RIIO-ED2 Draft Determinations

On 29 June 2022, Ofgem published its Draft Determinations (DDs) for the RIIO-ED2 price control covering the electricity distribution (ED) sector. The regulatory cycle for the ED sector follows that for the transmission and gas distribution (GD&T) networks with a two-year lag, which means that the recently published DDs build on the outcome of GD&T networks’ appeal to the Competition and Markets Authority (CMA). In this article, we outline the key elements of the DDs, highlighting any impacts we consider the CMA’s Final Determination (FD) had on them.

Ofgem’s recently published RIIO-ED2 DDs build on the methodologies described it its Sector Specific Methodology Decision (SSMD),1 and the distribution network operators’ (DNOs’) business plan submissions. Stakeholders will now have two months to provide their feedback to Ofgem, before it expects to finalise the price control package by December 2022. The price control is due to start on 1 April 2023 and will run for five years, until 31 March 2028.2

DNOs will play a central role in achieving net zero, as the deployment of low-carbon technologies (LCTs)—e.g. electric vehicles, heat pumps and low-carbon generation—will depend on the grids’ capacity to accommodate increasing electricity demand. Ofgem recognises that this will require investment in network capacity, which is reflected in the TOTEX allowances being above the ED1 level. However, Ofgem also encourages DNOs to limit such investment by maximising the innovation and flexibility potential of the energy system, for example, by investing in storage and demand-side responses and in procuring flexibility services. Ofgem did not consider that all investments pitched by the DNOs would be required, which was one of the reasons for Ofgem to cut the baseline cost allowance compared to the amounts requested by DNOs—an overall 17% cut relative to what companies put forward in their business plans.

The key facts from the DDs are:

- a 17% cut to TOTEX allowances relative to the DNOs requests—this compares to 20% cut for gas distribution and 55% cut for transmission networks at the RIIO-GD2/T2 DDs stage;

- an ongoing efficiency (OE) target of 1.2% p.a., which is broadly aligned with RIIO-GD2/T2;3

- an 85th percentile for the efficiency challenge (with a glide path from the 75th percentile), which is the same as in RIIO-GD2 (not applicable to RIIO-T2);

- incentive rates (the share of under- or out- performance that companies will keep) of between 49.2% and 50%, which is similar to RIIO-GD2, but is higher than in RIIO-T2;

- a total range of Output Delivery Incentive (ODI) rewards and penalties of between +1.95% and -4.0%, in terms of the return on regulated equity (RoRE);

- an allowed return on capital of 3.26% (CPIH-real), compared to 2.81% (CPIH-real) in RIIO-GD2/T2, with the methodologies being largely unchanged, except in relation to the outperformance wedge downwards adjustment which Ofgem applied in RIIO-GD2/T2 but does not use for RIIO-ED2.

We provide the details behind these estimates in the remainder of this article.

Efficiency assessment

Ofgem has proposed cost allowances of £20.9bn, representing a 17.1% cut relative to what companies put forward in their business plans.4 While there is considerable variation across the industry, even the most efficient network (LPN) has a reduction of 8.5% from its proposed expenditure level. At a high level, Ofgem justifies this reduction in cost allowances using three tools: (i) TOTEX and disaggregated cost modelling; (ii) volume adjustments; (iii) the catch-up and OE challenges.

TOTEX and disaggregated cost modelling

Ofgem uses three TOTEX models to derive a top-down view of companies’ expenditure requirements, and a series of disaggregated cost models to assess companies’ expenditure requirements in individual cost categories (i.e. a bottom-up view). Ofgem attaches equal weight to the top-down and bottom-up views when assessing companies’ overall expenditure requirements.

The TOTEX models follow a similar structure to what was done at ED1; however, two of the TOTEX models also account for ‘activity drivers’ that capture the impact of electric vehicles and heat pumps.

Volume adjustments

Ofgem highlighted in the SSMD that a key challenge for RIIO-ED2 would be the potential differences in forecast assumptions made by companies, specifically in relation to the growth of LCTs and their impact on network reinforcement expenditure. Indeed, Ofgem presents evidence in the DDs that companies have materially different forecast scenarios for the uptake of heat pumps and electric vehicles, stating that this could affect its ability to make like-for-like comparisons between companies. Moreover, Ofgem is concerned that companies might have proposed ‘optimistic’ forecasts with respect to LCT uptake, which could inflate cost allowances relative to a baseline scenario.

Therefore, Ofgem makes a ‘demand-driven adjustment’ to companies’ cost allowances, effectively bringing companies’ volume forecasts in line with independent forecasts of LCT uptake. This results in a negative adjustment for 13 out of the 14 DNOs. Note that LCT uptake is covered by uncertainty mechanisms, so companies are (to some extent) protected if LCT uptake is faster than Ofgem anticipates. One of the challenges in using uncertainty mechanisms for such expenditure is that it reduces the ability to have planned investment certainty on an ex ante basis. This can create its own challenges in relation to scheduling network upgrades.

Efficiency challenges

For its catch-up efficiency challenge, Ofgem is proposing to set a benchmark at the 85th percentile based on its TOTEX and disaggregated cost modelling, with a three-year glide path from the 75th to the 85th percentile. While this is materially more challenging than what Ofgem set in ED1 (i.e. a 75th percentile benchmark and further protections for companies through the information quality incentive, IQI), this is aligned with Ofgem’s approach in the RIIO-GD2 price control.

In addition to the challenging benchmark, Ofgem is proposing to set an OE target of 1.2% p.a. This is 0.2 percentage points higher than what the most ambitious companies proposed in their business plans, and is higher than recent precedent in the CMA PR19 water and RIIO-GD2/T2 energy appeals (although it is broadly aligned with what Ofwat and Ofgem apply in the respective price determinations). Many of Ofgem’s justifications for a more stringent challenge are similar to those it put forward at GD2. However, the focus has shifted from the use of quantitative to qualitative evidence, at this DDs stage in the RIIO-ED2 process.

Net zero uncertainty

As mentioned above, significant uncertainty is associated with the uptake of LCTs and therefore with the required infrastructure, as well as the developing government policies for meeting decarbonisation targets. With this in mind, Ofgem required DNOs to develop investment strategies in their business plans that would be robust across net zero scenarios, while also striving for the least cost investment path.

In order to fund load-related expenditure (LRE) within RIIO-ED2, Ofgem uses a combination of baseline allowances (i.e. those agreed on before the start of the price control period) and uncertainty mechanisms (i.e. allowances that are not approved upfront but assessed at a later stage when more information about the need for those investments is available).

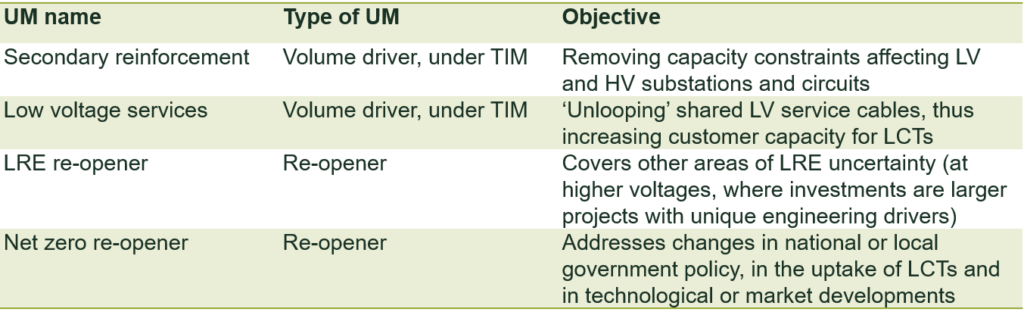

Ofgem proposes to introduce two automatic volume drivers, covering reinforcement and services for lower voltage levels, and an administrative re-opener covering all other LRE. Ofgem is also planning for a wider ‘net zero re-opener’, enabling networks to respond flexibly to technological and policy developments along the path to net zero. The table below summarises proposed net zero uncertainty mechanisms.

Table 1 Net zero uncertainty mechanisms

Source: Ofgem (2022), ‘RIIO-ED2 Draft Determinations – Core Methodology Document’, Chapter 3.

Innovation

Similar to the GD&T sectors, Ofgem proposes the use of the Strategic Innovation Fund (SIF) and of the Network Innovation Allowance (NIA) to foster innovation. Ofgem also considers that a standard cost efficiency incentive, such as the TOTEX incentive mechanism (TIM), will provide an incentive for companies to invest in innovative solutions.

The SIF supports network innovation that contributes to the achievement of net zero. The total funding is currently shared across the RIIO-GD2/T2 and ESO price controls and amounts to £450m. Ofgem is not planning to increase the size of the funding to accommodate RIIO-ED2 in the SIF, but will keep it under review during the price control period.

The NIA relates to innovation projects that could address consumer vulnerability and deliver financial and environmental benefits to consumers via the energy system transition. A total of £66.9m of fixed ex ante allowances is being made available for DNOs for the first three years of the price control. After that initial period, the need for additional funding will be reviewed.

Enabling a smarter, more flexible energy system

A smarter and more flexible energy system requires network operators to actively manage electricity flows to achieve efficiencies across the whole energy system. The use of smart technologies can help reduce the need for infrastructure investment by smoothing out peaks, i.e. the moments of greatest intensity for the system.

To enable these benefits, better data capabilities are required. Ofgem’s proposals in relation to this include mandating digitalisation strategies, action plans and best practice in relation to data, as well as a re-opener to react to changes in IT and digital estates. To facilitate DNOs taking on the role of distribution system operators (DSOs), Ofgem has developed a set of baseline requirements for the DSO role and an additional financial incentive. As envisaged in the SSMD, a re-opener is introduced to capture any changes to costs, outputs and incentives associated with any future decision on the separation of DSO functions from DNOs. There is also a Coordinated Adjustment Mechanism, which allows for the reallocation of activities and associated responsibilities from one licensee to another. Finally, in order to ensure that DNOs consider the impact of any decisions on the entire system, not just their own network, Ofgem proposes to introduce a licence condition mandating strategic whole system planning.

Output framework

All RIIO-ED2 outputs belong to one of the following categories:

- customer-focused (aimed at securing high-quality customer service, quality service for consumers seeking a connection, and support to consumers in vulnerable situations);

- safety- and resilience-focused (maintaining reliability, and ensuring the long-term safety and resilience of the network);

- environmental, that is aimed at taking appropriate steps to mitigate the environmental impacts of electricity distribution, such as pollution to the local environment, loss of visual amenity, and a reduction in biodiversity.

Overall, Ofgem has proposed seven common financial ODIs for RIIO-ED2, with a total incentive rate (expressed as a percentage of RoRE) of between +1.95% and -4.0%.5 Additionally, Ofgem foresees four reputational ODIs, three licence obligations and three price control deliverables.

TOTEX incentive mechanism

Potential TOTEX out- and underperformance of DNOs will be shared with consumers in proportion to an incentive rate—the higher the rate, the more exposed the networks are to out- and underperformance. Ofgem had announced at the SSMD stage that the incentive rates would be based on the confidence that Ofgem has in the efficiency of costs and could be set within the range of 15–50%. It has now proposed incentive rates of between 49.2% and 50%, which is towards the upper end of the possible range but lower than in ED1 (slow-track DNOs had incentive rates of 53–58%).6 For comparison, the incentive rates in RIIO-GD2/T2 were:

- in the range of 49–50% in RIIO-GD2;

- somewhat lower at 39% in RIIO-GT2 (for National Grid Gas Transmission, NGGT);

- between 33% (for National Grid Electricity Transmission, NGET) and Scottish Hydro Electric Transmission, SHET) and 49% (Scottish Power Transmission, SPT) in RIIO-ET2.

Business Plan Incentive

The Business Plan Incentive aims to encourage ambitious, high-quality business plans. Networks can be rewarded or penalised for up to +/- 2% of TOTEX. Compared to GD&T networks, the amounts of DNOs’ rewards and penalties are relatively low.

- Scottish and Southern Electricity Networks (SSEN) has a net penalty of £1.6m. This combines the effect of Ofgem rewarding the network for two successful Consumer Value Proposition (CVP) proposals and, at the same time, penalising the network for not providing sufficiently detailed information about the costs related to physical security;

- Western Power Distribution (WPD) has a net reward of £3.6m for a successful CVP.

Ofgem was more receptive to CVP proposals than in the RIIO-GD2/T2 price control review—it accepted 15 out of 24 proposals for DNOs against four out of 117 for GD&T networks. However, the number of CVP proposals which Ofgem rewards is similar—three for DNOs and four for GD&T networks.

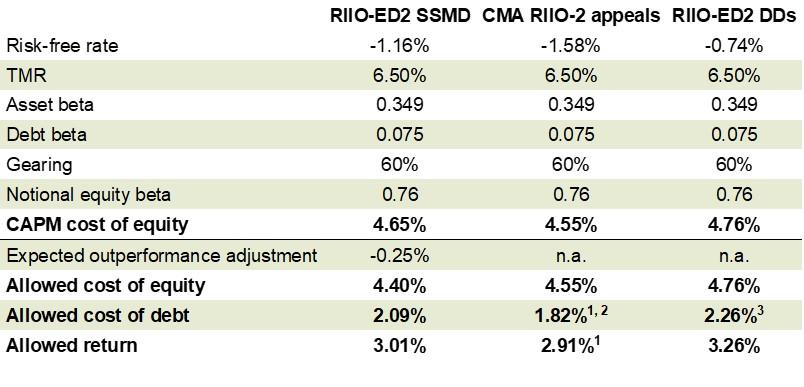

Allowed return on capital

In the RIIO-ED2 DDs, Ofgem set the allowed return on capital at 3.26% (CPIH-real),7 a 25bps increase from the SSMD. Table 2 shows the allowed return on capital parameters for Ofgem’s RIIO-ED2 SSMD, the CMA’s RIIO-GD2/T2 FD, and Ofgem’s ED2 DDs.

Table 2 Allowed return on capital (CPIH-real)

Source: Ofgem (2020), ‘RIIO-2 final determinations – Finance Annex’, 8 December, p. 71. Ofgem (2021), ‘RIIO-ED2 Sector Specific Methodology Decision: Annex 3 (Finance)’, 11 March, p. 88. CMA (2021), ‘Energy Licence Modification Appeals 2021 – Volume 2B: Joined grounds continued (Outperformance wedge, Ongoing efficiency, Licence modification process)’, 28 October. Ofgem (2022), ‘RIIO-ED2 Draft Determination – Finance Annex’, 29 June.

Ofgem is considering the impact of the difference between the long-term inflation forecast (applied to the rate of return allowance parameters) and the relatively high inflation expected during ED2 (used for the indexation of the regulatory asset value) on the realised returns.8 In this context, Ofgem is seeking the views of stakeholders on whether it should adjust its current approaches.9

Return on equity

Ofgem follows three steps in setting its return on equity allowance.

Step 1: the capital asset pricing model (CAPM) evidence. Ofgem maintains its position from the SSMD and the RIIO-GD2/T2 Determinations.

- Risk-free rate (RfR)—Ofgem’s estimate reflects yields on 20-year index-linked gilts and forward rates, deflated using the long-term forecast of the CPIH‒RPI wedge. The average RfR forecast for the next control period is

-0.74% CPIH-real, although the allowance will be indexed to reflect market movements. - Total market return (TMR)—Ofgem maintains the TMR range from 6.25% to 6.75% (CPIH-real), with a mid-point of 6.5%, set in the SSMD and in the RIIO-GD2/T2 Determinations.

- Unlevered beta—Ofgem presents updated two-, five-, seven- and ten-year beta analysis of the betas of Severn Trent, SSE, Pennon Group, United Utilities, and National Grid. Ofgem also presents a qualitative risk comparison between the GD&T and ED sectors. Overall, it concludes that there is no basis to deviate from the RIIO-GD2/T2 range of 0.285–0.335 (with a mid-point at 0.311), based on either the updated market data or the risk differential between the GD&T and ED sectors. This range for the unlevered beta corresponds to equity and asset beta point estimates of 0.759 and 0.349 respectively.10

- Debt beta—Ofgem’s mid-point debt beta estimate is the same as in the ED2 SSMD and RIIO-GD2/T2 Determinations.

Step 2: cross-checking the CAPM-implied cost of equity. Ofgem presents an update of the cross-checks analysis presented in the RIIO-GD2/T2 Determinations, including the Modigliani–Miller cross-check, market-to-asset ratios, OFTO investors’ bids, investment managers’ forecasts, infrastructure fund discount rates and implied internal rate of return cross-checks. The result of Ofgem’s cross-checks analysis is a CPIH-real cost of equity range of 3.1‒5.1%. Ofgem concludes that this evidence supports a cost of equity value in the lower half of the CAPM-implied range. However, for consistency with the RIIO-GD2/T2 Final Determinations and because no cross-check is perfect, Ofgem proposes not to adjust the allowed return on equity based on this second step of its analysis.

Step 3: selecting a baseline allowed return on equity. Following the CMA’s decision in the RIIO-GD2/T2 appeals, which concluded that Ofgem was wrong in introducing a 25bps outperformance wedge adjustment, Ofgem has dropped the adjustment.

Based on the CAPM-implied cost of equity, Ofgem sets the cost of equity allowance at 4.75% (CPIH-real) at 60% notional gearing.

Return on debt

Ofgem maintains its position from the SSMD—it calibrates the full indexation allowance to the average expected cost of debt for DNOs. An additional allowance is recognised for LPN, NPgN and SWALES in the form of an infrequent issuer premium. The specification of the index is as follows.

- There is a 17-year trailing average of the iBoxx GBP Utilities 10+ index yields.

- The additional costs of borrowing are 25bps—the same as for GD&T. This reflects transaction costs, liquidity costs, cost of carry, and additional costs related to the transition of the price control from RPI to CPIH indexation.

- A 6bps infrequent issuer premium is included in the cost of debt allowance for three licensees: LPN, NPgN and SWALES. This was not allowed for at the SSMD stage.

- The nominal cost of debt derived from the sum of all of the allowances above is deflated using the Fisher equation and the five-year CPI forecast published by the Office for Budget Responsibility.

Return Adjustment Mechanisms

As in RIIO-GD2/T2 price controls, Ofgem protects consumers and investors from extreme deviations of outturn returns from those anticipated at the price control decision stage via Return Adjustment Mechanisms. Ofgem proposes to apply two thresholds:

- for RoRE deviations between 3% and 4% from the baseline return, companies’ returns will be adjusted by 50%;

- for RoRE deviations above 4%, companies’ returns will be adjusted by 90%.

Next steps

The DNOs now have just under two months to respond to Ofgem’s consultation questions and provide feedback on Ofgem’s assessments, after which Ofgem will issue Final Determinations by December 2022.

1 Ofgem (2022), ‘RIIO-ED2 Draft Determinations’, 29 June. Ofgem (2020), ‘RIIO-ED2 Sector Specific Methodology Decision’, 17 December.

2 Ofgem (2020), ‘RIIO-ED2 Sector Specific Methodology Decision’, 17 December, p. 4.

3 In RIIO-GD2/T2, the OE challenge was 1.15% and 1.25% p.a. for CAPEX/REPEX and OPEX respectively.

4 Note that the 17.1% figure is calculated based on Ofgem’s view of companies’ submitted costs, which are higher than what companies requested in the business plans data tables due to Ofgem’s cost normalisation process.

5 The seven common financial ODIs are the customer satisfaction survey, complaints metric, the time to connect incentive, the major connections incentive, the vulnerability incentive, the DSO incentive and interruptions incentive scheme. The impact of rewards and penalties will be limited by the Return Adjustment mechanisms (RAMs).

6 Ofgem (2014), ‘RIIO-ED1: Final determinations for the slow-track electricity distribution companies’, 28 November.

7 The allowed return on capital of LPN, NPgN and SWALES is set at 3.29% (CPH-real), reflecting an uplift to the cost of debt allowance for an infrequent issuer premium.

8 Ofgem (2022), ‘RIIO-ED2 Draft Determination – Finance Annex’, 29 June, pp. 59–60.

9 Ofgem (2022), ‘RIIO-ED2 Draft Determination – Finance Annex’, 29 June, paras FQ16–FQ18.

10 An unlevered beta is derived from raw equity betas using a zero debt beta and is quoted for comparability. An asset beta is based on a non-zero debt beta.

Contact

Sahar Shamsi, CFA

PartnerContributors

Related

Related

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More