Mergers in the NHS: a time for choosing?

This article was first published in May 2015.

Political rhetoric in the UK suggests that competition between healthcare providers benefits patients in a similar way to consumers in other sectors of the economy. However, the structure and organisation of the National Health Service (NHS) mean that there are significant differences between healthcare providers and suppliers in other sectors. This has important implications for how competition policy should be conducted in this sector.

In October 2013, the UK Competition Commission (now the Competition and Markets Authority, CMA) broke new ground by blocking a merger between two NHS Foundation Trusts.1 This decision has since raised concerns that competition law could block, or at least severely delay, service changes that providers, commissioners and Monitor (the sector regulator for health services in England) may consider desirable and necessary. While mergers between Foundation Trusts continue to be subject to examination by the CMA (the most recent being between Ashford St Peter’s NHS Foundation Trust and Royal Surrey County NHS Foundation Trust), the 2015 General Election has reignited the debate about the importance (or otherwise) of competition between NHS institutions for the benefit of patients, and the prospect of further reorganisation of the way health services are delivered more generally. This article revisits some of the thinking behind the CMA’s approach.

The CMA’s approach

Underlying the CMA’s approach is the principle that, given the way in which the provision of NHS services is organised, competition will drive improvements in quality—a principle that is consistent with the political rhetoric about the importance of choice in improving the NHS. The introduction of the ability of patients to choose their secondary care provider (e.g. hospital) from 2006, and the Health and Social Care Act 2012, were justified partly on this principle.

The CMA’s framework for assessing competition in the healthcare sector is therefore similar to that used in other markets. For example, the rationale for blocking the Bournemouth/Poole merger was, at least in part, a result of the fact that there would be few, if any, competitors to the merged entity in many areas of secondary (hospital-based) care, and that the separate merging parties currently provided such a choice to patients.2 The rationale is therefore that competition between healthcare providers for patients is welfare-enhancing.

However, there are two main reasons why competition in healthcare may have different effects to competition in other markets. First, the way in which patient choice operates in the NHS is quite unlike consumer choice in most other industries. Second, the way in which Foundation Trusts are incentivised means that they do not normally act as profit-making entities.

Patient choice and competition

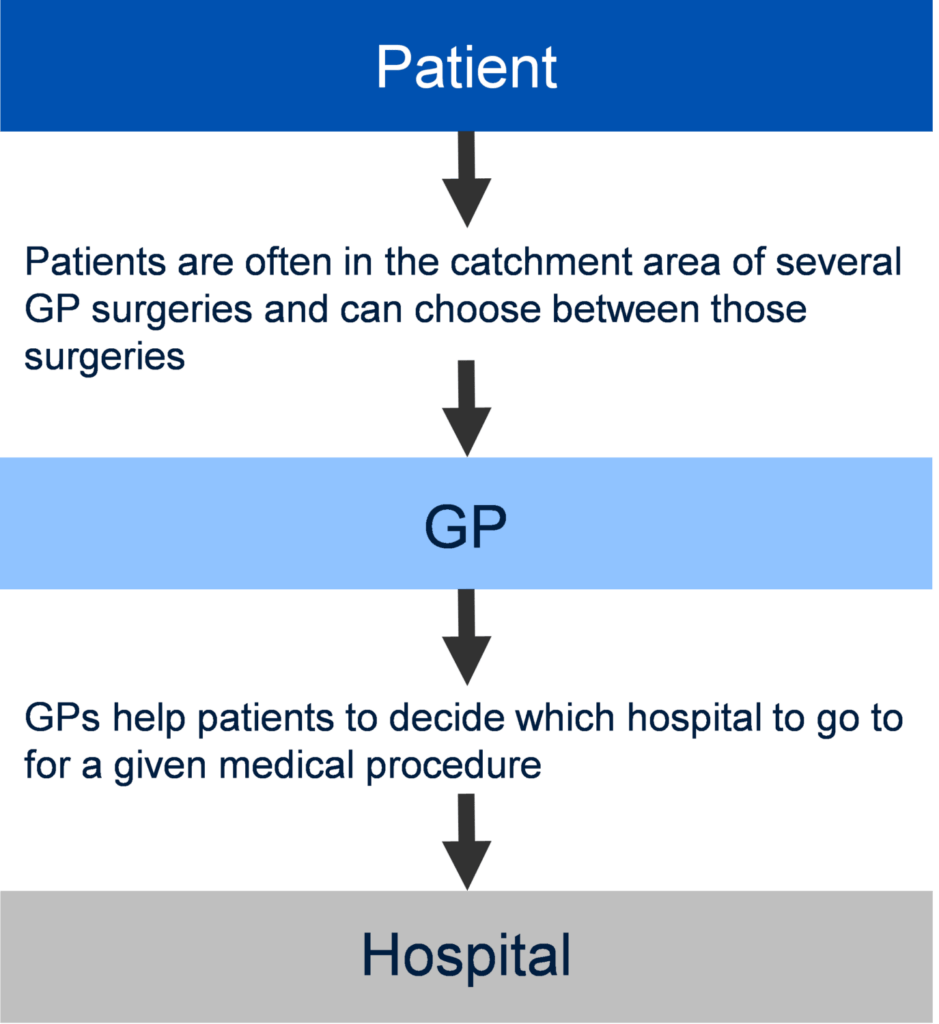

Underlying the assertion that competition is beneficial for consumers is the assumption that a sufficient proportion of market participants are well informed about the choice they are making. The well-informed consumer will choose the product that they think delivers the best value for money, or, when prices are fixed for all suppliers (as is the case with NHS services), they will simply choose the product with the most preferable non-price factors (such as distance from home or quality of service). Consumer choice therefore induces competition among suppliers and leads to increased welfare. The way in which choice is assumed to work in the NHS is shown in Figure 1.

Figure 1 The choice mechanism in the NHS

Given the way in which choice in the NHS is configured, in order for competition to work for health services as it does in other sectors, the following assumptions need to hold:

- there is a choice of alternative providers;

- patients care enough about hospital/treatment quality to be willing to trade an increase in quality against longer travelling distances (or other ‘costs’);

- patients are aware of their right to choose;

- patients are well informed about hospital/treatment quality and make rational use of their right to choose according to their preferences.

These assumptions do not always hold in the healthcare market. For example, for some specialised services only one option may be available close enough to the patient’s home, meaning that there is only one realistic choice for the patient.

Even when patients are able to choose from more than one provider, travel times may have a stronger influence on their final choice than the quality of service. A 2012 study by Beckert et al. found that, while 40% of patients overall did not choose the provider that was nearest to them, elderly patients, and those from income-deprived areas, were less willing to travel for hip replacements than other patients were.3 Factors other than quality of treatment therefore also affect the final choice of provider, and patients from some areas (e.g. those that are income-deprived) may be unwilling to travel beyond their nearest hospital. Similarly, The King’s Fund, a think tank that works on health and social policy in the UK, found that 69% of patients who were given a choice opted for their local provider, and a separate 2014 study found that only 18% of patients would be likely to change GP by registering with a GP practice outside of their current practice’s catchment area.4

In a situation where most patients have a strong preference for proximity, it might follow that these patients would prefer a lower-quality hospital nearby than a higher-quality hospital further away. This in turn would imply that hospitals would not be competing against each other for most patients, which would reduce the incentive for quality improvements relative to a situation in which travel times are a less important factor in patient decision-making.

There is also some evidence that many patients are unaware of their right to choose. For example, the same study by The King’s Fund found that only 45% of patients knew that they had a choice of providers before they visited their GP; 51% stated that their GP did not offer them a choice of secondary care provider; and only 8% were offered a private care option. More recent studies suggest that this situation has not changed significantly: a survey for NHS England in 2014 found that only 38% of patients recalled being offered a choice of secondary care provider, and a 2015 study of hearing care in the NHS found that 90% of patients were not given a choice over their provider.5 If patients do not know about their right to choose, they will not be able to exercise that right, and the mechanism through which competition creates better outcomes is far weaker than it would otherwise be.

Another critical assumption underlying the principle that patient choice drives quality is that patients (or GPs, as their agents) can identify quality differences at the level of the treatment they receive. Considerable effort is being put into providing more information to patients through the publication of quality indices such as mortality rates or patient feedback. However, while these indicators may correlate with provider quality to some extent, they do not take account of other factors that are not under the control of providers (such as the local demographic mix).6 There is a danger that, under these circumstances, quality metrics will reflect the make-up of the patients accessing a service, rather than the quality of the service delivered. Moreover, many of these are institution-level indicators and hence do not reflect the performance of the provider in specific services, which is the information that patients actually need.

Some of these data issues could be alleviated by using more detailed service-level data, as well as better data on patient demographics. However, at present, the data available to patients and GPs may not be of high enough quality for either of them to make meaningful choices about the quality of the specific services delivered by providers, which in turn weakens the financial incentive of providers to improve quality.

The assumptions set out above that underpin the dynamics linking the exercise of patient choice to increases in quality seem much less secure than the equivalent dynamics in some other sectors. Applying normal competitive dynamics to NHS service provision needs to be undertaken with care, and would ideally be backed by empirical research before being used to make decisions about the optimal market structure for these services.

In addition, in order for these market dynamics to work as expected, suppliers need to respond in the right way to the choices of patients (or GPs).

How do suppliers react?

In traditional markets, there are incentives for firms to improve quality (or reduce prices) in order to attract customers and therefore increase profits. However, a number of features of the reimbursement mechanism for NHS institutions mean that the analogy of this dynamic may not hold in health services and, as a result, health service providers may not have an incentive to compete on quality.

First, for certain services, if a provider provides more of the service than planned, the payment for this additional provision will be lower (by around 50%) than the average payment for the service, and may well be lower than the marginal cost.7 If the marginal income is lower than marginal costs then, to the extent that the provider can influence demand for its services, it has an incentive not to compete on quality, so that demand for its services will not exceed the planned level.

Second, Foundation Trusts are not incentivised by competition to improve quality in the same way as a firm in a traditional market would be. In traditional markets the incentive on the supplier is to set prices and quality at levels that maximise profits to that supplier, driven by shareholder pressure on management. In the absence of effective competition, these profit-maximising levels are high (i.e. well above cost). In such cases, effective competition acts as the counter to management’s desire to raise prices and/or reduce quality. However, for NHS-delivered health services there is no shareholder (at least not in the conventional sense) and, in particular, management may not be motivated to behave as a profit-maximiser (or, given that there is no price at the point of delivery, a cost-minimiser). This is because there is no direct incentive for NHS management to pursue profits in the same way as private firms, and its goal is to raise quality within its income constraint, regardless of the level of competition.

Impact of policy on merger control

In assessing the Bournemouth/Poole merger, the CMA adopted a competition framework in which patient choice played a critical role in the finding that the merger was not in patients’ interests. The test adopted, which is one applied across the economy under the Enterprise Act 2002, identified that there was a substantial lessening of competition.

The CMA’s assessment of the Bournemouth/Poole merger also dismissed the claimed benefits for patients, on the grounds that these were backed by insufficient evidence or that they were not merger-specific. In traditional markets, where merging parties are likely to have clear incentives to increase their market power in order to increase their profitability, claimed offsetting merger benefits need careful scrutiny. However, where the negative implications of mergers are less clear-cut, applying the same hurdle risks passing up on potential benefits to patients.

Furthermore, for the reasons set out above, the implicit assumption that a reduction in the number of providers can produce significant patient detriment is much less well established in the case of NHS institutions.

From a public policy perspective, the analysis of NHS mergers should be based on robust evidence about the specifics of both the likely patient detriments and the likely benefits. A 2014 literature review by the Office of Fair Trading (now part of the CMA) concluded that:8

Not all of the evidence at our disposal, however, reflects behaviours consistent with an effective implementation of patient choice and competitive mechanisms; GPs, for instance, do not seem to fully adhere to the role of ‘informed agents’ helping patients in the process of choice. On balance, however, the mechanisms intended to introduce quality competition appear to be effective…

The review carried out in our paper has highlighted some areas where there is a dearth of conclusive evidence, and more research would be informative.

This suggests that there is scope for the CMA and/or Monitor to gather further evidence to ensure that future merger assessments fully reflect the specifics of the way competition works in the healthcare sector and in the NHS in particular.

The CMA has a legal obligation to take decisions on mergers as and when they happen. However, the tight timescales involved in merger decision-making mean that this is often not the ideal time to assess more fundamental issues surrounding how competition works in the NHS. More research looking specifically into the benefits, costs and best practice of mergers would be helpful in order to establish how to optimise the market structure to deliver benefits to patients.

Conclusions

Successive governments have made it clear that competition is one way in which improvements in the NHS will be made. For this approach to be successful, it is important that the model of choice and competition for the NHS takes into account the inherent ways in which providers in the NHS differ from providers in other markets. Initiatives aimed at increasing patients’ awareness of their right to choose, and improving the information available to GPs and patients, will also be important if competition is to have a meaningful positive effect on health outcomes in the NHS.9

1 In this case, The Royal Bournemouth and Christchurch Hospitals NHS Foundation Trust and Poole Hospital NHS Foundation Trust—the Bournemouth/Poole merger. See Competition Commission (2013), ‘The Royal Bournemouth and Christchurch Hospitals NHS Foundation Trust/Poole Hospital NHS Foundation Trust’, 17 October.

2 Competition Commission (2013), ‘The Royal Bournemouth and Christchurch Hospitals NHS Foundation Trust/Poole Hospital NHS Foundation Trust’, 17 October. See also Oxera (2013), ‘For better, for worse? NHS mergers after Bournemouth and Poole’, Agenda, October.

3 Beckert, W., Christensen, M. and Collyer, K. (2012), ‘Choice of NHS-funded hospital services in England’, The Economic Journal, 122:560, pp. 400–17.

4 The King’s Fund (2010), ‘Patient Choice’. Mays, N., Eastmure, E., Erens, B., Lagarde, M., Roland, M., Tan, S. and Wright, M. (2014), ‘Evaluation of the choice of GP practice pilot, 2012–13: Final report’, Policy Innovation Research Unit, PIRU publication 2014–6.

5 Populus (2014), ‘NHS England & Monitor May 2014: Outpatient Appointment Referrals’, Populus Summary, May. Monitor (2015), ‘NHS adult hearing services in England’, March.

6 Mays, N., Eastmure, E., Erens, B., Lagarde, M., Roland, M., Tan, S. and Wright, M. (2014), ‘Evaluation of the choice of GP practice pilot, 2012–13: Final report’, Policy Innovation Research Unit, PIRU publication 2014–6.

7 For example, see Sheffield Teaching Hospitals NHS Foundation Trust (2014), ‘Board of Directors meeting 17th December 2014: Finance Report’.

8 Office of Fair Trading (2014), ‘Competition on Quality Literature Review’.

9 Matthews-King, A. (2014), ‘Practices who fail to offer choice to face crackdown from CCGs following Monitor ruling’, Pulse, 25 September. Monitor (2014), ‘Investigation into the commissioning of elective services in Blackpool and Fylde and Wyre: Final report’, September.

Download

Related

Access to land for mobile telecoms networks: a framework for negotiation and regulation

Mobile towers serve as the backbone of mobile telecoms networks, hosting radio access network equipment that enables us to receive calls, texts and to access the internet on our mobile devices. In turn, the ability of the builders of mobile towers to access land—whether that is on the ground,… Read More

What is venture capital, how does it work, and what are the risks?

In the third and final episode demystifying private equity, we explore the world of venture capital. While venture capital has delivered exceptional returns for some investors and founders, it’s also very high risk. So, is vibrant venture capital essential for economies seeking to boost innovation and drive productive growth? In… Read More