Promoting the green transition: the EU’s Recovery and Resilience Facility

Over the next five years, significant funding will be made available through the EU’s Recovery and Resilience Facility (RRF) to support member states’ recovery from the COVID-19 crisis. A large part of this funding will be allocated to the ‘green transition’, supporting the EU’s goal to reach net-zero emissions by 2050. We take a look at some of the investments, and the role of economic and financial analysis in ensuring that they are in line with state aid rules.

This article develops on topics discussed in Oxera (2021), ‘Different plans, common challenges: national recovery and resilience plans in the EU’, Agenda, May.

Under the RRF, up to €338bn in grants and €390bn in loans is expected to be allocated to EU member states.1 A significant part of this funding will be channelled to the green transition—at least 37% of the funding received by a member state should be invested in projects supporting this.2 The green transition encompasses a broad range of areas, including green energy generation and infrastructure, energy efficiency, innovation, biodiversity, and the circular economy.

As funding under the RRF will come on top of other national spending planned by member states, public funding is likely to play a key role over the coming years in achieving a low-carbon economy in the EU. In line with national spending, funding under the RRF must also be compliant with state aid rules. Unless financing is provided on a no-aid basis (for example, if funding is provided in line with market terms), funding can be granted only if it constitutes ‘compatible’ aid. This means that it must be demonstrated that the aid is limited to the minimum necessary, that no private investment is crowded out, and that the positive effects of the aid outweigh any expected distortions to competition and trade. Alongside legal analysis, financial and economic analysis is key in ensuring that these objectives are met.

This article provides an overview of selected funding initiatives proposed by member states under the RRF to facilitate the green transition, and discusses the role of economic and financial analysis in designing such funding in line with the applicable state aid rules.

Member states’ recovery plans and the green transition

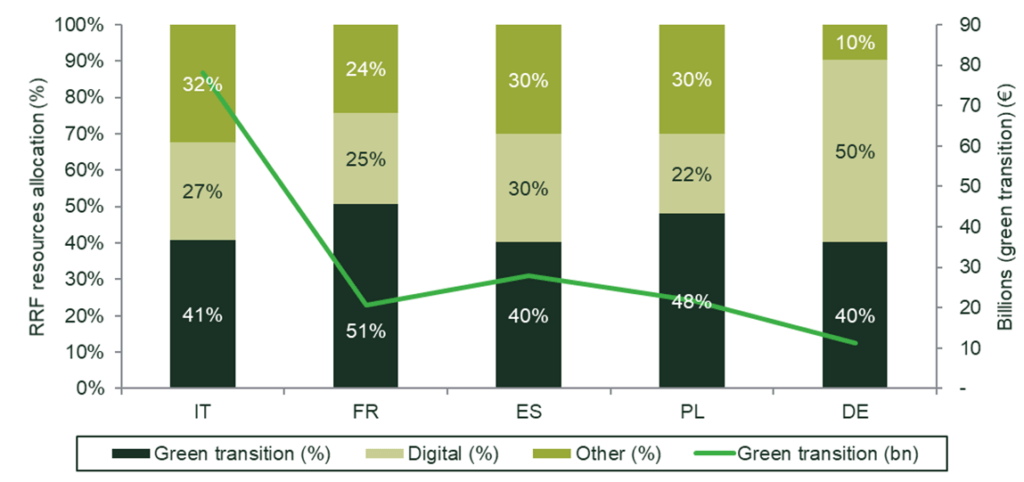

In their National Recovery and Resilience Plans (NRRPs), member states have set out the reforms and investment that will be financed through the RRF.3 Figure 1 shows the composition of funding requests (both loans and grants) from the five largest member states,4 including for the green transition.

Figure 1 Member states’ requested funding under the RRF

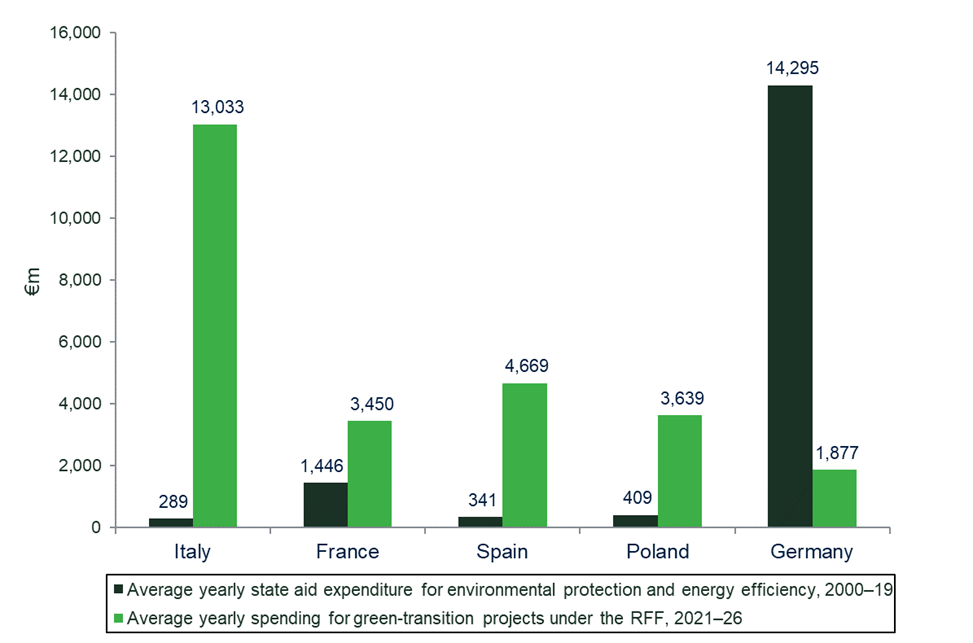

Although the amount of state aid targeted towards climate- and energy-related objectives in the EU has increased steadily since the early 2000s, for some member states, RRF funding is likely to create a significant catch-up effect in making their economies ‘greener’. As shown in Figure 2, in Italy, climate- and energy-related state aid expenditure amounted to approximately €289m per year, on average, over the period 2000–19. Under the RRF, Italy plans to invest €13bn per year, on average, in green projects over the period 2021–26 alone.5 Similar, albeit smaller, catch-up effects can be expected for Spain, Poland and France. In Germany, which has provided considerable support, in particular to renewable energy generation, the share of RRF funding is likely to make a smaller contribution to overall public funding targeted at the decarbonisation of the economy.

Figure 2 Average yearly state aid expenditure for green projects: historical average vs RRF funding

Source: Oxera analysis, based on the Commission’s 2020 State aid Scoreboard and a selection of NRRPs made available by the Commission.

For each measure that will be funded under the RRF, member states have indicated whether it is likely to constitute state aid, and if so, whether the measure would be exempted from a prior notification; whether it would be covered by an aid scheme that has already been approved; or whether it will require a separate notification to the Commission.

With regard to energy-related projects, the main applicable state aid rules are the energy-specific provisions under the General Block Exemption Regulation (GBER)6 and the Commission’s ‘Guidelines on State aid for environmental protection and energy’ (EEAG).7 As some green-transition projects funded under the RRF will also cover research and development activities, the Commission’s ‘Framework for State aid for research and development and innovation’ (R&D&I)8 and the ‘Communication on important projects of common European Interest’ (IPCEI)9 are also relevant.10

The Commission is currently undertaking an evaluation of these state aid rules and plans to adopt updated rules by the end of 2021.11 The new rules can be expected to be better aligned to the objectives set out in the Commission’s Green Deal,12 and are likely to cover new technologies.

Recently, the Commission has published new draft ‘Guidelines on State aid for climate, environmental protection and energy’, which will replace the EEAG.13 The draft guidelines cover new technologies, such as hydrogen infrastructure, as well as aid for clean mobility, energy efficiency in buildings, circularity and biodiversity, and aid for the phase-out of fossil fuels. Contracts for difference (CfDs) are also specifically covered in the draft guidelines, as an instrument to support renewable energy generation, including ‘green’ or low-carbon hydrogen.14 In general, the Commission has allowed higher amounts of aid for green investments, as the draft guidelines make fewer references than the EEAG to maximum aid intensities.15 Overall, the Commission has taken a more refined approach to assessing the compatibility of aid under the new draft guidelines, as the general compatibility criteria are further specified and tailored to each of the areas covered by the new guidelines. As the new guidelines will come into effect on 1 January 2022, these rules will be applicable to green projects funded under the RRF.

An overview of selected investment projects targeted in the green transition that will be financed under the RRF is presented in the box below.

Selected investment projects targeted towards the green transition

Germany

Germany’s NRPP focuses on support for hydrogen technologies through the promotion of integrated hydrogen projects via collaboration with other EU member states within the IPCEI framework.

France

The French plan emphasises the need for investments in energy efficiency, sustainable transport and green technologies.For example, France plans to support the environmental transformation of its aviation sector, with aid to support the manufacturing of the next generation of ‘ultra-clean’ or even ‘zero-emission’ aircraft.

Italy

Under the Italian plan, around 40% of funding is targeted at the green transition, including in particular ‘Energy Transition and Sustainable Local Mobility’. This includes the promotion of green hydrogen, increasing the capacity and resilience of electricity grids, developing rapid mass transport systems that aim to reduce the use of private cars, and investments in biomethane to support the development of a circular economy.

Poland

Poland is planning to invest in a range of green investments. In relation to renewable energy production, its plan foresees investments of €3.9bn for the development of offshore wind energy, including the construction of offshore port facilities, and funding for the construction of offshore wind farms in the Baltic Sea.

Spain

Unlike with other member states, the Spanish plan is focused on a short-term horizon of two years, and aims to support and integrate renewables in the energy system, energy infrastructure, and hydrogen.

Source: Oxera analysis of a selection of National Plans made available by the European Commission.

Assessing the state aid compliance of ‘green transition’ projects

When it comes to assessing the compatibility of aid, under the current EEAG and the proposed new draft guidelines, economic and financial analysis plays an important role in assessing the incentive effects of the aid, its proportionality (i.e. whether the aid is limited to the minimum amount necessary), its appropriateness, and the degree of market distortions.

The assessment of the incentive effects of the aid (i.e. whether the aid leads to a change in the behaviour of the beneficiary that would not have taken place without the aid) and its proportionality go very much hand in hand. In particular, the financial analysis required for demonstrating the proportionality of the aid can also be used to inform the incentive effects.

When assessing the proportionality of investment aid, typically only the additional costs of implementing an environmentally friendly project relative to an alternative (less environmentally friendly) project are eligible. Similarly, under the GBER, only the incremental investment costs that are necessary to achieve a higher level of energy efficiency (for example) or to increase the level of environmental protection are eligible.16 In practice, however, it has not always been possible to determine clearly the additional costs relating to a more environmentally friendly investment option. To provide greater flexibility, in the new draft guidelines, the Commission proposes that, where applicable, the counterfactual scenario could be that the investment is not undertaken at all (i.e. there is no counterfactual scenario) or the company does not introduce any changes to its current business.17

As the costs of investments in clean technologies are typically greater than less environmentally friendly technologies, the expected cash flows of green projects are often not sufficient to cover the initial investment costs; however, state aid can help to close this ‘funding gap’. The funding gap is calculated as the net present value of the difference between the initial investment costs and the expected cash flows from the project over the lifetime of the investment. Financial analysis is key to estimating the cash flows and determining an appropriate rate of return for investors. Given the potentially long time horizon of green investment projects, sensitivity analysis should be undertaken to assess the robustness of the results and to avoid the risk of overcompensation. This is particularly relevant in the energy sector, where the assets often have economic lifetimes that span decades, thereby making future trends in costs and revenues highly uncertain.18

Robust electricity price forecasts are crucial for determining the right level of compensation for both investment aid and operating aid—for example, for the production of renewable or otherwise ‘low-carbon’ electricity. Economic modelling can be used to estimate long-term electricity prices that would feed into the proportionality assessment. Such forecasts are also crucial when determining the appropriate level of compensation for the phase-out of fossil fuels such as coal. In these cases, the level of aid is determined on the basis of a case-by-case assessment taking into account the forgone revenues, which are based on electricity price forecasts, and the additional costs linked to the early closure of plants.

It is likely that, in future, economic analysis will also play a greater role in assessing the need for aid and its appropriateness among alternative policy measures. In the new draft guidelines, the Commission reiterates that state aid should address only ‘residual’ market failures (i.e. market failures that remain unaddressed by other policy measures).19 In particular, in cases where an efficient, market-based mechanism has been put in place to specifically counter the problem of negative externalities, such as the EU’s Emissions Trading System, state aid should be designed in such a way as not to undermine the efficiency of the market-based mechanism. Similarly, it should be demonstrated why demand-side measures, such as regulation or the introduction of minimum environmental standards, are not sufficient to remedy a specific market failure. In such cases, economic analysis can help to determine the existence of a residual market failure.

Alongside financial analysis to assess the proportionality and the incentive effects of the aid, economic analysis can be used to assess whether the positive effects of the aid outweigh the expected negative effects on competition and trade (the so-called balancing test). In its new draft guidelines, the Commission identifies two main potential distortions caused by environmental aid: (1) product market distortions; and (2) location effects.20

In general, aid that leads only to a change in location of the economic activity without improving the existing level of environmental protection is generally not considered compatible. The assessment of potential distortions on product markets is undertaken on a forward-looking basis and typically requires the relevant product market(s), as well as the expected market share of the aid beneficiary and its competitors, to be defined. In addition, it must be examined whether the aid would lead to higher barriers to entry or give the beneficiary a ‘first mover advantage’.

In the draft guidelines, the Commission also specifies that, for aid measures that are targeted at reducing greenhouse gas emissions (including through support for renewable energy), the subsidy per tonne of CO2 equivalent emissions that can be avoided must be estimated, with the underlying assumptions and methodology provided to the Commission.21 The Commission will also verify that the aid measure does not stimulate or prolong the consumption of fossil-based fuels or ‘crowd out’ more environmentally friendly forms of energy.22 Economic analysis and modelling—for example, to assess energy markets developments over a longer time horizon, taking into account regulatory changes—can be used to inform this assessment.

Specifically, through economic modelling of the long-term evolution of energy markets, the impact of the aid on the capacity and energy mix can be analysed, together with the knock-on implications for other market-driven investments and retirement decisions, given that market prices and cross-border flows could also be affected. Moreover, economic modelling could also be used to assess the impacts of the aid on system-wide emissions and security of supply, as well as the evolution of indicators of market concentration and market power.

Given the long investment lead times and operational lives of energy infrastructure, economic modelling would also enable a number of scenarios to be considered reflecting the potential for fuel and CO2 prices, as well as capital and operating costs of infrastructure, to change. In some cases, the impact of the maturation of new technologies may also need to be accounted for. Different policy scenarios may also need to be considered to capture the potential for further reforms (or aid) necessary to meet long-term emission reduction targets and to safeguard security of supply.

To further ensure that distortions of competition are limited, the Commission requires that, for aid schemes with large aid budgets,23 for those that contain novel characteristics, or when significant market, technology or regulatory changes are foreseen, an ex post evaluation is carried out by independent experts.24 The evaluation should, among other aspects, consider whether the aid is likely to have distorted competition. The economic tools outlined above can be used to assess the impact of aid on competition for the purposes of the ex post evaluation.25

Looking ahead—planning the green transition

Alongside regulation, state aid will play a vital role in supporting the green transition. Following the establishment of the RRF, EU member states will embark on ambitious investment programmes over the coming years to promote the transition to a low-carbon economy.

Given the amounts that will be distributed under the RRF, the application of sound economic and financial analysis will be key in ensuring that the green transition is implemented in a cost-efficient way, does not crowd out private investments, and limits distortions to competition and trade.

1 At current prices. For further information, see European Commission, ‘The Recovery and Resilience Facility’.

2 Regulation (EU) 2021/241 of the European Parliament and of the Council of 12 February 2021 establishing the Recovery and Resilience Facility, L57, Official Journal of the European Union, 18 February 2021, para. 23.

3 The NRPPs have been submitted to the Commission and have to be approved by the Council of the EU (expected at the end of July 2021).

4 In terms of population.

5 For further information, see Italia domani (2021), ‘Piano nationale di ripresa e resilienza’, and Italian government (2021), ‘Riforme e investimenti nelle missioni del PNRR’.

6 European Commission (2014), ‘Commission Regulation (EU) No 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty Text with EEA relevance’, L 187, Official Journal of the European Union, 26 June.

7 European Commission (2014), ‘Guidelines on State aid for environmental protection and energy 2014-2020’, C 200, Official Journal of the European Union, 28 June.

8 European Commission (2014), ‘Framework for State aid for research and development and innovation’,

C 198, Official Journal of the European Union, 27 June. For a discussion on the role of economic and financial analysis in assessing compatibility of state aid for R&D&I projects and IPCEIs, see Alimonti, R. and Puglisi, L. (2021), ‘Research, development and innovation aid’, in L. Hancher, F.M. Salerno and Y. de Vries (eds), EU State Aid, Sweet & Maxwell, 6th edition.

9 European Commission (2014), ‘Criteria for the analysis of the compatibility with the internal market of State aid to promote the execution of important projects of common European interest’, C 188, Official Journal of the European Union, 20 June.

10 The Commission has published guidance for member states on those investments that are expected to be most commonly funded under the RRF and how they relate to state aid. See European Commission (2021), ‘Recovery and resilience facility (RRF) guiding templates’.

11 European Commission (2020), ‘Fitness Check of the 2012 State aid modernisation package, railways guidelines and short-term export credit insurance’, SWD(2020) 257 final, 30 October.

12 Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions ‘The European Green’, COM/2019/640 final.

13 See European Commission (2021), ‘Public consultation on the revised Climate, Energy and Environmental Aid Guidelines (CEEAG)’.

14 A CfD is a form of operating aid. It entitles the beneficiary to a payment that is calculated as the difference between a fixed ‘strike’ price and a reference price such as a market price, per unit of output. See draft guidelines, para. 103.

15 ‘Maximum Aid Intensity’ means the total aid amount expressed as a percentage of the eligible costs.

16 European Commission (2014), ‘Commission Regulation (EU) No 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty Text with EEA relevance’, L 187, Official Journal of the European Union, 26 June, section 7.

17 For some measures—in particular, aid for the reduction of greenhouse gas emissions including through support for renewable energy—the aid should in general be granted through a competitive bidding process to ensure that it is proportional. However, in cases where individual aid is awarded without a competitive bidding process, which might be relevant for investment aid, member states can also use the funding gap approach. See draft CEEAG, section 4.1.3.5 and paras 50–52.

18 In the draft guidelines, the Commission proposes to introduce ex post clawback mechanisms or cost monitoring mechanisms in cases where the aid is not awarded through a competitive bidding process and where the input parameters to assess the proportionality of the aid are highly uncertain. See draft CEEAG, para. 53.

19 The general compatibility criteria in relation to the need for aid and its appropriateness do not apply, for example, to aid measures targeted at reducing greenhouse gas emissions including through support for renewable energy. However, the Commission specifies that ‘short and long term interactions with any other relevant policies or measures, including the EU’s Emission Trading System, should be considered’ when assessing distortions to competition and trade. See draft CEEAG, para. 99 and section 4.9.3.1.

20European Commission (2014), ‘Guidelines on State aid for environmental protection and energy 2014-2020’, C 200, Official Journal of the European Union, 28 June, para. 89.

21 See draft CEEAG, para. 98.

22 See draft CEEAG, paras 107 and 108.

23 Aid schemes where the budget or expenditure exceeds €150m in any given year or €750m over the total duration of the scheme.

24 The requirement for ex post evaluations also applies to aid schemes exempted under the GBER.

25 Oxera (2017), ‘Ex post assessment of the impact of state aid on competition’, November.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More