Ofwat’s PR24 final methodology

On 13 December Ofwat published its Final Methodology for the PR24 price review. The document gives further clarity on how Ofwat will determine allowed revenues and performance targets for AMP8 (2025–30), and will be of great interest to water companies, investors, and other stakeholders.

The following provides a summary of, and initial Oxera commentary on, Ofwat’s methodology. Further analysis of what Ofwat’s decisions mean, and the extent to which they will generate a price review outcome that appropriately balances Ofwat’s statutory duties, will be needed in the coming months.

Ofwat’s Final Methodology—key points

Ofwat’s Final Methodology is largely consistent with the Draft Methodology. However, there are a few areas in which Ofwat has provided additional information or signalled a change in approach. The main new areas that we have identified from an initial review are as follows.

- Ofwat has set out an early view on the cost of capital. This provides companies and investors with a clearer view on what Ofwat considers to be a reasonable rate of return in PR24. The ‘early view’ (3.23% wholesale WACC) is higher than the Ofwat PR19 and the Competition and Markets Authority (CMA) PR19 numbers.

- Ofwat has left open the possibility of further indexation of elements of the cost of capital (in particular, the risk-free rate).

- Ofwat has set out enhanced expectations around dividends, executive pay and voluntary outperformance sharing. It is considering an ex post reconciliation mechanism that would allow it to adjust allowed

- revenues where it considers that a company has not sufficiently demonstrated that its executive pay award is justified by performance.

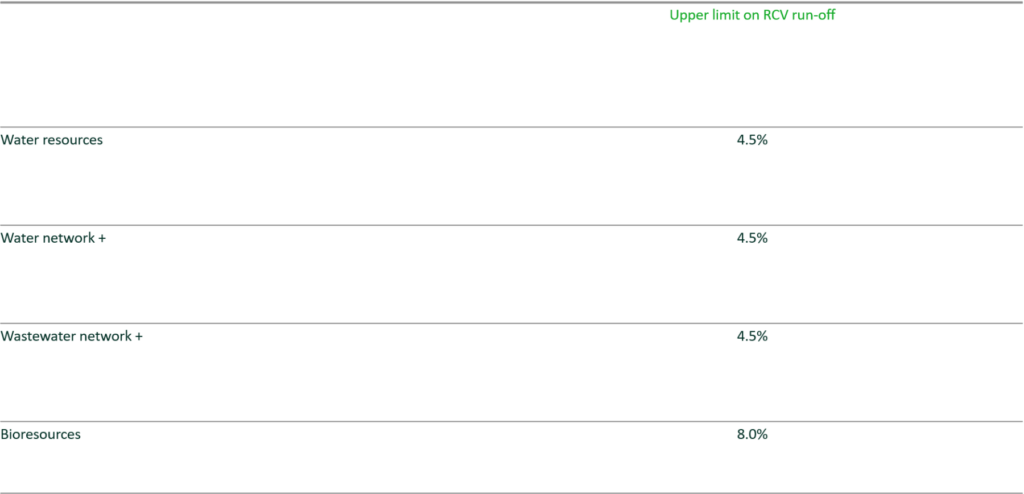

- Ofwat has set out guidance on upper limits for regulatory capital value (RCV) run-off rates. These are well below the run-off rates used by some companies at PR19, which would have the effect of pushing revenue recovery into the future.

- Ofwat has outlined stronger financial rewards and penalties related to the residential customer service measure (C-Mex). This reflects its view that a step change in customer service is needed.

Business plan assessment

Arguably the most significant development for companies at the time of Ofwat’s Draft Methodology was the regulator’s proposals around the assessment of business plans. In particular, that Ofwat planned to penalise companies whose business plans are categorised as ‘inadequate’ or ‘lacking ambition’ with a combination of financial penalties (up to 30bps of the base return on regulatory equity) and adjusted cost sharing rates. Of particular concern to companies was that this approach to assessment would penalise companies for departing from Ofwat’s guidance on key assumptions (e.g. the required rate of return and Outcome Delivery Incentives, ODI, rates).

Ofwat has now provided some further clarification on this process, but has not provided any additional guidance on the thresholds of its quality and ambition assessments.

Key points include the following.

- Ofwat will conduct a two-stage process, with no Initial Assessment of Plans (IAP) stage.

- The business plan categorisation, and rewards/penalties, will be solely based on the company’s first business plan submission (and not any subsequent revisions). Ofwat may ask clarification questions if it considers this necessary to take an informed view on the plan.

- Companies will be able to take an alternative view on the rate of return and ODI incentive rates but there will be a high evidential bar, requiring ‘compelling evidence’ from companies as to why the alternative proposal is warranted.

- Ofwat has set out 26 minimum expectations for companies to meet. It has added a minimum expectation for each company to provide evidence that it can credibly deliver its business plan. The required evidence will be proportionate to the company’s track record of performance relative to previous plans/regulatory assessments.

- The potential rewards and penalties remain as set out in the Draft Methodology (i.e. ±30bps return on regulatory equity).

- Companies rated as ‘outstanding’ will be protected from reductions in the allowed return and, for the first time, reductions in base cost allowances between draft and final determinations. They will still be allowed to benefit from increases in either allowance.

Overall, the approach to business plan assessment remains very similar to that set out at Draft Methodology stage.

Outcomes

Ofwat had provided a high level of detail on its proposed outcomes and performance commitments at the time of the Draft Methodology, having held separate consultations on this issue in the lead up to the Draft Methodology.

As a result, the main features of the PR24 ODI framework—in particular, the reduction in bespoke commitments to 2-3 per company, greater use of common performance commitments and incentive rates based on centralised research—had already been presented to companies.

In the Final Methodology, Ofwat has further outlined that:

- It considers a step change in customer service is needed and has signaled that the value of the C-MeX incentive is expected to be ±18% of annual allowed residential retail revenue (compared to a range of +6% to -12% in AMP7);

- it will set separate performance commitments to reduce leakage, per capita consumption and business demand;

- a number of environmental performance measures (i.e. serious pollution incidents and discharge permit compliance) will now apply to water-only companies, as well as water and sewerage companies;

- Ofwat has slightly revised its approach to enhanced incentives, which apply for ‘very high’ performance. It has made minor amendments to the eligibility criteria and currently expects to set enhanced incentives for six performance commitments (water supply interruptions, leakage, per capita consumption, internal sewer flooding, external sewer flooding and total pollution incidents). Enhanced thresholds will now be set using companies’ PR24 performance commitment levels as the starting point, with a common improvement factor applied to all companies. Enhanced incentives will be set at twice the standard incentive rates, while caps will apply to leakage and per capita consumption;

- in addition to applying an aggregate sharing mechanism once ODI payments exceed ±3% return on regulatory equity, Ofwat will also use caps and collars on certain individual performance commitments;

- Ofwat does not consider that exclusions for factors such as such as extreme weather events are appropriate, but has allowed limited exclusions for external factors where companies cannot manage or mitigate potential impacts on customers and the environment, or are outside their statutory functions.

Ofwat has also confirmed that companies will be expected to hold two open challenge sessions during the PR24 process.

Cost assessment

Ofwat has restated its expectation that companies will need to deliver a step change in efficiency in PR24. In practical terms, this means that Ofwat could use efficiency benchmarks that are more stretching than the upper quartile in its relative benchmarking.

Its high-level approach to cost assessment is mostly as envisaged in the Draft Methodology. However, it has outlined some changes/additional information, as follows.

- In certain instances, Ofwat will add enhancement OPEX to modelled base costs.

- It will include an end-of-period cost reconciliation for third-party services governed by the price control (subject to an ex post efficiency assessment).

- It will consider the merits of having lower cost sharing rates on enhancement expenditure. This would represent something of a move away from the original rationale of the TOTEX approach of treating capital and operating expenditure in the same way.

- Companies will be given an allowance of 2% for equity issuance costs in the case of significant RCV growth.

Ofwat has also provided additional views in some contested areas.

First, the regulator has indicated that it is currently not minded to increase expenditure allowances for asset replacement relative to historical levels on the basis that AMP7 renewal levels are below what companies were funded for in PR19.

‘At PR19, companies were funded based on plans to renew 0.4% of water mains per year. So far this period (2020-2022) they have only delivered 0.1% per year, which we are concerned is un-sustainably low and not enough to keep up with deterioration. Companies can submit cost adjustment claims to go beyond historical water main renewal rates where they can provide compelling evidence that an increase is required to maintain asset health. But water customers should not pay twice for the same mains renewals, and so we expect companies to undertake the renewals they were funded for before making additional allowances.’

In terms of the question of ‘what base expenditure buys’, and the cost/service mix, Ofwat will publish historical performance data sets with a view to allowing companies to determine where performance improvements can be funded through base expenditure allowances. It expects to set base expenditure performance commitment levels for sewer collapses, mains repairs, storm overflows, and operational greenhouse gas emissions on a company-specific basis. Expectations for unplanned outage performance will be set at a common level.

Finally, Ofwat will retain and increase the size of the Innovation Fund to at least £300m in PR24, and is also proposing to introduce a new water efficiency fund of up to £100m.

Ofwat will consult stakeholders on its econometric models in spring 2023 and has indicated that it is continuing to review cost drivers ahead of this consultation.

Return on capital

Of particular interest to investors, Ofwat has set out an early view on the PR24 cost of capital.

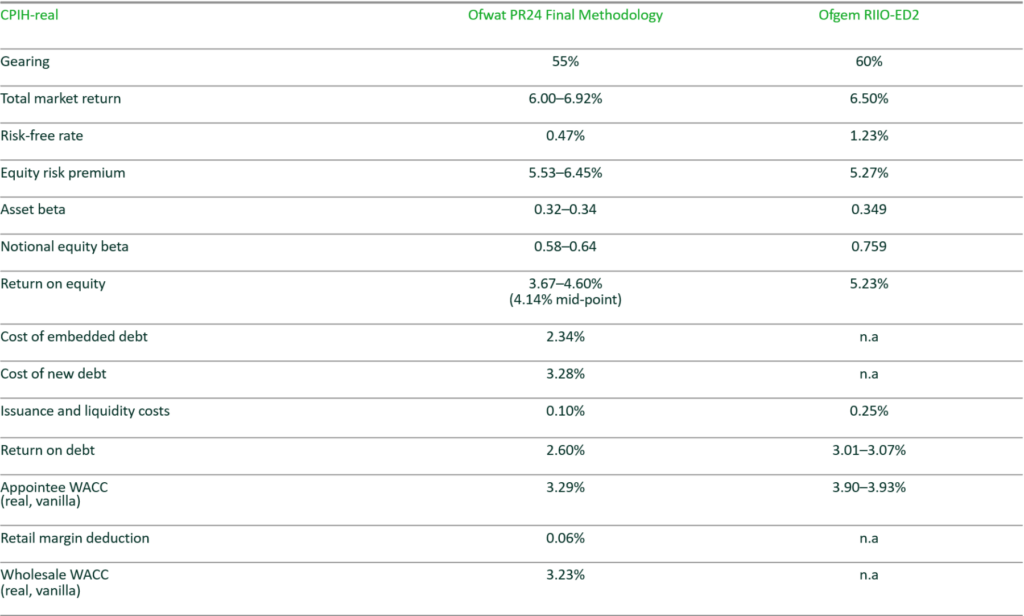

Ofwat’s initial application of its methodology results in a CPIH-real return of 3.29% based on a cut-off date of 30 September 2022. This rises to 3.53% CPIH-real based on a 31 October 2022 cut-off date, given movements in gilt and corporate bond markets in the month of October.

The table to the right provides a comparison of Ofwat’s early view with Ofgem’s RIIO-ED2 final determinations, which were published at the end of November. The table shows that there is a relatively significant gap between Ofwat’s initial return on equity range and Ofgem’s allowance for electricity distribution companies. Once accounting for differences in notional gearing, this gap is largely driven by Ofwat’s lower estimate for the risk-free rate—Ofgem having used a 31 October cut-off date in its analysis.

There are a number of elements of Ofwat’s assessment that are of note.

- In terms of the risk-free rate estimate, Ofwat continues to place most weight on index-linked gilt yields. Ofwat has considered evidence on the convenience yield but has concluded that there is insufficient evidence to support the application of a convenience yield uplift when estimating the risk-free rate for PR24.

- Noting the volatility in interest rates in recent months, Ofwat has used a one-month average of data over September 2022. Ofwat has indicated it may use longer trailing averages of yields when making its draft/final determinations, and has also left open the possibility of indexing the risk-free rate once the control period is in flight (as Ofgem now does for energy networks).

- In terms of the total market return, Ofwat appears to have used the Office for National Statistics’ revised CPIH backcast series to deflate ‘historical ex post’ returns. Unlike the CMA, it does not place any weight on the CED/RPI series, thereby effectively removing the top end of the CMA’s total market return range. Ofwat has also produced estimates of ‘historical ex ante’ returns, resulting in a lower bottom end to its total market return range than used by the CMA in the PR19 redeterminations. The overall effect is that the mid-point of Ofwat’s range (6.46%) sits below the CMA’s range mid-point (6.81%).

- Ofwat considers two-, five- and ten-year beta estimates, placing more weight on longer estimation windows. It does not reweight beta data to reflect assumptions about the future recurrence of systematic risk events (e.g. COVID-19).

- The cost of embedded debt is based on a balance sheet approach, which involves analysing the actual cost of debt on company balance sheets (but excluding certain instruments, e.g. interest rate swaps). This differs from Ofwat’s PR19 approach in which it used a benchmark index as its primary reference point for the cost of embedded debt (with the balance sheet approach used as a cross-check). This aligns Ofwat with the approach taken by the CMA at the PR19 redeterminations.

- Ofwat has reduced the notional gearing assumption to 55% (from the 60% used at PR19).

Overall, Ofwat’s early view on the return on capital indicates a likely increase in the allowed rate of return relative to PR19, driven by higher risk-free rate and cost of debt estimates.

Limited and Yorkshire Water Services Limited

price determinations’, Final Report, 17 March, p. 1099.

Comparison to other sectors

Despite the joint work through the UK Regulators Network (UKRN), there remain notable differences in approaches to setting the allowed return on capital across regulators. Examples include the following.

- The estimation of the total market return—although the total market return is an economy-wide parameter, Ofwat, Ofgem and the CAA have all come to different views on the appropriate level for the next price control cycle, reflecting minor differences in methodology.

- Whether to apply a convenience yield—Ofwat and Ofgem have made no adjustment for the convenience premium, while the CAA calculated a convenience yield of 37bp in its Initial Proposals for NATS.

- The weighting of pandemic-affected betas—in its assessments for Heathrow and NATS, the CAA has followed a methodology that reduces the weight that is placed on betas post-February 2020 (which have generally increased among airport and air traffic control comparators). Ofwat, by contrast, argues that reweighting requires ‘significant subjective judgments to be made’ and, hence, is implicitly critical of the CAA’s approach.1

- The approach to estimating the cost of (embedded) debt—Ofwat has used a balance sheet approach (in line with the CMA), whereas Ofgem and the CAA currently favour benchmark index approaches.

- The use of indexation—Ofgem indexes the cost of debt and the risk-free rate, Ofwat just the cost of new debt, and the CAA does not use indexation at all.

Financeability

Ofwat has mostly confirmed its approach on financeability, with companies expected to target a credit rating of BBB+/Baa1 on the notional company basis. Ofwat does not see a case for increasing the target credit rating for the notional company in light of its decision to increase the level of cash lock-up to Baa2/BBB, as it considers the notional company would maintain adequate headroom above the trigger. Ofwat has added dividend yield to the list of equity financeability metrics considered in its price control financial model.

Other finance issues

RCV run-off

While Ofwat’s assessment of efficient TOTEX and the required return on capital determine the costs that can be recovered from consumers, the pay-as-you-go rate and the RCV run-off rate determine the point in time at which these costs are recovered.

For PR24, Ofwat has taken a previously unprecedented step of setting guidance on the upper limits of acceptable RCV run-off rates for each of the price controls (see the table to the right).

The run-off rate determines the speed at which the value of the RCV is recovered through consumer bills. The lower the run-off rate, the smaller the value of RCV depreciation that is recovered from consumers now. Consequently, a lower RCV run-off rate implies that bills will be lower now, but correspondingly higher in the future.

Lower RCV run-off rates may therefore be attractive in the context of current affordability pressures as they will help to keep bills down over the AMP8 period. However, it is important to recognise (as Ofwat does) that this passes on the burden to a future generation of consumers. Ofwat has encouraged companies to consider this point and its guidance is to base run-off rates of new RCV additions on economic asset lives. The focus of the debate is therefore largely on the rate at which to run off the AMP8 opening RCV.

Ofwat’s guidance also raises an interesting question around financeability. During the PR19 redeterminations, one area of contention related to whether advancing revenues through adjustments to pay-as-you-go and/or RCV run-off rates was credit-positive. The CMA took the view that it was not, given how a number of credit ratings agencies treated such adjustments within their assessment of credit ratios. This would suggest that RCV run-off rates can be reduced without negatively affecting financeability. In practice, delayed revenue recovery may create cash-flow issues, particularly if companies have significant capital outlays.

Expectations around dividends, executive pay and outperformance sharing

Finally, Ofwat has set out updated expectations around dividends, executive pay and outperformance sharing. Its expectations in these areas go beyond what regulators have historically sought to directly impose on companies.

In terms of dividends, Ofwat believes a base dividend yield of 4% is reasonable for AMP8. Companies will be expected to outline their proposed dividend policies for the 2025–30 period and Ofwat has further set out an expectation that companies will retain or reinvest the increased (nominal) equity returns that will be generated from high inflation, through the indexation of the RCV, in AMP7. It is separately consulting on a proposed licence modification to require that dividends take account of service delivery for customers and the environment, current and future investment needs, and financial resilience.

Companies are likely to be particularly concerned by Ofwat’s proposal to adjust allowed revenues if it does not believe a company has demonstrated its executive pay award is justified by its performance. Ofwat appears to suggest that this mechanism could apply for the remaining years of AMP7. This would be the first instance of such a mechanism being used in UK economic regulation, and appears to be far more intrusive than previous regulatory approaches to executive pay.

‘In order to underscore our expectations with respect to performance related pay awards, including the exercise of judgement by remuneration committees with respect to overall performance delivery, we are considering the introduction of a new end-of-period reconciliation mechanism. This mechanism would apply for the remainder of the 2020-25 period (including 2022-23), at PR24, as well as for 2025-30 at PR29, and would allow us to adjust revenue allowances, so that customers no longer fund such awards, if companies are unable to demonstrate their decisions reflect our expectations, including by reference to overall performance.’

Ofwat is also encouraging companies to commit to voluntarily sharing of outperformance from factors that Ofwat considers to be outside companies’ control (e.g. taxation, cost of debt outperformance or high inflation).

Download

Related

Ofgem RIIO-3 Draft Determinations

On 1 July 2025, Ofgem published its Draft Determinations (DDs) for the RIIO-3 price control for the GB electricity transmission (ET), gas distribution (GD) and gas transmission (GT) sectors for the period 2026 to 2031.1 The DDs set out the envisaged regulatory framework, including the baseline cost allowances,… Read More

Time to get real about hydrogen (and the regulatory tools to do so)

It’s ‘time for a reality check’ on the realistic prospects of progress towards the EU’s ambitious hydrogen goals, according to the European Court of Auditors’ (ECA) evaluation of the EU’s renewable hydrogen strategy.1 The same message is echoed in some recent assessments within member states, for example by… Read More