The Thames Tideway Tunnel: returns underwater?

Ofwat, the economic regulator of the water industry in England and Wales, has awarded the project licence for the Thames Tideway Tunnel (TTT), a planned £4.2bn ‘super sewer’ in London. The project’s low headline weighted average cost of capital (WACC) figure of 2.497% has attracted attention from several quarters. But what lies behind this figure, and what lessons can be learned for other regulated sectors and projects?

On 24 August 2015, Ofwat confirmed the award of the project licence for the TTT to Bazalgette Tunnel Limited (BTL). BTL is a special-purpose company formed by a consortium of funds comprising Allianz Infrastructure (34%), Dalmore Capital (34%), INPP (16%), DIF (11%) and Bazalgette Investments Limited (5%).[1] Ofwat’s announcement marks the formal end to an intense bidding process to appoint an infrastructure provider to deliver the 25km TTT, which will reduce the number of sewage outflows into the River Thames.

The bid WACC (BWACC) for this project that resulted from the bidding process, after all parties had submitted their bids, was 2.497%. This is less than the indicative TTT point estimate of 3.29% from Ofwat’s draft guidance on the economic regulation of the TTT,[2] and more than 110 basis points (bp) below the current 3.60% wholesale WACC from Ofwat’s final determination for the PR14 price control for water and sewerage companies.[3]

This offers a significant saving to customers. Previously, the worst-case forecasts had predicted that the tunnel could increase the average water bills of Thames Water customers by £70–£80 per year by the mid-2020s. The lower WACC has contributed to a reduction in the expected increase to around £20–£25 per year, £7 of which is already included in current bills.[4]

How does the BWACC compare to other regulatory settlements?

At a headline level, the BWACC is significantly lower than any cost of capital set for a regulated utility in the UK. However, a closer look reveals some key reasons for this.

First, in recent years the cost of debt has fallen significantly. At PR14 Ofwat set a total cost of debt of 2.59%, comprising an embedded cost of debt of 2.65% and a new cost of debt of 2.00%.[5] As the TTT does not have any embedded debt, its debt costs should more closely reflect the lower cost that new debt is currently raised at. If water companies at PR14 had been funded only on the basis of Ofwat’s assumption for the cost of new debt, the PR14 WACC would have been reduced by more than 30bp.

Second, the TTT has a government support package. This package is designed to mitigate high-impact/low-likelihood risks during the construction period and includes insurance cover of last resort, short-term liquidity in the event of financial market disruption, and an additional equity contribution in the event of a significant construction cost overrun. However, the TTT is still the largest construction project ever undertaken by the UK water industry, and all tunnelling projects face a degree of delivery risk.[6] Furthermore, the project will have a significant initial gap between revenues and expenditure, and requires substantial equity funding up front.

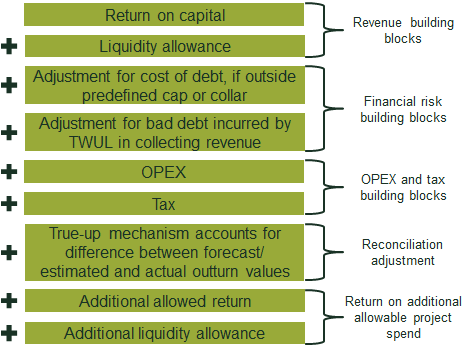

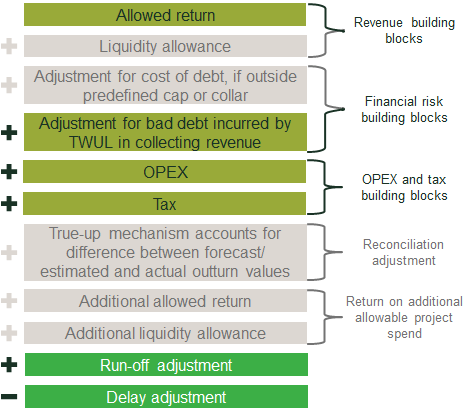

Third, Ofwat’s regulatory regime for the TTT provides additional risk shields in the regulatory formula for the period of the construction phase. These are shown in Figure 1, along with all the other building blocks of the allowed return. For the initial period after the construction, the regulatory regime will resemble Figure 2, until the first periodic review.

Figure 1 Regulatory framework during construction

Note: TWUL, Thames Water. OPEX, operating expenditure.

Source: Oxera.

Figure 2 Regulatory framework after construction

Source: Oxera.

Two of the most significant features are the liquidity allowance and the adjustment factor for the cost of debt. The liquidity allowance enables BTL to earn a return on the following charging year’s expected spend to compensate for the financing cost of drawing down funding early to meet capital expenditure requirements. The debt adjustment factor effectively allows the WACC to increase or decrease should a specified cost of debt index increase or decrease by more than 50bp.

So is it really 2.497%?

Given these features, there are a number of reasons why the WACC could be considered to be above 2.497%. First, during the construction phase, BTL will see significant growth in its regulatory capital value. Therefore, earning a return on next year’s value gives a greater return than would be observed with a more traditional regulatory framework. This (based on some simplifying assumptions) is broadly equivalent to a 20–25% increase to the return on BTL’s current year capital value (or around 50–60bp more than implied by the headline figure).

Second, Ofwat has used a banded approach to the debt mechanism. It has defined the debt adjustment factor as:

where the difference between the base reference point and the annual reference point is:

(i) equal to or less than 50bps – the adjustment factor will be equal to zero;

(ii) greater than 50bps but not exceeding 100bps – the adjustment factor will be equal to 50% of the amount by which the difference exceeds 50bps; and

(iii) greater than 100bps – the adjustment factor will be equal to the amount by which the difference exceeds 75bps.[7]

While forecasting macroeconomic variables is often more of an art than a science, it should be noted that the current conditioning path for the Bank Rate implied by forward market interest rates[8] implies a Bank Rate rise of between 70bp and 120bp over 2017 and 2018 from today’s levels. Therefore, market-derived expectations suggest that the cost of debt may increase by more than 50bp in the medium term. Indeed, when Ofwat set the cost of new debt at 2.00% at PR14, it explicitly assumed a 60bp uplift to market rates in anticipation of future interest rate rises.[9] Using Ofwat’s notional gearing assumption of 62.5%,[10] an increase to the cost of debt of 100bp would equate to an increase in the cost of capital of around 30bp. However, by this point, BTL would have been exposed to 70bp of the increase, so the mechanism leaves a significant amount of cost of debt risk with the company.

An alternative way to consider the framework is in terms of options. That is, the debt mechanism makes the TTT somewhat like a long ‘call option’ (revenues increase if rates rise above the option ‘strike price’) and a short ‘put option’ on future interest rates (revenues decrease if rates fall below the option strike price). Given the expected path for future interest rates, the call option is likely to be worth more than the put option. This difference in value would enable the consortium to bid for a return on equity that is lower than the underlying cost of equity.

Potential scope for precedent

Unlike traditional regulatory determinations, where the regulator sets a cost of capital, the TTT WACC was reached through a bidding process. This might encourage future regulators to adopt a bidding process-type model in their regulatory determinations. There are a number of ways in which regulators could achieve this.

- Ofgem and Ofwat both already use ‘truth telling mechanisms’ for total expenditure (TOTEX),[11] and similar approaches could be explored for the WACC.

- Ofwat (and the Secretary of State for Environment, Food and Rural Affairs) already has some powers to specify which infrastructure projects in the water and sewerage sectors should be put out to competitive tender.[12]

- In the longer term, franchising approaches for parts of the value chain (such as Ofgem’s forthcoming consultation on Extending Competition in Transmission, ECIT) could also be a way of reaching a WACC (as well as other costs and service levels) through competitive bidding, although there might need to be a trade-off between this approach and providing investors with sufficient long-term stability in order to enable a low WACC.[13]

The liquidity approach of allowing the firm to earn a return on the following charging year’s capital value represents a new approach to dealing with financeability issues. In recent years regulators have tended to favour net present value-neutral solutions. However, the scale of the liquidity issue with the TTT has led Ofwat to adopt an alternative approach.

Applying a debt adjustment factor is not a new concept. Indeed, Ofgem has recently used a rolling cost of debt approach in its determinations. However, using a banded approach, whereby only a proportion of the cost difference is passed back, is a key variation. Furthermore, the benchmark index is an annual figure compared to the cost of debt at a fixed point in time, as opposed to the ten-year rolling approach used by Ofgem. This means that the benchmark could change more in step with market rates, which would be beneficial for BTL if it were able to issue a lot of debt prior to any rate rise.

Perhaps a surprising feature of the TTT’s form of control is the indexation to RPI. An independent report for the Institute of Fiscal Studies has recently declared RPI ‘no longer fit for purpose’,[14] and recommended that regulators move towards replacing it as soon as practicable.[15] It should be noted that the UK Department of Energy & Climate Change is now indexing electricity generation contracts to CPI,[16] and a number of pension funds now have liabilities linked to CPI.[17]

While the exact assumption of the cost of equity is not in the public domain, as the WACC is below Ofwat’s guidance for the TTT (which assumed a cost of equity of 4.18%), the final bid might be understood to have assumed a value of less than this figure. Yet making the adjustments outlined above leads to a different conclusion. Adding 50bp to the BWACC to account for the liquidity adjustment, and assuming gearing of 62.5% and a cost of debt of 2.0%, would imply a cost of equity of 4.7%. However, the cost of debt could plausibly be around 1.5%, which would imply a cost of equity of 5.5%—broadly comparable to the 5.65% assumed by Ofwat in PR14.

This is unlikely to be applicable to other sectors or projects, since it has been developed within the specific context of the TTT’s regulatory and government protections. The TTT is also likely to have a very different type of operational risk compared with those observed in other sectors. Drawing any useful comparisons with other sectors therefore requires careful analysis.

Conclusion

While the WACC of the TTT appears to be significantly lower than regulatory precedent, there are some clear reasons for this headline number. The liquidity allowance increases BTL’s expected returns, and the project is able to raise debt at current market rates rather than being locked into the higher rates of debt raised in the past. The debt adjustment factor and the government protections also enable a lower upfront cost of capital by sharing risk with customers and the taxpayer.

There are potentially some lessons that could be applied to other sectors. Most notably, the TTT’s use of a bidding process to reach a cost of capital may lead regulators to consider ways to expand this to other determinations.

[1] Ofwat (2015), ‘Reasons for designating Bazalgette Tunnel Limited as an infrastructure provider responsible for delivering the Thames Tideway Tunnel’, August.

[2] Ofwat (2014), ‘Consultation on the regulatory framework for the infrastructure provider that will deliver the Thames Tideway Tunnel project. Annex 3: draft guidance on the approach to the economic regulation of the infrastructure provider for the Thames Tideway Tunnel’, September, p. 23.

[3] Ofwat (2014), ‘Setting price controls for 2015-20. Final price control determination notice: policy chapter A7 – risk and reward’, December, p. 41.

[4] Ofwat (2015), ‘PN 02/15 Ofwat awards licence for Thames Tideway Tunnel’, press notice, 24 August.

[5] The embedded:new cost ratio was 75:25, with 0.1% for allowance of debt fees. Ofwat (2014), ‘Setting price controls for 2015-20. Final price control determination notice: policy chapter A7 – risk and reward’, December.

[6] Examples of problems with previous tunnelling projects are the 1994 Heathrow tunnel collapse, and the 80% cost overrun of the Channel Tunnel. More recent projects have been more successful, such as Crossrail and the Lee Tunnel.

[7] Ofwat (2015), ‘Project Licence: Bazalgette Tunnel Limited’, pp. 72–3. The reference point is a benchmarked index as at 31 March 2015. The annual reference point is taken at 31 March of charging year Yt-2. Both are from iBoxx indices for UK corporate non-financials with a 10+ year maturity. The licence states a BBB index. In contrast, Ofgem, the energy regulator for Great Britain, uses a slightly different index to set the cost of debt allowance for energy networks, which averages the cost of BBB and A rated debt.

[8] Bank of England (2015), ‘Inflation Report’, August, p. 32.

[9] Ofwat (2014), ‘Setting price controls for 2015-20. Final price control determination notice: policy chapter A7 – risk and reward’, p. 39.

[10] Ofwat (2015), ‘Project Licence: Bazalgette Tunnel Limited’, p. 59.

[11] See Oxera (2015), ‘Menu regulation: is it here to stay? (revisited)’, Agenda, April.

[12] The Water Industry (Specified Infrastructure Projects) (English Undertakers) Regulations 2013.

[13] See Oxera (2015), ‘Integrated Transmission Planning and Regulation: what choice of tender model?’, Agenda, June.

[14] Johnson, P. (2015), ‘UK Consumer Price Statistics: A Review’, January, p. 23.

[15] See Oxera (2015), ‘Is the end nigh for RPI?’, Agenda, February.

[16] Department of Energy & Climate Change (2013), ‘Electricity Market Reform – Contract for Difference: Contract and Allocation Overview’, August, para. 4.22.

[17] See Oxera (2015), ‘Index-linked bonds 2.0: introducing CPI-linked securities’, Agenda, July.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More