Putting a price on ideas: how can intellectual property be valued?

How much is a new technology worth? What level of royalties could it generate? How much could a start-up sell for? The increasing use of intellectual property (IP) rights in today’s businesses has increased the importance of IP valuation in various contexts. We look at ways of valuing a new technology in a commercial context, such as the sale of a start-up.

Sales of start-ups to major industry players regularly make the news. For example, in 2016 General Motors acquired Cruise Automation, a developer from Silicon Valley, as a way of boosting its driverless-vehicle technology pool; and Apple bought start-up Emotient, an owner of artificial intelligence software that analyses facial expressions to identify emotions.1 But how can the inventions of these companies be valued?

There are a number of broad approaches to valuing IP, including the cost-based method, the income-based (or cash flow-based) method, and the market-based (or comparator) method.2 At a high level, these approaches are the standard financial tools used to assess any asset (with or without a formal IP right). However, the appropriateness of each method depends on the specific context of the valuation exercise, as each has its advantages and limitations. For example, the cost-based method does not account for the revenues and profits arising from an innovation, and therefore might not reflect the true contribution of the innovation to the implementer. The market-based method critically relies on information on comparable transactions, which is intrinsically challenging given that IP rights are established based on the unique characteristics of the invention. The income-based method requires a forecast of cash flows that is likely to involve significant uncertainty, in particular when there is little or no track record of the technology’s impact, such as in the case of a start-up.

This poses a natural challenge to owners of start-ups, who might be persuaded to sell their IP too cheaply or might experience a string of failed negotiations due to unrealistic value expectations. From the perspective of IP buyers, it is important to agree a price, and to structure the risk-sharing and incentives of the deal in a commercially attractive way.

This article explores the valuation of IP with a focus on the income-based approach. It builds on the fundamental principle that the economic value of an asset, here the IP, arises from its use—and therefore that the IP has a commercial value if it translates into products or services that end-consumers are willing to access or purchase.3 The article presents three steps for valuing IP using this approach in the context of a novel technology, as shown in Figure 1.4

Figure 1 Valuation based on future income

A three-step framework for valuing IP

Step 1: Thinking ahead to sales…

The first step of the exercise is to estimate the revenue and profits accruing to the implementer or user of the IP. This involves assessing how the IP generates sales of the end-product that implements the IP, which might be done by attracting new customers or giving the implementer an advantage over competitors, for instance by offering a more efficient way of serving customers or a more cost-effective way of producing a good.

It is also important to understand all the potential applications of the IP, and to identify the relevant markets where it would or could be used. Cruise Automation’s driverless technology, for instance, can be used in multiple areas within the automotive industry, including passenger cars, trucks, delivery and logistics, and emergency and construction vehicles. While each of these applications may require a different route to market, in general the higher the number of potential applications, the wider will be the invention’s market potential, and the higher the value.

The core requirement in assessing the market potential of a particular invention is to create a realistic future range of cash flow forecasts of the good or service that the invention enables. This task can be performed in a structured way by considering the economics of the market, which will involve answering questions such as:

- timing—how easy is it to bring the invention to market? How quickly can this happen, what are the main barriers, and how can these barriers be overcome?

- macroeconomic factors—how is the size of the market for the application expected to develop? Are there any accelerating factors, such as customer demand shifts or regulation change?

- size of the opportunity—what market share will the new product realistically capture? How will that share evolve over time?

- competitors—what alternatives already exist? How likely are competitors to develop new ones?

- investment and costs—what investments or changes to existing processes are needed? What does that mean for staff and other costs?

A complete cash flow forecast will factor in all of the above elements. While it is tempting to specify a central scenario at the outset, it is often helpful to think about a range of outcomes as bounds to the valuation, and to refine the more probable scenarios from there. This helps to make the creation of a base-case set of cash flow forecasts more robust.

Step 2: What does the IP add?

Two approaches that could be used to move from a valuation of the end-product to the value contribution of the IP are:

- estimating the incremental cash flows that are enabled by the IP;

- applying a royalty rate to the total end-product cash flows.

Under the first approach, the value of the IP can be estimated as the difference between the cash flows in two scenarios:

- a scenario where the end-product uses the IP;

- a scenario in which only old or alternative technologies are available.

There may be disagreement between parties over the cash flows in each scenario. For example, in the context of the sale of a start-up, the IP owner may take the view that the operations would not exist without the IP and hence that there are zero cash flows in the alternative scenario, implying a high incremental value of the IP. In contrast, an IP buyer may consider that other business models or alternatives would generate high cash flows, and hence that the incremental value of the IP is low. In addition, it is often necessary to acquire multiple IP rights to produce and market the end-product, which will mean allocating the incremental cash flows between different parts of the IP portfolio.

Under the second approach, a suitable royalty rate is applied to the total cash flows that are generated by the implementer. Royalty payments in licensing agreements are often structured as a percentage of the user’s revenues or profits, and similar royalty rates from comparable transactions can be used to inform what a suitable royalty rate might be in a specific context. The royalty rate negotiated by the parties, however, does not have to coincide with the benchmark royalty rate(s). In the context of IP (which by its nature involves novel products or services), the ‘comparable’ transactions are likely to differ in their characteristics to some extent (such as uniqueness of technology, patent protection, number and nature of alternatives, and nature of competition).5 Furthermore, payments between parties are the outcome of a commercial negotiation, which may result in a different level of royalty rate or royalty payments.6

Step 3: From cash flows to a valuation

Once the incremental cash flows that the IP is forecast to generate are identified, one of the established valuation methodologies can be applied to estimate their value. There are two main approaches:

the discounted cash flows (DCF) approach—future cash flows are discounted to the present moment using the cost of capital. This results in a present value of the future cash flows identified as incremental to the IP;

- financial multiples—a multiple that is based on a set of comparators is applied to a financial metric (such as earnings before interest, taxes, depreciation and amortisation, EBITDA) to get to the value.

DCF has the potential to provide a more accurate result, although it will need to be critically evaluated to detect instances of spurious accuracy. Financial multiples will tend to generate a less accurate valuation but are arguably simpler and more transparent to apply. The two approaches are complementary, and ideally both would be applied in any given circumstance.

A practical example

A simple example can illustrate how the techniques described above might be applied. Imagine that a young student invents a way to make ‘fantastic’ bread. She knows that most of her neighbourhood prefers ‘fantastic’ bread to any other sort. The inventor wants to license her formula to an existing baker. The box shows how different methodologies result in a range of values of the IP.

Stylised example of valuation of an innovation

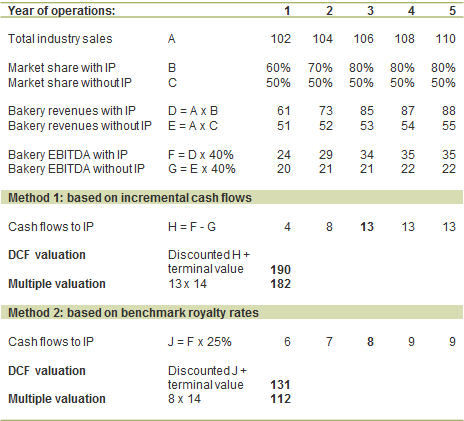

Last year, the bread market in the neighbourhood was worth 100, and the market is currently a duopoly with each baker enjoying 50% market share. The expected annual bread market growth rate is 2%. The inventor also expects that no alternatives to the ‘fantastic’ bread will be developed in the future, and as such the lifetime of the invention is assumed to be infinite.

The two approaches discussed above are applied below.

- Method 1, based on incremental cash flows. Construction of the cash flow forecast begins with the projected total industry value (row A). Market share forecasts (rows B and C) result in forecast bakery revenues (rows D and E) in scenarios with and without the IP. To get to EBITDA (rows F and G), revenues are multiplied by an industry EBITDA margin (40% is assumed). Using EBITDA to proxy cash flows with and without the IP, it is then straightforward to estimate cash flows incremental to the IP (row H) and calculate the IP’s value. DCF gives an IP value of 190 (using a cost of capital of 8%), while a financial multiples approach results in a value of 182 (a multiple of 14 is applied to cash flows to the IP in year 3).

- Method 2, based on benchmark royalty rates. A benchmark royalty rate of 25% is applied to the total cash flows (i.e. the scenario with the IP) in order to infer the likely royalty payments and hence the cash flows to the IP. The DCF and financial multiples approaches applied to these royalty payments yield a value range of 112 to 131.

Source: Oxera.

The calculations based on an estimate of incremental cash flows suggest that the value of the ‘fantastic’ bread formula is in the range of 182–190. Alternatively, the benchmark royalty rate of 25% leads to a range of 112–131. In this example, a fair royalty rate might be higher than 25% of EBITDA, because the impact of the IP on the business appears to be significant. This means that IP holders may be in a position to negotiate hard on the valuation, while IP buyers/licensees would have a higher ability to accommodate such demands. This all stems from a full understanding of the likely range of industry outcomes.

Concluding remark

IP rights are an important means of providing commercial incentives to innovate. The ability to value IP is important for a well-functioning market in IP rights, and in generating appropriate incentives to innovate. This article has highlighted some of the key relevant factors and potential approaches in arriving at a valuation. While different approaches may indeed generate different valuations, the key aspect of such an assessment is to arrive at a plausible range of values to assist the parties in concluding a commercial arrangement and bringing the innovation to the market.

1 For example, see Nagesh, G. (2016), ‘GM Closes Acquisition of Cruise Automation’, The Wall Street Journal, 13 May, accessed 1 August 2016; and Winkler, R., Wakabayashi, D. and Dwoskin, E. (2016), ‘Apple Buys Artificial-Intelligence Startup Emotient’, The Wall Street Journal, 7 January, accessed 1 August 2016.

2 For example, see the guidance on IP valuation provided by the UK Intellectual Property Office (IPO). Intellectual Property Office (2014), ‘Valuing your intellectual property’, 12 December, updated 22 February 2016. See also a study commissioned by the European Commission on how IP valuation plays a part in innovation and the bottlenecks that occur: European Commission (2013), ‘Final Report from the Expert Group on Intellectual Property Valuation’, November.

3 There may be other, more strategic reasons for purchasing new technology, such as actively delaying its introduction into the market in order to delay obsolescence, or preventing a competitor from having access to it. This article focuses on the most straightforward, commercial considerations.

4 This article discusses the two most commonly used methods under the income-based approach. There are other methods, such as the residual value method, which may be useful in specific contexts of IP valuation (for example, when all intangible assets of a business need to be valued together).

5 The assessment of comparable transactions, which is not discussed in this article, involves detailed analysis of the qualitative and quantitative characteristics of each transaction in order to determine the suitability of its use in context. This includes assessing whether the transaction is in the context of an acquisition of a start-up, or a subset of patents, or whether it is in the context of licensing of patents/trademarks. In particular, in the case of standard essential patents, royalty rates would need to comply with the patent holder’s FRAND obligations—i.e. they need to be fair, reasonable and non-discriminatory.

6 As noted above, it is not straightforward to find comparable transactions in the context of IP valuation. If suitable comparators are not available, it is possible to use rules of thumb such as ‘the 25% rule’, which allocates 25% of the implementer’s profit to the IP. This rule for royalty rates has been debated extensively in the literature, with some academics providing empirical support for the rule and others criticising it. For example, see Goldscheider, G., Jarosz, J. and Mulhern, C. (2002), ‘Use Of The 25 Per Cent Rule In Valuing IP,’ les Nouvelles, 37:4, December, pp. 123–33; and Heberden, T. (2011), ‘Intellectual Property Valuation and Royalty Determination, chapter 4, in A. Liberman, P. Chrocziel and R. Levine (eds), International Licensing and Technology Transfer: Practice and the Law, Wolters Kluwer Law & Business. The rule has been rejected in some court proceedings as it was seen as ‘fundamentally flawed’ (for example, see Uniloc v. Microsoft, 632 F.3d 1292 (Fed. Cir. 2011)).

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More