De-stressing distressed investments: portfolio returns in restructuring aid cases

Financial distress is a natural characteristic of a well-functioning competitive market, as it indicates that supply and demand conditions change and the most efficient firms are displacing less efficient competitors. However, when market frictions, such as high entry and exit costs, impede this process, important services may be interrupted and there may be adverse consequences for employment, particularly in the short term.1 In such situations, the state may intervene to support firms in distress.

Alitalia and Air Berlin are two recent high-profile examples. In 2017, the airlines were offered state bridging loans of €900m and €150m respectively to enable them to continue operations in the short term.2 Earlier in 2017, the Commission had approved a €4.5bn capital injection by the French State to enable the nuclear provider, Areva Group, to restructure its operations following difficulties originating from the financial crisis.3

In such cases, while government intervention may be desirable from a social and economic perspective, it may also have the potential to distort competition and trade between member states. As a result, the Commission requires member states to notify all instances of rescue and restructuring aid (‘R&R aid’). In order for the R&R aid to be in line with state aid rules, it must comply with the Rescue and Restructuring Aid Guidelines (the ‘R&R Guidelines’).4

Before reaching this stage, it is important to consider whether the state’s intervention is, in fact, justified on a commercial basis. If this is the case, the support is not considered to be state aid.5 This article explores the circumstances under which it may be possible to demonstrate that the state’s actions are commercially justifiable (i.e. that support is provided on market terms).

The R&R Guidelines in a nutshell

As with other types of aid, the Commission approves R&R aid only if: it contributes to a well-defined objective of common interest; it is necessary and appropriate; it creates additional economic activity that would not have taken place without the aid; it is limited to the minimum necessary; and it does not significantly distort competition and trade. However, in contrast to other types of aid, the Commission adopts a particularly stringent approach when assessing the compatibility of R&R aid (i.e. whether the aid is consistent with the above criteria), in light of the potential for the state’s actions to distort the normal functioning of the market (i.e. by propping up inefficient firms).6

To demonstrate the compatibility of R&R aid under the R&R Guidelines, detailed economic and financial analysis is required, as outlined in the box below.

Main pillars of the economic and financial assessment

- The aid restores the firm’s long-term viability. The firm receiving the aid must demonstrate, on the basis of a robust business plan, that it expects to be viable in the long term without any aid.

- The aid creates a positive incentive effect. It must be demonstrated that, without the aid, the common interest objectives would not be achieved. The feasibility of scenarios without aid may need to be considered, including restructuring through the reorganisation of existing debt, divestments of activities, private capital injections, sale, or liquidation.

- The aid is proportionate (i.e. limited to the minimum necessary). In most restructuring cases, the beneficiary must finance at least 50% of the costs of the restructuring. Investors must also pay a fair share of the costs. The aim is to avoid a situation where investors do not consider significant downside risks, on the presumption that the state will step in to support the firm.

- There are measures in place to limit distortions to competition. Compensatory measures designed to limit any distortions of competition caused by the aid are required. A classic example is a required reduction in the beneficiary’s business activities.*

Note: * Only those reductions in business activities that would not be undertaken to restore viability can be considered compensatory measures. For example, the closure of a non-profitable business segment might instead be considered a restructuring measure.

Source: Oxera.

Assessments of R&R aid often focus on demonstrating compatibility with the R&R Guidelines. However, there are a number of other important points to consider:

- time is of the essence for distressed firms, and the process of receiving approval from the Commission can take several months, during which time the firm’s situation could deteriorate further;

- restructuring aid can be granted only once in a ten-year period, to avoid aid being used to keep unviable companies artificially in business;

- there may be instances where it is not possible to demonstrate that the aid is compatible with all the criteria from the R&R Guidelines, particularly as the need for compensatory measures can impede the ability of firms to restructure.

An important, but sometimes under-used, element of R&R cases is a consideration of whether a state intervention could be undertaken on market terms—i.e. in line with the market economy operator principle (MEOP), which determines whether a private market operator would be willing to undertake the same action.7 If this can be credibly demonstrated then the intervention is not considered aid.

How can the MEOP be applied in restructuring cases?

Typically, actions by the state in supporting a distressed firm are more likely to be in line with the MEOP when the state is already (or is aiming to be) a significant stakeholder in the beneficiary firm (as either a shareholder or a debt-holder). This provides a platform for assessing the future returns expected by the state from its actions—i.e. for applying the MEOP.

It is not necessarily straightforward to demonstrate that there is a commercial motivation behind state intervention in the restructuring of distressed firms. However, it is not uncommon for private companies to invest in distressed assets with the expectation of earning returns commensurate with the investment risk. For example, in summer 2017, Liberty House Group, a global supplier of metals and engineering solutions, signed an agreement to purchase two distressed manufacturing businesses from Tata Steel.8 This was motivated by the Group’s ambition to create a fully integrated value chain, which, according to its CEO, aimed to make the Group a world leader in the field.

Broadly speaking, there are two approaches to assessing whether state intervention is consistent with the MEOP.

- If the distressed firm’s assets are jointly owned by the state and private investors, the simplest and most straightforward way to demonstrate compliance with the MEOP is to show that the state is entering into a transaction on an equal footing with a private investor (i.e. on a pari passu basis).9 For example, in the Estonian Air case, the Commission concluded that the capital injection from the state did not constitute aid, as at least one private shareholder matched the state’s measure in proportion to its shareholding.10

- If it is not possible to show that the state has behaved on a pari passu basis, a more involved assessment may be required. In particular, detailed financial analysis is likely to be needed in order to assess whether the expected financial returns from the state’s intervention exceed the expected return in the counterfactual (i.e. hypothetical ‘but for’) scenario where the firm is in liquidation.11 For example, in the Compel Rail restructuring case, the Commission agreed that the conditions of the tax settlement reached between the state and the firm did not constitute aid, as they led to a better financial outcome for the state than in the counterfactual scenario where the firm would be liquidated.12

As the state could provide a number of restructuring measures to firms in difficulty over time, it may be difficult to demonstrate that all restructuring measures (as one package) are compliant with the MEOP. If the measures are sufficiently distinct from each other, it may, however, be possible to consider some measures separately. In order to do so, it would need to be shown that there are significant gaps in time between the various measures (with latter measures not being foreseen at the time of the earlier measures), and that the purpose of each measure, and the beneficiary’s situation when the state decided to provide it, differ distinctly.13

In such a scenario, it is possible that some measures may be consistent with the MEOP, while others are not; but they may still constitute compatible R&R aid. Therefore, two concurrent approaches could be envisaged to demonstrate compliance with state aid rules.14 Although the member state would still need to notify the Commission, the quantum of aid would be lower, as a result of some measures being compliant with the MEOP.

If the MEOP assessment focuses solely on the returns generated by the beneficiary firm, ignoring any second-order impacts in relation to the wider portfolio of assets held by the state, the conclusion may be that the state intervention is not in line with the MEOP. However, an investor holding a portfolio of assets may be incentivised to contribute to the restructuring of a distressed company even if the investment, on a stand-alone basis, is not expected to generate a market return. This could be due to the positive effects (or the avoidance of negative effects) expected from the restructuring on related firms owned by the same investor.15

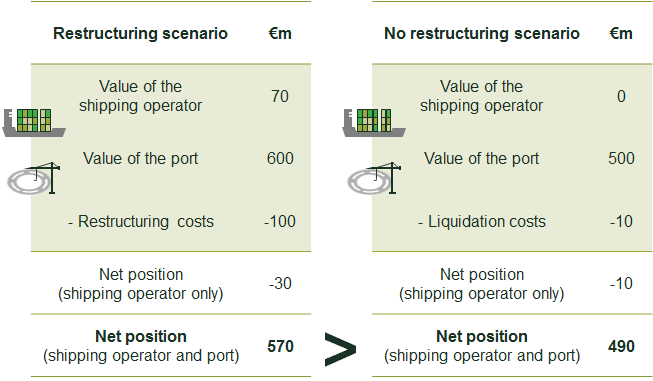

As an illustrative example, consider a port and a shipping operator, both of which are state-owned, and assume that:

- the shipping operator is the port’s main customer;

- the shipping operator is experiencing financial difficulty and faces a realistic prospect of insolvency;

- there is limited expectation of earning a market return from rescuing the shipping operator;

- the insolvency of the shipping operator is expected to lead to liquidation costs of €10m and a significant reduction in the port’s share price in the medium term.

The state (as the shareholder of both the port and the shipping operator) has to decide whether to invest and rescue the shipping operator. In this decision, any rational investor is likely to consider the overall implications for its portfolio of assets. As shown in Figure 1, taking into account the fact that the state owns both the port and the shipping operator, the state’s actions of rescuing the shipping operator are in line with the MEOP. This is because, at the portfolio level, the state’s net financial position is better in the restructuring scenario (€570m) than in the scenario where there is no restructuring (€490m).16

Conversely, if the MEOP assessment focused solely on the shipping operator, the restructuring might have been deemed to constitute aid, as the state would be better off by not undertaking the restructuring (due to losses of €30m compared with losses of €10m). In this situation, the only option available to the state to support the shipping operator would be to seek approval from the Commission for R&R aid (demonstrating compliance with the R&R Guidelines).

Figure 1 Illustrative example of considering the state’s portfolio of assets

In general, testing compliance with the MEOP will require detailed economic and financial analysis, as outlined in the box below.

The role of economic and financial analysis

Detailed financial analysis is required to assess the value of the assets in the factual (i.e. where the restructuring goes ahead) and counterfactual scenarios (i.e. where the restructuring does not go ahead), and potentially the liquidation costs.

Two main valuation approaches are adopted by corporate finance practitioners. Each approach requires a business plan that projects future cash flows associated with the actual and counterfactual scenarios.

- Discounted cash flow (DCF) approach. To reflect the uncertainty of future cash flows and investors’ preferences for money today rather than tomorrow, future cash flows are discounted at a rate that reflects the risks of the entity in each scenario (i.e. at the cost of capital). The value of the assets in each scenario is the sum of the discounted cash flows (i.e. the expected net present value).

- Multiples-based approach. This approach requires a set of similar transactions to be identified (i.e. comparators) for both scenarios. For each group of comparators, the value of the firm relative to a financial metric (e.g. earnings) is calculated.1 The resulting multiples are applied to the projected financial metric for the firm in difficulty in both scenarios to derive the value of the assets.

Note: 1 The firm’s value can be measured by its enterprise value (i.e. the combined value of the firm’s equity and debt).

Source: Oxera.

Conclusions

For cases involving state intervention to assist distressed firms, one point is clear: the standard approach—seeking aid approval under the R&R Guidelines—may not always be optimal.

It is therefore prudent to explore the potential for arguing that the intervention does not constitute aid in the first place by justifying the commerciality of the state’s intervention. In some cases it may be relevant to consider the commercial position of the state at the portfolio level. Furthermore, in situations where several measures have been (or need to be) adopted over time, and where not all of the measures are consistent with the MEOP, it may be possible to advance simultaneous arguments that some measures are in line with the MEOP, while others constitute compatible aid.

The main advantages of the MEOP approach in such circumstances are that it is likely to be more time-efficient, offers greater flexibility in terms of the restructuring process, and leaves the door open for advancing aid in the future should it be required. If it can be demonstrated that some of the overall restructuring measures are in line with the MEOP, this is likely to make it easier to demonstrate the compatibility of the aid with the R&R Guidelines.

Such an approach is, however, not without its risks, as there are few previous Commission decisions that relate to such situations. However, given the dark cloud that often looms over distressed firms, exploring whether support that is consistent with the MEOP can be provided may just provide the required silver lining.

1 A study by Oxera in 2010 for the European Commission identified that the effects of financial distress are likely to be more severe when the distressed firm owns assets that cannot be easily transferred to other firms; suppliers are heavily reliant on the distressed firm; there are high levels of unemployment in the local region; or skills of employees are not readily transferable. For details, see Oxera (2010), ‘When the going gets tough: a closer look at financial distress and restructuring’, Agenda, February; and Oxera (2009), ‘Should aid be granted to firms in difficulty? A study on counterfactual scenarios to restructuring state aid’, prepared for the European Commission, December.

2 Financial Times (2017), ‘Cerberus proposes complete takeover of Alitalia’, 25 October; and European Commission (2017), ‘State aid: Commission approves German rescue aid to Air Berlin’, press release, 4 September.

3 European Commission (2017), ‘Commission Decision (EU) 2017/1021 of 10 January 2017 on State aid SA.44727 2016/C (ex 2016/N) which France is planning to implement in favour of the Areva group’, Official Journal of the European Union, 17 June.

4 European Commission (2014), ‘Communication from the Commission – Guidelines on State aid for rescuing and restructuring non-financial undertakings in difficulty’, 2014/C 249/01, Official Journal of the European Union, 31 July.

5 For a measure to be deemed state aid, all of the following four conditions must be met: the measure is financed through state resources and is imputable to the state; the measure confers an economic advantage on the recipient; the advantage is selective; and the measure has the potential to distort competition and trade.

6 European Commission (2014), ‘State aid: Commission adopts revised guidelines for supporting firms in difficulty’, 9 July, accessed 2 November 2017.

7 The MEOP assesses whether the state acted in a manner consistent with a market economy operator in relation to a certain transaction, and therefore did not confer an economic advantage on the undertaking in question.

8 Liberty House Group (2017), ‘Liberty targets key role in global oil and gas pipe market as it completes Hartlepool acquisition from Tata Steel UK’, 1 August.

9 European Commission (2016), ‘Commission Notice on the notion of State aid as referred to in Article 107(1) of the Treaty on the Functioning of the European Union’, Official Journal of the European Union, 19 July, paras 86–87.

10 European Commission (2015), ‘State aid SA.35956 (2013/C) and State aid SA.36868 (2014/C) – AS Estonian Air’, 6 November, paras 108 to 113.

11 European Commission (2016), ‘Commission Notice on the notion of State aid as referred to in Article 107(1) of the Treaty on the Functioning of the European Union’, Official Journal of the European Union, 19 July, para. 107.

12 European Commission (2008), ‘State aid No N 472/2007 – Slovak republic. Restructuring aid to Compel Rail’, 2 April.

13 European Commission (2016), ‘Commission Notice on the notion of State aid as referred to in Article 107(1) of the Treaty on the Functioning of the European Union’, Official Journal of the European Union, 19 July, para. 81.

14 For example, in the airBaltic case, the Commission concluded that some of the measures did not constitute aid, while other measures constituted compatible R&R aid. For further details, see European Commission (2015), ‘Commission Decision (EU) 2015/1091 of 9 July 2014 on the measures SA.34191 (2012/C) (ex 2012/NN) (ex 2012/CP) implemented by Latvia for A/S Air Baltic Corporation (airBaltic)’, Official Journal of the European Union, 10 July.

15 See the above example in relation to Liberty House Group’s acquisition of two distressed businesses from Tata Steel.

16 For MEOP arguments based on the state’s portfolio of assets to be successful, it is important to demonstrate that a similar private investor that owns stakes in several firms considers the implications for their portfolio of firms when making investment decisions.

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More