No backstop? Recovery and resolution of central counterparties

Financial sector regulations introduced in recent years1—in particular, the requirements for over-the-counter (OTC) derivatives contracts to be centrally cleared—have increased the role of central counterparty clearing houses (CCPs) in the financial system. Regulators on both sides of the Atlantic have been keen to create systems that would not require a government to bail out a CCP, so as to avoid the ‘too big to fail’ problem. In line with this, wider international authorities have launched regulatory initiatives, such as recovery and resolution guidelines for financial market infrastructures (FMIs) including CCPs.2 The European Commission is expected to publish proposed legislation on CCP resolution before the end of 2016.

The purpose of recovery and resolution regimes is to increase the financial resources available in stress situations (to reduce the risk of collapse) and to outline the tools and steps available so that, if collapse does happen, a defaulting infrastructure provider can be resolved without the use of public funds. These policy initiatives have sparked debate on the options for private funding of default costs, such as the extent to which CCPs’ own capital is at risk if a clearing member defaults.

CCPs: not a normal business

CCPs have a specific set of functions in financial markets. In particular, they assume the role of neutral counterparty in a transaction between two separate undertakings or individuals (A and B). In doing so, they also enable the ‘netting’ of members’ positions, which is not possible if trades are cleared and settled bilaterally.3

The CCP will always have equal and opposite transactions that cancel out if both sides do what they have agreed. Only in cases where one party fails to do what it said will the CCP have to honour one side of the transaction only. CCPs set requirements for their clearing members; collect collateral (known as margins) and other contributions from the clearing members; and set aside part of their equity as pre-funded default resources, so that when transactions become due the CCP can complete them even if one of the parties fails to deliver. In such cases, the CCP will close out4 the transaction over a period of several days (known as a liquidation period) using the available funds. In this context, CCPs differ from other financial institutions, such as banks, in several ways:

- all positions of a CCP are collateralised to allow them to cover the costs of closing out defaulting member positions in normal times;5

- collateral and other funds are typically held by CCPs in liquid form to enable the CCP to respond quickly in the event of the default of a clearing member;6

- contributions of non-defaulting members to the default funds pool will be used if costs cannot be covered by the defaulter’s own resources, implying a degree of mutualisation of liabilities.

Although the risk of default losses cannot be completely eliminated, these transactions are therefore protected in ways that would not normally occur without the presence of a CCP—i.e. counterparties’ exposures are reduced through netting, collateralisation, and robust risk management.7

However, the CCP’s function of ‘centralising’ trading obligations and the mutualisation means that risks can be transmitted within the financial system. If a CCP failed, there would be consequences for all counterparties with that CCP. However, without a CCP, the failure of an individual company would directly affect only those counterparties that had entered into bilateral contracts with that company. Furthermore, CCPs must still be able to deliver essential infrastructure services in a stress scenario. CCPs therefore need sound and robust risk management arrangements to mitigate the risk that member default will materially disrupt the economy. These arrangements can relate to either the pre-funded or non-funded default resources, as discussed in turn below.

The risk covered by the waterfall

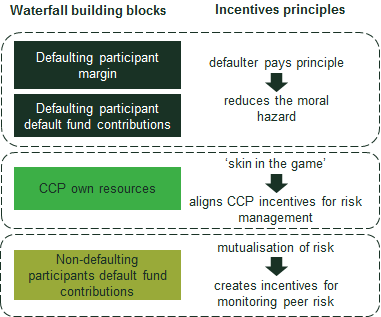

The order in which the types of pre-funded resources available to the CCP are drawn on is known as the ‘default waterfall’8. In Europe, the European Market Infrastructure Regulation (EMIR) prescribes how the size of these funds should be determined, as well as the ‘flow’ of the waterfall (see the box below). A similar waterfall is used for CCPs in other jurisdictions, as the structure is guided by key principles relating to the incentives that it creates (see Figure 1): in particular, reducing an individual member’s moral hazard that is created by the mutualisation of risk; incentivising the CCP to undertake rigorous risk management; and incentivising members to monitor each other’s activity.

Figure 1 Default waterfall

Source: Oxera.

Margins and pre-funded resources under the EMIR

Margins: there are two types of margin: variation and initial. The variation margin covers the changes in the potential losses due to daily movements in the price (value) of the open positions that the CCP holds.1 The initial margin covers the exposures to normal, ‘expected’ price movements until a participant’s position has been closed, in the event that a CCP has to close that position. Initial margins are typically not set at a level that is sufficient to cover these exposures in periods of extreme stress.2

Default fund: an additional layer is needed to cover costs under more volatile market conditions where the variation margin cannot be reset quickly enough, or the participant fails before the additional margin has been received by the CCP. The purpose of the default fund is to cover costs that remain after the defaulter’s margins have been used up, and the contributions of each individual member to the fund are proportional to the members’ positions and the risk that they bring to the CCP.

CCP own resources: CCPs also contribute a share of their capital to the pre-funded resources. In the EU, CCPs are required to hold a minimum of 25% of their regulatory capital as own default waterfall resources.3

Total size of pre-funded resources: the EMIR prescribes that the total size of the default fund and CCP dedicated resources should at least cover the costs associated with the default of the two participants to which the CCP has the largest exposures.4 This ‘cover 2’ standard aims to ensure that a CCP can cover the costs of participant default in extreme circumstances, thereby significantly reducing the probability of CCP default.

Note: 1 If the CCP takes on both sides of a bargain and one of the parties fails to deliver, the CCP is left owning an asset as principle, having discharged its own liability to the non-defaulting party. The CCP can then sell that asset. The value of that asset, compared to the value of the liability, depends on the relative price of the asset to the liability. The relative values of the asset and liability are likely to vary throughout the time that the CCP holds the open position. The CCP therefore requires the party with the asset that has lost relative value to ‘top up’ the margin that it is providing to the CCP, so that in the event that the CCP does have to sell the asset it now owns, the combination of the asset, the initial margin and any variation margin more than covers the costs incurred by the CCP in completing the bargain with the non-failing member. 2 Under the EMIR, some additional allowance for periods of stress is required in the margin calculation. See European Commission (2013), ‘Commission delegated regulation (EU) No 153/2013 of 19 December 2012 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on requirements for central counterparties’, Official Journal of the European Union, L 52/41, 23 February, Chapter 6, Articles 24–26. 3 European Commission (2013), ‘Commission delegated regulation (EU) No 153/2013 of 19 December 2012 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on requirements for central counterparties’, Official Journal of the European Union, L 52/41, 23 February, Chapter 9, Article 35. 4 European Commission (2012), ‘Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories’, Official Journal of the European Union, L 201/1, 27 July, Chapter 3, Article 43.

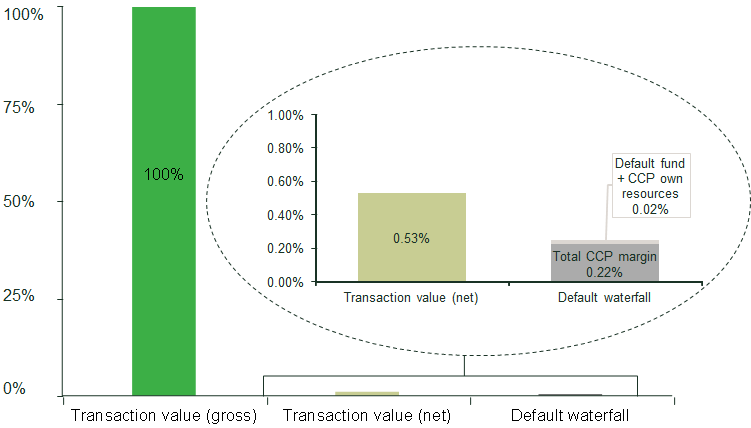

Figure 2 presents the gross and net values of transactions with clearing members, and the total of all the funds that form part of the default waterfall (referred to as size of the default waterfall), based on data for 2014 from a large European CCP. The size of the default waterfall comprises the total CCP margin, the default fund, and CCP own resources.

Figure 2 Net value of transactions and size of default waterfall as a percentage gross value of transactions with clearing members

Source: Oxera based on LCH.Clearnet Limited (2015), ‘Annual report and financial statements for the year ended 31 December 2014’.

The figure illustrates two important points. First, the impact of netting on the CCP’s liabilities is significant, with the value of transactions that the CCP is liable for reduced to less than 1% of the total gross value of transactions. This means that the CCP’s liabilities can be much smaller than those of their largest clearing members. Second, the default waterfall is a non-trivial proportion of the value of the CCP’s obligations, with the default fund and dedicated resources alone accounting for 4–4.5% of the net positions. In addition, the numbers suggest that the total size of the default waterfall can be around 50% of the net value of transactions. However, it is important to note that this is not a measure of the funds that would actually be available in the event of a participant default, as only the defaulting member’s margin—i.e. a fraction of the total margin—would be used. Rather, it is a measure of the funds that would be available if all clearing members defaulted—i.e. an extreme scenario.

The question remains, however: to what extent is the waterfall default-proof? CCP waterfalls and risk management procedures have never actually been tested since the introduction of mandatory OTC clearing and new regulations such as the EMIR, but research suggests that existing regulations, and cover 2 in particular, are reasonable prudential requirements that reduce the risk of system disruption and instability.9 In addition, the European Securities and Markets Authority’s (ESMA) conclusion from the first EU-wide stress-testing exercise of 17 CCPs is in line with these findings.10 The Authority finds that, under scenarios that assume the default of the top two clearing member groups across the EU in conditions of market stress, CCPs’ prefunded resources are sufficient to cover default losses. However, if the top two clearing members of each CCP are assumed to default in a period of stress—implying that for each CCP there could be more than two defaulting clearing members—losses could exceed the prefunded resources. This scenario is considered by ESMA to be very conservative and to imply ‘an unprecedented and rather implausible number of entities simultaneously defaulting at EU-wide and CCP level’.11 Overall, ESMA concludes that the system is currently resilient to extreme market outcomes caused by the default of clearing members combined with significant price shocks.

The risk in the tails

Even if the prefunded resources met strict regulatory requirements, and were increased beyond cover 2, some residual ‘tail’ risk of default leading to uncovered losses would remain. For this reason, CCPs have loss-allocation rules outlining the types and sources of additional funds that they would turn to if their default funds were depleted before they could close out all their outstanding positions. This is the area that has recently attracted most of the regulatory and industry focus.

If a clearing member default leads to losses beyond the size of the waterfall, a CCP can use the tools outlined in its risk management procedures and recovery plan to return to a matched book and sustain their operations. Having a range of tools provides flexibility to choose an appropriate response to the circumstances of the default scenario. Recovery tools that already exist in CCP risk management procedures, or that have been publicly considered, include:

- replenishing the default fund—the CCP requests clearing members to contribute additional resources in proportion to their default fund contributions. There is usually a cap on the amount that the CCP can request as, according to some regulations (such as the EMIR), clearing members cannot have unlimited liabilities towards a CCP;

- variation margin haircutting—the amount of margin that the CCP has to pay to clearing members whose positions are in the money is reduced (i.e. the positions will generate a profit if they were closed on the day);

- additional CCP capital—a proportion of CCP capital (beyond the CCP’s own resources, which form part of the default waterfall) is used to cover losses;

- allocation of open positions to non-defaulting members—clearing members are required, or agree on a voluntary basis, to take up the open positions of the defaulted member (these positions are likely to be loss-making);

- full or partial contract tear-up—the affected open contracts that would be likely to fail to deliver an expected profit to the non-defaulting party are cancelled, or settled in cash.

According to the international guidelines, a resolution body will step in if the recovery mechanism set out by the CCP in advance has not been effective in bringing the CCP back to a balanced book. In such a scenario, central banks may also provide emergency liquidity support, although there is no pre-commitment to do so.

In principle, the tools set out above that are available to the CCP to cover losses can also be used by the resolution authority. However, there are also some legal or regulatory constraints on potential CCP actions that might not apply to resolution authorities.

One such tool is the use of public financial funds to cover residual CCP losses—i.e. a bailout. However, as with the ‘too big to fail’ concerns in the banking sector, the potential use of public funds could introduce moral hazard, whereby the expectation of state support acts as an implicit subsidy to the financial system and leads to excessive risk-taking.12 Publicly funded resolution is also more politically sensitive than privately funded solutions. As such, attention has tended to focus on additional privately funded ‘bail-in’-type solutions, such as using non-defaulting members’ initial margins.

Concluding remarks

Although the above discussion of CCP recovery and resolution frameworks reflects the differences between CCPs and banks, at a fundamental level there is a similar assumption—that the use of public funds, and the associated implicit state subsidy to the financial sector, is not appropriate and should be significantly reduced or eliminated. The consequent focus on privately funded tools raises questions about whether these are credible options for situations of financial and economic distress, and about the impact on systemic risk and contagion in a stress scenario.

The important difference between CCPs and the pre-crisis position of the banking sector is that significant private resources are already in the CCP default waterfall, and there is a clear process for ‘bailing-in’ in the event of distress. This means that the probability of CCP failure is low (as the ESMA stress tests indicate), and that the circumstances that would actually lead to CCP failure may mean that the use of state funds would be unavoidable. Furthermore, the significant ‘burden-sharing’ by the private sector that the default waterfall entails acts to reduce or eliminate the moral hazard that is created when it is assumed that public funds are an option. This suggests that it is worth considering an ex ante commitment to a publicly funded ‘backstop’ to the CCP waterfall.

1 For example, see European Commission (2012), ‘Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories’, Official Journal of the European Union, L 201/1, 27 July.

2 See Bank for International Settlements and International Organization of Securities Commissions (2014), ‘Recovery of financial market infrastructures’, October; and Financial Stability Board (2014), ‘Key attributes of effective resolution regimes for financial institutions’, 15 October.

3 Netting occurs when the delivery of an asset by a clearing member is offset by receipt of the same asset. Netting can occur across multiple asset classes. A clearing member is an intermediary who clears transactions on behalf of clients. For a more detailed discussion of the nature of CCP activity, see Oxera (2014), ‘Out of the (banking) frying pan and into the (CCP) fire?’, Agenda, November.

4 To close out is to eliminate the initial exposure associated with the transaction.

5 However, as the positions’ value is not fixed over time, and collateral is set such as to allow positions to be closed under the assumption of normal market conditions plus a buffer, in stress periods these positions might not be fully collateralised.

6 It is important to have a clear and legally robust framework for seizing the collateral in the event of default.

7 Oxera (2014), ‘Out of the (banking) frying pan and into the (CCP) fire?’, Agenda, November.

8 Default fund models vary, and there is a trend towards establishing default funds for individual asset classes.

9 See Murphy, D. and Nahai-Williamson, P. (2014), ‘Dear Prudence, won’t you come out to play? Approaches to the analysis of central counterparty default fund adequacy’, Bank of England Financial Stability Paper 30, 21 October; and Heath, A., Kelly, G. and Manning, M. (2015), ‘Central counterparty loss allocation and transmission of financial stress’, Reserve Bank of Australia, Research Discussion Paper RDP 2015-02, March.

10 See ESMA (2016), ‘EU-wide CCP Stress test 2015’, Report, 29 April.

11 ESMA (2016), ‘EU-wide CCP Stress test 2015’, Report, 29 April, p. 6.

12 State support to the banking sector is discussed and quantified in Oxera (2011), ‘Assessing state support to the UK banking sector’, prepared at the request of The Royal Bank of Scotland, March.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More