Is the end nigh for RPI?

In January 2015, the UK Statistics Authority published an independent review of consumer price statistics, led by Paul Johnson, Director of the Institute for Fiscal Studies.[1] The review was commissioned to consider what changes are needed to the range of consumer price statistics, following previous conclusions that the current approach to calculating RPI, the UK’s longest-running measure of consumer price inflation, fails to meet international standards.[2]

This article provides more detail behind the conclusions of the Johnson review. It then reflects on the impact of these conclusions on how UK regulators take inflation into account when setting tariffs and revenues.

There is more than one inflation

The Johnson review begins by considering what should be the fundamental purpose of an inflation measure. The review distinguishes between three possible measures:

- the increase in the price of goods and services;

- the increase in spending necessary to attain the same level of welfare due to the increase in the price of goods and services;

- the increase in the actual cash outflow necessary to attain the same level of consumption due to the increase in the price of goods and services.

The first measure, which represents the traditional approach to measuring inflation (and includes the RPI, and Consumer Prices Index—CPI statistics, and CPIH), tracks the price movements of a basket of goods and services across the entire economy. All inflation statistics currently published in the UK use this measure.

The second measure relates to the concept of a ‘cost of living index’. It would measure the amount that households need to increase their spending by in order to achieve the same level of welfare as before the price increase, taking into account the fact that households might substitute goods and services based on their relative prices.[3] The review acknowledges that any cost of living index would have to be published with a substantial lag, due to uncertainty over how people would substitute between goods and services.

The third measure differs from the other two price indices in that it would focus on the actual cost, in cash terms, that a household would have to incur in order to achieve the same level of consumption as before the price increase. This is sometimes referred to as the ‘household index’, and it would be primarily used to quantify the increase in incomes necessary to offset the increase in living costs. The argument for using such an index is that traditional price indices do not properly account for certain items that affect the level of household spending.[4] However, the Johnson review argues that publishing such an index, in addition to the traditional price indices, could lead to ‘inflation rate shopping’ (i.e. choosing the inflation rate that gives the desired answer). He also argues that such a population-wide index would not be an appropriate uprating index that could be applied to wages and benefits of households that belong to very different population sub-groups.

The Johnson review concludes that the ONS should aim to make the CPIH statistic the UK’s headline measure of inflation (see the discussion below). It also states that, in addition to the traditional consumer price indices, the UK Statistics Authority and the ONS should aim to publish an annual cost of living index in arrears, as well as more detailed information on the changes to prices and costs faced by the different population sub-groups.

CPIH in, RPI out

Among the existing range of traditional consumer price indices (the first measure above), the Johnson review states that CPIH, an upgrade on CPI, represents the best measure of inflation in the UK, as it is the most comprehensive and based on international best practice. It was introduced in 2013, and is calculated in the same way as CPI, but including owner-occupiers’ housing costs. In addition, CPIH holds an advantage over CPI, as changes to the latter are constrained by EU legislation, while CPIH is under the control of the UK Statistics Authority. However, CPIH is not currently considered to be a ‘National Statistic’ by the ONS due to issues in the calculation of private rents.[5]

Moreover, CPIH is still not widely used. According to the Johnson review, this could be due to ‘the lack of statutory underpinning for CPIH’.[6] The review therefore suggests that stronger and more binding procedures should be put in place for CPIH to become the UK’s headline inflation statistic, in order to encourage its use.[7]

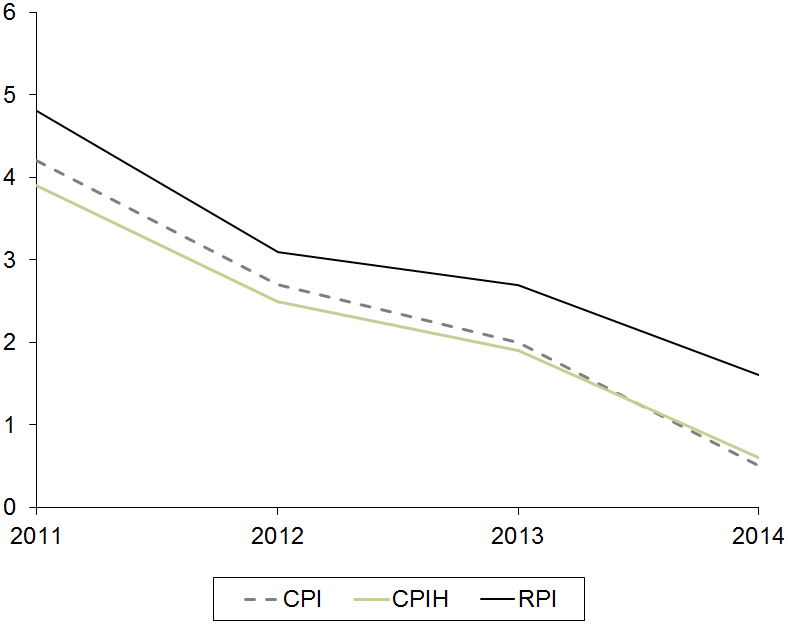

Separately, the review has confirmed the problems facing RPI. As of March 2013, RPI, the longest-standing consumer price index, lost its status as a National Statistic following a consultation by the National Statistician.[8] The main flaw with the RPI statistic is that items are weighted using an arithmetic mean (the Carli formula), instead of the geometric mean (the Jevons formula), which is more compliant with international standards.[9] The Johnson review agrees with the National Statistician that this flaw has caused an upward bias in the inflation recorded under the RPI statistic. The three recorded rates are depicted in Figure 1.

Figure 1 Annual inflation rates as measured by CPI, CPIH and RPI (%)

Source: Oxera analysis, based on data from the ONS.

Another challenge with RPI is that one of the recommendations from the National Statistician’s consultation is that, in order to ensure consistency, no changes should be made to the method by which RPI is calculated.[10] This is problematic, since any further changes that might be made to improve the CPIH and CPI statistics would not be applied to the RPI statistic, leading to further discrepancies between CPIH/CPI and RPI.

As a result, the Johnson review advises the ONS and the UK Statistics Authority to review their stance regarding the flaws underlying the RPI statistic, and urges regulators and other public bodies to aim to discontinue the use of RPI and to rely on more internationally acceptable statistics as soon as is practicable. If they decide to continue to rely on RPI, the review suggests that they should state publicly and clearly their reasons for doing so.

However, the review concedes that a swift switch from RPI to CPIH/CPI is not feasible when contractual commitments are at stake. Specifically, RPI is still used significantly in commercial contracts, including £470bn worth of index-linked gilts.[11] As a secondary effect, the indexation of government debt to RPI creates even more demand for assets for which the returns are also linked to RPI, despite the inherent statistical flaws.

What does this mean for regulated companies?

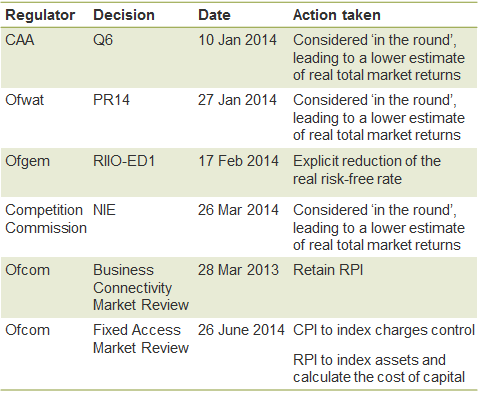

Most regulated sectors in the UK still use RPI to set the annual increase in allowed revenues or prices. However, during the most recent price reviews, regulators have considered how to respond to the increased divergence between the RPI and CPI measures.[12] The most prominent of the adjustments have related to the cost of capital determinations, and are summarised below.[13]

‘In the round’ adjustments

In its draft and final decisions on the appealed price determination for Northern Ireland Electricity (NIE), the UK Competition Commission (now the Competition and Markets Authority, CMA) attributed the low yields on index-linked gilts partly to ‘imperfections with RPI as a measure of inflation’.[14] Specifically, as it considered that CPI better reflected true inflation, and given the historical gap between RPI and CPI, the Commission considered that yields on index-linked gilts were artificially reduced. This was one reason why it reduced its estimate of the real cost of capital. As this downward adjustment to the weighted average cost of capital (WACC) offset the faster rate of increase in the RPI-linked regulatory asset base (RAB), the Commission decided that no further adjustments were needed to address this issue.

The UK Civil Aviation Authority (CAA) (2014) then followed suit by decreasing the total market returns assumption used in the final proposals for the price determination of Heathrow and Gatwick airports from 6.75% to 6.25%.[15] This 50bp (basis point) reduction was due mainly to the lower total market returns range used by the Competition Commission and, as such, implicitly reflected the Commission’s approach to resolving the problems with RPI.

In its Risk and Reward Guidance document (2014), Ofwat, the economic regulator of the water industry in England and Wales, also reduced the total market returns by 0.32%, which corresponds to the increase in the size of the RPI formula effect following the adjustments in 2010 to how the price of clothing items was collected.[16]

Explicit reduction of the real risk-free rate

In its consultation on the methodology for calculating the equity market return for the purpose of assessing RIIO-ED1 business plans,[17] Ofgem, the energy regulator for Great Britain, reduced its estimate of the real risk-free rate (relative to RPI) by 40bp. Ofgem has since presented further evidence (unrelated to the change in RPI methodology) for decreasing the allowed cost of equity by an additional 30bp by giving greater weight to contemporary market conditions.[18] The resultant estimate of 6% (in real terms) for the allowed cost of equity was applied in the final determinations for slow-tracked electricity distribution networks.[19]

Mixing CPI with RPI in the same price control

In its 2013 Business Connectivity Market Review,[20] Ofcom, the UK communications regulator, retained RPI as its benchmark for inflation for consistency reasons, as its calculations of the regulatory asset value and cost of capital also rely on RPI.

In the subsequent Fixed Access Market Review,[21] Ofcom selected CPI as its inflation index for the charge controls. However, it retained the use of RPI for the indexation of copper and duct asset values and the calculation of the cost of capital. The choice of using RPI in the cost of capital reflects the fact that the real risk-free rate is obtained by considering the yields on index-linked gilts, which are indexed to RPI. For consistency, Ofcom added a forecast of RPI to the real risk-free rate to convert the cost of capital to nominal terms.

Ofcom confirmed that the use of two different inflation benchmarks (CPI for the charge controls and RPI for the copper and duct assets and certain cost of capital items) in the same price control would not affect the forecast nominal charges at the end of the control period.[22]

Summary

Table 1 summarises the regulators’ approaches.

Table 1 Regulatory adjustments for RPI deficiencies

So far, only Ofcom has switched to using CPI rather than RPI to index prices. Other regulators have retained RPI for price indexation but made adjustments to the calculation of the cost of capital and other aspects of the price control calculation. All regulators appear to have been guided either explicitly or implicitly by the principle of achieving a similar path of nominal prices as would have prevailed without the 2010 change to the RPI calculation.

To maintain consistency over time, similar adjustments may need to be considered in future price controls. Whether these adjustments are equal to those made for the recent price reviews will depend on the extent to which inflation as measured by RPI is judged to have converged to, or diverged from, ‘true’ inflation. Additionally, up to this point regulators have based reductions to the cost of capital on the differential between RPI and CPI inflation.

Long-term implications

The Johnson review recommends that regulators consider a wholesale change from RPI towards CPIH. The obvious challenge to such a change is the lack of a CPIH-linked corporate bond market, and hence the mismatch that would be created between indexation of regulated prices and indexation of financial liabilities. A necessary first step in establishing a CPIH-linked corporate bond market would be for the UK Debt Management Office to start issuing CPIH-linked government bonds, which would act as a pricing benchmark for corporate bonds.

If and when the basis for indexing regulated prices changes, it will still be necessary to convert RPI to CPIH when using historical evidence that has been collected and presented relative to RPI or CPI. Under any scenario, translations between different inflation metrics are likely to be an important part of regulated price-setting for years to come.

[1] Johnson, P. (2015), ‘UK Consumer Price Statistics: A Review’, January.

[2] The review comes as a direct consequence of a consultation undertaken in 2012 by the then National Statistician, Jil Matheson, on behalf of the ONS in 2012 regarding the appropriateness of the methodology used to calculate RPI. In January 2013, the Board of the UK Statistics Authority accepted the National Statistician’s conclusion that the current approach to calculating RPI fails to meet international standards. The UK Statistics Authority promotes the production and publication of official statistics in the UK. Its executive body, the ONS, is responsible for the collection and publication of these statistics. The National Statistician is the UK Statistics Authority and the government’s principal adviser on official statistics, and provides strategic oversight of the ONS. See also Office for National Statistics (2012), ‘National Statistician’s consultation on options for improving the Retail Prices Index’, 14 November.

[3] The inflation rate under the second measure will always be lower than that under the first measure. This is due mainly to the shift from more expensive to cheaper goods, while maintaining the same level of household welfare. However, different households will have different relative preferences between the various goods and services, as well as different income-induced capabilities of substituting goods for other goods.

[4] For example, under CPIH, insurance is included on a net cost basis (i.e. the premium paid by the household, less any claims received). Under the ‘household index’, only the gross premium would be included. Other examples of items which would be accounted for differently under a ‘household index’ compared with a traditional index include mortgage interest payments and allowances for renovations and repairs.

[5] These issues relate primarily to the way in which private rents data is currently processed, which has led to an understatement of owner-occupiers’ housing costs. The Johnson review states that, for most items in the basket, this could be due to implicit changes in quality (i.e. the houses on the market today are of higher quality than those available a few years ago). The ONS is currently investigating this issue alongside the Valuation Office Agency (VOA).

[6] Johnson, P. (2015), ‘UK Consumer Price Statistics: A Review’, January, p. 12.

[7] This is subject to appropriate adjustments being made to correct the issues surrounding the calculations of private rents.

[8] Office for National Statistics (2012), ‘National Statistician’s consultation on options for improving the Retail Prices Index’, 14 November.

[9] Both CPI and CPIH rely on the Jevons formula.

[10] Office for National Statistics (2013), ‘Response to the National Statistician’s consultation on options for improving the Retail Prices Index’, February.

[11] Johnson, P. (2015), ‘UK Consumer Price Statistics: A Review’, January, p. 13.

[12] The GB Office of Rail Regulation (ORR) did not make any explicit adjustments in its periodic review (PR13) of Network Rail’s outputs and funding.

[13] Other important areas where the ‘RPI effect’ has been considered include the forecasting of real input costs.

[14] Competition Commission (2014), ‘Northern Ireland Electricity Limited price determination’, Final determination, 26 March; Competition Commission (2013), ‘Northern Ireland Electricity Limited price determination’, Provisional determination, 8 November.

[15] Civil Aviation Authority (2014), ‘Estimating the cost of capital: a technical appendix for the economic regulation of Heathrow and Gatwick from April 2014: Notices of the proposed licences’, January.

[16] Ofwat explained that this reduction to the total market returns should apply only to estimates derived from historical evidence, as the current expectations of RPI would already be embedded in total market return estimates which are based on forward-looking evidence (e.g. the dividend growth model). Ofwat (2014), ‘Setting price controls for 2015-20 – risk and reward guidance’, January.

[17] Ofgem (2013), ‘Consultation on our methodology for assessing the equity market return for the purpose of setting RIIO-ED1 price controls’, 6 December.

[18] Ofgem (2014), ‘RIIO–ED1: Draft determinations for the slow-track electricity distribution companies’, 30 July; Ofgem (2014), ‘Decision on our methodology for assessing the equity market return for the purpose of setting RIIO-ED1 price controls’, 17 February.

[19] Ofgem (2014), ‘RIIO-ED1: Final determinations for the slow-track electricity distribution companies – Overview’, 28 November.

[20] Ofcom (2013), ‘Business Connectivity Market Review’, review of retail leased lines, wholesale symmetric broadband origination and wholesale trunk segments, 28 March.

[21] Ofcom (2014), ‘Fixed access market reviews: wholesale local access, wholesale fixed analogue exchange lines, ISDN2 and ISDN30’, Volume 2: LLU and WLR Charge Controls, 26 June.

[22] For a detailed discussion of Ofcom’s underlying reasons, see Ofcom (2014), ‘Fixed access market reviews: wholesale local access, wholesale fixed analogue exchange lines, ISDN2 and ISDN30’, Volume 2: LLU and WLR Charge Controls, 26 June, para. 3.155.

Download

Related

Economics of the Data Act: part 1

As electronic sensors, processing power and storage have become cheaper, a growing number of connected IoT (internet of things) devices are collecting and processing data in our homes and businesses. The purpose of the EU’s Data Act is to define the rights to access and use data generated by… Read More

Adding value with a portfolio approach to funding reduction

Budgets for capital projects are coming under pressure as funding is not being maintained in real price terms. The response from portfolio managers has been to cancel or postpone future projects or slow the pace of ongoing projects. If this is undertaken on an individual project level, it could lead… Read More