RIIO-ED2 Sector Specific Methodology Decision: on track to net zero?

In December 2020, Ofgem published its Sector Specific Methodology Decision (SSMD) for the RIIO-ED2 price control covering the electricity distribution (ED) sector. In this article, we review Ofgem’s RIIO-ED2 SSMD and compare some of its elements with Ofgem’s recent Final Determinations (FDs) for the gas distribution and gas and electricity transmission (GD&T) sectors, as well as the Competition and Markets Authority’s (CMA’s) Final Decision (FD) on its redetermination of the PR19 price control for water networks.

In December 2020, building on the Framework Decision,1 Ofgem published its Sector Specific Methodology Decision (SSMD) for the RIIO-ED2 price control covering the electricity distribution (ED) sector.2 Distribution network operators (DNOs) will now need to prepare their business plans and submit drafts in July 2021 and final versions in December 2021,3 before Ofgem publishes its Draft Determinations (DDs) in 2022. The price control is due to start on 1 April 2023 and will run for five years, until 31 March 2028.4

The RIIO-ED2 SSMD should be read together with other regulatory and policy developments in GB energy and water networks. Figure 1 outlines the key milestones.

Figure 1 The timeline for Ofgem’s RIIO-ED2 publications, the CMA’s RIIO-2 GD&T and PR19 water appeals and the Energy White paper

In this article, we review Ofgem’s RIIO-ED2 SSMD and compare some of its elements with Ofgem’s recent Final Determinations (FDs) for the gas distribution and gas and electricity transmission (GD&T) sectors, as well as the Competition and Markets Authority’s (CMA’s) Final Decision (FD) on its redetermination of the PR19 price control for water networks. We build on Oxera’s reviews of Ofgem’s RIIO-ED2 Framework Decision,5 Ofgem’s FDs,6 and the CMA’s PR19 FD.7

Net zero and energy system flexibility

DNOs are expected to play a key role in enabling net zero and need to plan how grids will accommodate increasing electricity demand, particularly from transport and heating electrification. Ofgem recognises that this will require investment in network capacity, but also encourages DNOs to limit that by maximising the flexibility potential of the energy system.

Net zero uncertainty

Some clarity on net zero policies and the corresponding pathways is emerging—for example, the government has announced the end of sales of new combustion engine vehicles by 2030. However, there remains significant uncertainty on the uptake of low-carbon technologies and therefore required infrastructure. With this in mind, Ofgem requires DNOs to develop investment strategies that would be robust across scenarios considered in their business plans. Based on DNOs’ submissions, Ofgem will make a decision on which investments should be recovered with baseline allowances (i.e. those allowed before the start of the price control period), and which ones can be considered under uncertainty mechanisms (i.e. not approved up front but assessed at a later stage when more information about the need for those investments is available).

To address the uncertainty, across the sectors, Ofgem uses a widely defined ‘net zero re-opener’, which aims to address material changes in revenue requirements, for example, due to changes in government policy or market developments. In addition to that, for electricity distribution, Ofgem is considering the use of an automatic mechanism for adjusting revenue allowances faster than via the re-opener.

Innovation

As in the gas distribution and gas and electricity transmission (GD&T) sectors, Ofgem will use the Strategic Innovation Fund (SIF) and Network Innovation Allowance (NIA) to facilitate innovation. Ofgem also considers that a standard cost efficiency incentive, such as the TOTEX incentive mechanism, will encourage companies to invest in innovative solutions.

Enabling a smarter, more flexible energy system

To enable a smarter, more flexible energy system, Ofgem:

- sets up data management requirements to DNOs;

- requires DNOs to outline their strategies on functioning as distribution system operators (DSOs)—the strategy should meet the minimum requirements set by Ofgem and the delivery of the strategy should be reviewed through a DSO strategy delivery incentive;

- introduces flexibility to reassign costs and outputs if the allocation of DSO roles and responsibilities changes.

Output framework

As in all RIIO controls, for RIIO-ED2, Ofgem specifies outputs that it expects DNOs to deliver over the price control period. In line with the other sectors, the output framework for RIIO-ED2 consists of: (i) Licence Obligations (LO) setting minimum standards; (ii) Price Control Deliverables (PCDs) specifying deliverables for the allocated funding and mechanisms for refunding consumers in the event of outputs not being delivered; and (iii) Outcome Delivery Incentives (ODIs) that drive service improvements through reputational and financial incentives.

All outputs belong to one of the following categories:

- customer-focused (aimed at securing high-quality customer service, quality service for consumers seeking a connection, and support to consumers in vulnerable situations);

- safety- and resilience-focused (maintaining reliability, and ensuring long-term safety and resilience of the network);

- environmental.

DNOs can propose bespoke outputs. However, Ofgem asks that these are submitted only for issues that are of material importance to consumers. It therefore introduces the thresholds of 0.25–1% of base revenues for bespoke ODI proposals and >£15m per project for bespoke PCD proposals.

Least-cost delivery and high-quality business plans

TOTEX incentive mechanism (TIM)

Potential TOTEX outperformance and underperformance of DNOs will be shared with consumers in proportion to an incentive rate—the higher the rate, the more exposed the networks are to outperformance and underperformance. As with the GD&T networks, the incentive rates for DNOs will be set at the DDs stage based on the confidence that Ofgem has in the efficiency of the costs proposed by the companies. The incentive rates can be set within the range of 15–50%, which is lower than in RIIO-ED1 (slow-track DNOs had incentives rates of 53–58%).8

Business Plan Incentive (BPI)

The BPI was developed to encourage ambitious, high-quality business plans. The RIIO-ED2 BPI takes the same form as for GD&T networks—to ensure strong performance against this incentive, the networks need to:

- comply with minimum requirements for business plans—among the GD&T networks, NGGT and NGET were penalised against this criterion;

- put forward customer value propositions (CVPs), clearly demonstrating additional value to customers on top of the business-as-usual activities—for the GD&T networks, Ofgem approved only four out of 117 proposals;

- put forward cost forecasts and undertake cost benchmarking, being incentivised to aim lower and justify the costs more effectively—all of the GD&T networks were rewarded or penalised (or both) against this incentive.

Competition

As in the GD&T sectors, Ofgem intends to tender out the ownership, financing, and delivery of large discrete projects. In their business plans, DNOs will flag projects over £50m that may be suitable for ‘early competition’ and projects over £100m that may be suitable for ‘late competition’. Ofgem continues to develop all three models of late competition (CADO, SPV, and CPM).9 Unlike GD&T networks, DNOs will not be required to produce a competition plan, i.e. separately develop ‘native competition’.

Efficiency assessment

Cost allowances

In order to assess whether the proposed expenditure in companies’ business plans is efficient, Ofgem is planning to use econometric benchmarking, activity-level analysis, and engineering-based reviews.

- Historical vs forecast data: Ofgem recognises the trade-off between its standard approach of relying on historical data to assess business plans and the challenge that this poses now that the sector is experiencing significant changes. It states that it will make use of historical data (DPCR5 and RIIO-ED1), as well as RIIO-ED2 forecast data.

- Aggregation level: Ofgem has stated that it intends to continue using two TOTEX regression models and disaggregated modelling, but also sees value in middle-up models. It has not yet been decided how the results of the models will be combined.

- Estimation technique: Ofgem believes that there are benefits to using Ordinary Least Squares (OLS) regressions, but recognises that with additional data available there may be alternative estimation techniques to support the analysis.

- Choice of benchmark: Ofgem will determine the efficiency benchmark once the suite of models is sufficiently developed.

Regional or company-specific factors may be applied in the benchmarking process. Ofgem intends to set a high evidential bar for the acceptance of these factors and expects DNOs to demonstrate that the factors are:

- material (more than 0.5% of TOTEX);

- unique;

- outside of the company’s control (and showing that an effort has been made to mitigate the effect of the factor);

- not already captured as part of the modelling.

Real price effects (RPEs) and frontier shift

As previously proposed, Ofgem decided to index costs RPEs in RIIO-ED2. The indices that will be used for this purpose have not been decided yet, but Ofgem will consider whether they are under DNOs’ management control and how they interact with other areas, such as regional factors. Ofgem is working on developing a notional cost structure to apply RPEs.

Ofgem intends to use a wide range of evidence for setting its ongoing efficiency assumption, including EU KLEMS data, but a specific target has not been set yet. Ofgem expects DNOs to clearly show their underlying ongoing efficiency assumptions as part of the business plan.

Allowed return on capital

In the RIIO-ED2 SSMD, Ofgem set a working assumption for the allowed return on capital at 3.01% (CPIH-real), so that DNOs could use it for their business plans. However, Ofgem will recalibrate the estimate at the DDs stage.

The allowed return on capital was one of the key topics for the CMA’s PR19 water redeterminations, the FD for which was published after Ofgem’s RIIO-ED2 SSMD.10 It also continues to be a key battleground for the ongoing RIIO-2 GD&T appeals, where all networks appealed the allowed return on equity, and one network appealed the allowed return on debt.11

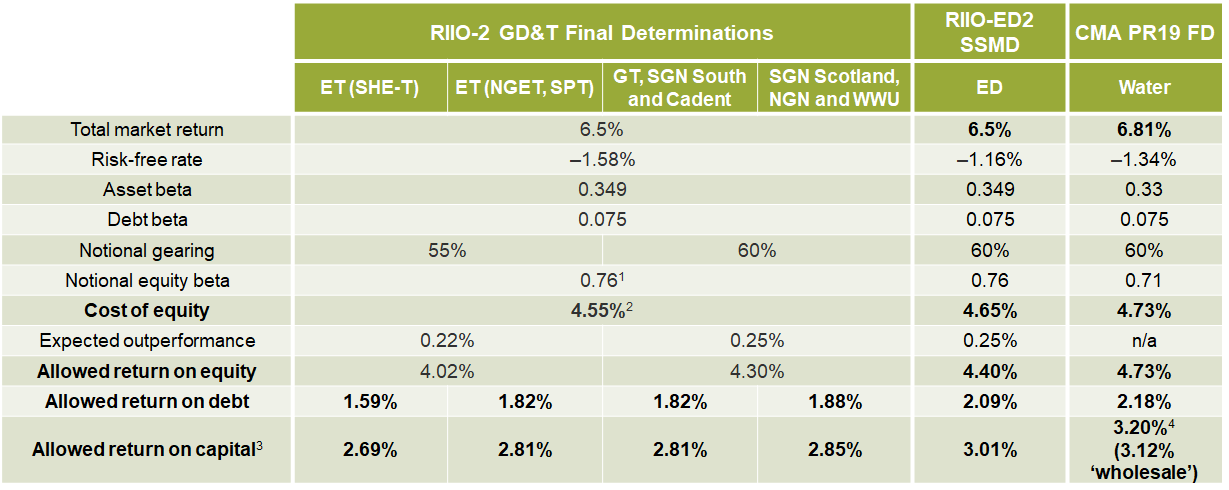

Table 1 shows the allowed return on capital parameters for Ofgem’s RIIO-2 GD&T FDs, Ofgem’s RIIO-ED2 SSMD, and the CMA’s PR19 FD. Ofgem’s ED2 estimate of 3.01% (CPIH-real) is 16–32bps higher than 2.69–2.85% for GD&T (due to market movements in the risk-free rate).12

Table 1 Allowed return on capital (CPIH, real)

Source: Ofgem (2020), ‘RIIO-2 final determinations – Finance Annex’, 8 December, p. 71. Ofgem (2021), ‘RIIO-ED2 Sector Specific Methodology Decision: Annex 3 (Finance)’, 11 March, p. 88. CMA (2021), ‘Anglian Water Services Limited, Bristol Water plc, Northumbrian Water Limited and Yorkshire Water Services Limited Price Determinations – Summary of Final Determinations’, 17 March, p. 27.

Return on equity

Ofgem uses the same three-step approach to the allowed return on equity as for the GD&T networks.

- Step 1: the capital asset pricing model (CAPM) evidence. For the working assumptions in the business plan, the only parameter for which Ofgem has updated the estimate reflecting market movements is the risk-free rate. Other parameters will be calibrated at the DDs stage.

- Step 2: cross-checking the CAPM-implied cost of equity. Ofgem did not undertake cross-checks for the SSMD working assumptions but will do so at the DDs stage.

- Step 3: expected versus allowed returns. As per the GD&T FDs, the estimate implied from Steps 1 and 2 will be reduced by 25 bps, reflecting networks expected outperformance. The networks will receive it back if the outperformance does not materialise.

Now that the CMA has published its FD for the PR19 water redeterminations, we can compare Ofgem’s working assumptions with the CMA’s estimates.

- Total market return—Ofgem’s total market return ranges from 6.25% to 6.75% (CPIH, real), which is narrower than the CMA’s range of 6.2–7.5% and excludes the point estimate of 6.81% (prior to ‘aiming up’) adopted by the CMA.

- Risk-free rate—Ofgem’s estimate reflects yields on 20-year index-linked gilts. This methodology differs from the CMA’s, which uses both index-linked gilts and AAA-rated corporate bonds.

- Debt beta—at the GD&T FDs stage, Ofgem aligned its debt beta estimate with the mid-point of the CMA’s provisional range of 0.0–0.15, which did not change in the PR19 FD.

Return on debt

Ofgem follows the same principles to the cost of debt allowance as for GD&T—it plans to calibrate the full indexation allowance to the average expected cost of debt for DNOs. The working assumption specification of the index is as follows.

- There is a 17-year trailing average of the iBoxx GBP Utilities 10+ index yields.

- The additional costs of borrowing are 25bps—the same as for GD&T. This reflects transaction costs, liquidity costs, cost of carry, and additional costs related to the transition of the price control from RPI to CPIH indexation.

- No premium to infrequent issuers is allowed at this stage.

Next steps

As the next step of the RIIO-ED2 price control review process, the DNOs will prepare their business plans, based on Ofgem’s SSMD, discussed in this article, and the business plan guidance.13

1Ofgem (2019), ‘RIIO-ED2 Framework Decision’, 17 December. Also see Oxera’s commentary at Oxera (2020), ‘RIIO-ED2 framework decision’, January.2Ofgem (2020), ‘RIIO-ED2 Sector Specific Methodology Decision’, 17 December.3Ofgem (2021), ‘RIIO-ED2 Business Plan Guidance’, 1 February, para. 1.3.

4 Ofgem (2020), ‘RIIO-ED2 Sector Specific Methodology Decision’, 17 December, p. 4.

5 Oxera (2020), ‘RIIO-ED2 framework decision’, January.

6 Oxera (2020), ‘RIIO-2 Final Determinations: how final?’, December.

7 Oxera (2021), ‘CMA PR19 Final Determination’, March.

8 Ofgem (2014), ‘RIIO-ED1: Final determinations for the slow-track electricity distribution companies’, 28 November.

9 CADO—Competitively Appointed Distribution Owner; SPV—Special Purpose Vehicle; CPM—Competition Proxy Model.

10 CMA (2021), ‘Anglian Water Services Limited, Bristol Water plc, Northumbrian Water Limited and Yorkshire Water Services. Limited Price Determinations. Summary of Final Determinations’, 17 March.

11 CMA (2021), ‘Energy Licence Modification Appeals 2021’, 5 March.

12 32bps increase relative to the allowed return on capital for SHET, 20bps increase relative to other ET companies, GT, SGN South and Cadent, and 16bps relative to SGN Scotland, NGN and WWU.

13 Ofgem (2021), ‘RIIO-ED2 Business Plan Guidance’, 1 February.

Download

Related

What is venture capital, how does it work, and what are the risks?

In the third and final episode demystifying private equity, we explore the world of venture capital. While venture capital has delivered exceptional returns for some investors and founders, it’s also very high risk. So, is vibrant venture capital essential for economies seeking to boost innovation and drive productive growth? In… Read More

Measuring and inferring anticompetitive effects from an exchange of information

In four rulings1 dated 3 November 2025, the Spanish National Court overturned the Decision of the Comisión Nacional de los Mercados y la Competencia (CNMC) in case S/DC/67/17 Tabacos2 (‘the Decision’). These four rulings are significant because they close one of the first cases that the… Read More