Retail payments: a changing European landscape

The landscape for retail payments in Europe is going through a period of considerable upheaval due to technological developments and entry by new providers, supported by regulatory changes. What exactly are these changes, and what are their implications for the competitive dynamics and market outcomes in retail payments?

This article is based on Oxera (2020), ‘The competitive landscape for payments: a European perspective’, March, prepared for Mastercard.

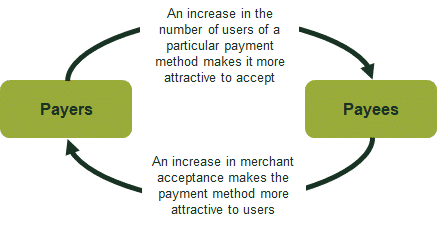

Retail payment systems bring together retailers and consumers. Retailers want to accept a payment method that consumers like to use, and, vice versa, consumers want to be able to use a payment method that is accepted by retailers. Hence, the attractiveness of participating in a payment system is a function of the level of participation on the other side of the market—what economists call a ‘two-sided network externality’, as illustrated Figure 1 below.

Figure 1 Network effects in payments

The traditional view was that these network effects were so strong that new providers would find it extremely difficult to enter the retail payments space and be successful in creating a sufficient customer base on both the retailer and the consumer side. Retail payments took place in the store itself, and were limited to cash, cheques, or cards managed by domestic or international payment schemes. However, market changes are now significantly reducing barriers to entry and giving consumers access to new ways to pay.

New payment methods

The past 10–15 years have seen different types of player enter the payments market. Network externalities still matter, but technological, market and regulatory developments are stripping back barriers to entry and changing the way competition works in this market.

Certainly, in the past decade, various types of player that have developed their own payment solutions have successfully entered the payments market. Most consumers nowadays have access to multiple payment methods beyond cash, cheque and a single card, including co-badged cards (common in Germany, France and other European countries, as well as elsewhere). These give access to two different debit schemes, digital wallet accounts, or new payment methods—mobile apps, near-field communication (NFC) or quick response (QR) technology—that use (often instant) credit transfers directly from bank accounts.

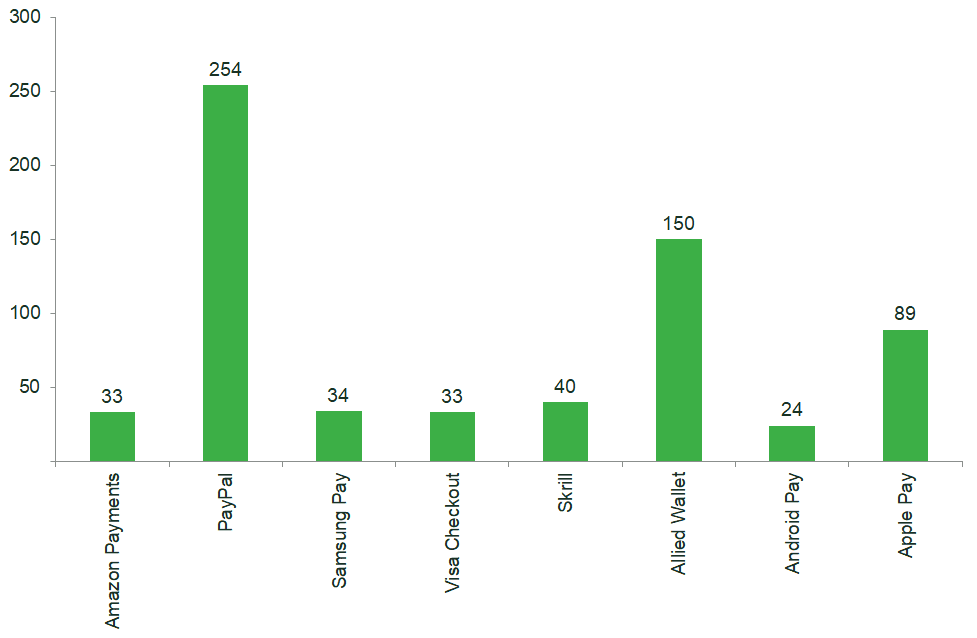

One entry point has been through large customer bases established in neighbouring markets. Retailers (such as Amazon) have leveraged their existing customer base to introduce new digital wallet services for online payments. Digital wallets are an electronic device or online service that allows a user to make electronic transactions. They can be linked to the users’ bank or card details. Mobile phone manufacturers (such as Apple and Samsung) have leveraged their handset user bases and NFC technology to enable in-store payments. This is illustrated in Figure 2 below.

Figure 2 Global customer base of digital wallets (m users), 2018

Furthermore, banks have leveraged their current account customer base and existing interbank-processing infrastructure to enable retail payments online, as well as in stores. Examples of this include iDEAL in the Netherlands and Swish in Sweden.

Various providers have also entered the payments market through technological innovation without having an existing customer base. PayPal and Klarna, which offered convenience that appealed to consumers and therefore indirectly also to merchants, are two such examples. PayPal was bought by eBay and became eBay’s preferred payment method, further strengthening PayPal’s success (and in 2018 eBay decided to spin off PayPal).

Technology means that the use of interbank infrastructure is increasingly not limited to banks. It is not necessary to build a payments infrastructure to offer a payments service. Sofort and Trustly were among the first new entrants to make the existing interbank processing infrastructure available for e-commerce transactions. Regulatory developments have now further facilitated this business model; the revised EU Payment Services Directive (PSD2) will promote further entry into the payments market, enabling the development of new propositions and business models that build on top of existing interbank payment infrastructures. This should help to create a more level playing field in the payments market.

These new entrants are now well established in e-commerce. For example, PayPal is now used in more than 52% of e-commerce transactions in Germany, while iDEAL has a 56% market share in e-commerce in the Netherlands and in Sweden Klarna accounts for 73% of digital payments usage, with a 10% market share in e-commerce across Northern Europe.1 Nor are these trends limited to e-commerce, as the broadening use of smartphones provides options at the point of sale, for example through NFC and QR codes. Some retailers have integrated the delivery of their service with the payment method, which blurs the long-held distinction between online and in-store payments. For example, the Uber app can be used both to order a taxi and to pay for the journey; similarly, the Starbucks app can be used to order and pay for a coffee. In both scenarios, although technically the payment may be considered an online transaction, it competes with methods such as cash or cards used for in-store payments.

Changing the market dynamics for payments

A fundamental change in the competitive dynamics of retail payments relates to consumers having access to multiple payment methods. New payment alternatives mean that consumers and retailers today ‘multi-home’, meaning that they have multiple payment methods at their disposal simultaneously. This can include cash, a co-badged card giving access to two different debit cards, a digital wallet account, and a bank account enabling payment methods that use credit transfers. This allows multiple large payment networks to operate at scale alongside each other. One payment provider having a large user base and acceptance network does not preclude another provider also having one. This means that payment service providers increasingly compete for the actual use of the method that they offer to consumers at the point of sale, in store, or online.

This matters for the dynamics of the market, because it means that having a large customer base on the consumer side is no longer a sufficient condition for a payment service provider to enjoy market success. Customers have a choice of alternative payment methods at the point of transaction, and retailers have an alternative means of reaching those customers. Payment method providers compete for consumers by making their payment product as convenient to use as possible. For in-store transactions, this means offering contactless or NFC technology; for online transactions, it means allowing consumers to pay simply by entering a username and password.

A retailer may steer consumers in a particular (or its own) direction—for example, by displaying its preferred payment method prominently on its website, or by setting it as the default for in-store transactions. In addition, providers of payment methods may offer specific discounts to merchants or seek to enter into preferential agreements with large retailers. This can be seen in France, for example, where most debit cards are co-badged and give consumers access to both the local debit card and a Visa or Mastercard debit card. The card schemes promote their brands directly to retailers or acquirers, to encourage them to select the scheme’s network as the default option for payments made using co-badged cards.

Multi-homing also means that digital wallets are starting to play a pivotal role in the competitive process. First, digital wallets can combine the use of relatively basic payment methods, such as credit transfers and direct debits (which offer no or very limited consumer protection), with consumer convenience and protection. In doing so, they compete for online transactions directly with other payment methods, such as cards. For example, in Germany, many PayPal transactions are funded by direct debits and credit transfers.

Second, digital wallets do not only compete directly with other payment methods. By storing consumers’ details, providing a convenient app, and enabling customers to put various payment methods in one wallet, they tend to ‘own’ the customer relationship. Thus, they play a crucial role in a consumer’s choice as to how a transaction is settled, which imposes additional competitive pressure on the payment methods that their customers can use to load the wallet or fund the transaction. By enabling customers to put various payment methods in one wallet and allowing them to make an instant selection, there is increased competitive pressure on established international and domestic card schemes from digital wallet providers. In particular, digital wallets can steer consumers towards methods that are the most advantageous to the digital wallet providers, and the threat of using steering in itself puts pressure on the underlying payment method providers.

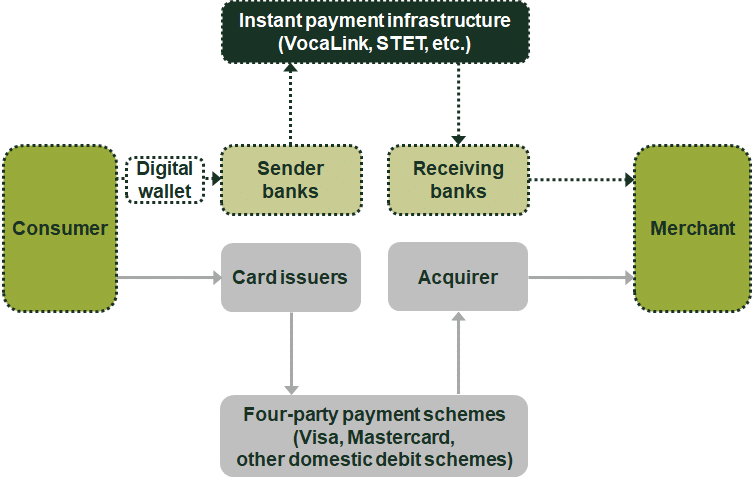

Third, digital wallets can reduce their use of some underlying payment methods by internalising a higher proportion of transactions—or, under PSD2, by directly linking the wallet to the customer’s bank account. While digital wallets can already take payment for the balance from consumers via bank transfers and direct debits, PSD2 greatly facilitates the use of digital wallets on a regular, per-transaction basis without requiring the consumer to load any money into the wallet in advance. This will result in increased competitive pressure on card schemes as digital wallet providers have easier access to alternative underlying payment methods, such as direct debits and credit transfers. This is illustrated in Figure 3 below.

Figure 3 Alternative routes of payment

Greater choice all round

The increase in competition for the actual use of payment methods has resulted in greater choice for consumers and retailers. Both now have a range of payment methods at their disposal, with different price–quality trade-offs. This is allowing multiple payment methods to operate at scale alongside each other, leading to competition for the actual use of their method by consumers in the physical and online world. This competition is also an important driver of innovation in the payments landscape, as providers are looking for solutions that can offer increased convenience and safety. For example, some local debit card schemes, such as Girocard in Germany, have now decided to roll out contactless technology in order to compete with Mastercard and Visa cards, which already offer contactless. Different players may flourish in different contexts, and multi-homing and open infrastructure mean that economies of scale matter less.

1 Deutsche Bundesbank Eurosystem (2018), ‘Payment behaviour in Germany in 2017’; iDEAL (2019), ‘iDEAL information’, 26 March; Klarna, ‘About us’.

Download

Contact

Reinder Van Dijk

PartnerContributors

Related

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More