transactions expected to continue with the FTT in place, multiplied by the relevant tax rate;

- the (negative) impact on economic output, which would lead to a reduction in tax revenues from other types of taxation (for example, corporation tax revenues decline if corporate profits are reduced);

- the impact of the cost of servicing government debt, as summarised above.

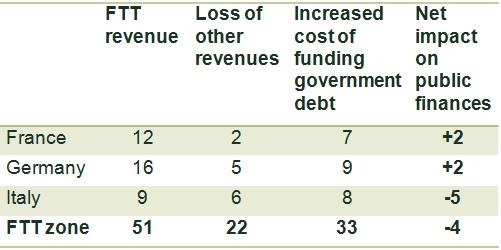

This overall impact on the state of public finances is summarised in Table 3 for France, Germany, Italy and the total for the 11 FTT-zone countries. The revenues that the FTT collects (the first data column of the table) will be partially offset by the loss of revenue from other forms of taxation (the second data column), due to the negative economic impact of the tax. But the public finances will also be negatively affected by the increase in the cost of funding government debt that results from the FTT (the third data column).

The long-term net impact on public finances could therefore actually be negative, which would be a poor result for the introduction of a new form of taxation. For the FTT-zone as a whole, the overall impact is estimated to be an annual loss of €4bn, as the FTT revenues would be more than offset by the loss of other tax revenue and the increased cost of funding government debt. But the impact would be relatively more severe for countries with high levels of government debt relative to GDP (such as Italy, shown in the table). According to these results, the heavily indebted countries could see an overall negative impact on public finances, while less-indebted countries (such as Germany and France) might see an overall positive impact on public finances.

Table 3 Estimated impact on public finances (€bn per year)

Source: Oxera and Oxford Economics analysis, drawing on Eurostat data for government debt and GDP.

In summary, the Oxera study found that the long-term net impact of the FTT on public finances could actually be negative, making it an extremely inefficient tax. For countries with relatively high levels of government debt, the loss of government revenues resulting from the impact of the tax on the economy and government funding costs is estimated to be greater than the expected revenues from the FTT. This means that the FTT could ultimately result in further reductions in public spending in those countries. These findings suggest that governments need to consider carefully the potential economic implications of an FTT, especially in light of the impact on government finances.

[1] European Commission (2011), ‘Proposal for a Council Directive on a common system of financial transaction tax and amending Directive 2008/7/EC’, COM(2011) 594 final.

[2] The tax rate proposed was 0.1% of the value of equity and bond transactions, and 0.01% of the notional value of derivative transactions. The definition of a ‘financial institution’ was relatively broad, and included pension funds and some large corporations outside of the financial services sector, as well as banks, insurers and other financial services firms.

[3] The FTT in France covers equity transactions; the FTT in Italy includes both equity and equity-based derivatives. The UK’s long-running stamp duty on equity transactions is another form of FTT.

[4] Oxera (2013), ‘What could be the economic impact of the proposed financial transaction tax?’, December. The independent study was commissioned by Marex Spectron, a leading broker of financial products in the commodities sector.

[5] The Oxera analyses of the components of the economic impact were entered into the Oxford Economics Global Economic Model to assess the overall impact on the economy, and hence public finances.

[6] European Commission (2011), ‘Impact assessment: Proposal for a Council Directive on a common system of financial transaction tax and amending Directive 2008/7/EC’, Commission Staff Working Paper, SEC/2011/1102. For a comprehensive review of the impact assessment, see Oxera (2011), ‘What would be the economic impact of the proposed financial transaction tax on the EU?’, prepared for the Association for Financial Markets in Europe, the Italian Association of Financial Intermediaries and the Nordic Securities Association, December.

[7] The Oxera study covers a comprehensive range of financial instruments, including equity, bonds, derivatives and repos.

[8] European Commission (2011), ‘Impact assessment: Proposal for a Council Directive on a common system of financial transaction tax and amending Directive 2008/7/EC’, Commission Staff Working Paper, SEC/2011/1102, p. 52.

[9] See Oxera (2013), ‘What could be the economic impact of the proposed financial transaction tax?’, December, section 4.

[10] The original Commission proposal for the FTT includes taxing government debt. A number of countries that support the FTT in principle have since objected to the taxing of government bonds.

[11] Data from the Bundesrepublik Deutschland Finanzagentur GmbH.

[12] Data from Banco de España.

[13] The Commission’s proposal combines a fall in volumes of 10% due to ‘relocation and evasion’ and 21% due to the increase in transaction costs deterring trading. See European Commission (2011), ‘Proposal for a Council Directive on a common system of financial transaction tax and amending Directive 2008/7/EC’, COM(2011) 594 final, volume 12, p. 18.

[14] See, for example, European Economy (2009), ‘Determinants of intra-euro area government bond spreads during the financial crisis’, Economic Paper 338, November; or Bernoth, K., von Hagen, J. and Schuknecht, L. (2004), ‘Sovereign risk premia in the European government bond market’, ECB Working Paper Series Nov 369, June.

[15] Bernoth et al. (2004) find that a 1 percentage point increase in the proportion of trading in the relevant European market (the liquidity proxy) increases the spread by 0.7bp. So, Germany’s 25% share of the eurozone bond market reduces its spread by 17.5bp, which, including measurement error, suggests 15–20bp. This is broadly consistent with observations for countries such as Austria, which has a 35bp spread over Bunds (German government bonds), linked to liquidity risk and default risk (estimates based on current data from Bloomberg). See Bernoth, K., von Hagen, J. and Schuknecht, L. (2004), ‘Sovereign risk premia in the European government bond market’, ECB Working Paper Series Nov 369, June.

[16] Available from: http://epp.eurostat.ec.europa.eu/portal/page/portal/government_finance_statistics/data/main_tables.

[17] A trillion is a million millions, or ten to the power of 12.

Download

Related

Economics of the Data Act: part 1

As electronic sensors, processing power and storage have become cheaper, a growing number of connected IoT (internet of things) devices are collecting and processing data in our homes and businesses. The purpose of the EU’s Data Act is to define the rights to access and use data generated by… Read More

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More