Zero rating: free access to content, but at what price?

As the net neutrality debate rolls on, new areas of concern are being highlighted. One prominent topic is zero rating, whereby part of a user’s data consumption is not counted towards their monthly data allowance. Despite some countries banning specific cases of zero rating, little work appears to have been done so far to assess the economic effects of these offers. What are the important considerations for such an assessment?

In a world where high-quality Internet connectivity has become essential for economic prosperity, fundamental questions are being asked about how far Internet service providers (ISPs) should be able to affect the online content that people access. Over the past ten years, few communication policy issues have caught the headlines more.

In a debate which has come to be known as ‘net neutrality’, the central question is whether restrictions should be imposed on ISPs to ensure that Internet access is unfettered. Net neutrality proponents argue that any content discrimination (such as restricting video quality on some movie streaming sites but not others) violates the premise of an ‘open Internet’—i.e. the concept that all Internet traffic should be treated equally.

In late 2015, the European Commission, Council and Parliament agreed on the text of a new Regulation introducing net neutrality rules across the EU.1 More recently, the Body of European Regulators for Electronic Communications (BEREC)2 has sought to clarify the level of flexibility that ISPs should have under these net neutrality rules.

Notwithstanding these developments, uncertainties remain, including over the treatment of agreements on IP interconnection and other commercial matters between ISPs and Internet content and application providers (CAPs). The issues around IP interconnection are discussed in a companion Agenda article.3 One other area that has come under the spotlight is zero-rating offers (whereby particular data usage is made exempt from counting against a user’s inclusive data allowance, or from accruing any excess usage charges). This concept is explained in the box below.

Zero rating and net neutrality

What is zero rating? This is when the use of certain content or applications (such as YouTube, Facebook or Spotify) does not count towards the data allowance of retail (typically mobile) broadband packages, or accrue any excess usage charges.

Examples of zero rating: in Germany, T-Mobile (Deutsche Telekom) currently offers premium Spotify access on a zero-rated basis. In 2015, the Dutch regulator fined Vodafone for zero-rating HBO GO (a video streaming service).1 In Chile, while zero rating appeared to be banned outright in 2014, it was later clarified2 that the ban did not extend to not-for-profit endeavours (such as Wikipedia Zero).

Net neutrality in Europe: ISPs are prohibited from blocking or throttling access to content or applications, unless it is justifiable on the basis of necessary and reasonable traffic management.

Of specific relevance to zero rating is Article 3(2) of the Regulations, which notes that ‘Providers of internet access services shall treat all traffic equally, when providing internet access services, without discrimination, restriction or interference.’

Recital 7 of the Regulations also makes it clear that any commercial practices of providers of Internet access services should not limit the rights of end-users to access and distribute information and content and to use and provide applications and services of their choice.

There is ongoing debate about whether zero rating is in violation of these conditions.

Source: 1 Authority for Consumers and Markets (2015), ‘Fines imposed on Dutch telecom companies KPN and Vodafone for violation of net neutrality regulations’, 27 January. 2 Welinder, Y. and Schloeder, C. (2014), ‘Chilean regulator welcomes Wikipedia Zero’, Wikimedia blog, 22 September.

In light of the data-hungry demands of users, ISPs have introduced zero-rating offers in the hope of attracting customers who would value free access to such content. A 2014 study identified 92 zero-rated mobile services in OECD countries.4

The key driving force behind the value of such an offer is the presence of a data allowance constraint—clearly, if an end-user has an unlimited data allowance (as is the case for many fixed broadband tariffs), there is no additional benefit of the zero-rating offer. This is most often the case in mobile networks, where network bandwidth remains a constraint for network operators and is therefore reflected in data caps in retail packages. In this instance, ‘free’ content access is likely to be highly valued by consumers.

However, these offers could also raise concerns about the violation of net neutrality principles, and potential anticompetitive foreclosure of rival ISPs and/or CAPs. Indeed, for these reasons, a growing number of European countries have taken a negative view towards zero-rating offers. Some (e.g. the Netherlands and Slovenia) have banned specific cases of zero-rating offers.5

The European Commission Regulations do not explicitly mention zero rating. However, as noted in the box above, it is clear from the recitals of the regulation that commercial practices that limit end-users’ rights to access the content of their choice would come within their scope. In this context, BEREC’s draft Guidelines identify only one circumstance that would constitute a definite breach of EU net neutrality rules—namely, if ISPs block non-zero-rated content (while continuing to leave the zero-rated content accessible) once the user’s data allowance has been exhausted.6 Beyond this, the determination of what is and is not acceptable will fall to the discretion of national regulators.

This article sets out a series of benefits and risks associated with zero-rating offers. It also looks at key considerations for an effects-based approach to assessing such offers, based on a number of (interdependent) factors that will determine the magnitude of any foreclosure effects. While there is no one-size-fits-all regulatory approach, this article presents a framework, grounded in economic principles, that can assist regulators in assessing zero-rating offers. It could also help firms planning to launch such offers in determining whether they would be compatible with regulation.

The benefits

Various benefits have been claimed for zero-rating offers, for CAPs, ISPs and end-users, but there is currently little consensus on their validity and magnitude. These potential benefits include the following.

- Free access for users: the most obvious (and least controversial) benefit to end-users is the ‘free’ access to content.

- Increased Internet usage: supporters of zero rating argue that it promotes take-up and use of mobile services—specifically, mobile Internet services and content consumption—especially in developing countries. For example, some claim7 that initiatives delivering free Internet content, such as ‘Wikipedia Zero’ and Facebook’s ‘Free Basics’ (as part of its ‘internet.org’ initiative), have driven Internet usage and thereby promoted innovation (as content creators will have a greater incentive to create content if the addressable market is larger).

This ‘positive network effect’ is particularly pronounced for user-generated content platforms, such as YouTube—i.e. the more people who use YouTube, the more content is produced, and the more useful YouTube is for everyone.

- Facilitating entry of content providers: zero rating could also bring significant benefits to content platforms that need to reach a critical mass of users (before being able to deliver value), by providing an avenue for subscriber growth. One example is social media sites (such as Facebook), in which users value the platform only if their friends also use it. In an attempt to reach critical mass, it may be beneficial for new content providers (such as small start-ups) to agree a zero-rating deal with an ISP (possibly in exchange for a fee) if they think that that will increase take-up and visibility.

- Promoting competition between ISPs: from the perspective of ISPs, providing zero-rated content offers an additional way to differentiate their services from those of competitors (as with other retail promotions such as bundling and exclusive offers). A good example can be seen in the broadband market, in which bundling of broadband and content is an increasingly important dimension of competition between ISPs.

Zero rating could therefore lead to more intense competition, lower prices and/or higher-quality services, which could benefit end-users and therefore be desirable from a public policy perspective. However, such strategies can also raise concerns.

The concerns

The concerns arising from zero rating involve the potential foreclosure of CAPs at the upstream level, and of ISPs in the downstream market.

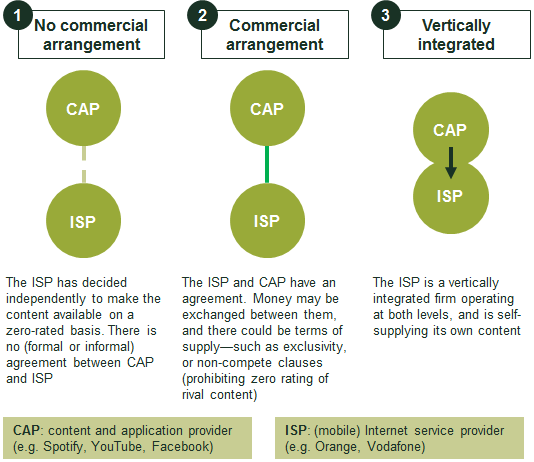

Figure 1 sets out three scenarios in which an ISP is offering an individual CAP’s content on a zero-rated basis. The only difference between the scenarios is the relationship between the CAP and the ISP.

Figure 1 CAP and ISP relationships for zero-rated content

These different scenarios can act as a starting point in any assessment of zero-rating offers, since they can determine the potential for such practices to result in distortions of competition. For example, under scenario 2 there could be concerns about vertical agreements that restrict competition (under Article 101 TFEU). However, under scenario 1 it is likely to be difficult to use Article 101 to address any concern, as there is no ‘agreement’.

Another consideration could be secondary line injury—a concept whereby a claim is raised against one party (in this instance, an ISP independently deciding to zero-rate content) for causing indirect harm to another (in this instance, a content provider that is foreclosed from a substantial part of the market as a result of the ISP’s zero rating on its rival’s content).

While the commercial relationships (identified above) will shape the nature of the concern, the strength of any foreclosure effects will depend on a number of factors. These concerns could affect the downstream (ISP) market, or the upstream (CAP) market.

Downstream (ISP) market concerns

While zero rating could be considered a legitimate commercial strategy for ISPs, it could also raise concerns about ISP foreclosure. For example, content provided by a particular CAP to an ISP on an exclusive basis or on preferred terms could lead to foreclosure effects in the ISP market. These foreclosure effects are likely to be stronger if the content is considered ‘must have’—i.e. customers will switch their ISP in order to have (exclusive or better) access to the essential content.

Upstream (CAP) market concerns

Open Internet concerns

A principal concern about zero rating is that it violates the premise of an ‘open Internet’—the idea that all online content should be treated equally by ISPs, with consumers being free to access what they want, when they want.

Zero-rating offers require ISPs to discriminate between online content, for the purpose of offering preferential terms of access for the zero-rated content. Open Internet proponents would claim that this action (absent any effects) runs counter to the idea of net neutrality (indeed, this position was taken by the Dutch regulator when it deemed zero-rating offers illegal, imposing fines on Vodafone and KPN in 2015).8

CAP foreclosure concerns

Zero rating could drive a loyalty-enhancing effect for the zero-rated CAP, potentially resulting in distortion to competition in the CAP market.

A key starting point is to assess what is being zero-rated. For example, a zero-rating offer for YouTube could raise concerns about anticompetitive foreclosure in the market for video streaming, by encouraging loyalty for YouTube over its competitors (such as Vimeo or Dailymotion). In contrast, zero-rating offers for ‘all video streaming services’ would not raise competitive distortions within the market, since there would be no loyalty-inducing effect for one market player over others.

A number of (interdependent) factors can then be assessed to determine the degree of any such foreclosure effect. Two of these are described below.

Degree of the data capacity constraint

As discussed above, in considering potential competitive distortions, it will be important to assess any loyalty-inducing effect (for the CAP’s content) of the zero-rating offer. A key factor affecting the degree of this effect will be the relationship between the user’s data usage terms (such as the inclusive monthly allowance and associated excess usage charges) and their demand for data. The more limited the user’s data allowance is (relative to their demand), the more likely it is that they will choose to consume the zero-rated CAP over rival offerings—i.e. the greater will be the concern of CAP foreclosure.

A relevant factor in this assessment is Wi-Fi availability and usage, since if the user consumes content over Wi-Fi this could affect the degree of the data capacity constraint.

Proportion of the CAP’s target customers falling under the offer

The foreclosure effect of the zero-rating offer will depend on the aggregate loyalty-inducing effect, which is based on the degree of the effect on an individual, multiplied by the number of people that fall under the offer (i.e. could experience the effect).

This concept is similar to that seen in the Intel rebate case,9 in which Intel offered conditional rebates to computer manufacturers purchasing a large proportion of their CPU chips from Intel. The European Commission concluded that this had the effect of foreclosing Intel’s closest rival (AMD), and therefore that Intel had violated competition law. In recent years, such promotional offers have been increasingly scrutinised by competition authorities (owing to their possible foreclosure effects).

The starting point is to consider the relevant addressable market for the CAP. For example, this could be strictly national (for example, a music streaming service specialising in Estonian music will have a focused addressable market of Estonia), regional (such as Europe or Latin America) or global.

It is worth noting that, even for global CAPs, the markets of competition are often national—for example, Netflix competes in the UK with other video streaming services (such as Amazon Prime). As such, there could be legitimate concerns regarding national-level foreclosure from large global players—for example, Netflix could face foreclosure in the UK market if UK ISPs decided to zero-rate Amazon Prime and not Netflix.

Concluding thoughts

Zero-rating offers can deliver material benefits, but can also present legitimate concerns. A key emerging question is whether competition law is sufficient to deal with the risks associated with these offers, or whether further regulation is needed.

For a case to be brought under competition law, a number of conditions must be met, which may mean that some zero-rating offers slip through the net. For example, if there is no explicit agreement between a CAP and an ISP, there can be no grounds for an Article 101 case (anticompetitive collusive agreements). In addition, conditions for an Article 102 case (abuse of dominance) may represent a high hurdle, for example by requiring it to be demonstrated that an ISP is dominant at the retail level.

The fact that Article 3(2) and Recital 7 of the European Commission net neutrality Regulations explicitly refer to commercial agreements made by an ISP means that national telecoms regulators—many of which do not have competition law powers—may be forced to decide whether the practice of zero rating should be permissible, and on what terms. In such a scenario there is a risk (which has already played out in some countries) that regulators err on the side of overzealous interventions, including outright prohibition.

The effects-based assessment considerations in this article show that, even in the absence of a (formal or informal) agreement or dominance (either for CAP or ISP), there could still be concerns of distortions to effective competition and anticompetitive foreclosure.

In light of the benefits that zero rating can deliver—to innovation, competition, and ultimately consumers—regulators should remain mindful of the importance of establishing an economically justifiable theory of harm, and therefore an understanding of the degree of any competition concerns due to zero-rating offers. These potential anticompetitive concerns should then be weighed against the efficiency benefits of these offers. Although not a straightforward exercise, it cannot be avoided, as the alternative is blunt interventions that can stifle innovation.

1 Regulation (EU) 2015/2120 of the European Parliament and of the Council of 25 November 2015 laying down measures concerning open internet access and amending Directive 2002/22/EC on universal service and users’ rights relating to electronic communications networks and services and Regulation (EU) No 531/2012 on roaming on public mobile communications networks within the Union.

2 BEREC (2016), ‘BEREC Guidelines on the Implementation by National Regulators of European Net Neutrality Rules’, BoR (16) 94, June.

3 Oxera (2016), ‘Bargaining over slices of cloud: should IP interconnection markets be regulated?’, Agenda, July.

4 Drossos, A. (2014), ‘The real threat to the open Internet is zero-rated content’, World Wide Web Foundation.

5 Sørensen, F. (2014), ‘Net neutrality and charging models’, Norwegian Communications Authority, 18 November. Netherlands Authority for Consumers and Markets (2015), ‘Fines imposed on Dutch telecom companies KPN and Vodafone for violation of net neutrality regulations’, 27 January. Scales, I. (2015), ‘Slovenia bans “zero-rating” price discrimination as the EU dithers’, TelecomTV.

6 BEREC (2016), ‘BEREC Guidelines on the Implementation by National Regulators of European Net Neutrality Rules’, BoR (16) 94, June, para. 38.

7 Brake, D. (2016), ‘Mobile Zero Rating: The Economics and Innovation Behind Free Data’, Information Technology and Innovation Foundation, May.

8 Authority for Consumers and Markets (2015), ‘Fines imposed on Dutch telecom companies KPN and Vodafone for violation of net neutrality regulations’, 27 January.

9 European Commission, ‘The Intel antitrust case’.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More