Italian renaissance in regulation? Cost of capital for energy networks

AEEGSI has applied a consistent approach to calculating the cost of capital since 2004. In this context, the regulator’s focus has been on incentivising an adequate level of investments. In addition to remunerating the companies with a weighted average cost of capital (WACC) on capital expenditure, in the last eight years the regulator has applied additional incentives through uplifts to the WACC for certain types of investment. Together, these measures have aimed at creating a safe and stable environment for investment.

However, in the aftermath of the global financial crisis and the eurozone debt crisis, AEEGSI recognised that certain aspects of its established framework might need to change.1

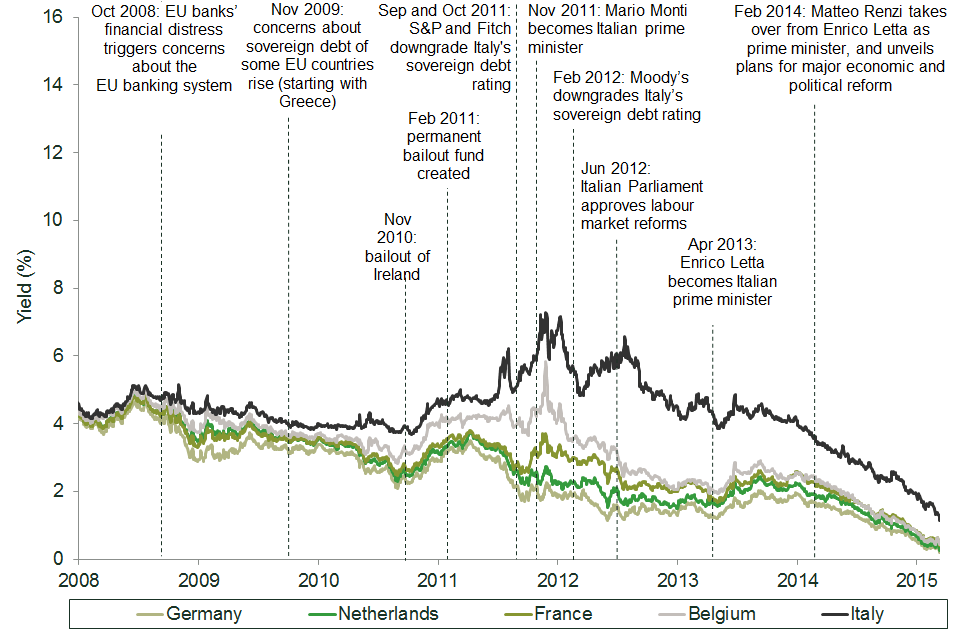

A key anchor point in most asset pricing models used to derive the WACC is the risk-free rate (RFR)—the expected return on an investment free of default and systematic risk. Historically, AEEGSI has used the Italian government bond benchmark to estimate the RFR. Up until late 2008, most eurozone government bond yields had traded at similar levels. Since 2008, however, Italian government bonds have been unusually volatile and have sometimes traded at much higher yields than historically, reflecting, to a degree, a number of downgrades in Italy’s sovereign credit rating. This is shown in Figure 1.

Figure 1 Nominal yields on ten-year government bonds, 2008–15

At the outset of its methodology review process, AEEGSI indicated which elements were unlikely to change.2 In particular, the cost of equity component of the WACC would continue to be estimated using the capital asset pricing model (CAPM). The allowed rate of return would also continue to be defined in real pre-tax terms.

At the same time, however, AEEGSI indicated that key elements of the WACC calculation would need to be reconsidered.3 The main changes introduced by the regulator were as follows.

- Use of market parameters, the RFR and the equity risk premium (ERP), which reflect ‘normal’ market conditions, before considering the impact of the fiscal crisis in Italy on required returns. In particular, the RFR is estimated with reference to government bond yields from jurisdictions that are still considered to be largely default-free.

- Placing greater weight on the concept of the total equity market return (TMR) to ensure a consistent set of assumptions for the RFR and the ERP, rather than estimating the ERP in isolation from the RFR.

- Capturing the impact of the fiscal crisis on required returns for regulated utilities in Italy explicitly through an additional parameter in the WACC calculation, the country risk premium (CRP).

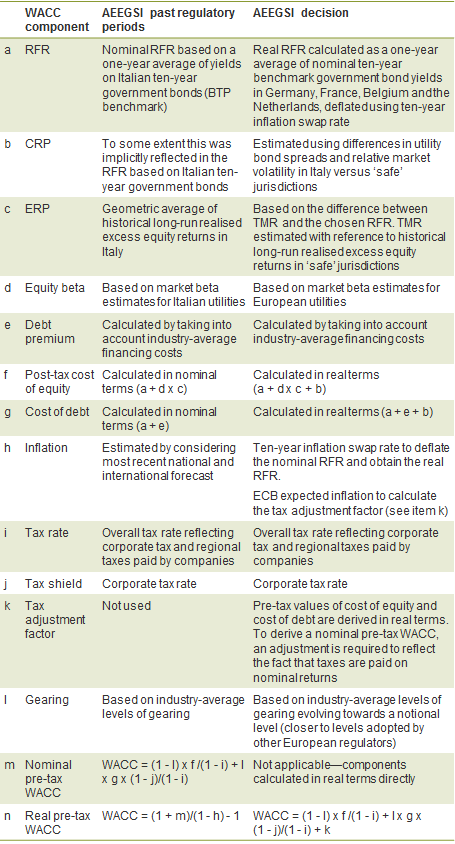

These changes are discussed further below. Table 1 provides a more detailed comparison of the approach previously adopted by AEEGSI and the current approach.

Table 1 Comparison of the old and new methods

Source: Oxera, based on AEEGSI regulatory decisions.

Market parameters reflecting ‘normal’ market conditions

In previous regulatory reviews, AEEGSI used a one-year average of yields on the ten-year Italian government bond (the Buoni del Tesoro Poliennali (BTP) benchmark) to estimate the RFR. For the ERP, it relied on a geometric average of historical long-run realised excess returns in Italy.

The high volatility of yields on BTP experienced during the financial crisis exposed the limitations of using it as the reference for the RFR. AEEGSI’s revised methodology is to estimate the RFR with reference to government bond yields that are rated at least AA (from Germany, France, Belgium and the Netherlands). This ensures that the RFR is more stable over time and is more consistent with the notion of the risk-free asset in asset pricing models.

To deal with the impact of the fiscal crisis on required returns for Italian regulated utilities, AEEGSI has introduced a separate CRP parameter. To ensure that there is no double-counting of this impact in the WACC estimation, AEEGSI’s revised methodology for the ERP involves using evidence from jurisdictions that are not affected by the fiscal crisis (as with the RFR).

Focus on total market return

Previously, AEEGSI used long-run historical evidence to estimate the ERP, and estimated the RFR based on short-term evidence. However, under unusual capital market conditions, it can be useful to consider the evidence on the TMR, which is the sum of the real RFR and the ERP. With government bond yields continuing to be at unprecedented low levels, TMR evidence can provide a useful sense-check on the consistency between the chosen RFR and ERP parameters in the context of estimating required returns for long-lived infrastructure.

In this context, AEEGSI has decided to place more weight on TMR evidence in deriving the ERP. Specifically, it has proposed to estimate the TMR reflective of ‘normal’ market conditions on the basis of available evidence for countries not affected by fiscal concerns. The ERP is then calculated as the difference between the TMR and RFR used for the WACC calculation.4

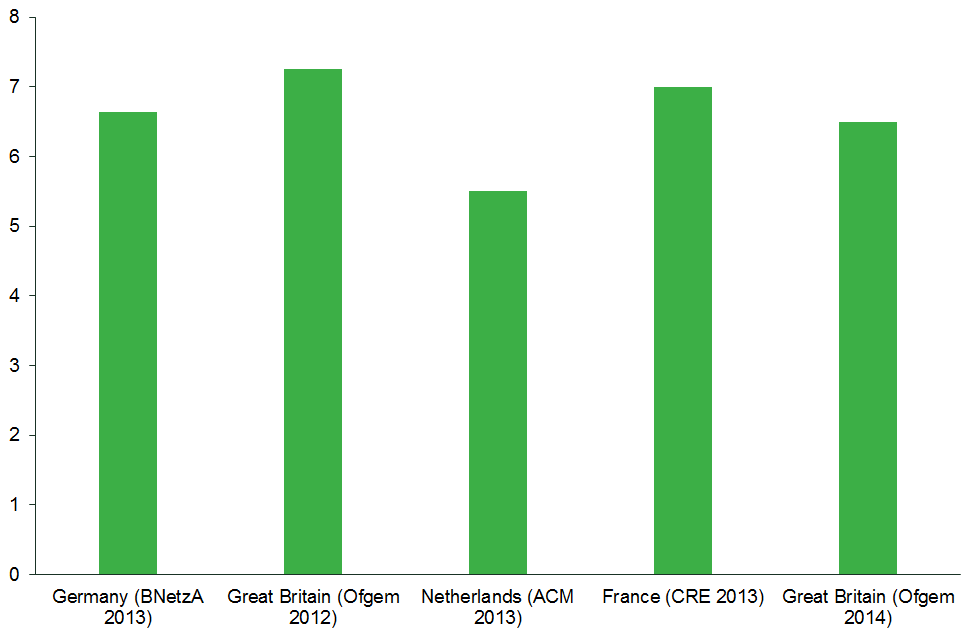

AEEGSI has adopted a value of 6% for the real TMR for the next cost of capital regulatory period.5 A 6% real TMR is consistent with the TMR range used by other regulators in recent decisions in countries not affected by fiscal concerns, as shown in Figure 2.

Figure 2 Regulatory precedent on the real TMR (%)

Source: Oxera analysis of various regulatory decisions.

Country risk premium

A debt or equity investor may require an additional premium for investing in a utility operating in Italy compared with investing in an otherwise identical utility operating in a country not affected by fiscal concerns, such as Germany. There might even have been some differences in the required returns between Italian utilities and similar utilities operating in other European countries prior to the crisis. However, it is reasonable to assume that the difference in required returns might have increased after the crisis, which is why an explicit consideration of the CRP effect in the WACC methodology can be useful.

Country risk may affect the required cost of debt by affecting the credit risk of the regulated company. In particular, credit rating agencies typically link corporate ratings to the credit rating of the government under whose jurisdiction a company operates.6 The downgrades in Italy’s credit rating have therefore translated directly into changes in corporate credit ratings, and may thereby have affected the cost at which corporates can raise finance.

There is evidence that Italian utility bonds trade at higher yields than comparable bonds issued by utilities operating in countries not affected by fiscal concerns. While some of this difference may be due to company-specific characteristics, overall, the evidence suggests that investors require an additional premium to hold Italian utility bonds. As explored in an Oxera report for AEEGSI,7 this premium is likely to be at least 0.5%.

Similarly, equity investors may require a premium for investing in a utility operating in Italy relative to an otherwise identical one operating in a country such as Germany.

In the CAPM framework, investors require compensation for systematic risk only.8 The inclusion of an additional compensation for the increased uncertainty in equity returns in a particular country therefore depends on the extent to which country risk is non-diversifiable. There are several reasons why country risk might not be diversifiable in practice. These include imperfect international capital flows and investors’ propensity to exhibit a preference for domestic securities (the home-bias phenomenon);9 and an increasing correlation between national economies and equity markets, which implies that a greater proportion of the overall risk is non-diversifiable.10

In addition, the fiscal crisis might imply a higher probability of events with negative implications for equity returns, such as windfall taxes, regulatory pressure on prices, or political upheaval, than events with positive implications. In corporate finance theory, the increase in downside risk is generally accounted for by adjusting expected cash flows downwards to account for negative contingencies (rather than adjusting the discount rate). However, it may be difficult to assign probabilities to the downside risk arising from changes in economic conditions in Italy. There is therefore an argument for adding a premium to the discount rate directly.

To quantify the impact of country risk on returns required by equity investors, one potential source of evidence is relative equity market volatility. This approach assumes that differences in equity risk between markets are captured by differences in the volatility of national equity markets.11 A similar analysis could be conducted focusing on the relative volatility of utility stocks only. Other sources of evidence include estimates of required equity returns from forward-looking asset pricing models.

Oxera’s report indicated that the evidence from equity markets was more mixed and harder to interpret than the evidence from debt markets. Nevertheless, the evidence pointed to the presence of a CRP for equity in Italy, and indicated that this premium was not immaterial (and potentially in excess of 1.5%).12 However, there was also an indication that the premium required by equity investors in the utility stocks might be somewhat smaller than that required for average equity.

In developing its position, AEEGSI has considered the available evidence on the CRP, and has settled on a value for the CRP of 1% for the costs of both the debt and equity components of the WACC.13 This value is broadly consistent with the evidence from both debt and equity markets. Required debt and equity returns are linked to some degree, as they are attributable to the same fundamental drivers of cash-flow risk.

Conclusions

AEEGSI’s past methodology for estimating the allowed rate of return was particularly exposed to the high volatility of certain cost of capital parameters observed during the height of the global financial and eurozone fiscal crises. In light of this, AEEGSI has decided to revisit its methodology.

AEEGSI has maintained the overall framework (for example, in terms of the WACC and CAPM), but has explicitly anchored some of the key parameters of the cost of capital that would be required by investors in ‘normal’ market conditions, to ensure greater stability and predictability of the evolution of these parameters over time.

At the same time, the greater risk of investing in a utility in Italy compared with investing in jurisdictions that are not as affected by fiscal concerns has been recognised explicitly14 through the addition of a CRP to both the cost of equity and the cost of debt.

In addition, AEEGSI has sought to stabilise its regulation and reduce risks for regulated companies and their investors by, for example, introducing a mid-term review of some key parameters (notably the RFR and ERP), and a trigger mechanism to review the CRP value.

However, only time will tell if the changes will have the intended effects, especially if fast-evolving market conditions continue to be the norm.

Oxera advised AEEGSI on its methodology review. See AEEGSI (2015), ‘Tasso di remunerazione del capitale investito per i servizi infrastrutturali dei settori elettrico e gas: criteri per la determinazione e l’aggiornamento’, Delibera 583/2015/R/com. The beta parameters for the electricity networks were provided in the subsequent decision, Delibera 654/2015/R/EEL.

1 Further regulatory changes (such as the withdrawal of cost of capital uplifts) will be introduced over the next few years. For example, see Oglietti, A. and Delpero, M. (2016), ‘Electricity network regulation in Italy moves towards a new paradigm’, Agenda, February.

2 AEEGSI decided to conduct a cost of capital review separately from the overall price control review for the energy sectors, in order to guarantee consistency on cost of capital parameters across these sectors. See AEEGSI (2014), ‘Avvio di procedimento per l’adozione di provvedimenti in materia di metodologie e criteri per la determinazione e aggiornamento del tasso di remunerazione del capitale investito, nei settori elettrico e gas’, Delibera 597/2014/R/Com, December.

3 AEEGSI (2014), ‘Avvio di procedimento per l’adozione di provvedimenti in materia di metodologie e criteri per la determinazione e aggiornamento del tasso di remunerazione del capitale investito, nei settori elettrico e gas’, Delibera 597/2014/R/Com, December.

4 Assuming a long-term stable TMR, the implied ERP would increase at times when RFR estimates reduce, and decrease when RFR estimates increase.

5 This value is the weighted average of the arithmetic and geometric averages of long-run historical realised excess returns in European countries not affected by the fiscal crisis, with 80% and 20% weights respectively on the arithmetic and geometric averages.

6 For example, the energy utilities, Snam and Terna, have been downgraded on several occasions by S&P as a direct result of changes to the credit rating of Italy.

7 Oxera (2015), ‘Estimating the cost of capital for Italian electricity and gas networks’, prepared for AEEGSI, June, sections 2.4.3 and Appendix A2.

8 This is the risk affecting the entire market, and cannot be reduced by diversifying the portfolio of investments.

9 French, K. and Poterba, J. (1991), ‘Investor diversification and international equity markets’, American Economic Review, 81, pp. 222–6.

10 Ball, C. and Torous, W. (2000), ‘Stochastic Correlation Across International Stock Markets’, Journal of Empirical Finance, 7:3–4, pp. 373–88, November.

11 Damodaran, A. (2003), ‘Measuring Company Exposure to Country Risk: Theory and Practice’, September, Stern School of Business, p. 8.

12 For example, see Oxera (2015), ‘Estimating the cost of capital for Italian electricity and gas networks’, a report for AEEGSI, June, section 2.4.

13 For example, see AEEGSI (2015), ‘Criteri per la determinazione e l’aggiornamento del tasso di remunerazione del capitale investito per le regolazioni infrastrutturali dei settori elettrico e gas’, Documento per la consultazione 275/2015/R/Com, June, p. 26.

14 It could be argued that using the Italian government bond as RFR would implicitly capture the country risk. However, as the effect on corporate debt costs might have been different from that on government debt costs, for example, it is more robust to explicitly estimate the impact of country risk on utilities.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More