The evolution of UK energy regulation

As the UK energy sector undergoes rapid technological transformation, the tools and frameworks that are being used by policymakers and regulators in the sector are also evolving. Ofgem’s RIIO2 network price control reviews are underway, with a framework decision published at the end of July and sector-specific methodology consultations due to be published by December 2018.

As stated in the framework decision, Ofgem’s objective for RIIO2 is to ensure that regulated networks deliver the ‘value for money services that both existing and future consumers want’. Affordability is a notable part of this stated objective, as is the development of flexible networks that adapt to the needs of consumers. It is imperative that the evolution of the RIIO framework continues to facilitate the changes afoot throughout the value chain in the UK energy sector.

Rapid transformation of the UK energy landscape

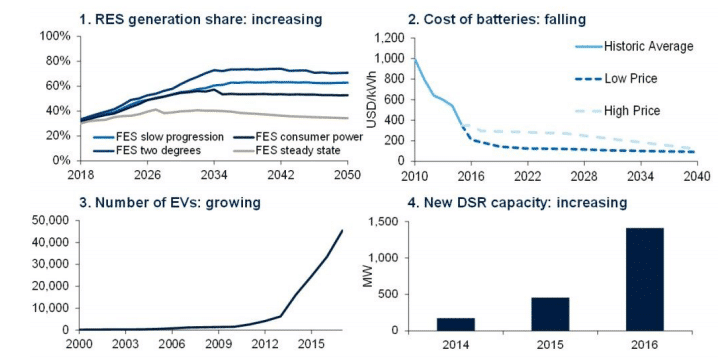

Source: National Grid (2017), ‘Future Energy Scenarios’; Department for Transport (2018), VEH0203; Ofgem (2017), ‘Annual report on the operation of the capacity market in 2016/2017’, 7 June.

Increasing scrutiny of network costs

Alongside policy and regulatory objectives promoting the development of smart and flexible energy networks, there are pressures to reduce network costs, which may influence the calibration of the RIIO2 price control package. In a blog article on its website in March, Ofgem signalled that RIIO2 will be “tough”: Our proposals are tougher on network companies, requiring lower costs and better service quality… To make sure the cost to consumers is as low as possible, we are proposing the lowest rate ever for the amount we think energy network owners need to pay their shareholders…

Concerns about companies’ profitability, financing structures and dividend policies have also been widely reported and discussed, for example by Citizens Advice. Ofgem says that it has launched a comprehensive review of company financial arrangements, including taxation, which is referred to as its ‘ring-fence’ review, and intends to consult on any resultant reform proposals in December this year. Aligned with this, one of the focal points of the RIIO2 framework decision is ensuring that utility companies earn ‘fair returns’.

Retaining focus on the big picture (I): ‘fair returns’ for good outcomes

In this context, it is important not to lose sight of the big picture. According to Ofgem, the GB regulatory regime has supported around £100 billion of investment since privatisation. Furthermore, as noted in Ofgem’s framework consultation in March, in reviewing RIIO1 to date—”[c] ustomer satisfaction scores have been improving’ and ‘network reliability has improved across sectors”.

It is worth noting that since privatisation, Ofgem’s framework has evolved as a largely ex ante regulatory approach. However, given prevalent concerns around network returns, the RIIO2 framework appears to be moving towards more ex post scrutiny and adjustment.

As examples, Ofgem is considering the use of more true up and cost pass-through mechanisms, such as cost of equity indexation, indexation of ‘uncertain costs’, greater use of revenue and volume drivers, and within-period mechanisms. In addition, Ofgem is considering options for ‘return adjustment mechanisms’ such as discretionary adjustments, a return sharing factor, and anchoring returns.

Retaining focus on the big picture (II): the ‘IIO’ in RIIO

Observing these indications of a direction of travel towards greater ex post scrutiny and adjustment, it will be important for all parties to retain a coherent vision of what RIIO2 should achieve as a complete package. There is a risk that introducing more ex post measures could dilute the incentives built into the regulatory framework—in terms of both the incentives to invest, and the incentives to outperform.

It is important to retain focus on the fundamental and ambitious delivery of the ‘I+I+O’ in ‘RIIO’. The ‘IIO’ refers to the incentives, innovation and outputs that will underpin the development of a flexible, coordinated and efficient energy system. Arguably, retaining this focus on the big picture is more important than ever to ensure lower costs to consumers in the long term, given the widening technological possibilities that networks are facing in RIIO2 and beyond.

Download

Related

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More