Taking Britain to net zero: Ofgem’s decarbonisation action plan

On 3 February Ofgem, the energy regulator for Great Britain, published its decarbonisation action plan to support the UK in achieving net zero carbon emissions by 2050. Outlining Ofgem’s role in facilitating decarbonisation, the plan lists the trade-offs faced and nine actions that the regulator will take. We look at what the plan says and its implications.

Carbon neutrality by 2050 was prescribed in law in June 2019.1 In this article we first describe the actions2 proposed by Ofgem in its decarbonisation plan.3 We then provide our commentary on the plan, split into three identified themes.

Ofgem’s plan: actions

The box below sets out the nine actions that Ofgem plans to take by August 2020 to achieve the decarbonisation objective.

Ofgem’s nine decarbonisation actions

1. designing cost-effective networks for net zero

2. long-term planning and innovation

3. more effective coordination to deliver low-cost offshore networks

4. making progress on low-carbon heat

5. preparing system operators for a net zero future

6. supporting flexibility

7. enabling electric vehicles at low cost

8. opening up retail innovation

9. adapting the organisation

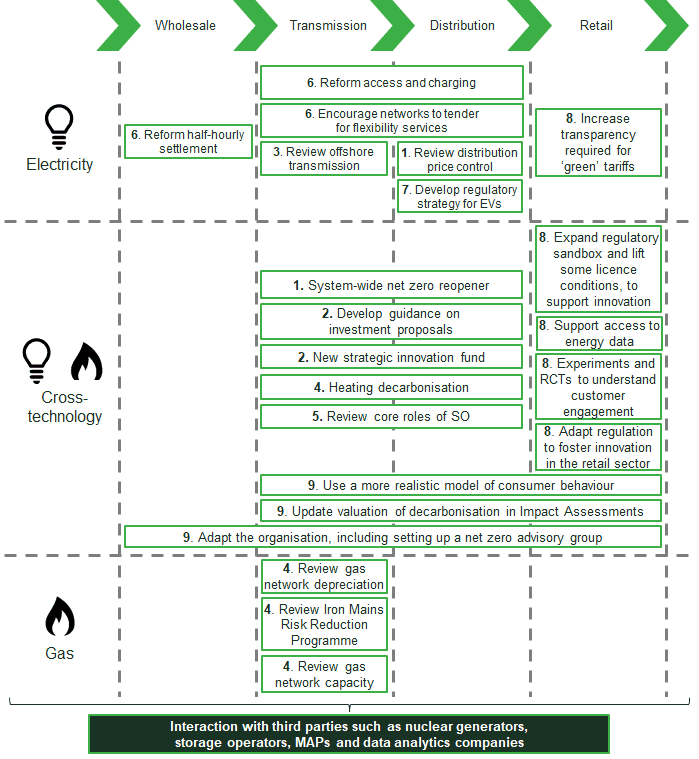

Figure 1 summarises the individual tasks listed by Ofgem against the nine actions, broken down by sector (i.e. electricity, cross-technology or gas) and the parts of the energy value chain that are affected.

Figure 1 Tasks mapped to actions in Ofgem’s plan

Source: Ofgem (2020), ‘Ofgem decarbonisation programme action plan’, 3 February.

The tasks are spread fairly evenly across transmission, distribution and retail, with relatively few within wholesale (i.e. energy production). Many of these also cover both gas and electricity, reflecting an increased focus on sector coupling in the delivery of net zero targets.

Notably, Ofgem has also grouped its actions into four categories:

- preparing the networks to deliver net zero;

- ensuring that the electricity system is ready, with clearly defined roles for SOs, adequate incentives for flexibility and a new regulatory strategy for EVs;

- unlocking retail innovation and driving behavioural change;

- reforming the organisation (i.e. Ofgem).

So, what does Ofgem say about these within its plan? (The section headings below correspond to groups of actions as defined by Ofgem.)

Preparing the networks

Designing a cost-effective network for net zero. Ofgem plans to retain price controls for achieving net zero, and to design its forthcoming price control, RIIO-2, to make it easier for Ofgem and networks to respond to policy changes. For example, it plans to introduce a range of net zero-oriented investment and innovation mechanisms that allow the implementation of decarbonisation actions at any point during the price control period. This includes the introduction of a new net zero reopener (i.e. a mechanism to reopen the price control if needed).

Long-term planning and innovation. While implicitly acknowledging that additional network capacity can be costly for consumers, Ofgem recognises that grid investment will be necessary to accommodate future increases in decarbonisation-related electricity demand (e.g. from EV uptake). The regulator aims to encourage companies to develop and test innovative solutions for the decarbonisation of heating and transport.

More cost-effective coordination to deliver low-cost offshore networks. Ofgem aims to work with the government and industry stakeholders to re-design and change the existing regulatory framework for offshore transmission, unlocking a more cost-efficient way to connect offshore wind. Initially, Ofgem will review the existing regulatory process in collaboration with the electricity system operator (ESO), National Grid.

Making progress on low-carbon heat. Given the uncertainty over the decarbonisation of heating, Ofgem is committed to working with the government and stakeholders to assess the feasibility and cost of different options, and to adjust policy accordingly. Specifically, Ofgem plans to work with National Grid, the electricity and gas transmission operator in England and Wales, on the capacity review of gas transmission, and will review gas network depreciation once there is more certainty on the future of heat.

Ensuring that the electricity system is ready

Preparing system operators for a net zero future. Ofgem aims to work with the Department for Business, Energy and Industrial Strategy (BEIS) to encourage the ESO to deliver greater value and hold it to account for committing to operate a zero carbon system by 2025 through its market facilitation role. It aims to work closely with the BEIS in enabling effective system operation in a net zero world.

Ofgem acknowledges that more distributed generation and flexibility resources will cause distribution network operators (DNOs) to play an SO role. Therefore, to promote coordination across transmission and distribution networks, Ofgem will review the core roles of the SOs.

Supporting flexibility. Ofgem wants to develop markets for flexibility in both transmission and distribution. It hopes to improve data availability and transparency, and lower barriers to entry. The regulator will encourage retailers to develop products and services that create flexibility through demand-side management by increasing data availability, transparency and the interoperability of platforms. Ofgem sees these products as a desirable solution to match demand and supply, and an alternative to building additional network and generation capacity.

Enabling EVs at low cost. Ofgem is committed to supporting the rapid uptake of EVs by developing a regulatory strategy in the near future. The objectives are to maximise consumer benefit, remove regulatory obstacles to new business models, and ensure that electricity charging network costs are recovered efficiently.

Promoting retail innovation and driving behavioural change

Promoting retail innovation. Ofgem understands that retailers are important in changing the energy consumption patterns of households and businesses. To this end, it plans to remove regulatory barriers to new business models, products and services,4 for example by expanding the use of a regulatory ‘sandbox’ that allows innovative firms to test new products in a simplified regulatory environment.5 To anticipate more accurately the consumer response to new policies, the regulator plans to use experiments and RCTs—for example, to test the impact of different ‘time-of-use’ tariff designs. Recognising the importance of tariffs in engaging consumers, Ofgem has committed to addressing ‘greenwashing’, whereby some retailers overstate the green credentials of their electricity tariffs.

Reforming the organisation

Adapting the organisation. Finally, Ofgem recognises that its decision-making needs to adapt in the face of significant uncertainty surrounding the pathway to net zero. It therefore plans to update its guidance on how to appraise decarbonisation in impact assessments, explore the integration of more ‘realistic’ models of consumer behaviour in policy analysis (rather than relying on an assumption of consumer rationality), and set up a Net Zero Advisory Group.

Oxera commentary

We have identified three overarching themes in Ofgem’s decarbonisation plan:

- securing value for money;6

- signalling some support for anticipatory investments from companies, but expecting that companies will demonstrate a high value-for-money proposition for these uncertain investments;

- promoting innovation across the entire value chain, with an increased focus on retail and consumer engagement.

These are discussed further below.

Securing value for money

Delivering net zero at ‘lowest cost’ lies at the heart of Ofgem’s plan. This objective spans several dimensions.

When it comes to consumer cost, Ofgem considers not only the total costs of achieving net zero, but also the associated distributional effects:7

[…] [E]lements of the transition to net zero will involve additional costs or changes to how costs are distributed… Where the costs of this are met through consumer bills, this will be generally regressive, impacting the poorest, hardest. It is our role as a regulator to ensure that, where possible, these additional costs are minimised, efficient and distributed fairly [emphasis added]

Networks and other regulated companies may therefore have to take increasing account of which segments of society are most affected by their spending plans.

Decarbonisation will require research into, and installation of, novel solutions, which may require regulation. Ofgem has stated that it may apply RAB-based8 approaches to nuclear, carbon capture and storage, and other decarbonisation technologies, some of which may be operated by companies not previously regulated by Ofgem.

Some of these companies—particularly small and/or asset-light businesses—may require specific adjustments to the existing regulatory models (e.g. RAB-WACC). For example, since SOs are generally not allowed to own storage assets,9 the ownership and/or operation of storage might be increasingly undertaken by relatively small, independent storage operators or aggregators.

Ofgem has also explicitly acknowledged the possibility of asset stranding as a corollary to securing value for money, and stated that it will attempt to minimise this risk.10

Three examples of how assets could become (partially) stranded are considered below.

- Technology contests: assets could become stranded if the other technologies that they compete against are deemed superior from a decarbonisation perspective and eventually take precedence. For example, decarbonisation of heat could involve a ‘contest’ between hydrogen and electrification. Gas distribution networks may therefore invest in pipeline adaptations while electricity distribution networks may expand their line capacity. If the market settles at different proportions of hydrogen and electricity to those forecast by the gas and electricity distributors, this could lead to (partial) asset stranding.

- System constraints: assets could be stranded in a different part of the value chain to that where a policy change occurs. For example, if the UK were to move to primarily hydrogen-based (as opposed to electricity-based) heating, some capacity upgrades or ancillary services contracted by electricity networks could become superfluous. In this case, companies providing these services might find that their businesses are no longer able to operate at a sufficient scale.

- Policy decisions: finally, some assets could be ‘crowded out’. In a regulatory context, this refers to reduced demand for one type of technology as a result of a decision taken early on in the regulatory process. An example of such crowding out could be a decision made by government to prioritise one particular type of technology (e.g. offshore wind) at the expense of another (e.g. onshore wind), which results in the latter technology having more limited expansion potential.

Supporting risk-taking and expecting companies to provide value to consumers

Ofgem appears to be willing to incentivise companies to take on the potentially riskier investments required for decarbonisation.11 However, Ofgem’s commitment is not open-ended:12

We are encouraging network companies to invest in the infrastructure necessary to decarbonise, such as strengthening the electricity grid for electric vehicles, provided they can demonstrate this represents good value for consumers. [Emphasis added]

It therefore appears that these incentives will be present only if regulated companies can demonstrate the value of these technologies. This requires good visibility of the costs and technical characteristics of the technologies. However, a potential unintended consequence is that this could hinder the adoption of technologies that are in earlier stages of development. Further discussion between Ofgem and the industry may be useful to understand how customer value can be demonstrated in high-uncertainty environments.

Ofgem is not currently committing to any particular technological solution for delivering net zero:13

We have an important role in designing and facilitating markets so that the correct market signals are created to enable decarbonisation through the whole system—from consumers to generators.

It appears that Ofgem wants to allow for ‘winners’ to emerge through a competitive process. The regulator appears to be aware of the risks of this process14—for example, that companies may make investments in technologies that become obsolete or cannot generate a sufficient financial return.15 Ofgem plans to develop further guidance in relation to anticipatory investment.16

Focusing on innovation, including by non-network stakeholders

As discussed above, Ofgem accepts that incentivising innovation and balancing risk between industry and customers are likely to play greater roles in future regulation. To this end, it plans to work more closely with regional organisations and encourage greater innovation in the retail sector.

Different regions and governments may want to implement policies at different times, and regional action may allow quicker experimentation with policies. Some energy system issues may be appropriately dealt with at a regional level too, such as ensuring that distributed generation is not stranded due to insufficient local network capacity. Some decarbonisation strategies are fundamentally local, such as peer-to-peer trading of electricity, which could encourage consumers with generation or storage capacity to profit from load-shifting activities. Ofgem has therefore signalled a move towards a more local/regional approach to future regulation.17 If implemented, this might imply changes to Ofgem’s ability to rely on current regulatory models that undertake benchmarking of outputs and costs across UK energy networks.

Ofgem has also embraced innovation in the retail market by moving away from a conventional assumption of rational consumers, and intends to incorporate a ‘realistic model of consumer behaviour’18 into policymaking. It has explicitly stated that it intends to continue using RCTs (or, more generally, various behavioural trials) to understand how consumers are likely to adapt to the changing energy market.

Next steps…?

Ofgem has highlighted that the next few years are critical to the delivery of decarbonisation. It has signalled an ambitious strategy for the next 18 months, during which we expect several concrete policy proposals to be made. One of the next steps to look out for is a joint paper from Ofgem and BEIS on their planned strategy for system governance.19 This should provide more implementation details on the policy and regulatory initiatives to support the UK economy’s transition to a net-zero future.

1 Department for Business, Energy & Industrial Strategy and The Rt Hon Chris Skidmore MP (2019), ‘UK becomes first major economy to pass net zero emissions law’, news story, 27 June.

2 Throughout the article we use ‘groups of actions’ to refer to the four groupings of actions used by Ofgem, as can be readily seen in the Appendix of its action plan. The ‘actions’ then refer to the nine actions listed by Ofgem, and ‘tasks’ refer to the main distinct components of each action.

3 Ofgem (2020), ‘Ofgem decarbonisation programme action plan’, 3 February.

4 Ofgem (2020), ‘Ofgem decarbonisation programme action plan’, 3 February, p. 26.

5 In particular, the sandbox involves temporarily exempting businesses from rules that are suspected to inhibit innovation. The entity subjected to derogation has to be licensed by Ofgem or be in partnership with an entity that is licensed by Ofgem. For details, see Ofgem (2018), ‘What is a regulatory sandbox?’, September.

6 This is consistent with Ofgem’s strategic narrative, which states that it plans to facilitate decarbonisation to deliver net zero at the lowest cost to consumers. Ofgem (2019), ‘Ofgem strategic narrative: 2019-23’.

7 Ofgem (2020), ‘Ofgem decarbonisation programme action plan’, p. 14.

8 An incentive-based model of regulation where allowed revenues are set partially on the basis of a regulated asset base (RAB), and where allowed revenues are based on companies’ WACCs.

9 Council of European Energy Regulators (2019), ‘Implementation of TSO and DSO Unbundling Provisions’.

10 Ofgem (2020), ‘Ofgem decarbonisation programme action plan’, p. 15.

11 Ofgem (2020), ‘Ofgem decarbonisation programme action plan’, p. 15.

12 Ibid., p. 5.

13 Ibid., p. 13.

14 Ibid., p. 5.

15 Ibid., p. 15.

16 Ibid., p. 5.

17 Ibid., p. 14.

18 Ibid., p. 28.

19 Ibid., p. 20.

Download

Contact

Sahar Shamsi, CFA

PartnerGuest author

Alex Smirnov

Contributors

Related

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More