The EU Emissions Trading Scheme: what are the options for reform?

Decarbonisation is one of the primary objectives of EU energy policy. It is built into the EU’s 20/20/20 targets, which require that, by 2020, greenhouse gas emissions are reduced by 20% and energy efficiency is improved by 20% relative to 1990 levels, and 20% of energy supply is delivered from renewable sources.

The EU ETS is the primary tool through which the EU aims to achieve this decarbonisation objective, with separate policies specifically targeted at renewables and energy efficiency. A ‘cap-and-trade’ scheme, the EU ETS sets a limit on the quantity of greenhouse gases (‘carbon’) that can be emitted by certain sectors of the economy, as follows.

- Emissions allowances are allocated to individual companies (either free of charge or through auctions).

- Companies must obtain a sufficient number of allowances to cover their emissions or pay a large penalty. Allowances can be obtained through their free allocation, through auctions run by government, or by trading with other companies.

- The cap on the quantity of emissions relative to the expected business-as-usual emissions creates a price for emissions allowances, which is higher the more stringent the cap.

- The overall objective is to incentivise companies to consume less carbon, mainly by investing in less carbon-intensive means of production.

How has the EU ETS performed?

Carbon price

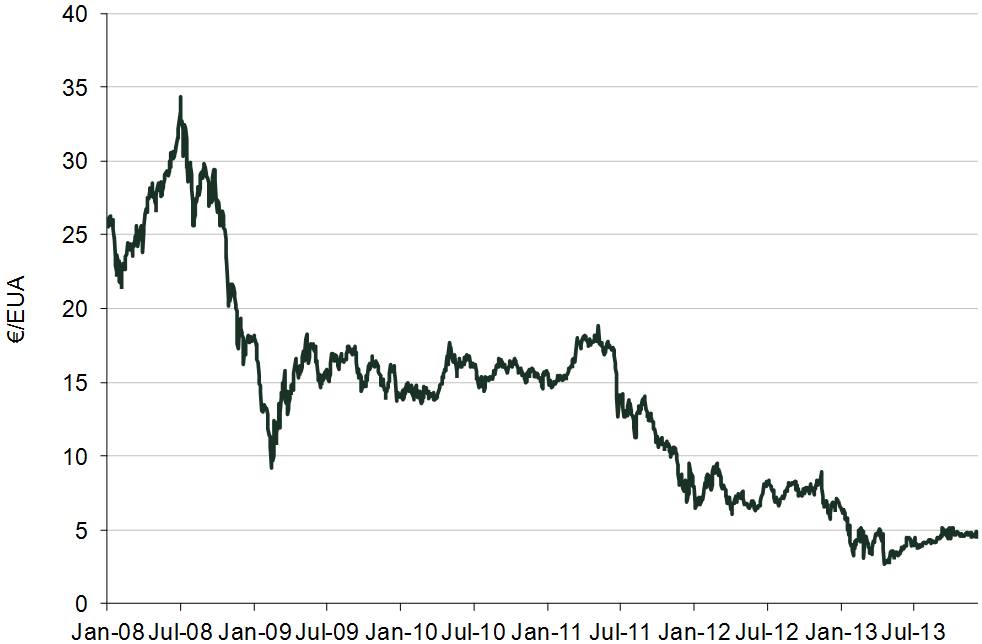

Since there is a fixed quantity of carbon that sectors covered by the EU ETS can emit by 2020, the success of the scheme cannot simply be judged by carbon emission reductions. The price of EU ETS allowances (EUAs) is arguably a better indicator as, in theory, it should represent the marginal cost of carbon emission reductions under the scheme. It is therefore striking that the price of EUAs has declined substantially from an average of €26/tonne in 2008 to less than €5/tonne for most of 2013 (see Figure 1).

On the one hand, this may be good news, as it means that the EU can meet its emissions-reduction targets at lower cost, and that the market has been successful in identifying low-cost opportunities for reduction. On the other hand, it may mean that emissions allowance prices are currently too low to provide additional incentives for reduction, undermining the purpose of the EU ETS. This would especially be the case if the current low price, and the apparent meeting of the 2020 reduction target, are the result of other factors (e.g. poor macroeconomic growth), since this means that industries may not have made sufficient efforts to reduce their carbon footprints after all.

Accordingly, if one of the aims of the EU ETS is to achieve a stable and sufficiently high price of emissions to incentivise investment in low-carbon technologies, it could be argued that the scheme has not been successful.

Figure 1 EU ETS allowance prices

Indeed, the EUA price is unlikely to represent the true marginal cost of carbon emissions reduction, since a significant proportion of overall reduction has been achieved through the adoption of renewable generation technologies, which have received direct subsidies. Despite this additional support, the roll-out of EU renewable generation has not exceeded expectations. The surprise factor has been economic growth, which has been significantly below the expectations at the time when the scheme was devised.

The economic downturn has reduced industrial output and consequently emissions levels, thereby reducing the demand for emissions allowances. The emissions cap is not linked to economic activity, and the supply of allowances remains constant throughout the economic cycle, and thus lower allowance prices have followed the economic downturn.

International competitiveness

The EU ETS imposes an additional cost on EU companies, which could put them at a disadvantage to their rivals based outside of the EU. This cost has been partially mitigated by the allocation of emissions allowances to carbon-intensive sectors free of charge. However, the allocation of EUAs free of charge is being phased out, and this mitigating factor is not expected to have an effect going forward.

The potential impact of the EU ETS on competitiveness can be expected to differ over the short and long term. Short-term price elasticity of demand for goods and services (i.e. the responsiveness of demand to changes in prices) can be expected to be relatively low, as consumers may find it difficult to switch to non-EU suppliers if the prices of goods and services provided by EU suppliers increase. However, price elasticity also differs between sectors. It can be expected to be materially higher for sectors such as steel and chemicals, for which carbon costs are likely to constitute a material part of their total cost base, and where it may be easier to switch to non-EU suppliers than in other sectors.

Long-term price elasticity of demand can be expected to be higher than short-term price elasticity, which implies a greater loss of international competitiveness in the longer term. This may lead to a reduction in industrial output and demand for EU-produced goods, and lower profit margins on EU-produced goods that are sold. This may in turn lead to reductions in dividends, higher unemployment, financial distress of companies, lower taxes raised by government, and currency depreciation.

Some of these effects may be mitigated over the longer term as labour and economic activity in the EU are reallocated from carbon-intensive industries to other sectors of the economy.

Carbon leakage

The reallocation of EU resources to less carbon-intensive economic activities is likely to lead to carbon emissions being exported outside the EU unless it is accompanied by equivalent changes in consumer demand. Total carbon emissions could actually increase as a result. One mechanism that could lead to this is an increase in demand for transportation services (i.e. freight) due to goods that were previously manufactured in the EU being manufactured elsewhere and imported into the EU. Moreover, more carbon-intensive processes might be used to conduct the same economic activities outside the EU.

Indeed, there is evidence of carbon leakage from the UK, where over the last 15 years or so carbon emissions have fallen by 15%, whereas estimated carbon consumption has risen by 19%.1 However, this particular trend is unlikely to be due to the EU ETS, which was introduced only in 2005.

What changes are being introduced?

The European Commission has introduced reforms to the EU ETS over the short term and is consulting on long-term reform.2 The main change is the ‘backloading’ of allowances, which involves withdrawing allowances from the market with the intention of releasing them back into the market in the later years of the current phase of the EU ETS (2013–20).

The reason for backloading was an expectation of an excess supply of allowances in 2012 and 2013 in light of the impact of the economic recession, combined with the specific regulatory provisions pertaining in these years. These regulatory provisions included the forward selling of allowances originally meant for later years, in order to raise revenues to fund carbon capture and storage (CCS) and innovative renewables. It is also hoped that economic recovery in later years will allow the market to absorb additional allowances without significant downward pressure on the EUA price.

Backloading can be seen as a price stabilisation measure. Since the overall quantity of allowances available over time is to remain constant, this should increase the EUA price in the near term. Arguably, however, its effect on the incentives to invest in carbon emissions reduction technologies could be negative, as it signals a higher supply of allowances and thus lower carbon prices in the future.

What are the options for additional reform?

Further reform of decarbonisation policy is likely to be required to provide carbon price stability and investment incentives, and to deal with concerns about competitiveness and carbon leakage. This may entail a radical transformation of policy through a tax on emissions production or consumption, or a less-intrusive amendment to the EU ETS.

Taxing carbon production

The EU’s decarbonisation policy has aimed at limiting the quantity of emissions, while allowing the price of emissions allowances to fluctuate. An alternative option would be to impose a price (or tax) directly on emissions, while allowing the quantity of emissions to be determined based on the size of the tax and the costs of emissions reduction.

If companies that reduce carbon emissions are risk-averse, they are likely to favour price instruments such as taxes over quantity targets such the EU ETS, provided that governments can be trusted, or otherwise credibly commit, to retain these taxes over the long term. Investors in carbon emissions reduction technology with a long investment horizon are likely to have a strong preference for certainty over the carbon price. Such certainty may attract a lower required rate of investment return, and thus reduce the social cost of carbon emissions reduction.

In addition, economic theory suggests that a tax is more efficient than a quantity target in the context of climate change policy.3 Indeed, the UK has aimed to reduce the risk of low and fluctuating carbon prices by introducing a carbon price floor through a tax on fossil fuels used to generate electricity.

Taxing carbon consumption

A direct way to deal with the potential loss of international competitiveness and carbon leakage resulting from the EU ETS would be to tax carbon consumption directly, instead of targeting carbon emissions production, as is the case under the EU ETS.

Such a carbon consumption taxation policy would take into account both the direct carbon emissions by the EU and the indirect emissions from the foreign manufacture of goods consumed in the EU. This reform could be implemented by introducing a carbon tax within the EU and adjustment tariffs on EU borders to ensure that total carbon emissions relating to goods imported into the EU are reflected in the price of that good on the same basis as for goods manufactured within the EU.4

Such reform would mitigate the problems associated with loss of competitiveness of energy-intensive EU industries, by subjecting them to the same carbon price as equivalent industries outside the EU from the perspective of EU consumers. However, it would do nothing to remove the disadvantage of energy-intensive EU industries relative to their competitors from the perspective of consumers outside the EU. This disadvantage can be mitigated by providing exemptions from participation in the EU ETS or other decarbonisation schemes to export industries.

Exemptions from participation in decarbonisation schemes

One instrument to mitigate the loss of competitiveness by energy-intensive EU industries as a result of EU climate policy is to grant these industries exemptions. Exemptions may be targeted towards goods and services that can be traded across EU borders and are relatively price-elastic. While, in theory, this could mitigate most of the problems associated with carbon leakage, it might also bring some associated costs, the most obvious being that there would be no economic incentive for some of the most prolific carbon emitters to reduce their emissions. Another is that the resulting differences in carbon prices paid by different sectors can introduce distortions to resource allocation that reduce social welfare. For example, granting an exemption to the aviation sector when all other sectors of the economy are covered might result in a switch from rail to air travel.

Assuming that carbon pricing is not applied outside the EU, granting an exemption on exports from the EU in combination with a border tax adjustment for imports into the EU and carbon pricing within the EU could, in theory, put goods and services produced inside and outside the EU on the same footing with regard to carbon pricing both within the EU borders and in other markets.

Price stabilisation mechanisms

It is argued above that the absence of a link between economic activity and the supply of allowances has resulted in volatility and a substantial decline in EU ETS allowance prices. One alternative to deal with this volatility might be to retain a quantity-based instrument, but to introduce price caps and floors. A carbon ‘central bank’ could be created from which further allowances could be purchased or sold when the allowance price is higher or lower, respectively, than the price cap. An alternative arrangement could involve linking the supply of allowances to indicators of economic activity in a transparent way.

Implications for EU decarbonisation policy

As set out above, it could be argued that the EU ETS has not been an efficient mechanism for encouraging the reduction of EU carbon emissions. Low and volatile carbon prices, for which the main causes are the economic crisis and the lack of a link between the supply of carbon credits and economic conditions, are unlikely to incentivise significant investment in carbon emissions reduction technologies. Additionally, the problem of carbon leakage has meant that the EU ETS has not been an effective mechanism for reducing carbon emissions due to the consumption of goods in the EU.

There are several options for reform, as follows, with the final choice likely to depend as much on what is likely to be politically acceptable as on what is economically optimal.

- A stable tax regime for carbon emissions resulting from the consumption of goods and services in the EU may be more economic than the policy mix currently employed by the EU, but disagreements between member states and the potential for trade disputes with non-EU countries are likely to make such arrangements politically infeasible.

- The proposals to backload the supply of a proportion of allowances to later years are unlikely to fully address the problems of the EU ETS, as they would signal lower carbon prices towards 2020 when the backloaded allowances were released back into the market.

- Arguably, a more adequate solution could involve a combination of measures such as permanently retiring carbon allowances to deal with the current surplus, while adding a mechanism tied to the supply of allowances over the economic cycle in a transparent manner. However, this would be likely to test the limits of what is politically feasible in the near term.

Contact: Jostein Kristensen

This topic was discussed at the December 2013 meeting of the Oxera Economics Council. The Council, whose members include prominent European thinkers and academics, meets twice a year to discuss the economic aspects of a wide range of policy issues. This article does not necessarily represent the views of the Oxera Ecomonics Council or its individual members.

1 Helm, D. (2012), ‘To Slow Warming, Tax Carbon’, opinion piece, New York Times, 11 November.

2 European Commission (2012), ‘Report from the Commission to the European Parliament and the Council. The state of the European carbon market in 2012’, 14 November. See also European Commission, ‘Structural reform of the European carbon market’, available at: http://ec.europa.eu/clima/policies/ets/reform/.

3 Weitzman, M. (1974), ‘Prices vs. Quantities’, The Review of Economic Studies, 41, pp. 477–91.

4 For a discussion on border tax adjustment policies, see, for example, Ismer, R. and Neuhoff, K. (2007), ‘Border tax adjustment: a feasible way to support stringent emission trading’, European Journal of Law and Economics, 24, pp. 137–64.

Download

Related

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More