Contract theory in regulation: the in-betweener of risks and incentives

On 10 October 2016, Oliver Hart and Bengt Holmström were awarded the Nobel Prize in Economic Sciences for ‘their contributions to contract theory’. Their research has helped to define how contracts enable cooperation between parties with potentially conflicting incentives. Applications of this work can be found in many areas of society and policy, from employment contracts to corporate finance and governance. What has been its effect on regulation?

As a research discipline, contract theory studies how people make agreements in the context of the practical limitations that they face in the real world. Both Hart and Holmström’s most significant contributions were in establishing strong frameworks that could be used to consider real-world difficulties in writing contracts.

Contracts are formal agreements setting out the rights and responsibilities of the signatories. They are ubiquitous in economic life. We have contracts with our employers, mobile phone providers, insurers, mortgage providers and landlords. From one perspective, companies themselves are essentially a collection of contracts—between shareholders and the management; the firm and its employees; the firm and the bank; and the firm and its suppliers.

Holmström and Hart’s contributions to the discipline are far-reaching, but the areas highlighted by the Nobel committee are:1

- Holmström’s contributions to the study of agreements where the feature that the parties would like to contract on is hard to objectively define, but a strong, complete contract can nevertheless be written. For example, an employer might want to reward an employee in proportion to the effort they exert—but effort is often hard to measure objectively;

- Hart’s contributions to the study of agreements in which it is difficult to map out all the finer details in advance. For example, firms embarking on a joint venture will struggle to map out what should be done in every possible scenario of market development.

Holmström and Hart’s research has enabled economists to study aspects of a wide range of real-world contracts, such as the ‘front-loaded’ design of insurance contracts;2 the design of CEO compensation packages; different corporate securities in corporate finance;3 and individuals’ incentives to work hard even under simple fixed-wage contracts.4 The same theoretical frameworks in contract theory can be applied to any other type of agreement or arrangement that relates to the economic interests of the parties involved. Regulations can therefore be considered a contract between the regulator or government and firms operating in the regulated sector. Regulations guarantee firms some level of certainty and benefits in return for the services they provide. However, firms are also subject to various fines and restrictions that would reduce their future profitability if they failed to abide by the regulations.

The fundamental purpose of contracts—or regulations in this case—is to provide appropriate incentives and rules for regulated firm to achieve the best outcome for the regulator and thereby the consumer, be that lower prices or a higher quality of services. Since the regulator cannot monitor all business decisions made by the regulated firm, it is not straightforward to design a regulation that would appropriately incentivise firms to achieve the best possible outcome from the regulator’s perspective—or the ‘optimal’ contract.

Why not a contract based on outcomes?

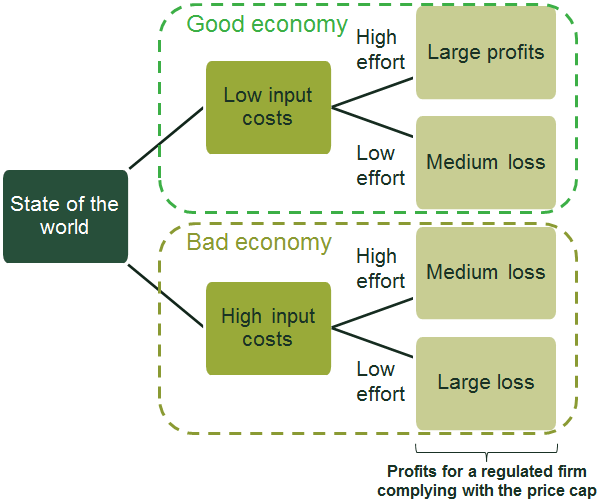

The most natural solution would be to design a regulation based on outcomes that are observable to the regulator, such as prices. A regulator may then want to enforce a price cap on charges imposed by regulated firms.5 However, these outcomes may be affected by factors that are not within the firms’ control. In the hypothetical example in Figure 1, when inputs are abundant and cheap—in the ‘good economy’ state of the world—it is possible for firms to achieve a fixed price without incurring a loss. However, when cost of production is high—in a ‘bad economy’—firms may have no choice but to incur a loss in order to comply with the regulator’s price control. Since neither firms nor regulators know what the state of the economy will be in advance, if firms are not willing to take the risk of a bad economy, they will choose not to make the necessary investments and enter the market in the first place.

Figure 1 Regulation with a simple price cap

This example highlights the difficulty of regulation based on a simple price cap. Holmström’s ‘informativeness principle’6 states that the regulator should allow adjustments to a fixed price control for external factors or ‘cost pass-through’ components, such as input and fuel prices. Price cap regulation is therefore preferable in sectors such as utilities, where regulators can estimate a fixed price and allow for cost pass-through components reasonably efficiently.

Rate-of-return (RoR) or price cap regulation

If regulated firms are particularly sensitive to risk—i.e. uncertainty about the economy, in our hypothetical example in Figure 1—then the regulator should strive to eliminate uncertainty for the firms, for example through RoR regulation. In this case, firms would be allowed to charge a price that would give them a level of return on top of their costs, as determined by the regulator.7 This would mean that firms can be certain about their ability to recover and make profits on their investments, regardless of the state of the economy.

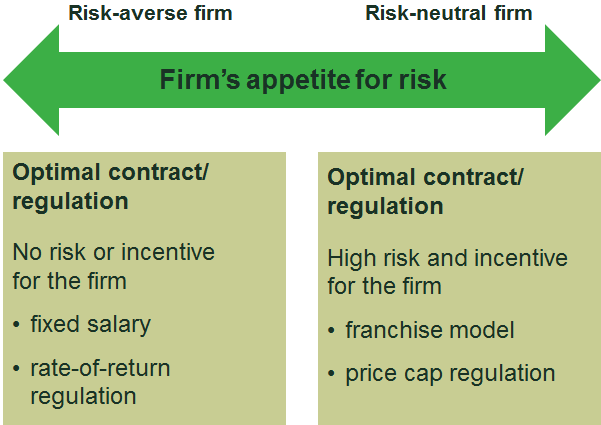

The well-known drawback of RoR regulation is that it removes firms’ incentives to innovate and operate efficiently beyond the level determined by the regulator. If firms are not very sensitive to risk then a form of regulation similar to a price cap may be more desirable. This is the trade-off between risk and incentives in any contract design, as illustrated in Figure 2.8

Figure 2 Optimal regulation based on a firm’s appetite for risk

Source: Oxera

If the regulator is concerned about quality of service in addition to price, a simple price control regulation is not appropriate for achieving the desired outcomes. The multi-tasking model by Holmström and Milgrom shows that when quality is important but difficult to evaluate, too close a focus on price will result in distorted and undesirable outcomes for the regulator.9

Regulatory authorities around the world have used all of the contract and regulation designs described above, with varying levels of success.

- RoR regulation was first developed and used to regulate prices of private or privatised public utilities in the USA. However, it has been criticised for not providing sufficient incentives for efficiency improvement due to the trade-off between risk and incentives discussed above.

- On the other hand, price cap regulation, and variations based on it, has been widely used in the UK to regulate prices of privatised utilities, as it is considered to provide more incentives for firms to innovate and improve efficiency than RoR.

- Ofgem, the energy regulator for Great Britain, has recently moved from an RPI – X to a RIIO model,10 with its greater emphasis on quality of service and specific key outputs such as customer satisfaction and reliability. Ofwat, the economic regulator of the water industry in England and Wales, has taken a similar approach with TOTEX (total expenditure) and outcome delivery incentives, including both rewards and penalties. These regulations aim to provide balanced incentives for both price and quality, instead of focusing only on price.

Incomplete contract: privatisation versus public ownership

If a complete contract is assumed, the implication is that it is possible to put in place rules for all possible scenarios. Hart’s work on the theory of incomplete contracts stems from the fact that, in many situations, it is difficult to write and enforce such a contract. In a world of complete contracts, the government can hire public employees and specify via contracts what they need to do. Equivalently, the government can sign a contract with a private supplier which, in turn, has contracts with its own employees. Under the assumption of incomplete contracts, these two choices may not produce the same outcome. The incomplete contracts literature suggests that contracting a private supplier can be a better alternative to hiring public employees, for the following reasons.

One of the applications from Hart’s and his co-authors’ work on incomplete contracts is examining when a service should be outsourced to the private sector, and when it should be owned by the government.11 Instead of designing a complex employment contract to cover all possible scenarios and provide enough incentives for public employees to deliver the desirable outcome, the government may consider privatising the service and transferring the ownership and decision/control rights to a private company. If a private contractor is chosen over a government-owned service provider, contracts between the government and the private contractor—or regulations, as discussed above—can then be designed so as to control for a firm’s potential incentive to engage in quality-reducing cost-cutting.12

Examples of privatisations include those of British Rail, Royal Mail and various water authorities in the UK; Deutsche Telekom in Germany; Enel and Terna in Italy; and Telecom New Zealand. Some of these examples have been deemed successful, while others are more controversial. The debates on privatisation versus nationalisation surround the trade-off between efficiency and quality control, as formalised in Hart, Shleifer and Vishny’s framework.13

Theory of the firm: the ‘hold-up’ problem

One of the most prominent contributions of Hart’s work is to the theory of the firm, which concerns factors determining the optimal size of firm. The 2009 laureate for the Nobel Prize in Economic Sciences, Oliver E. Williamson, and others emphasised ex post inefficiencies created by bargaining—or the ‘hold-up’ problem—where the private contractor must make an investment specific to the contract in advance and is thus at a disadvantage when bargaining for its share of the profits.14 With this expectation, a firm may choose not to make the investment in the first place. The hold-up problem is particularly serious in long-term agreements where changes in regulations and policies may lead to violations of the terms included in such agreements. Oxera’s work as economics experts on behalf of the service providers in cases such as Tallinn Water vs Estonia15 and EDF International vs Hungary16 provides examples of how violations of long-term agreements through new regulations imposed by the government can put private contractors/service providers at a disadvantage and lead to costly disputes.

This hold-up problem can be resolved if the government makes the investment and provides the services itself. However, it has been shown that it is rarely socially optimal for a government to provide all public services. According to work by Grossman and Hart, if investments necessary to provide the services have high-valued outside options, using a private contractor is preferable.17

Concluding thoughts

This article has discussed some of Holmström and Hart’s main contributions to contract theory and illustrated several applications, especially in regulatory economics. Their work investigates the mechanism behind how certain forms of contract work in specific contexts, and reconciles existing theoretical frameworks with reality. Anyone who is interested in contracts—either in terms of understanding how commonly written contracts work, or in terms of finding appropriate contractual solutions to new problems—would therefore benefit from an understanding of the key principles behind their contributions. Their input has certainly contributed to general thinking in regulation across the world.

1 The Royal Swedish Academy of Sciences (2016), ‘Oliver Hart and Bengt Holmström: Contract Theory’, Scientific Background on the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2016, 10 October.

2 In front-loaded contracts, which are most common in life insurance, initial premiums are high, but they are lower later on to lock in consumers and to provide dynamic insurance (since those with deteriorating health prospects benefit by paying less). This design is, however, not found in accidental death contracts, which pay only if death is accidental. The Royal Swedish Academy of Sciences (2016), ‘Oliver Hart and Bengt Holmström: Contract Theory’, Scientific Background on the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2016, 10 October, p. 17.

3 For example, see Hart, O. and Moore, J. (1998), ‘Default and Renegotiation: A Dynamic Model of Debt’, Quarterly Journal of Economics, 113:1, pp. 1–41.

4 See Holmström’s career-concerns model in Holmström, B. (1982), ‘Managerial Incentive Problems A Dynamic Perspective’, Essays in Honor of Lars Wahlbeck, Helsinki: Swedish School of Economics, re-published in Review of Economic Studies, 66, pp. 169–82.

5 A simple form of price cap regulation can be considered an outcome-based contract, since firms that do not abide by the price cap are subject to a fine from the regulator.

6 Holmström, B. (1979), ‘Moral hazard and observability’, The Bell Journal of Economics, 10:1, Spring, pp. 74–91.

7 The costs are estimated by the regulator in advance based on what would occur in an efficient operation, to ensure that the efficiency incentive is still preserved in RoR regulation.

8 Failure to understand this trade-off may result in time-consuming and costly disputes. One example is BSkyB’s litigation in 2008 against Electronic Data Systems (EDS) for fraudulent misrepresentations of EDS’s capability to deliver a new customer relationship management system. It illustrates how limiting risk by including in the contract a limitation of liability clause of £30m for both parties also reduced EDS’s incentive to deliver the new system.

9 Holmström, B. and Milgrom, P. (1991), ‘Multitask Principal–Agent Analyses: Incentive Contracts, Asset Ownership, and Job Design’, Journal of Law, Economics & Organization, 7, Special Issue: [Papers from the Conference on the New Science of Organization, January 1991], pp. 24–52.

10 Revenue = Incentives + Innovation + Outputs.

11 Hart, O., Shleifer, A. and Vishny, R.W. (1997), ‘The Proper Scope of Government: Theory and an Application to Prisons’, The Quarterly Journal of Economics, 112:4, pp. 1127–61.

12 These conflicts in government procurement have also been formalised in the context of complete contract theory, for example in Laffont, J.-J. and Tirole, J. (1990), ‘The regulation of multiproduct firms’, Journal of Public Economics, 43:1, October, pp. 1–36.

13 Hart, O., Shleifer, A. and Vishny, R.W. (1997), ‘The Proper Scope of Government: Theory and an Application to Prisons’, The Quarterly Journal of Economics, 112:4, pp. 1127–61.

14 For example, see Williamson, O.E. (1971), ‘The Vertical Integration of Production: Market Failure Considerations’, The American Economic Review, 61:2, May, pp. 112–23.

15 AS Tallinna Vesi, an Estonian Water Company privatised in 2001, and its part-owner, United Utilities B.V., filed a claim against the Republic of Estonia in relation to Estonia’s alleged breach of the various privatisation agreements. See AS Tallinna Vesi (2015), ‘The timetable for the International Arbitration Proceedings against the Republic of Estonia has been determined’, Company Announcement, 22 June.

16 Oxera acted as the quantum experts on behalf of EDF International (EDFI) in a claim against the Republic of Hungary brought under the Energy Charter Treaty in the Permanent Court of Arbitration. The claim followed from Hungary’s decision in 2009 to prematurely terminate Power Purchase Agreements (PPAs) that it had signed with EDFI’s generating asset in Hungary without sufficient compensation to EDFI. When Hungary’s electricity/heat generation industry was privatised in the 1990s, PPAs were introduced as an alternative to providing regulatory certainty for potential investors (i.e. through contractual agreements). In December 2014, the Tribunal awarded EDFI the original claimed amount of €107m.

17 Grossman, S.J. and Hart, O.D. (1986), ‘The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration’, Journal of Political Economy, 94:4, August, pp. 691–719.

Download

Contact

Dr Leonardo Mautino

PartnerContributor

Related

- Energy

- Financial Services

- Pharmaceuticals and Life Sciences

- Telecoms, Media and Technology

- Transport

- Water

Download

Related

Ofgem’s RIIO-3 Sector Specific Methodology Decision

On 18 July 2024, Ofgem published its Sector Specific Methodology Decision (SSMD) for the forthcoming RIIO-3 price control period for electricity transmission (ET), gas transmission (GT) and gas distribution (GD) networks.1 This follows Ofgem’s consultation on the matter in December 2023.2 RIIO-3 will last for… Read More

The future funding of the England & Wales water sector: Ofwat’s draft determinations

On Thursday 11 July, Ofwat (the England and Wales water regulator) published its much anticipated Draft Determinations (DDs). As part of the PR24 price review, this sets out its provisional assessment of allowed revenues and performance targets for AMP8 (2025–30)—and will be of great interest to water companies, investors,… Read More