Water 2020: do Ofwat’s upstream market proposals hold water?

Ofwat, the economic regulator of the water industry in England and Wales, has recently consulted on a range of proposed reforms that would affect the structure and functioning of the market for water resources. What are these proposals, and what might they mean for the water industry, particularly regarding new entry?

On 10 December 2015, Ofwat published its consultation on its preferred approach to the 2019 price review (PR19) for water companies in England and Wales and the development of future markets post 2020.1 In this latter area, Ofwat is proposing to introduce market forces into the supply of water and the treatment and disposal of sludge (a by-product of the sewage treatment process). These changes are known collectively as ‘upstream market reforms’, in order to distinguish them from the creation of new retail markets. This article focuses on the proposals for new upstream water markets.

What are upstream water markets?

Currently, water used for public supply in England and Wales is predominantly provided by integrated monopolies, with limited trading taking place between incumbents. This has created concerns around how water is valued and allocated, prompting Ofwat to consider ways in which a more efficient ‘upstream’ market could be developed.

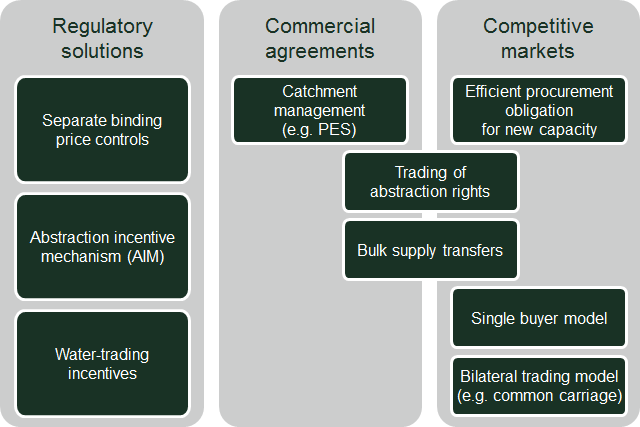

The term ‘upstream water markets’ is wide-ranging and has several interpretations. Indeed, at different times, various models have been proposed for upstream water services—some of which have been regulatory, some of which have been based on commercial agreements, and some of which have been based on the creation of new competitive markets. These are illustrated in Figure 1.

Figure 1 Possible upstream models

Note: AIM is a regulatory incentive introduced by Ofwat with the objective of encouraging water companies to reduce the environmental impact of abstracting water at environmentally sensitive sites when water is scarce. PES stands for payment for ecosystem services. ‘Common carriage’ refers to arrangements whereby a network company is remunerated for a third party moving water through its network and/or treatment works.

Source: Oxera.

While these models are not mutually exclusive, the choice of model(s) will depend on the following three considerations.

- What outcome is the industry (or even UK plc) seeking to achieve—in other words, what problem is the industry trying to solve?

- Which option best achieves this outcome at lowest cost in the most practical and sustainable way—i.e. which option has the highest ratio of benefits to costs?

- How are these benefits and costs spread across society, including customers, investors and new entrants—i.e. what are the distributional impacts?

As regards the first consideration, Ofwat’s Water 2020 consultation outlines the regulator’s rationale for introducing new upstream markets. It also sets out its preferred model for the upstream market that it is seeking to introduce.

Ofwat’s proposals at a glance

Ofwat’s proposals for new water markets cover the following initiatives.

- Separate binding price controls for water resources—not only to facilitate new markets, but also to provide more targeted price control incentives.

- The creation of a water trading market, which would apply to all water companies. This would involve creating a market information database and information platform, with the intention of encouraging third-party provision of new water resources. Third-party resource providers would be able to ‘bid’ to provide water resources, with the platform facilitating the assessment of bids. The disclosure of bids would be mandatory, and incumbents would need to record and publish information about third-party bids (such as reasons for accepting or rejecting them).

- The creation of a bilateral water resources market, which would apply to water companies operating wholly or mainly in England. The bilateral water resources market would involve a new entrant gaining access to an incumbent’s water network (and/or treatment works) to supply water to an end-user. Ofwat has explained that the bilateral water resources market is limited to non-household customers.2 The binding price controls described above would eventually provide the ‘access price’ for water resources (the price that third parties pay to an incumbent for moving water through its networks and/or treatment works), with a mechanism to offset the difference between long-run incremental cost (LRIC)3 and average costs. Ofwat’s rationale for this latter mechanism is to allow new entrants to recover their costs for new resources, while preserving average cost recovery.

- As regards the trading regime, Ofwat proposes to maintain and potentially enhance existing water-trading incentives.

To introduce these changes, Ofwat proposes to allocate the regulatory capital value (RCV) to water resources on an ‘unfocused’ basis—that is, in line with the percentage modern equivalent asset value across the water industry value chain. In addition, and perhaps most fundamental to companies and investors, Ofwat has committed to protecting efficiently incurred expenditure in the RCV up to 31 March 2020.

The more market-based reforms will be limited to companies operating wholly or mainly in England, due to the different legal framework applied in Wales.

Trading between existing companies

It has long been recognised that the costs of developing additional water resources vary markedly by geographic area.4 Future demand requirements will also be location-specific, with population growth most prominent in the south east, climate change having a non-uniform effect across the country, and environmental requirements to reduce abstraction being decided on a watercourse-by-watercourse basis by the Environment Agency.

However, at the national level, the demand for water has fallen over the last 20 years, due partly to lower leakage levels, greater water efficiency (in part driven by greater meter penetration), and a reduction in large water-consumptive industry.

This has driven an increased focus on ensuring that existing resources are as efficiently allocated as possible (as opposed to focusing on the development of new resources).

In the consultation, Ofwat states that it had considered introducing an interconnector incentive scheme. However, its current preferred approach is a combination of water-trading incentives, which aim to encourage water trading between companies, and mechanisms to increase transparency and certainty of funding for contracted supplies.

Ofwat first introduced water-trading incentives for the 2014 price review (PR14). It described the incentives as follows.5

In the water trading incentive, we confirm that we will introduce incentives for both new water exports and new water imports. For all new qualifying exports that start during 2015-20, we will allow exporters to retain 50% of the lifetime economic profits (that is, the profits over and above the normal return on capital invested).

Importers will benefit from totex efficiency sharing incentives. We will also allow importers to retain 5% of their costs from new qualifying imports during 2015-20. Companies will benefit more from this incentive if they bring forward new imports earlier in 2015-20.

As these incentives have only recently been introduced, it is not yet possible to assess their effect (i.e. whether they have resulted in a more efficient allocation of water resources across incumbents through increased water trading).

In its Water 2020 consultation, Ofwat proposed to maintain and potentially enhance the incentives.6 One way to do this would be to allow an importing company to add the whole-life cost of a trade to its RCV—on a net present value (NPV) basis (this could be removed if the trade ceases). Customers would benefit provided that the whole-life cost of the trade is lower than that of building the new water resource asset.

Encouraging efficient entry

The Water Act 2014 (once fully brought into force) will enable new entrants to apply for a licence to supply water into incumbents’ networks.

Ofwat’s proposal is for third parties to ‘bid’ for the creation of new water resources and for a new information platform to facilitate the assessment of bids. First and foremost, the fact that Ofwat has committed to protecting efficiently incurred expenditure in the RCV at 31 March 2020 should be welcome news to water companies and their investors, as it should reduce the risk of asset stranding.

In addition, as regards ‘bilateral’ water resource markets, Ofwat is proposing a compensation payment that offsets the difference between the incremental cost of new resources and incumbents’ average costs.7 Ofwat is proposing to base the former on the LRIC, or on the average incremental cost as an interim measure until companies develop a robust LRIC.8 These two components (average cost and the compensation payment) would be published in the form of access prices.

So far Ofwat has provided little in the way of detail as to how these prices would be structured in practice. The following key questions will need to be addressed.

- What would be the profiling of any compensation payment? New entrants may require a certain amount of cash upfront in order to be financeable (indeed, with the Thames Tideway Tunnel—a major infrastructure project being delivered by a new entrant—a substantial part of the regulatory framework was designed specifically to provide sufficient upfront cash flow9.

- Would the charge be based on volumes or capacity? New resources tend to be driven by dry-year peak demand. That is, for a significant proportion of the year, they may not need to supply much water into the system, although they are still required to exist in order to provide sufficient security of supply. This might suggest a capacity-based payment.

- For how long would access prices be fixed? New entrants might require a long-term commitment to (somewhat) stable cash flows in order to invest in assets. However, Ofwat has stated that investment incurred beyond 2020 may be ‘at risk’. This suggests that Ofwat may envisage a more dynamic market where players are regularly succeeded by competitors. Gaining an effective balance between long-term investment incentives and market dynamics will be key.

- How would costs to the network be treated? Ofwat’s proposed approach to access pricing assumes that the access price will cover an average cost for network services. However, exactly where a water resource is located within a water resource zone can drive significantly different network costs (for example, pumping costs will vary markedly if the water resource is located at the bottom of a hill compared to being at the top of a hill). Not reflecting these differences in the access price could potentially result in inefficient entry.

What is to play for?

Ofwat has estimated that the total benefit of increased interconnection is around £915m over the lifetime of the assets.10

While this is a non-trivial amount, it should be noted that total industry revenue is around £10bn per year, and so converting the interconnection net benefits into an annual figure gives approximately a 0.6% benefit.11 Therefore, it will be vitally important in achieving these benefits that any offsetting costs of implementation are minimised.

Ofwat has not yet provided an estimate of the benefit for new entry. As described above, given that net demand has fallen, there may be limited opportunity for new entry. However, following new entry, benefits could be felt more widely than solely with the resources in question. A key part of the Water Act’s impact assessment of upstream reforms were the dynamic benefits.12

Dynamic benefits could be realised through existing companies learning from new entrants, and therefore being able to improve their core businesses. In addition, getting ‘market-ready’ may drive incumbents to apply a greater level of focus to their operations, which could also deliver benefits.

The legal landscape

The UK Department for Environment, Food & Rural Affairs (Defra) is currently looking to reform the water abstraction system, with changes expected to be implemented in the early 2020s.13 Ofwat will need to ensure that its proposals fit with these reforms. Moreover, abstraction reform may be a necessity in achieving new entry, as without it new entrants may struggle to obtain abstraction licences.

The proposals do not (by themselves) address the issue that water companies have a legal obligation to ensure security of supply. This duty may drive a degree of risk aversion, with companies favouring the use of resources over which they have full control. This might ultimately require further legislation. However, it would take a brave politician to place such a high degree of faith in the market that they would feel comfortable removing the security of supply obligation.

Conclusions

Ofwat’s Water 2020 consultation contains some interesting initial proposals to encourage greater use of water resource markets. These proposals will be further developed over the coming months, and could substantially change the way in which water is provided in England and Wales.

One of the key areas of development will be refining the proposals for access pricing. After all, whether new entrants receive sufficient compensation in relation to the costs they would incur will ultimately determine whether the market sees any entry.

1 Ofwat (2015), ‘Water 2020: Regulatory framework for wholesale markets and the 2019 price review’.

2 Ofwat (2015), ‘Water 2020: Regulatory framework for wholesale markets and the 2019 price review – Explanatory document’, December, p. 71.

3 This is the additional cost of meeting a defined sustained increment of demand for services or products in the long run. For example, it includes the capital and operating costs of any new asset required to meet demand over the long term.

4 Ofwat (2010), ‘Valuing water – How upstream markets could deliver for consumers and the environment’.

5 Ofwat (2013), ‘Setting price controls for 2015–20 – final methodology and expectations for companies’ business plans’, July, p. 115.

6 Ofwat (2015), ‘Water 2020: Regulatory framework for wholesale markets and the 2019 price review – explanatory document’, December, p. 58.

7 Ofwat explains that: ‘by “bilateral” markets we mean wholesalers, which could be entrants or incumbents, (licensed under the Act) contracting directly with retailers in relation to the provision of new water resources…An issue that arises here is that, to incentivise efficient entry, those wholesale entrants will need to recover the long-run incremental cost (LRIC) of any new resource they develop.’ This would apply to companies operating wholly or mainly in England. Ofwat (2015), ‘Water 2020: Regulatory framework for wholesale markets and the 2019 price review – explanatory document’, December, p. 52. See also ibid., pp. 78–9.

8 Ofwat (2015), ‘Water 2020: Regulatory framework for wholesale markets and the 2019 price review – explanatory document’, December, p. 80.

9 See Oxera (2015), ‘The Thames Tideway Tunnel: returns underwater?’, Agenda, September.

10 Ofwat (2015), ‘Water 2020: Regulatory framework for wholesale markets and the 2019 price review. Appendix 2: Water resources – supporting evidence and design options’, December, p. 22.

11 The 0.6% figure is based on the government’s recommended discount rate of 3.5%, assuming a flat profile of benefits and a calculation period of 25 years.

12 UK Parliament (2013), ‘Upstream Competition (revised)’, pp. 42–3.

13 Department for Environment, Food & Rural Affairs (2013), ‘Making the Most of Every Drop: Consultation on Reforming the Water Abstraction Management System’, p. 6.

Download

Related

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More