Energy scarcity: arrivederci?

Italy is expected to introduce a capacity market, given its increasing risk of retirement of flexible generation capacity and a consequent reduction in security of supply. Simona Benedettini, Regulatory and Competition Specialist, and Giordano Colarullo, General Manager, both at Utilitalia, the Italian utilities federation, look at the Italian electricity capacity mechanism and whether capacity markets are compatible with the European single market.

The views in this article are those of the authors and do not necessarily represent those of Utilitalia.

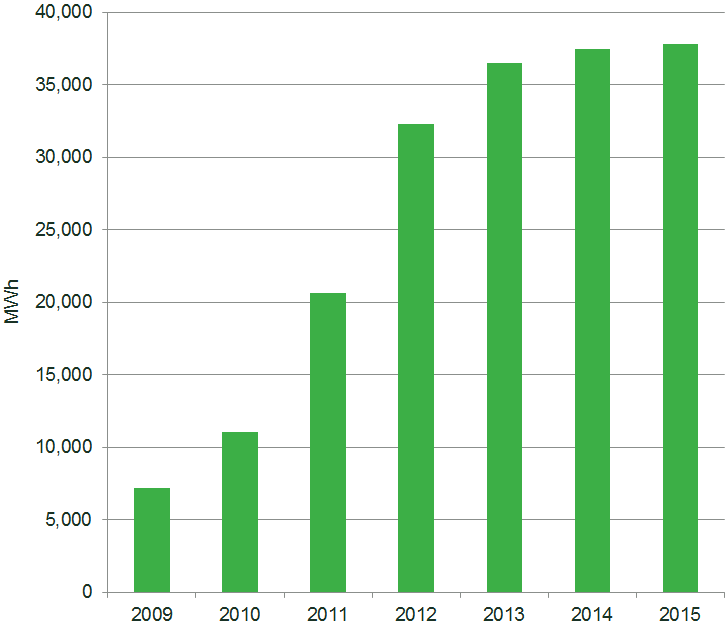

Power generation from intermittent renewable sources increased noticeably in Italy under the EU Renewable Energy Directive.1 Electricity production from wind and solar (photovoltaics, PV) grew from 7,129MWh in 2009 to 37,786MWh in 2015, reaching 13.35% of total generation,2 as shown in Figure 1.

Figure 1 Wind and PV generation in Italy, 2009–15

As a result, there has been a significant effect on the operation of thermo- and hydroelectric power plants—electricity generation from these plants has decreased during the central hours of the day, but increased in the morning and evening when wind speed is lower and/or there is no sunlight. For instance, comparing the monthly hourly load values from March 2014 with those from March 2012, one can see an increase of 34.4% in power output by conventional generation during the evening, and an average reduction of 12.5% during morning hours.3

In addition, due to the negligible variable cost of generation of solar and wind technologies,4 sales from thermoelectric power plants on the Italian day-ahead market fell by 29.47% between 2010 and 2015.5 Combined-cycle power plants (CCGTs) suffered most, with sales declining from 149.6TWh to 90.5TWh (-39.50%).6

This remarkable change in the generation mix, alongside the decline in demand following the economic downturn, has also depressed day-ahead peak-hour prices, which fell from €76.77/MWh in 2010 to €59.28/MWh in 2015 (-22.78%).7

The effects of intermittent renewable generation on production and prices have made conventional power plants less economically stable. The ‘clean spark spread’,8 a measure of CCGTs’ profitability, remained close to €0/MWh in 2014, and became negative in 2015.9

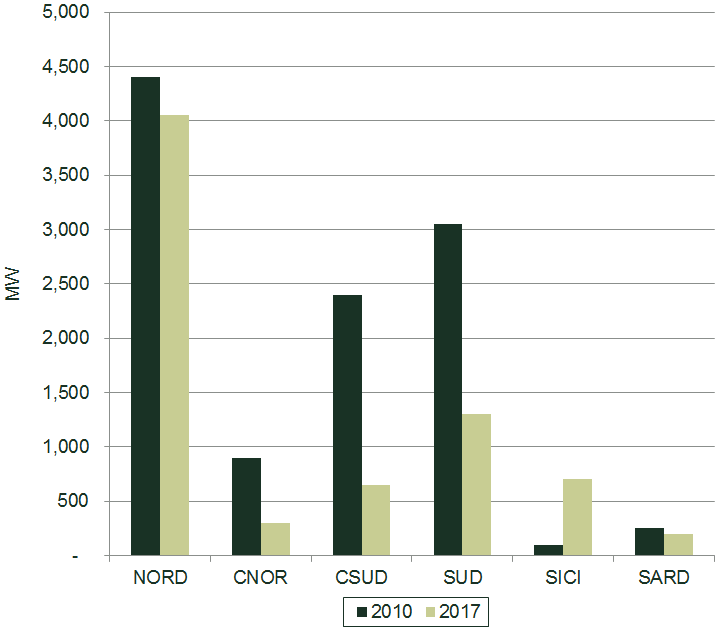

Consequently, and as observed by the International Energy Agency,10 Italy is facing an increasing risk that flexible generating capacity will be retired, to the detriment of system security in the long term, as shown in Figure 2.

Figure 2 Reserve margins in 2010 and 2017

Source: Terna, ‘Year ahead forecast margin including peak load’.

The development of intermittent renewable generation makes flexibility11 a salient feature of the generation mix. As argued above, conventional power plants are increasingly being required to raise their output during morning and evening hours to compensate for lower wind speed or faint sunlight, and to avoid black-outs.

CCGTs are the most flexible of conventional generation technologies. Representing about 35% of installed generation capacity,12 they have a crucial role in promoting system flexibility and security. Over the last three years, closed generating capacity in Italy amounted to about 12GW.13

To provide a solution to the increasing risk in security of supply, Italy is expected to introduce a centralised capacity market in 2017.

Why a capacity market?

Capacity markets may complement the design of day-ahead and ancillary services markets14 to overcome the ‘missing money problem’. This involves limiting the ability of power plants to recover fixed operating and maintenance costs, to the detriment of their economic viability. In turn, this limitation may result in underinvestment in or retirement of generation capacity, threatening security of supply.

There are several potential drivers for the missing money problem. One might be a reduction in peak-hour prices and thermoelectric generation due to increasingly intermittent renewable generation and decline in demand.15

The application of caps to electricity spot prices might be another driver.16 When day-ahead markets work under a ‘system marginal pricing’ rule,17 electricity is priced at the highest variable generation cost among generators producing in a given hour. Infra-marginal generating units—i.e. power plants whose variable production cost is below that of the highest cost unit that is generating electricity in a given hour—sell their production in the day-ahead market at a price equal to the variable generation cost of the highest cost unit in that hour.

Under the system marginal pricing rule, the plants that are likely to operate for only a few hours—because they have the overall highest variable generation cost (‘peaking generation’)—are able to recover a large portion of their fixed costs only when scarcity events occur—i.e. when electricity demand is greater than supply at a given point in time. In these circumstances, electricity prices rise in response to supply shortages, and peaking units can earn positive profits. Similarly, infra-marginal generation power plants can receive larger margins than those functioning under normal operational conditions. If caps apply, electricity prices may be prevented from rising to a value that allows for an appropriate level of profits for peaking generation units.

Deterioration in conventional power plants’ profitability may discourage investment in generation capacity and/or promote its retirement. Where this is the case, the probability that there will not be enough installed capacity to meet demand at a given point in time increases, and, with it, the probability of interruptions in electricity supply.

In addition, consumers’ limited ability to monitor electricity prices in real time—for example, due to the poor deployment of smart meters or consumers’ cognitive biases—may exacerbate the effects of the missing money problem.18 Since consumers display a limited ability to adapt their consumption in response to price spikes resulting from shortage events, the risk of power cuts increases.

The Italian capacity market in a nutshell

The policy process for the implementation of the Italian capacity market began in 2011 with Decision n. 98/2011 of the Italian energy regulator (AEEGSI).19 The Decision delineates the design of the mechanism. More recently, AEEGSI and the Italian transmission system operator (TSO) have consulted on the conclusive design of the mechanism and its parameters’ values. Their proposed approach is essentially that developed in 2011.20

The Italian capacity market requires the TSO, Terna, to estimate the amount of capacity (MW) necessary to ensure system reliability21 during a particular year—the ‘delivery period’.

Some years in advance of the delivery period, the TSO runs a descending clock auction (known as ‘Asta Madre’) to procure the target capacity.22 The clearing price of the auction—i.e. the price at which capacity supplied in the auction equals the target capacity—is the capacity payment (€/MW/year). This is the compensation received by the auction’s winners in exchange for making their capacity available during the delivery period.

Auctions are open to various types of capacity resources (conventional and renewable generation power plants, both existing and new) and demand (in the form of load reduction). Renewable generation and demand are eligible for participation in the capacity market, except where they benefit from other support schemes. The participation of cross-border capacity resources is also allowed, and the Italian TSO is currently developing the eligibility framework.

Participants that are awarded the capacity payment commit to offering their capacity in the Italian day-ahead market (the Mercato del Giorno Prima, MGP) in each hour of the delivery period. For the portion of capacity offered but not accepted in the day-ahead market, the same commitment is honoured in the ancillary services market (the Mercato dei Servizi di Dispacciamento, MSD).

Over the delivery period, the capacity payment can be adjusted by means of penalties levied for unavailability during shortage events, and through the ‘peak energy compensation’ (PEC).

The penalty for unavailability in cases of shortage events is €3,000/MWh (under Decision n. 98/2011). This represents the ‘value of lost load’—a price that is set administratively and that is conventionally considered the amount that consumers are willing to pay to avoid interruption in their electricity supply.

The PEC requires that whenever prices in the MGP or MSD markets (€/MWh) go above a threshold known as a ‘strike price’, beneficiaries of capacity payments should pay back this positive difference in proportion to the capacity offered in both markets. The strike price is set equal to the variable production cost of the marginal technology—i.e. the technology with the lowest cost of development among those included in an optimal generation fleet (a generation fleet that allows demand to be met at minimum cost).23 According to the recent consultations of the Italian TSO and AEEGSI, this technology has been identified as being the Open Cycle Gas Turbine. The PEC delivers an additional incentive for capacity resources to be made available during shortage events. Indeed, capacity resources are required to pay back the PEC,24 even if they do offer the contracted capacity on MGP and MSD markets.

The amount of capacity that can be procured by means of auctions is represented by a downward-sloping demand curve. Each point on the curve represents a combination of prices (€/MW/year) and capacity values (MW/year).

A cap on market participants’ bids is also established—i.e. owners of capacity resources cannot bid above this value. Such a cap is set equal to the cost of new entry—i.e. the cost of building a new peaking technology-generating unit.25 The regulatory authority has recently proposed a cost of new entry value equal to €75,000/MW/year.26

In addition to the main auction, the Italian capacity market entails two mechanisms allowing capacity markets’ participants to adjust their obligations: a reconfiguration auction and a bilateral market running, respectively, three and one years in advance of the delivery period.

Compatibility with state aid rules

The noticeable increase in intermittent renewable generation and the decline in electricity consumption due to the economic crisis significantly affected the profitability of Italian conventional power plants, especially those that were most flexible.

This decline in the profitability of flexible power plants might result in their retirement. However, flexibility has become essential in electricity markets that are characterised by significant intermittent renewable generation owing to the need to meet demand during periods of low wind speed or faint sunlight. Therefore, the retirement of flexible generation plants will be to the detriment of system flexibility and the security of supply.

In this context, Italy is expected to introduce a capacity market, but it is not alone in facing security of supply issues. For example, in 2014 the UK adopted a centralised capacity market based on capacity obligations. France has implemented a decentralised capacity market, and Ireland is consulting on the adoption of a capacity market based on reliability options similar to the model proposed for Italy.27

The adoption of any capacity mechanism must be notified to the European Commission under state aid rules. The Commission recently concluded an inquiry into whether the capacity mechanisms in place or under development in 11 member states were compatible with state aid rules, as set out in the Environmental and Energy Aid Guidelines (EEAG).28 It found that, ‘where appropriate market reforms have been implemented or are already planned, and a proper adequacy assessment has identified a residual regulatory or market failure, a capacity mechanism may be appropriate to ensure secure electricity supplies for consumers’.29 The Commission went on to conclude that ‘where a Member State identifies a long-term risk that there will be insufficient investment, market-wide capacity mechanisms (like those introduced in the UK and France, and planned in Ireland and Italy) are likely to be the most appropriate form of intervention. Market reforms should also be made to limit the State aid needed through the capacity mechanism’.30

According to the EEAG, capacity markets are generally considered compatible with state aid rules if: (i) they contribute to an objective of common interest; (ii) there is a need for state intervention; (iii) they are appropriate; (iv) they are proportionate; (v) they promote effective incentives; and (vi) they avoid undue negative effects on competition and trade. Strong evidence needs to be presented on each of these aspects to demonstrate the compatibility of capacity markets with state aid rules.

Recent Decisions from the European Commission31 on national capacity markets argue that, in general, these mechanisms meet the EEAG requirements. However, in the final report on the sector inquiry, the Commission highlights that some existing capacity mechanisms may not be designed in a way that fully addresses potential competition concerns.32

To demonstrate that capacity markets contribute to common interest goals, member states must show that there are inadequate levels of security of supply in the long term. This must be based on a rigorous assessment, reflecting a well-defined reliability standard that identifies any risks to the security of supply in order to determine the necessary size of any capacity mechanism.

In order to meet the appropriateness requirement, capacity markets must allow for sufficient lead times for new investments, and must be market-wide. In other words, capacity markets must be open to all relevant technologies and capacity providers, including interconnected capacity, and must compensate only for the availability of capacity.

The adoption of a competitive bidding process may help to ensure the proportionality of the aid. The descending feature of the auctions involved in capacity markets promotes the minimisation of procurement costs. This characteristic, in combination with the adoption of a negative sloped demand curve that prevents the exercise of market power, may inhibit windfall profits. As these mechanisms are market-wide and technology-neutral, capacity markets also seem to prevent the potential for capacity payments to favour specific generators or technologies.

According to the EEAG, aid for security of supply provides ‘effective incentives’ if it ensures that capacity providers make their capacity available at times of stress. Given this aim, and as discussed above, the sector inquiry argues that ‘the potential paybacks under the [reliability] option mean the capacity provider has a strong incentive to make sure he sells electricity at the reference price so that he has revenues to make any required contract paybacks’.33

All these characteristics of capacity markets mean that such mechanisms may avoid significant negative effects on competition. However, it will be important for a member state to demonstrate to the Commission that capacity mechanisms are designed in a way that prevents unacceptable distortions to competition and trade.

If capacity markets are found to be in line with state aid rules, this will enable the implementation of market reforms that allow an efficient and effective acknowledgement of emerging market trends, such as the increase in renewable intermittent generation and distributed generation. This aspect is of particular importance for Italy, which has undertaken a significant reform of electricity wholesale markets, including an attempt to balance the responsibilities of intermittent renewable generation, negative power prices, and incorporating customer demand in the balancing market.

Italy’s capacity mechanism has yet to be granted a ‘no objections’ decision, and this is expected over the next few months.

However, whether the Italian capacity market will achieve long-term security of supply depends on how the market responds to the implementation details. For example, the level at which the strike price of the reliability option is set might affect operators’ bidding strategies in the day-ahead and ancillary services markets. If it becomes a reference price, implying that market operators’ bids will converge to the strike price value, the latter might became a de facto cap on electricity prices. If this happens, the ability of electricity prices to signal scarcity and, overall, flexibility, will be significantly undermined if the strike price if set too low. As ever, the devil is in the detail.

Simona Benedettini

Giordano Colarullo

1 European Commission, Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the promotion of the use of energy from renewable sources and amending and subsequently repealing Directives 2001/77/EC an003/30/EC, OJ L 140, 5.6.2009.

2 Terna, ‘Dati Storici’, p. 159.

3 AEEGSI (2015), ‘Rapporto annuale dell’ Autorità per l’Energia Elettrica il Gas e il Sistema Idrico in materia di monitoraggio dei mercati elettrici a pronti, a termine e dei servizi di dispacciamento: consuntivo 2014’, Rapporto 630/2015/I/EEL, p. 68. Between March 2012 and March 2014, conventional power plants experienced a reduction in power output of 10% between 08.00 and 09.00, and 15% between 13.00 and 14.00.

4 In the day-ahead market, offers and bids are ranked according to merit. For each hour, supply offers are ranked by non-decreasing price order, whereas demand bids are ranked by non-increasing price order. Therefore, the merit order criterion sets the sequence in which generating units deliver power to the market to meet demand. The cheapest offers are those made by power stations with the lowest running costs. These offers therefore set the starting point of the merit order. Wind and solar power stations have much lower variable generation costs than conventional power plants, since they do not require input such as fuel, and involve operating personnel to a lesser extent. As such, they push more expensive conventional power plants down the merit order. The result is a reduction in the offers of thermoelectric power plants accepted in the day-ahead market.

5 Gestore dei Mercati Energetici (2016), ‘Annual Report 2015’, p. 42.

6 Gestore dei Mercati Energetici (2016), ‘Annual Report 2015’, p. 46.

7 Prices at which electricity is sold in the day-ahead market during peak hours. For the purposes of the Italian day-ahead market, peak hours correspond to the period between 09.00 and 22.00. Gestore dei Mercati Energetici, ‘Glossary’. See Gestore dei Mercati Energetici (2016), ‘Annual Report 2015’, p. 45.

8 This measure indicates the average revenues that a gas power station can expect from generating a unit of electricity during baseload operations, after fuel and carbon costs.

9 Moody’s (2015), ‘In Italy, Power Prices to Fall on Weak Demand, Low Gas Prices’, Sector in-depth, 30 June, p. 16.

10 International Energy Agency (2016), ‘Energy policies of IEA countries – Italy 2016 review’, p. 120.

11 In this context, flexibility refers to the ‘ramp-up/-down rate’, the rate at which conventional power plants can increase/decrease their output in a given time interval. The higher the rate, the more efficient is the response to declining wind speed or sunlight during morning and evening hours, and the lower the risk of interruptions in electricity supply.

12 Terna (2015), ‘Dati statistici’, pp. 63–64. CCGTs represent 64% of thermoelectric generation.

13 Italian Ministry for Economic Development (2014), ‘Rapporto sull’andamento delle autorizzazioni concernenti la realizzazione o il potenziamento di centrali termoelettriche di potenza superiore ai 300 MW termici’, February. Italian Ministry for Economic Development (2015), ‘Rapporto sull’andamento delle autorizzazioni concernenti la realizzazione o il potenziamento di centrali termoelettriche di potenza superiore ai 300 MW termici’, February.

14 In Italy, the ancillary services market, the ‘Mercato dei Servizi per il Dispacciamento’ (MSD), allows for the trading of supply offers and demand bids in respect of ancillary services. The Italian transmission system operator (TSO) uses this market to purchase resources to relieve network congestion, procure reserve capacity, and balance injections and withdrawals in real time. The market has two segments: (i) the so-called MSD ex ante market, concerning offers/bids that the TSO has accepted on a scheduled basis to relieve congestion and create an adequate reserve margin; and (ii) the balancing market, concerning offers/bids that the TSO accepted in real time for balancing injections and withdrawals. Source: Gestore dei Mercati Energetici, ‘Glossary’.

15 Cramton, P. and Ockenfels, A. (2010), ‘Economics and design of capacity markets for the power sector’, Zeitschrift für Energiewirtschaft, 36:2, p. 120.

16 Joskow, P. (2007), ‘Competitive Electricity Markets and Investment in New Generating Capacity’, in D. Helm (ed.), The New Energy Paradigm, Oxford University Press, p. 101.

17 See note 5 above.

18 Ausbel, L.M. and Cramton, P. (2010), ‘Using forward markets to improve electricity market design’, Utilities Policy, 18:2, p. 196.

19 AEEGSI (2011), ‘Criteri e condizioni per la disciplina del sistema di remunerazione della disponibilità di capacità produttiva di energia elettrica’, Decision ARG/elt n. 98/2011.

20 AEEGSI (2016), ‘Mercato italiano della capacità. Orientamenti Specifici’, Consultation document n. 713/2016/R/EEL, p. 8. Terna (2016), ‘Schema di proposta di disciplina per la fase di piena attuazione del del sistema di remunerazione della disponibilità di capacità di energia’.

21 Usually, system reliability is measured by means of the loss of load expectation (LoLE)—i.e. the number of hours per annum in which, over the long term, it is statistically expected that supply will not meet demand. For the purposes of capacity markets, the LoLE is usually set at three hours/year. The TSO is thus required to procure an amount of capacity ensuring this standard of reliability over the delivery period.

22 Descending clock auctions involve an iterative process with several rounds. Before the start of each round, the TSO announces the start-of-round and end-of-round prices to all participants. During each round, participants submit offers for the price level (€/MW/year), within the range of the start-of-round and end-of-round prices, at which they are willing to make their capacity available over the delivery period. If the amount of capacity offered in a given round is greater than the level of the target capacity, the TSO runs an additional round during which participants submit offers within a price range that is lower than that of the previous round. Participants who are unwilling to make their capacity available at prices below offers submitted in the previous round will exit the auction. The process is repeated until capacity supplied in the auction equals the target capacity.

23 The strike price will include costs such as fuel costs, weighted for the peaking power plants’ heat rate; variable maintenance costs; balancing costs; carbon costs; and costs for the purchase of energy for generation purposes. See Terna (2016), ‘Metodologia per il calcolo del prezzo di esercizio’.

24 Consider, for instance, the owner of a capacity resource dispatching its capacity in the day-ahead market as it is the beneficiary of a capacity payment. The PEC mechanism requires that during hours when Spot priceMGP > Strike price, the owner of the capacity resource pays back this difference. Thus, the margin it earns will be equal to (Spot priceMGP – VC) – (Spot priceMGP – Strike price) = Strike price – VC, where VC is the variable cost of generation of that capacity resource, and Spot priceMGP is the electricity price occurring on the Italian day-ahead market in a given hour. If the owner of the capacity resource does not deliver the committed capacity when Spot priceMGP – Strike price, it still has to pay back this difference, but it will not earn any revenue in the day-ahead market. Therefore, its margin will be equal to – (Spot priceMGP – Strike price) < 0.

25 The cost of new entry therefore includes both capital and operating costs. Capital costs are incurred when constructing the power plant, before the commercial online date, and might include costs required to buy the land and construct the generating plant, emission reduction credits, and gas and electricity connection costs. Operational and maintenance costs are incurred once the plant enters commercial operation. These might include property taxes, plant insurance, facility fees for labour and minor maintenance, and asset management costs.

26 AEEGSI (2016), ‘Mercato italiano della capacità. Orientamenti Specifici’, Consultation document n. 713/2016/R/EEL, p. 8.

27 European Commission (2014), ‘State Aid SA. 35980 (2014/N-2) – United Kingdom. Electricity market reform–Capacity market’, Decision, 23 July. European Commission (2015), ‘Aide d’Etat SA. 39621 (2015/C) (ex 2015/NN) – France. Mécanisme de capacité en France’, Decision 13 November; and Commission Européenne (2016), ‘Décision De La Commission du 8.11.2016 Concernant Le Régime D’Aides SA.39261 2015/C (ex 2015/NN). SEM Committee (2016), ‘Capacity market code consultation’.

28 European Commission (2014), ‘Guidelines on State aid for environmental protection and energy 2014-2020’.

29 European Commission (2016), ‘Final Report of the Sector Inquiry on Capacity Mechanisms’, report from the Commission, 30 November, pp. 8–9.

30 European Commission (2016), ‘Final Report of the Sector Inquiry on Capacity Mechanisms’, report from the Commission, 30 November, p. 17.

31 For example, see European Commission (2015), ‘Aide d’Etat SA. 39621 (2015/C) (ex 2015/NN) – France. Mécanisme de capacité en France’, Decision 13 November.

32 European Commission (2016), ‘Final Report of the Sector Inquiry on Capacity Mechanisms’, report from the Commission, 30 November, p. 18.

33 See European Commission (2016), ‘Commission Staff Working Document Accompanying the document. Final Report of the Sector Inquiry on Capacity Mechanisms’, COM(2016) 752 final, para. 424.

Download

Contact

Dr Leonardo Mautino

PartnerGuest authors

Simona Benedettini

Regulatory and Competition Specialist, Utilitalia

Giordano Colarullo

General Manager, Utilitalia

Related

Download

Related

Financing the green transition: can private capital bridge the gap?

The green transition isn’t just about switching from fossil fuels to renewable or zero-carbon sources—it also requires smarter, more efficient use of energy. By harnessing technology, improving energy efficiency, and generating power closer to where it’s consumed, we can cut both costs and carbon emissions. In this episode of Top… Read More

A map of AI policies in the EEA and UK

Oxera offers an overview of AI-related policies in EEA countries and the UK through an interactive map. This AI Policy Map allows users to follow developments in AI regulation and examine national policy approaches in more detail. Artificial intelligence (AI) is driving technological change at an unprecedented pace, transforming industries,… Read More