Quid pro quo? What factors influence IPO allocations to investors?

IPOs play a vital role in the economy, enabling companies to raise finance for investment, expansion, and continuing operations. They provide investment opportunities for pension funds, insurance companies, other institutional investors, and individuals.

A key aspect of a well-functioning primary market is an effective allocation process, and there have been concerns from issuers and investors that, when issuing equity or debt, the issuing banks may favour certain investors.1 This is because the banks work for issuing firms, and advise them on the pricing and allocation of the shares. But they also have long-term relationships with buy-side investors for whom they offer trading, research, and many other services.

In the USA, the IPO boom during the dot-com period witnessed several scandals, including laddering, spinning, and analysts’ conflicts of interest, as well as heavily underpriced shares being allocated in return for excessive trading commissions.2

In the UK, the FCA requires banks to have allocation policies in place; however, in a survey conducted by the Authority, buy-side investors tended to see a positive link between their business relationship with the bookrunner and IPO allocations.3

In 2014 the FCA began a review of wholesale financial markets which led to the launch of a market study into competition in investment and corporate banking, focusing on primary market services.4 As part of this market study the FCA decided to examine the transparency of the allocations process when issuing equity. The research presented in this article was conducted alongside this market study.

Determinants of IPO allocations

The underpricing of IPOs is well documented and represents ‘money left on the table’ for the original owners of the company.5 That money is picked up by those who are allocated shares at the IPO (see the box).

Underpricing

A benign interpretation sees underpricing as an equilibrium phenomenon. Given the asymmetry of information about the valuation of companies, investment banks reward investors who reveal useful pricing information by making preferential allocations of underpriced shares to them (Benveniste and Spindt, 1989). A less benign view is that conflicts of interest help to explain underpricing. Investment banks may reward those buy-side investor clients who generate revenues for the bank through broking and other services with allocations of underpriced IPOs (Reuter (2006), Nimalendran, Ritter and Zhang (2007), Ritter and Zhang (2007), Goldstein, Irvine, and Puckett (2011)).

Source: Benveniste, L.M. and Spindt, P.A. (1989), ‘How investment banks determine the offer price and allocation of new issues’, Journal of Financial Economics, 24:2, pp. 343–361. Reuter, J. (2006), ‘Are IPO allocations for sale? Evidence from mutual funds’, Journal of Finance, 61:5, pp. 2289–2324. Nimalendran, M., Ritter, J. and Zhang, D. (2007), ‘Do today’s trades affect tomorrow’s IPO allocation?’, Journal of Financial Economics, 84:1, pp. 87–109. Ritter, J. and Zhang, D. (2007), ‘Affiliated mutual funds and the allocation of initial public offerings’, Journal of Financial Economics, 86:2, pp. 337–368. Goldstein, M.A., Irvine, P.J. and Puckett, W.A. (2011), ‘Purchasing IPOs with Commissions’, Journal of Financial and Quantitative Analysis, 46:5, pp. 1193–1225.

The main question we address is how IPO allocations are determined. The two main competing hypotheses are as follows.

- The information revelation hypothesis. Bookrunners give favourable allocations to investors who provide them with information that is likely to be useful in pricing the IPO.6

- The quid pro quo hypothesis. Bookrunners make favourable allocations to investors with whom they generate the greatest revenues elsewhere in their business, notably through brokerage commissions.

Previous attempts to adjudicate between these hypotheses, which are not mutually exclusive, have been limited by lack of data. However, the FCA was able to gather detailed information on bids, allocations, meetings before and during the bookbuilding, fees, the economic relationship between investment banks and their buy-side clients, and various other aspects for all IPOs conducted from the UK between January 2010 and May 2015.

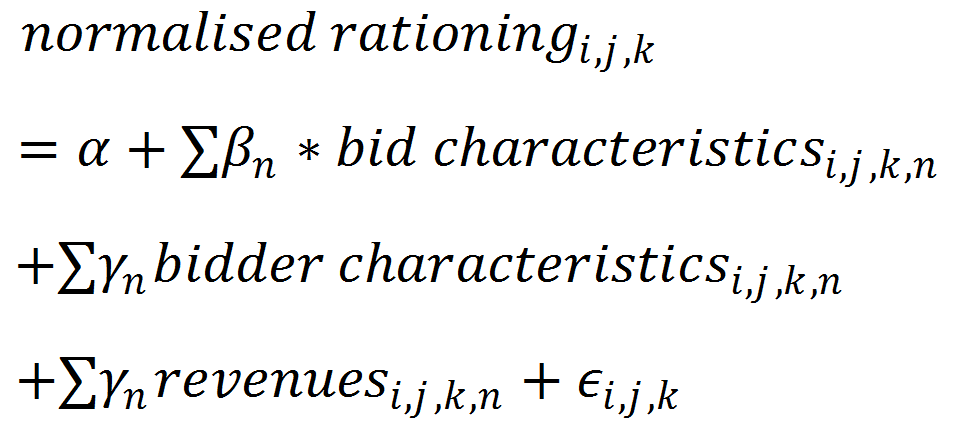

We use this dataset to disentangle the various attributes of investors that are likely to influence the allocation decision. For example, it is possible that buy-side investors who pay high broking revenues to syndicate banks have characteristics that are genuinely desirable for the issuer: they may contribute to the price discovery process or submit early and large bids, thereby ensuring the success of the IPO. To estimate the impact of the various possible determinants of allocation we use an econometric analysis that controls for various bid and bidder characteristics. Our baseline regression for each investor i, active in IPO j with bank k as a bookrunner, is:

Normalised rationing is the ratio of the percentage of shares allocated to the percentage of shares bid for—i.e. the higher the normalised rationing variable for an investor, the less that investor’s demand for shares is ‘scaled back’ compared with other investors in the IPO. For example, normalised rationing of one means that an investor’s allocation of shares is scaled back in line with the scaling back in that IPO as a whole, and normalised rationing of 0.5 means that an investor’s allocation is scaled back twice as much as the scaling back in the IPO as a whole.

We find that syndicate banks make favourable allocations to investors who provide them with information that is likely to be useful in pricing the IPO. In particular, investors who submit price-sensitive bids, and those who attend meetings with the issuer before the IPO, are favoured in allocations. While both of these variables are only indirect evidence of information revelation, our findings lend support to an account in which bookrunners reward investors if they provide information to the syndicate banks which is valuable for the pricing of the shares.

At the same time, investors in the top quartile of the bookrunners’ clients by revenues receive allocations, relative to the amount they bid, that are around 60% higher than those received by investors who have no revenues with the bookrunner. The pattern is broadly the same across individual banks, although for two banks investor revenues appear to have at most a weak impact on IPO allocations.

Is this really evidence of a quid pro quo?

The evidence that IPO allocations are higher for investors who generate more revenues for the bookrunner is consistent with the existence of a quid pro quo between bookrunners and investors.

However, while our econometric model controls for observable proxies for information production—such as the type of bid and attendance at meetings during and before the IPO bookbuilding—we cannot observe the full range of communication between investor and bank. It is conceivable that high-revenue clients—who will tend to be larger investors—are more sophisticated, generate more information, and have closer (but unobservable) relationships with investment banks. If this is so, the more generous allocations to high-revenue investors could be a reward for information production rather than a quid pro quo.

We are able to address this possibility with our unique dataset by controlling for the impact of investor-specific characteristics that are fixed across IPOs run by different banks, and for any specific (non-revenue-related) investor–bank relationships.

When fixed effects are included, we find that the marginal impact of changes in revenue ranking between IPOs is still significant. This is even the case when we include investor–bank fixed effects—i.e. an investor who participates in different IPOs run by the same bank will receive a higher allocation in the IPO in which it is more important, relative to other investors, to the bank in revenue terms.

These results suggest that the relationship between investor revenues and IPO allocations is not simply an artefact of some unobserved investor or investor–bank effect that involves information production.

Finally, bookbuilding theories predict that investors who provide valuable information will earn information rents. Our regressions, using a measure of expected profitability as the left-hand side variable, confirm that investors who generate the most revenue profit from allocations.

Welfare implications

Quid pro quo arrangements are not necessarily welfare-destroying.

A benign explanation for quid pro quos is that banks allocate shares more generously to their high-revenue clients only when all the relevant pricing information has been extracted from informed investors, at which point the choice of investor to allocate to is indifferent from an informational point of view. In competitive IPO markets, underwriters would then be forced to pass on to the issuer at least some of the benefits of the incremental broking revenues, which could be done through lower IPO fees or reduced underpricing.

Fees and underpricing in our sample are comparatively low, meaning that it is plausible that IPOs managed from the UK were, during this time, in a competitive equilibrium in which at least some of the quid pro quos were in fact passed on to issuers.

Conclusion and policy implications

Our findings suggest that regulators may want to monitor the IPO market more closely. This is already happening in the EU as part of the revised Markets in Financial Instruments Directive (MiFID II), which introduces a requirement for investment banks to justify final allocations made to each investor client.

Our research has been used to underpin the development of some guidance from the European Securities and Markets Authority (ESMA) on this requirement, which seeks to ensure that investment banks justify both their largest allocations and their allocations with the highest normalised rationing. This should have the effect of allowing banks continued discretion in allocation while requiring greater transparency for the issuer and regulators.

Tim Jenkinson, Howard Jones and Felix Suntheim

This article is based on Jenkinson, T., Jones, H. and Suntheim, F. (2017), ‘Quid Pro Quo? What Factors Influence IPO Allocations to Investors?’, Journal of Finance, forthcoming.

1 Financial Conduct Authority (2015), ‘Wholesale sector competition review’, 17 March.

2 Laddering is the practice of allocating shares on the understanding that investors will buy additional shares in the immediate aftermarket. Spinning refers to the practice of allocating shares to corporate executives in order to influence their decisions in future corporate investment banking transactions.

3 Jenkinson T., Jones, H. and Suntheim F. (2016), ‘Quid pro quo? What factors influence IPO allocations to investors?’, FCA Occasional Paper 15, October.

4 Financial Conduct Authority (2016), ‘Investment and corporate banking market study: Interim report’, April.

5 For a survey of the academic evidence on underpricing, see Jenkinson, T. and Ljungqvist, A. (2001), Going Public: The Theory and Evidence on How Companies Raise Equity Finance, Oxford University Press, second edition. Jay Ritter at the University of Florida Warrington College of Business produces a wealth of data for the USA and other countries on his website.

6 See Benveniste, L.M. and Spindt, P.A. (1989), ‘How investment banks determine the offer price and allocation of new issues’, Journal of Financial Economics, 24:2, pp. 343–361.

Download

Contact

Professor Tim Jenkinson

PartnerGuest authors

Howard Jones

Felix Suntheim

Contributor

Related

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More